North Carolina Unrestricted Charitable Contribution of Cash

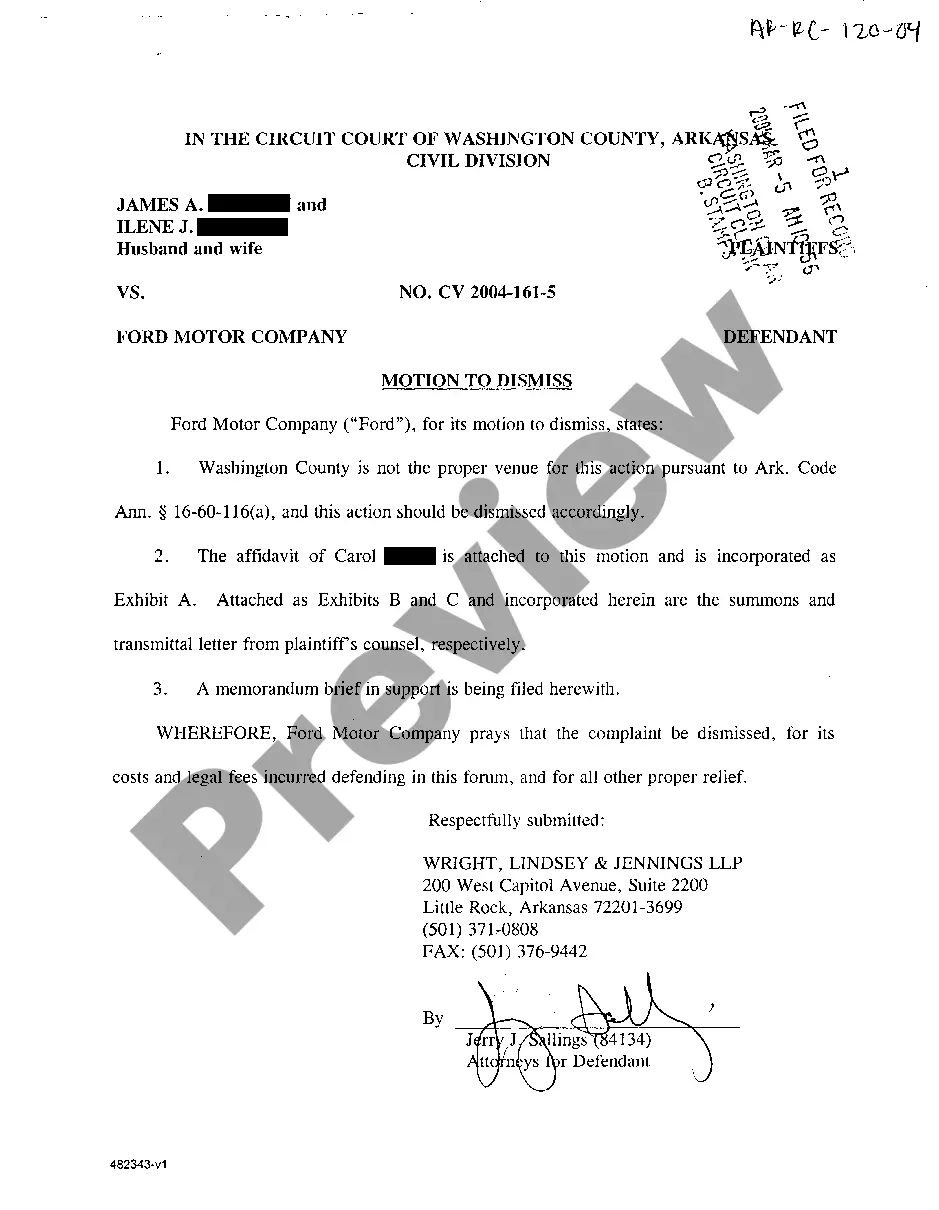

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

Are you presently in a placement that you will need paperwork for both company or individual purposes just about every day? There are tons of authorized papers themes available on the net, but finding versions you can trust isn`t straightforward. US Legal Forms provides 1000s of kind themes, just like the North Carolina Unrestricted Charitable Contribution of Cash, which can be created to fulfill state and federal requirements.

If you are previously knowledgeable about US Legal Forms web site and possess an account, simply log in. Afterward, you may down load the North Carolina Unrestricted Charitable Contribution of Cash design.

Should you not offer an profile and wish to start using US Legal Forms, adopt these measures:

- Get the kind you will need and ensure it is to the right city/county.

- Utilize the Preview key to examine the form.

- See the explanation to ensure that you have selected the correct kind.

- In case the kind isn`t what you are seeking, use the Look for area to get the kind that suits you and requirements.

- Whenever you get the right kind, click Purchase now.

- Pick the costs strategy you would like, fill in the desired information and facts to generate your account, and pay money for an order with your PayPal or charge card.

- Select a handy data file format and down load your duplicate.

Find each of the papers themes you possess purchased in the My Forms food list. You can get a further duplicate of North Carolina Unrestricted Charitable Contribution of Cash anytime, if required. Just select the required kind to down load or produce the papers design.

Use US Legal Forms, by far the most substantial variety of authorized varieties, in order to save some time and avoid blunders. The services provides expertly manufactured authorized papers themes which you can use for a selection of purposes. Make an account on US Legal Forms and commence generating your life easier.

Form popularity

FAQ

A qualified contribution for purposes of the 25 percent taxable income limit is a charitable contribution made in cash during the 2020 and 2021 calendar years to churches, nonprofit educational institutions, nonprofit medical institutions, public charities, or any other organization described in IRC §170(b)(1)(A).

Regular 30% Limitation Non-50% charities include veterans' organizations, fraternal societies, nonprofit cemeteries, and certain private non-operating foundations. Regular 30% contributions are limited to the lesser of: 30% of AGI, or. 50% of AGI reduced by all contributions to 50% charities.

Federal law limits cash contributions to 60 percent of your federal adjusted gross income (AGI). California limits cash contributions to 50 percent of your federal AGI.

Non-cash items are furniture, clothing, home appliances, sporting goods, artwork and any item you contribute other than cash, checks, or by credit card. Generally, you can deduct your cash contributions and the Fair Market Value (FMV) of most property you donate to a qualified charitable organization.

Consequently, an individual who claimed North Carolina itemized deductions for tax year 2021 could only deduct qualified contributions up to 60% of the individual's AGI and charitable contributions of food up to 15% of AGI.

Overall deductions for donations to public charities, including donor-advised funds, are generally limited to 50% of adjusted gross income (AGI). The limit increases to 60% of AGI for cash gifts, while the limit on donating appreciated non-cash assets held more than one year is 30% of AGI.

Non-cash donations. The deductible limit for non-cash donations falls between 20% and 50% of your AGI, depending on the type of non-cash donation that's being made. Non-cash donations include the following types of property: New or used clothing or other household items and food. New or used vehicles.

For contributions of non-cash assets held more than one year, the limit is 30% of your adjusted gross income (AGI). Your deduction limit will be 60% of your AGI for cash gifts.