North Carolina Deferred Compensation Agreement - Short Form

Description

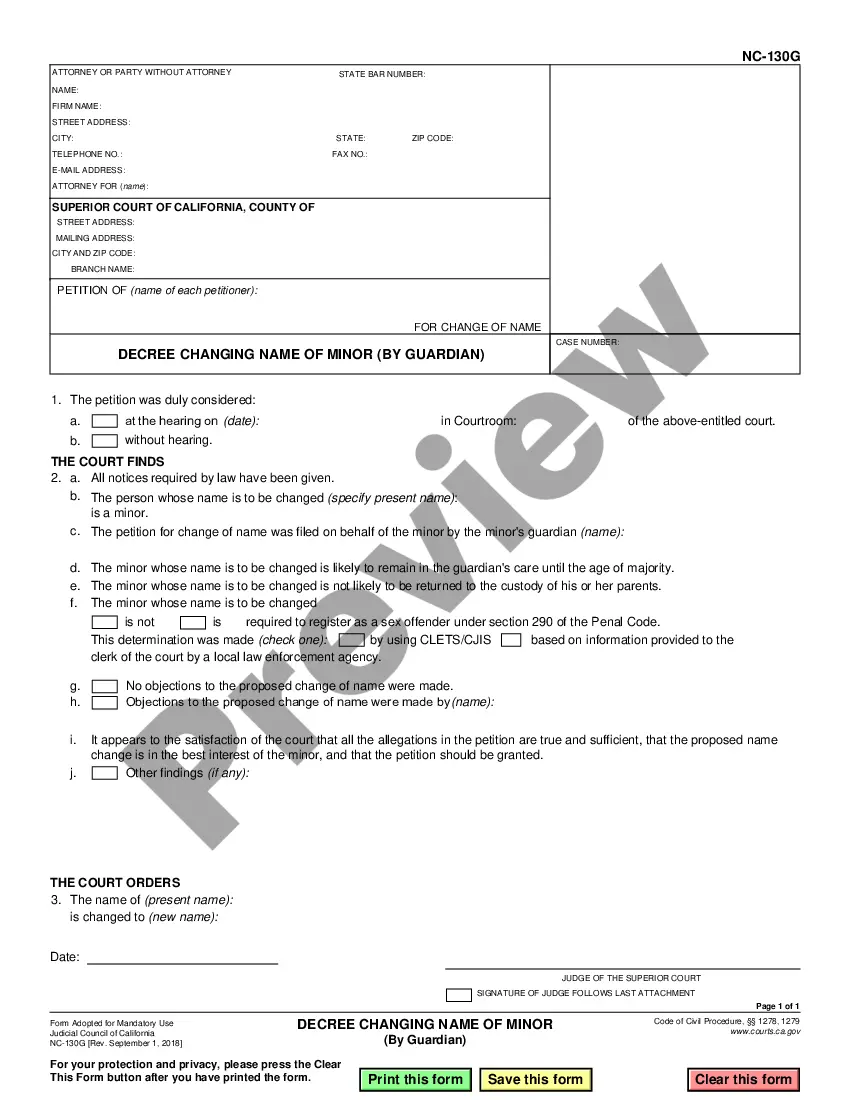

How to fill out Deferred Compensation Agreement - Short Form?

If you require thorough, acquire, or create licensed document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Employ the website's straightforward and user-friendly search to discover the documents you need.

A range of templates for commercial and personal use are categorized by classifications and states, or keywords.

Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and add your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Use US Legal Forms to locate the North Carolina Deferred Compensation Agreement - Short Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and hit the Download button to receive the North Carolina Deferred Compensation Agreement - Short Form.

- You can also find forms you previously acquired within the My documents tab of your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate area/state.

- Step 2. Utilize the Review feature to browse through the form's content. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

To retire from the state of North Carolina, you typically need to have at least five years of creditable service. However, eligibility for full retirement benefits can depend on your age and total years of service. Understanding your options through the North Carolina Deferred Compensation Agreement - Short Form can help you plan effectively for retirement. Utilize resources available on US Legal Forms to navigate your retirement journey confidently.

A deferred compensation form is a legal document that outlines an individual's agreement to defer a portion of their earnings until a later date, typically after retirement. The North Carolina Deferred Compensation Agreement - Short Form simplifies this process for employees, allowing you to save for retirement while reducing your current taxable income. This agreement can secure your financial future by offering tax advantages. By using a platform like US Legal Forms, you can easily understand and complete this essential document.

Avoiding tax on a 457b withdrawal largely depends on how and when you withdraw funds. If you roll over your 457b into another qualified retirement plan, you can defer taxes. Understanding the guidelines of the North Carolina Deferred Compensation Agreement - Short Form can help you strategize your withdrawals in a tax-efficient manner.

To be fully vested in the North Carolina retirement system, you generally need to complete five years of creditable service. This means that after five years, your benefits become fully yours, regardless of your employment status. Engaging with a North Carolina Deferred Compensation Agreement - Short Form can further enhance your retirement security.

The North Carolina 457 deferred compensation plan is a retirement savings program designed for state employees. It allows participants to save and invest portions of their salary, deferring taxes until withdrawal. By signing the North Carolina Deferred Compensation Agreement - Short Form, employees can maximize their savings potential and prepare for their future.

The 3 year rule for 457 catch-up allows eligible participants to contribute extra funds in the three years leading up to retirement. This provision applies to those who have reached their maximum contribution limits and helps boost savings before retirement. Utilizing the North Carolina Deferred Compensation Agreement - Short Form can facilitate this enhanced saving strategy.

You can typically withdraw from your deferred compensation plan without penalty once you reach the age of 59½. However, this is contingent on the conditions outlined in the North Carolina Deferred Compensation Agreement - Short Form. Ensure you review your plan details to avoid penalties and secure your financial future.

Yes, North Carolina does tax state employee pensions, but there are specifics to consider. Generally, the state taxes pension income, however, Georgia's law provides exemptions for certain pension amounts. Therefore, understanding your options under a North Carolina Deferred Compensation Agreement - Short Form can help you navigate taxation effectively.

To avoid paying taxes on deferred compensation, consider participating in a North Carolina Deferred Compensation Agreement - Short Form. By contributing to such a plan, you can defer income that will only be taxed when you withdraw it. Additionally, choose investments that fit within your financial strategy to maximize potential growth while minimizing tax liability.

While a 457 plan offers tax advantages, there are some downsides to consider. For instance, participants may face restrictions on withdrawals, leading to potential penalties if accessed before retirement. Additionally, if you withdraw your funds at the wrong time, you may face adverse tax consequences. Understanding these risks within the framework of the North Carolina Deferred Compensation Agreement - Short Form can help you navigate your choices more effectively.