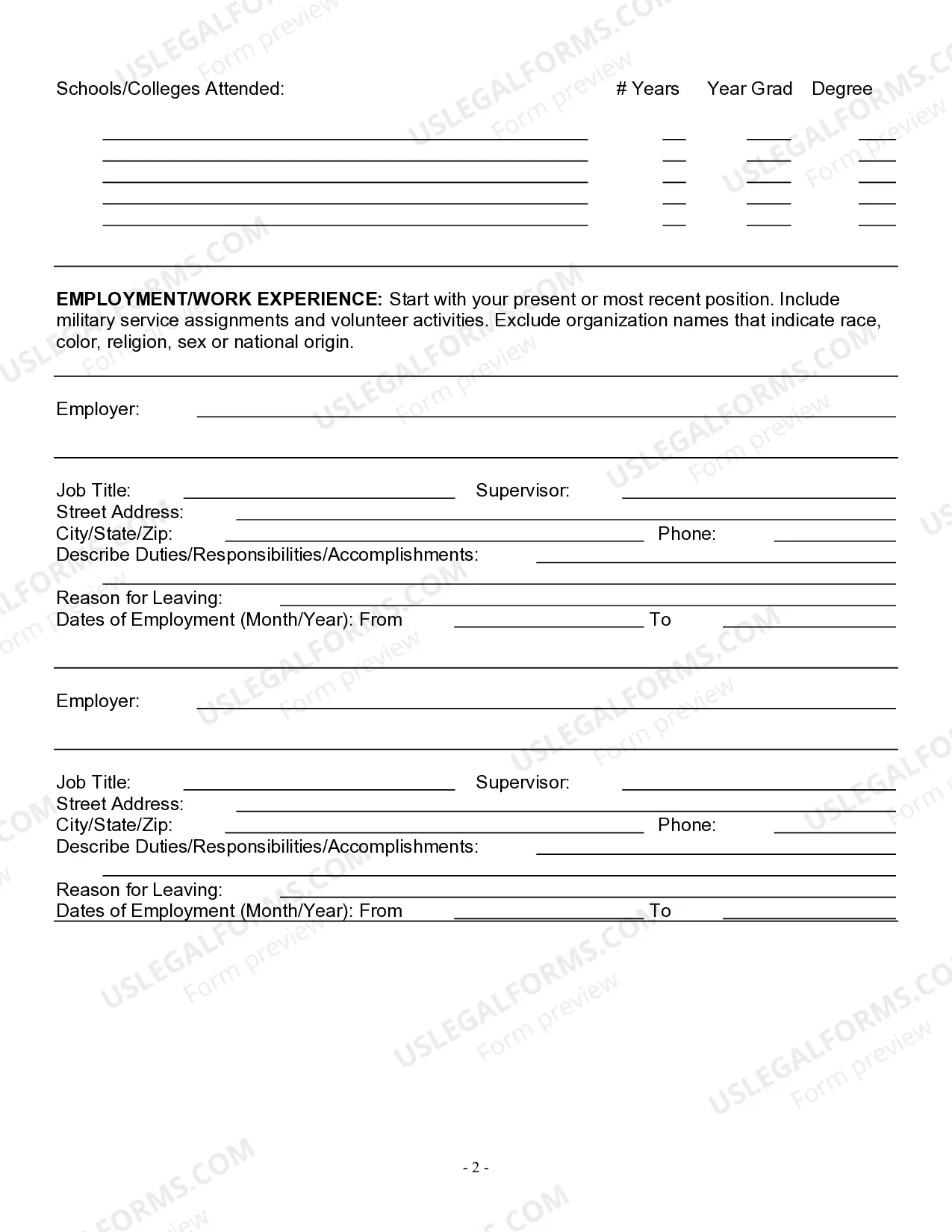

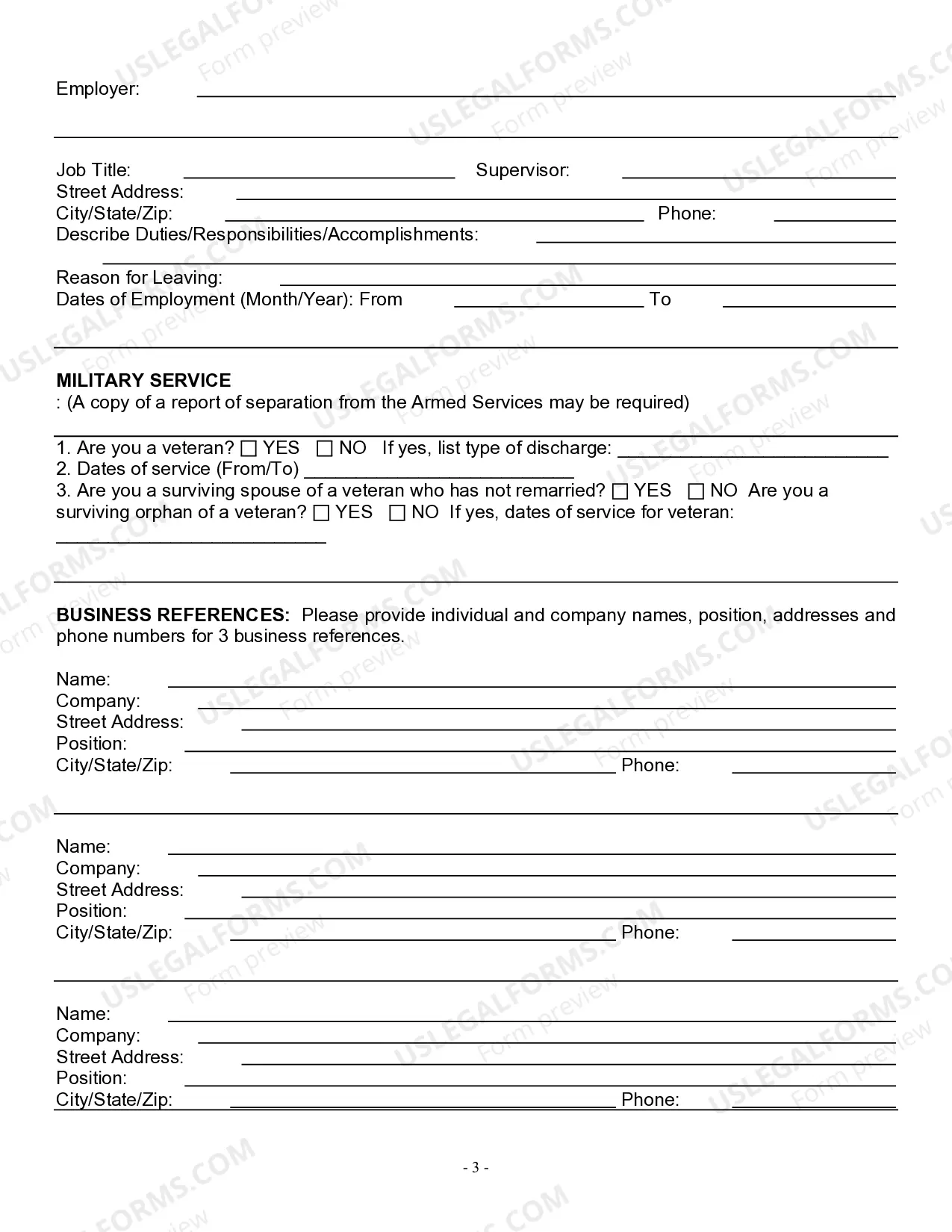

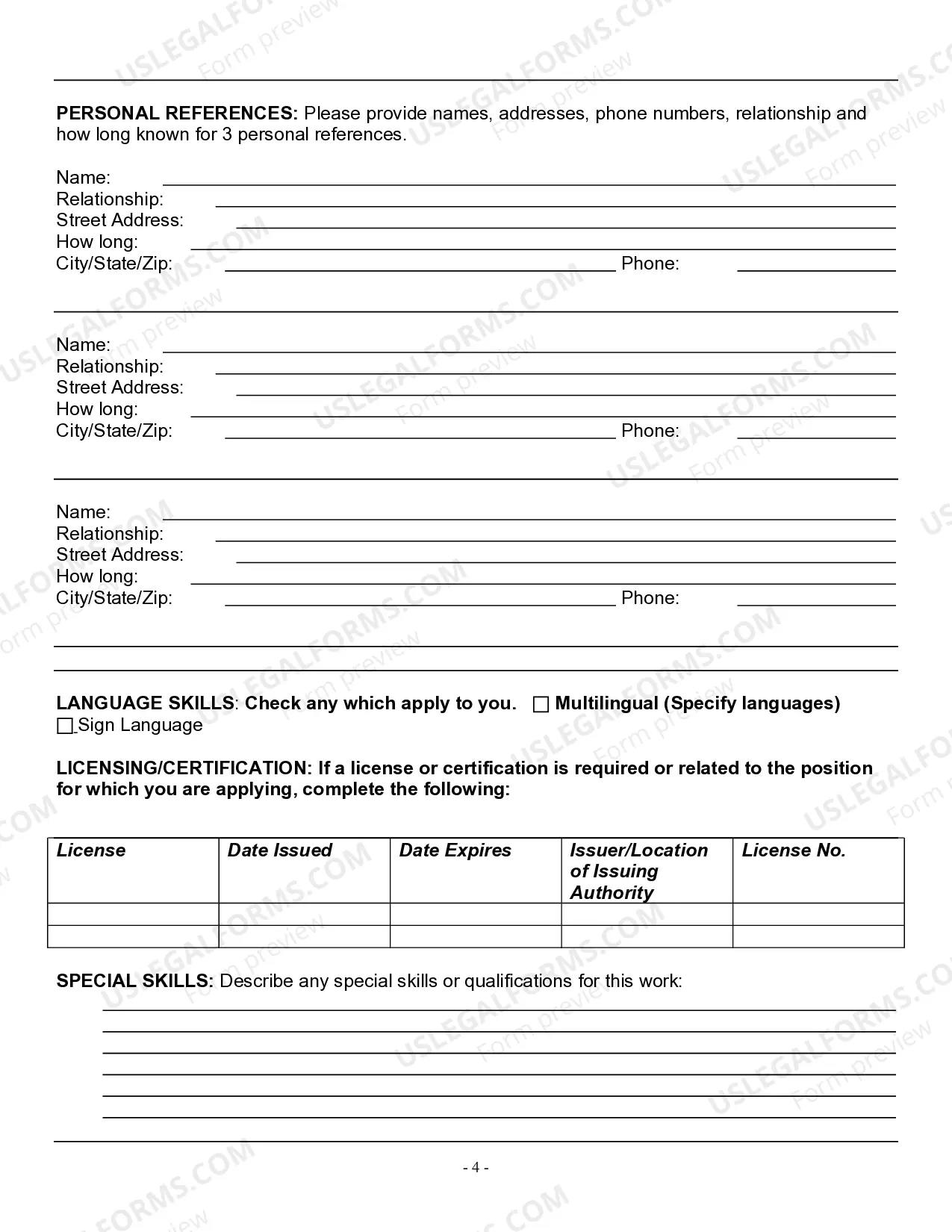

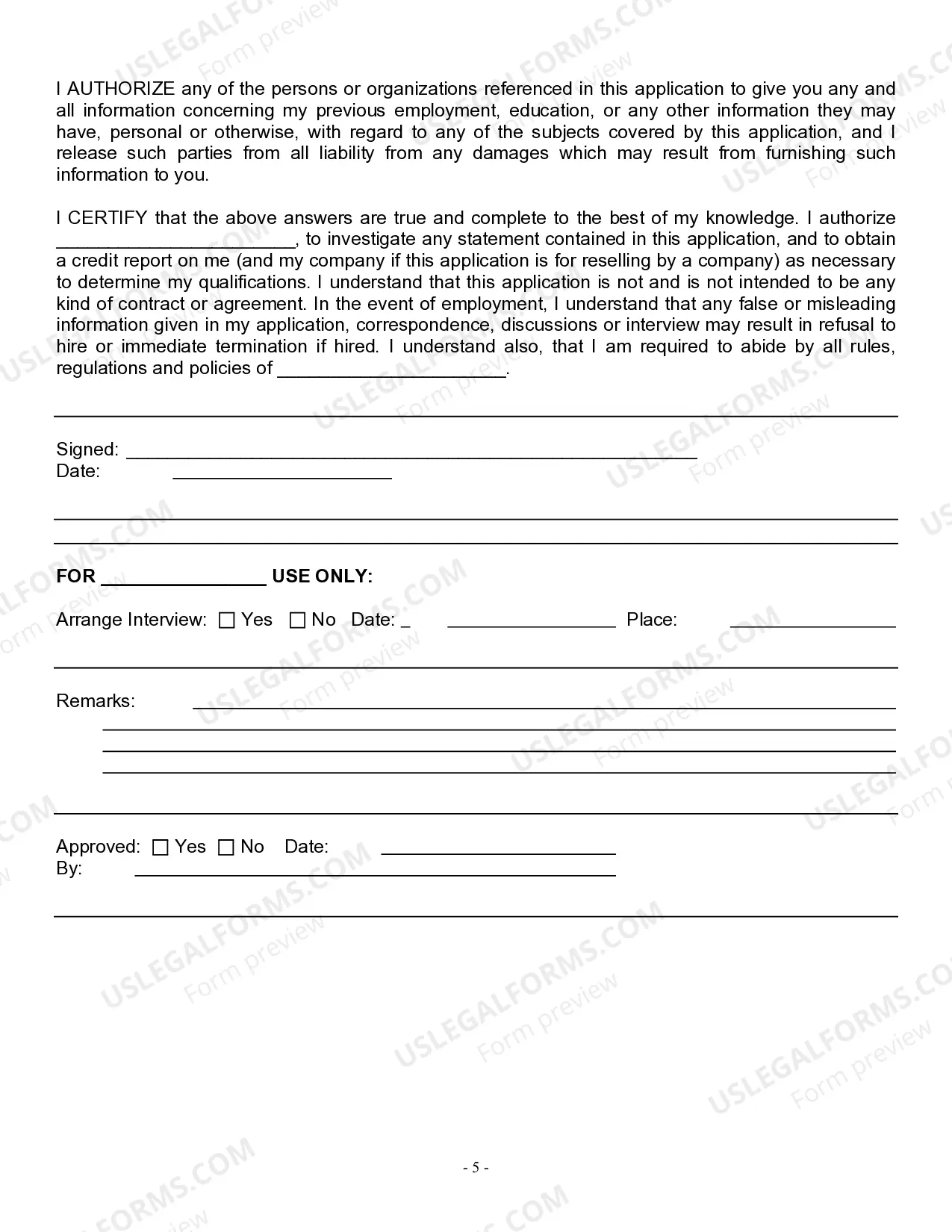

North Carolina Employment Application for Lawyer

Description

How to fill out Employment Application For Lawyer?

Are you presently in a situation where you need to have documents for potential business or personal use nearly every workday.

There are numerous legal document templates accessible online, but finding ones that you can rely on is not straightforward.

US Legal Forms provides thousands of form templates, such as the North Carolina Employment Application for Attorney, that are created to comply with state and federal regulations.

Once you find the right form, click Buy now.

Choose your desired pricing plan, fill in the required information to create your account, and process the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- After that, you can download the North Carolina Employment Application for Attorney template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you require and ensure it is for the correct city/state.

- Utilize the Preview option to review the form.

- Check the details to confirm you have chosen the right form.

- If the form is not what you need, use the Search section to find the form that fits your specifications.

Form popularity

FAQ

An employer must pay an employee at least the minimum wage (currently $7.25 an hour under both North Carolina and federal labor laws) or pay the employee the promised rate of pay, whichever is greater, and pay time and one-half overtime pay based on the employee's regular rate of pay for all hours worked in excess of

Forms for New EmployeesW-4 (2021) (Federal Withholding Allowance Certificate)Withholding Form for North Carolina State Tax (NC-4)Confidentiality Agreement Form.Substance Abuse Policy Form.Employee Information Form.Online Directory Profile Creation/Update Form.

Exempt refers to not being eligible to receive overtime pay or qualify for minimum wage. To be exempt, your job must meet the $684/week minimum requirement and meet the duties tests described above, in addition to being salaried. There is a common misperception that all non-exempt employees are paid on an hourly basis.

An exempt employee is an employee who does not receive overtime pay or qualify for minimum wage. Exempt employees are paid a salary rather than by the hour, and their work is executive or professional in nature.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

To be exempt according to FLSA and NCWAHA, employees must meet all the following criteria: Earn a guaranteed minimum of at least $23,600 per year or $455 per week. Get paid on a salaried basis, rather than hourly. Carry out exempt job duties at the FLSA defines.

The law categorizes all employees as exempt or non-exempt. Non-exempt employees are entitled to overtime pay, whereas exempt employees are not. There are certain types of employees that are more likely to be non-exempt.

To be exempt according to FLSA and NCWAHA, employees must meet all the following criteria: Earn a guaranteed minimum of at least $23,600 per year or $455 per week. Get paid on a salaried basis, rather than hourly. Carry out exempt job duties at the FLSA defines.

North Carolina is an employment-at-will state. This means that in the absence of a contractual agreement between an employer and an employee establishing a definite term of employment, the relationship is presumed to be terminable at the will of either party without regard to the quality of performance of either party.

Come in or send the following completed forms to your Division or Facility HR Office:Emergency Contact.Personnel Profile.Direct Deposit Authorization with a voided check. Direct Deposit Form.W-4.NC-4 or NC-4 EZ.Education/Credential Verification Form.Prior Creditable State Service Verification Form.