North Carolina Application For Base Fee Chapter 13 is an application used by debtors in North Carolina to pay a base fee for filing a Chapter 13 bankruptcy case. It must be completed and submitted to the court along with the applicable filing fee. There are two types of applications for North Carolina Chapter 13 filings: (1) the General Application for Base Fee and (2) the Application for Base Fee for Self-Employed Debtors. The General Application is used for most Chapter 13 cases, while the Application for Self-Employed Debtors is only used for debtors who are self-employed. The information provided on the application is used to calculate the base fee, which is set by the court. The application must include information such as the debtor’s name, Social Security Number, estimated total assets, estimated total liabilities, and estimated disposable income.

North Carolina Application For Base Fee Chapter 13

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Carolina Application For Base Fee Chapter 13?

If you're searching for a method to effectively finalize the North Carolina Application For Base Fee Chapter 13 without employing a legal expert, then you're in the perfect place.

US Legal Forms has established itself as the most comprehensive and esteemed repository of formal templates for every personal and business circumstance. Every document you discover on our online platform is crafted in compliance with national and state regulations, ensuring that your documents are properly organized.

Another excellent feature of US Legal Forms is that you will never misplace the paperwork you purchased - you can retrieve any of your downloaded forms in the My documents section of your profile whenever you need.

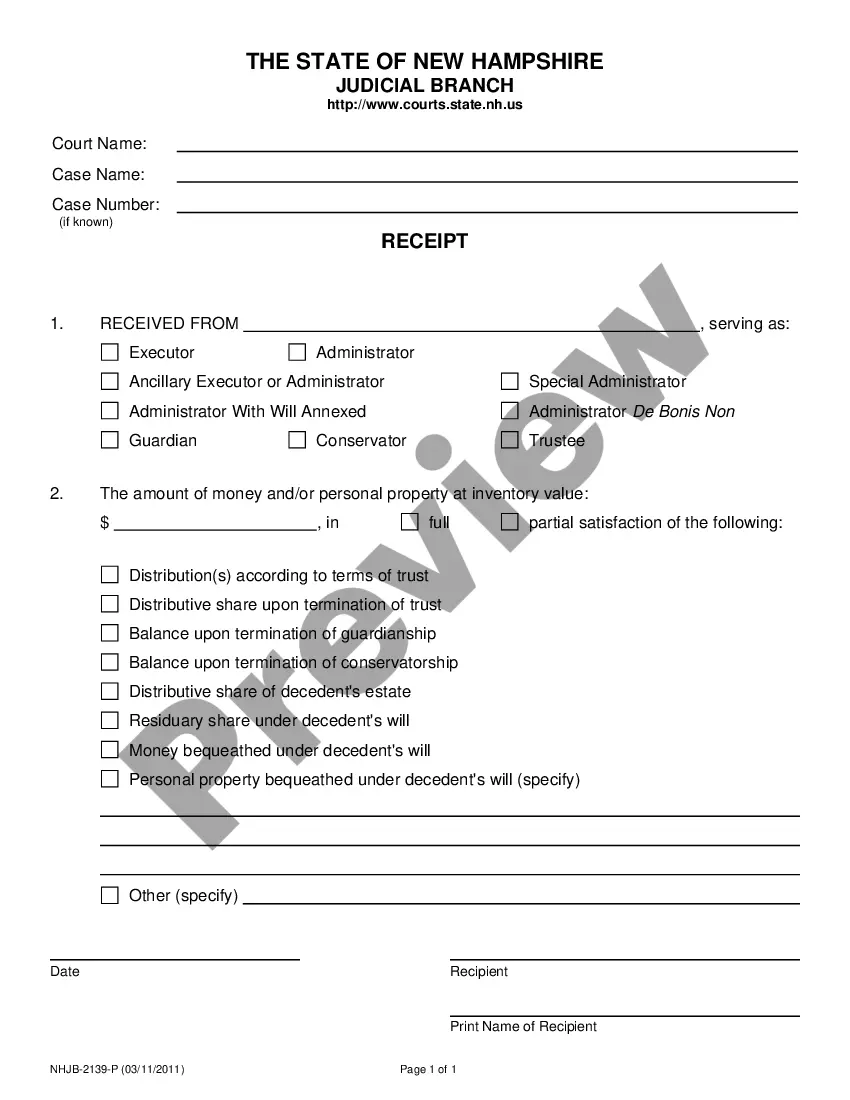

- Ensure the document displayed on the page corresponds with your legal circumstances and state regulations by reviewing its text description or exploring the Preview mode.

- Input the document name in the Search tab at the top of the page and select your state from the dropdown to find another template if there are any discrepancies.

- Repeat the content verification process and click Buy now when you are assured that the paperwork aligns with all the requirements.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you do not already possess one.

- Utilize your credit card or the PayPal option to purchase your US Legal Forms subscription. The form will be available for download immediately after.

- Select the format in which you wish to save your North Carolina Application For Base Fee Chapter 13 and download it by clicking the corresponding button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your physical copy manually.

Form popularity

FAQ

Firstly, all Chapter 13 payment plans must repay all priority claims and administrative expenses in full. These types of debts include taxes, child support, alimony, attorneys' fees and court costs.

If your Chapter 13 plan payment is too high, you can sometimes get it lowered if you encounter a reduction in household income. If your income reduces, you are many times also allowed to reduce your plan payment. This is accomplished usually by filing a Motion to Modify your Chapter 13 plan.

Your debts will not be discharged. Often creditors?especially unsecured creditors?don't bother to file claims with the bankruptcy court and their debts get discharged, but only if you complete the plan. When the case is dismissed, those creditors stay with you.

The Minimum Percentage of Debt Repayments In A Chapter 13 Bankruptcy Is 8 To 10 Percent.

Funds that are in a Chapter 13 debtor's case when the case is. formally closed as completed that are not necessary for the. satisfaction of creditors, or funds received after a case closes as a. completed case, will be paid directly to the debtor(s).

The discharge releases the debtor from all debts provided for by the plan or disallowed (under section 502), with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.

You can receive tax refunds while in bankruptcy. However, refunds may be subject to delay or used to pay down your tax debts.

If a debtor fails to keep up with payments under their repayment plan in a Chapter 13 bankruptcy, the bankruptcy trustee may file a motion to dismiss their case. This means that their debts would not be discharged because the case would be considered unsuccessful.