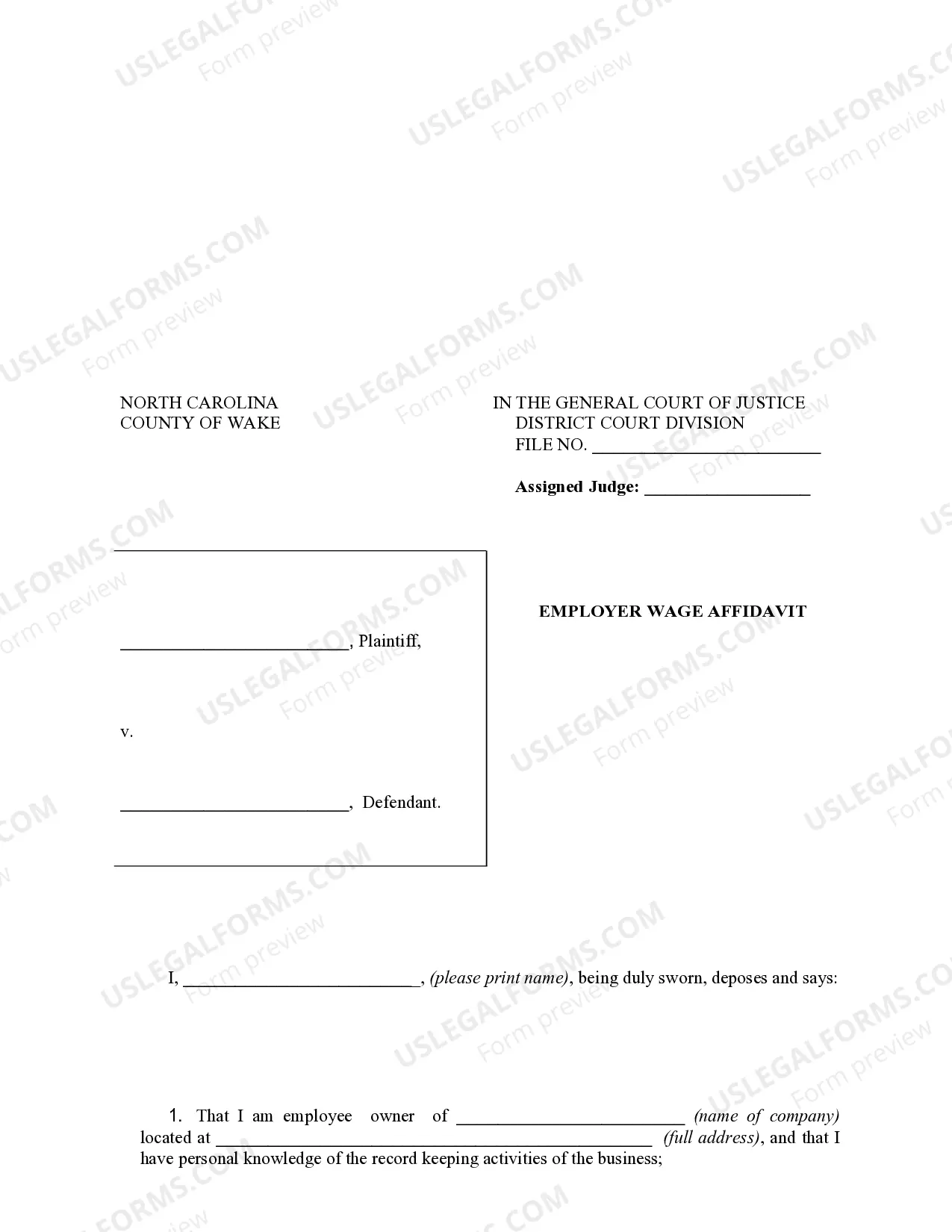

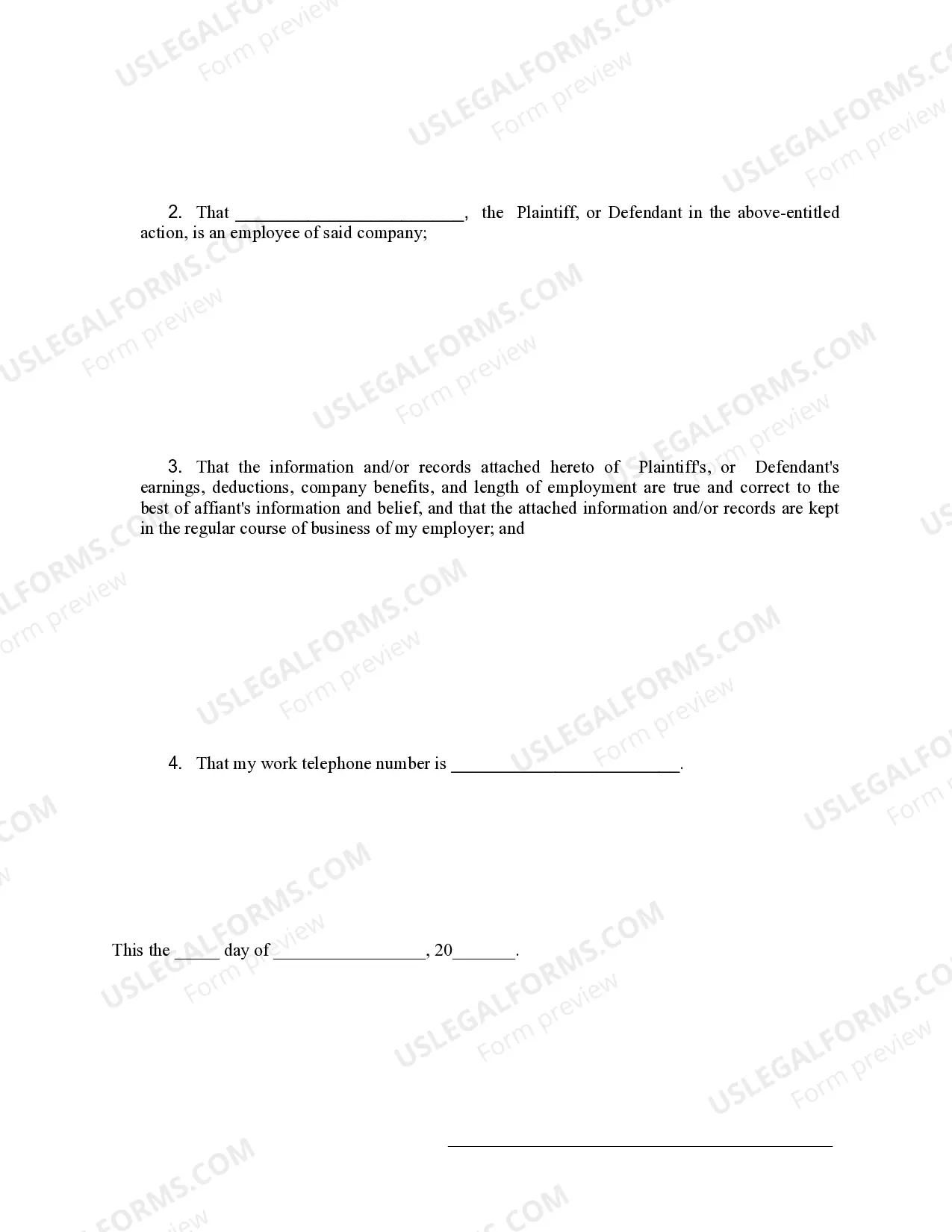

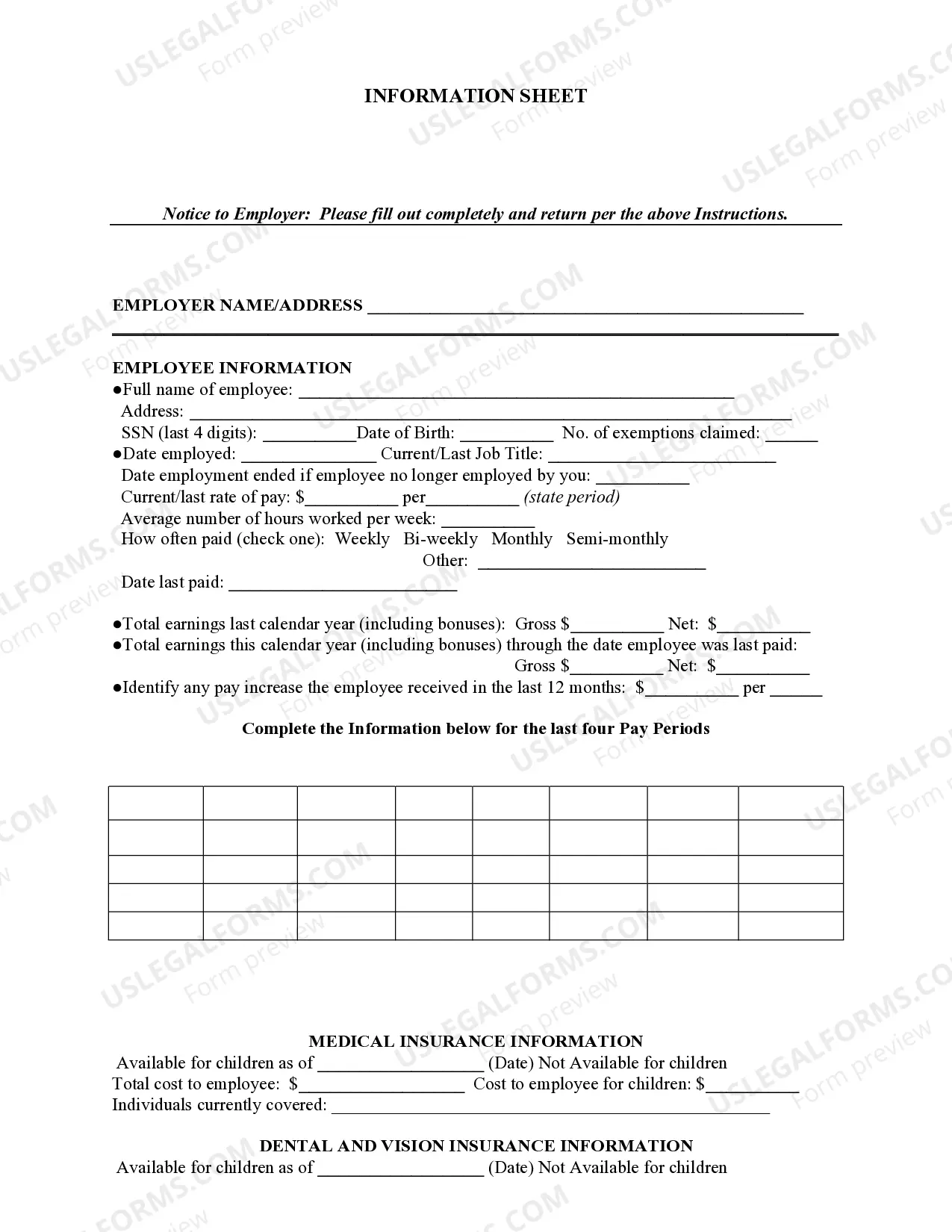

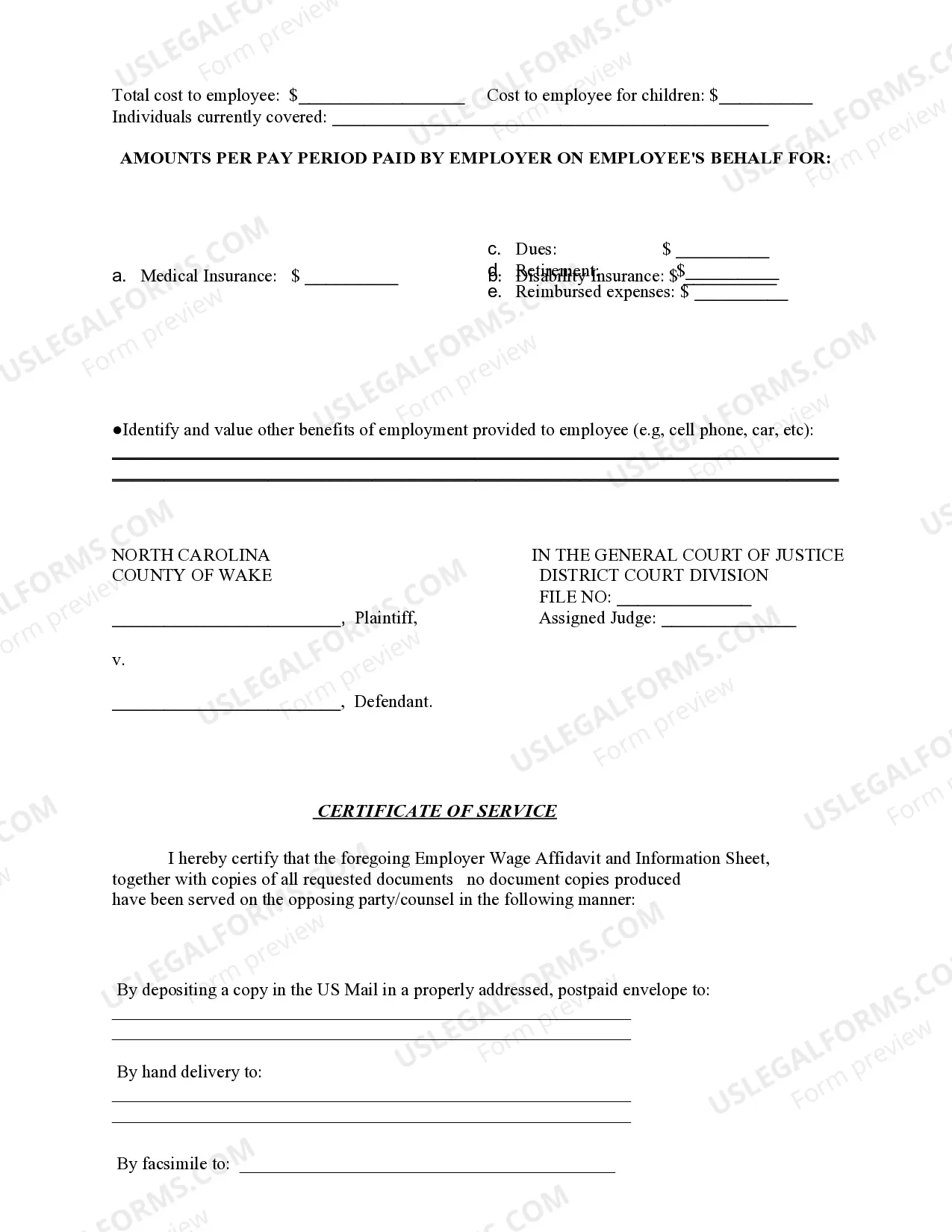

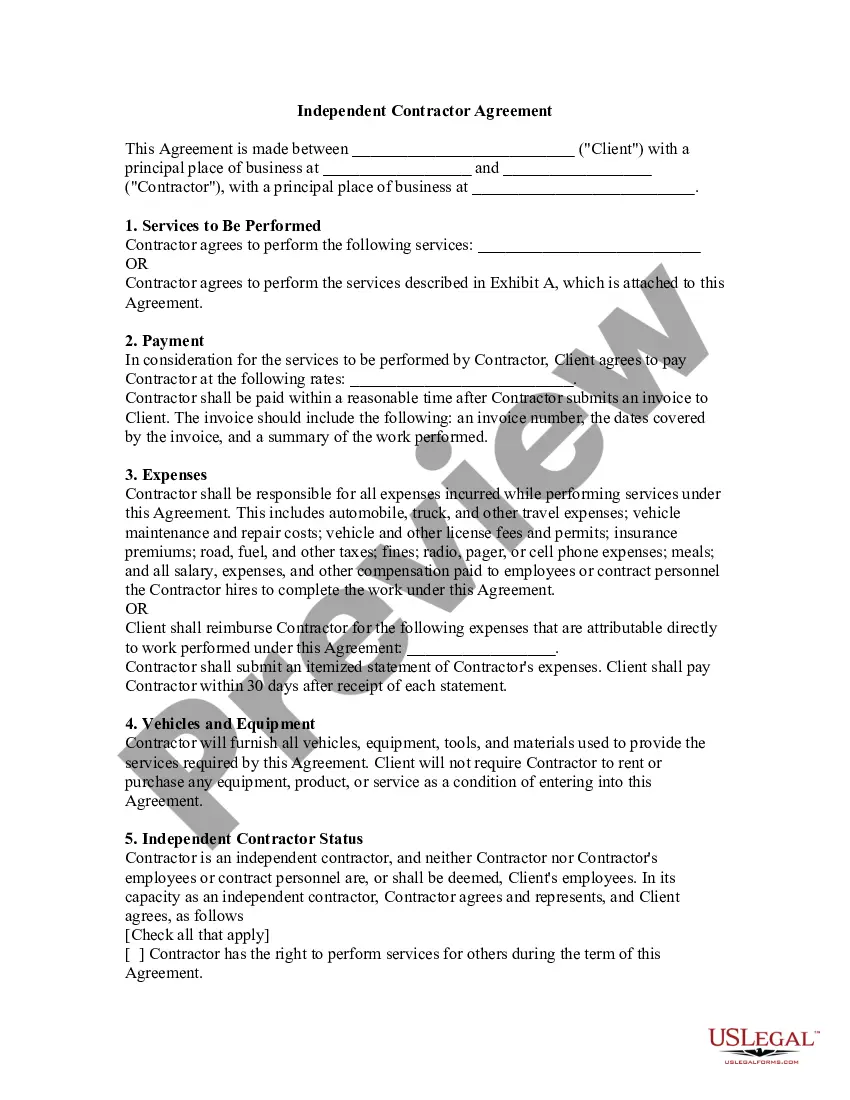

North Carolina Employer Wage Affidavit is a document that employers in North Carolina are required to complete in order to determine an employee's creditworthiness. The purpose of the affidavit is to provide information to the North Carolina Department of Revenue regarding the employee's wages and taxes withheld. The affidavit must be completed and signed by the employer in order to be valid. There are two types of North Carolina Employer Wage Affidavit: 1. NC-EZ Employer Wage Affidavit — This is a simplified version of the affidavit that can only be used if an employee's wages and tax withholding are identical for all pay periods. 2. NEW Employer Wage Affidavit — This is a more detailed version of the affidavit that must be used if the employee's wages and tax withholding vary between pay periods.

North Carolina Employer Wage Affidavit

Description

How to fill out North Carolina Employer Wage Affidavit?

If you’re looking for a method to effectively complete the North Carolina Employer Wage Affidavit without engaging a lawyer, then you’ve come to the right spot. US Legal Forms has established itself as the most comprehensive and trustworthy repository of official templates for every personal and business circumstance. Every document you discover on our online service is crafted in alignment with federal and state regulations, so you can be assured that your paperwork is accurate.

Follow these simple guidelines on how to obtain the ready-to-use North Carolina Employer Wage Affidavit.

Another significant benefit of US Legal Forms is that you will never lose the documents you bought - you can access any of your downloaded templates in the My documents tab of your profile whenever necessary.

- Ensure the document displayed on the page matches your legal needs and state regulations by reviewing its text description or browsing through the Preview mode.

- Input the form name in the Search tab at the top of the page and select your state from the list to locate another template if there are any discrepancies.

- Repeat the content verification and click Buy now when you are confident that the documents meet all requirements.

- Log in to your account and select Download. Register for the service and choose the subscription plan if you haven’t already.

- Utilize your credit card or the PayPal method to purchase your US Legal Forms subscription. The document will be available for download immediately afterward.

- Select the format in which you wish to save your North Carolina Employer Wage Affidavit and download it by clicking the appropriate button.

- Upload your template to an online editor to quickly fill out and sign it, or print it out to prepare a hard copy manually.

Form popularity

FAQ

Farm work is completely exempt from any of the provisions of the North Carolina Wage and Hour Act. Employment in haz- ardous or detrimental occupations is not permitted for youth under the age of 18.

The IRS and the Affordable Care Act define anyone working 30 hours or more a week or 130 hours or more a month as a full-time employee.

The NCWHA provides that the current minimum wage in North Carolina is $7.25 per hour, because this is the federal minimum wage set out in the Fair Labor Standards Act, 29 U.S.C. 206(a)(1).

The Equal Pay Act of 1963 makes it illegal for employers to pay unequal wages to men and women who perform substanally equal work. Your employer can pay different amounts based on seniority, merit, quanty or quality of producon, or a factor other than sex.

The federal minimum wage for covered nonexempt employees is $7.25 per hour.

Employers must notify employees in writing or through a posted notice maintained in a place accessible to its employees of any reduction in the rate of promised wages at least 24 hours prior to such change.

Every employer shall pay every employee all wages and tips accruing to the employee on the regular payday. Pay periods may be daily, weekly, bi-weekly, semi-monthly, or monthly. Wages based upon bonuses, commissions, or other forms of calculation may be paid as infrequently as annually if prescribed in advance.