North Carolina Dissolution Package to Dissolve Limited Liability Company LLC

Description

Definition and meaning

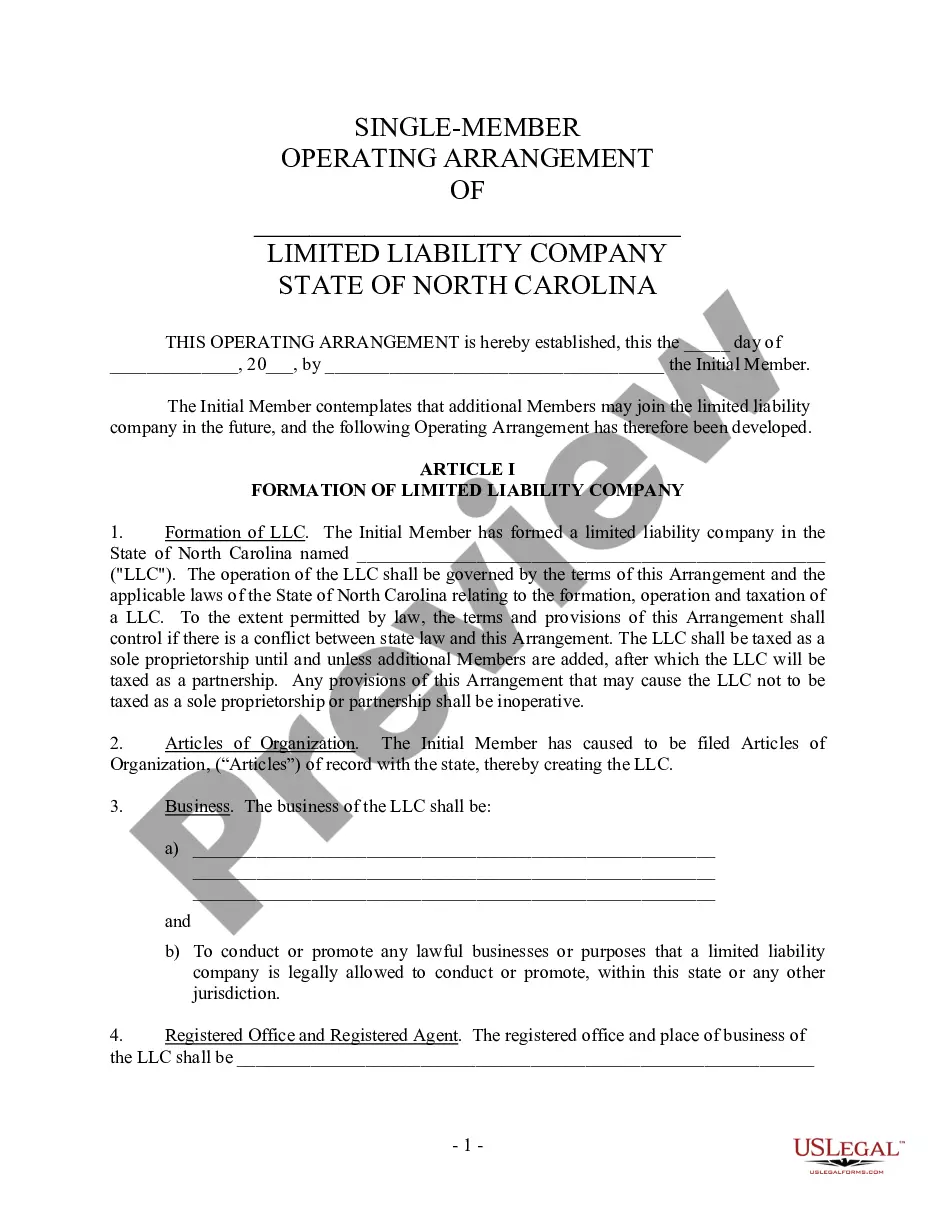

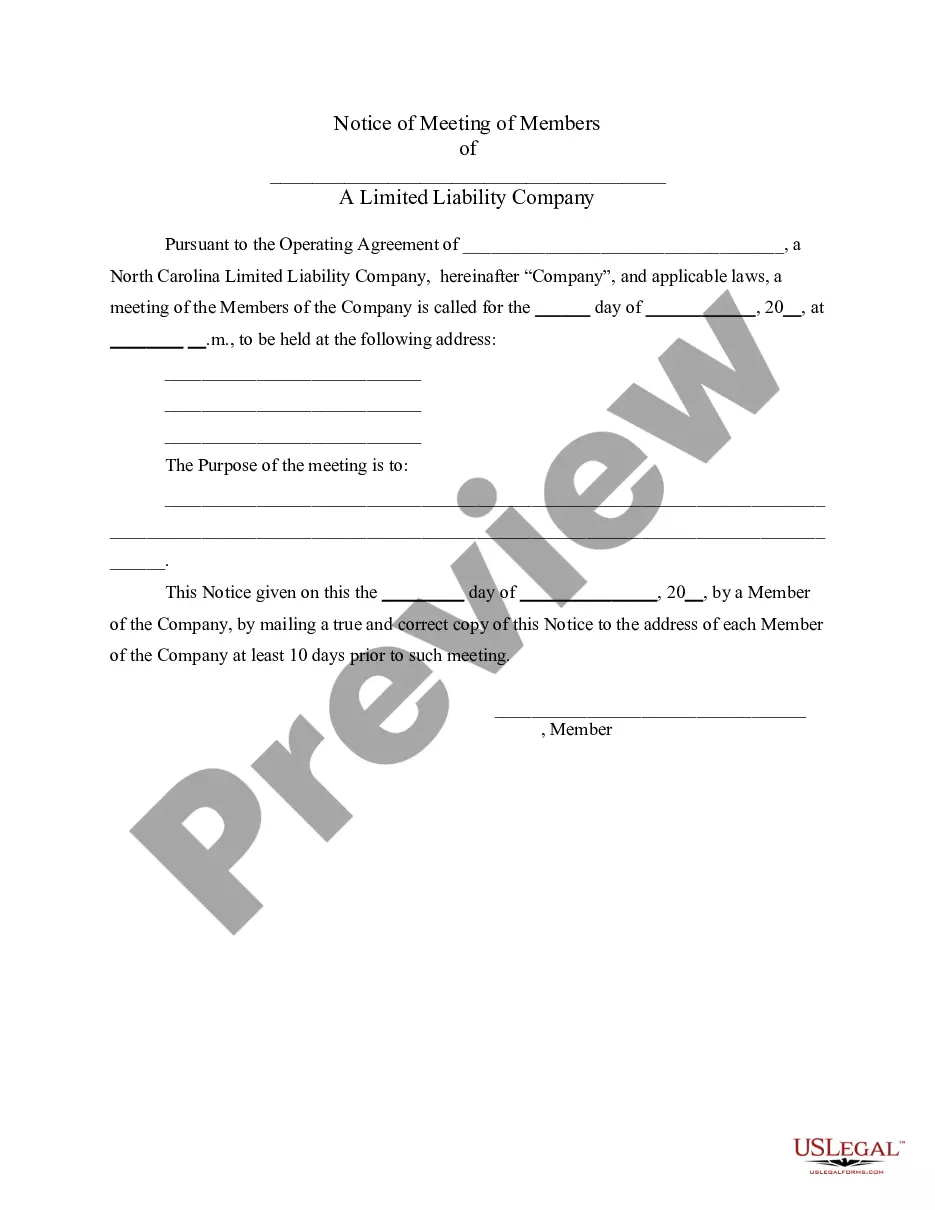

The North Carolina Dissolution Package to Dissolve Limited Liability Company (LLC) is a collection of legal documents necessary for formally dissolving an LLC in North Carolina. This package includes the required articles of dissolution, forms for notifying claimants, and guidelines on winding up the company’s affairs. The process ensures that all legal obligations are addressed and that the dissolution of the LLC is recognized by the state.

How to complete a form

To complete the dissolution process, follow these steps:

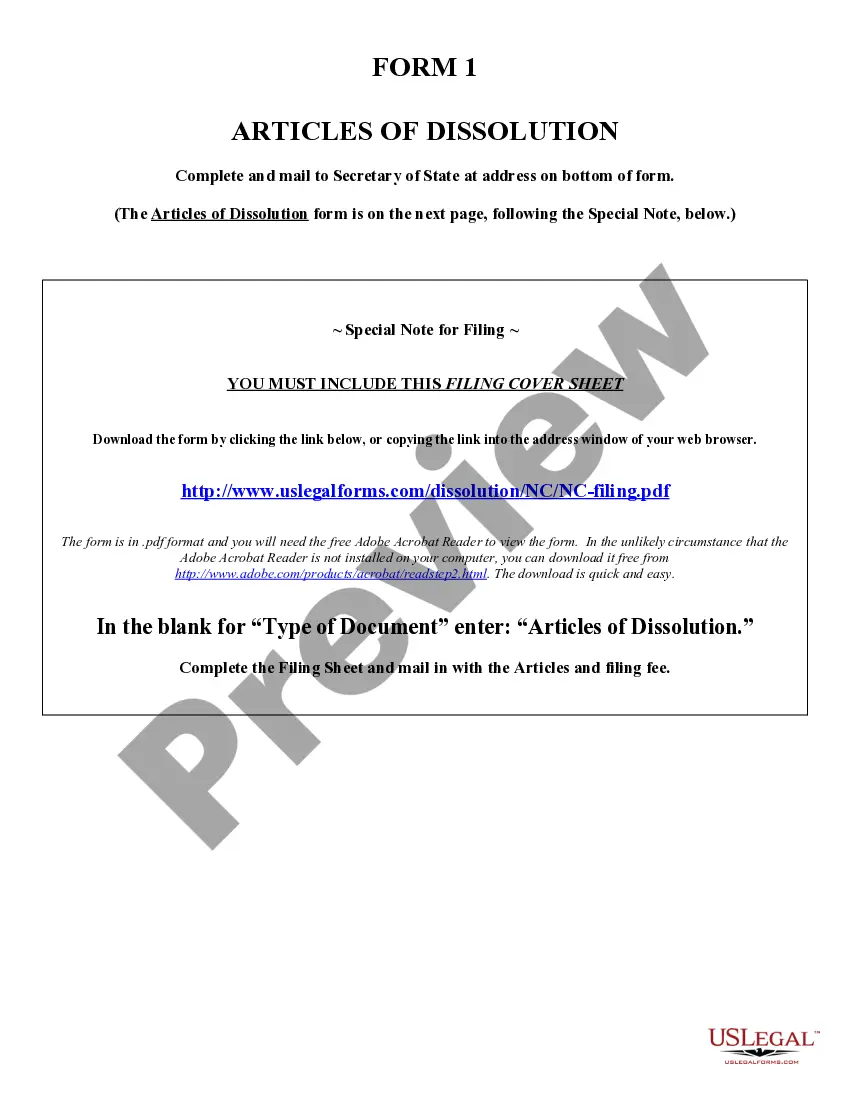

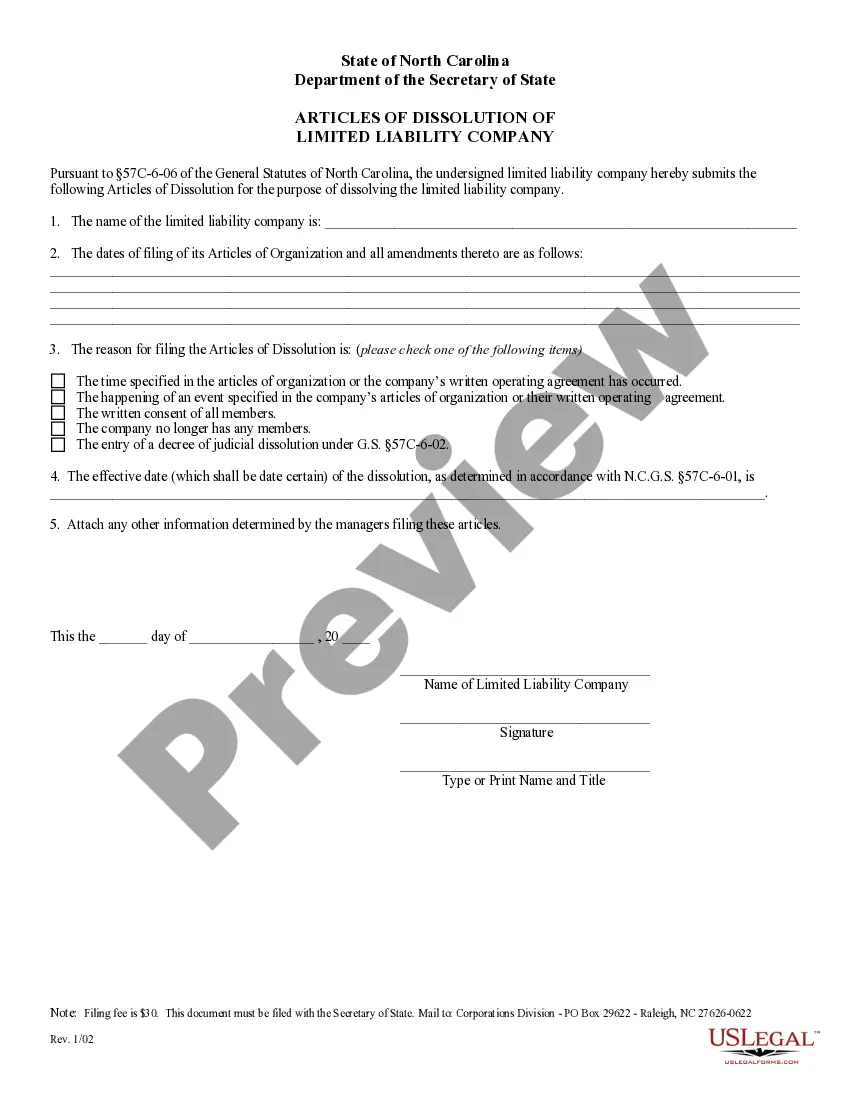

- Download the Articles of Dissolution form from the official source.

- Fill in the required information, including the company name, date of formation, and reason for dissolution.

- Provide the effective date of dissolution.

- Submit the completed form to the Secretary of State along with the required filing fee.

Ensure that all sections are filled out clearly to avoid any delays in processing.

Who should use this form

This dissolution package is intended for owners and managers of Limited Liability Companies (LLCs) in North Carolina who have decided to formally shut down their business. It is suitable for both single-member LLCs and multi-member LLCs. Before filing, it is advisable to consult with a legal professional to ensure that all business affairs are properly addressed.

Legal use and context

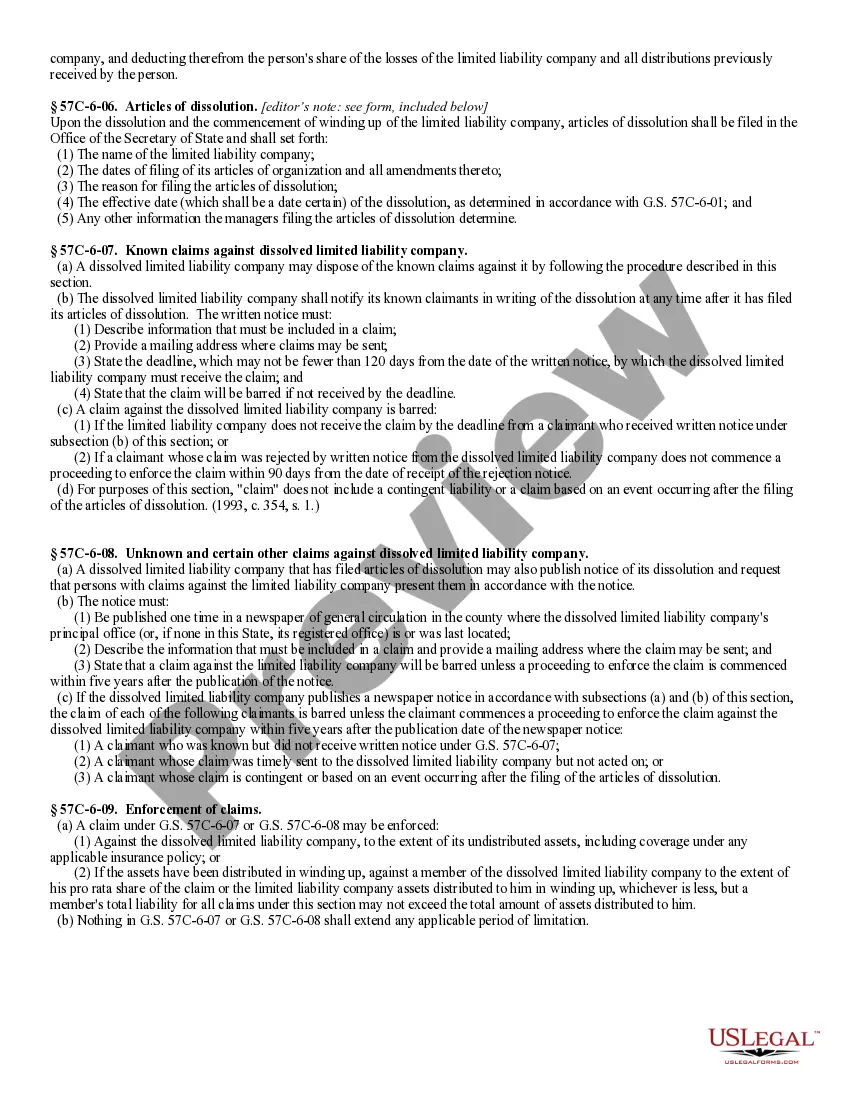

Dissolving an LLC in North Carolina through the Dissolution Package aligns with the state's legal framework as outlined in the North Carolina Limited Liability Company Act. Following the proper legal procedures for dissolution helps to protect the interests of members and creditors, preventing future liabilities associated with the company.

Key components of the form

The key components of the Dissolution Package include:

- Articles of Dissolution: Official documentation to be filed with the Secretary of State.

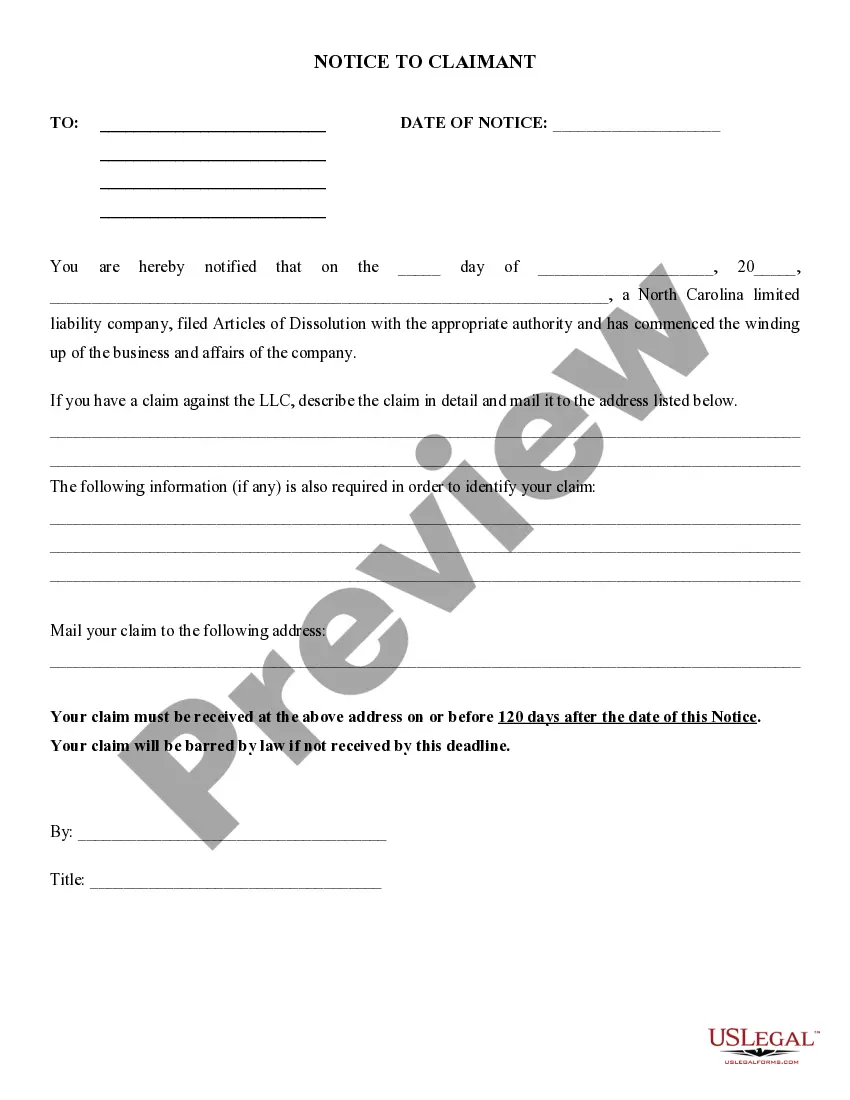

- Notices to Known Claimants: Forms for informing creditors and claimants regarding the dissolution.

- Winding Up Guidelines: Instructions for properly concluding the business's activities and addressing outstanding obligations.

State-specific requirements

In North Carolina, specific requirements must be followed when dissolving an LLC:

- The Articles of Dissolution must be filed with the Secretary of State.

- Notice must be provided to any known claimants or creditors.

- Compliance with any provisions outlined in the operating agreement of the LLC.

Adhering to these requirements is essential to ensure a smooth and legal dissolution process.

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

Avoid costly lawyers and find the North Carolina Dissolution Package to Dissolve Limited Liability Company LLC you need at a reasonable price on the US Legal Forms site. Use our simple categories functionality to search for and download legal and tax forms. Read their descriptions and preview them before downloading. Moreover, US Legal Forms enables customers with step-by-step tips on how to obtain and complete every single form.

US Legal Forms clients just have to log in and download the specific form they need to their My Forms tab. Those, who haven’t got a subscription yet need to follow the guidelines listed below:

- Make sure the North Carolina Dissolution Package to Dissolve Limited Liability Company LLC is eligible for use where you live.

- If available, look through the description and make use of the Preview option prior to downloading the templates.

- If you are confident the document fits your needs, click Buy Now.

- In case the template is wrong, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select obtain the form in PDF or DOCX.

- Click Download and find your template in the My Forms tab. Feel free to save the template to the device or print it out.

Right after downloading, it is possible to fill out the North Carolina Dissolution Package to Dissolve Limited Liability Company LLC by hand or with the help of an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement. With the required votes, you can move forward with the dissolution.

Unless dissolved, your California LLC will continue to be liable for state fees, it will continue to be open to incurring more debts, it will continue to own the assets under its name, and you won't be able to sell those assets as your own.

If you want to close a North Carolina business, you do so by voluntarily filing Articles of Dissolution for the entity type (Business Corporation, Nonprofit Corporation, Limited Liability Company (LLC)).

There is no fee to file the California dissolution forms. To speed up the process, you can pay for expedited service and preclearance.

If you are a member of a limited liability company and wish to leave the membership voluntarily, you cannot simply walk away. There are procedures to follow that include methods of notification of the remaining membership, how assets are handled, and what the provisions of withdrawal are for each LLC.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.