Montana Post Acquisition Opinion

Description

How to fill out Post Acquisition Opinion?

Discovering the right authorized papers template can be a struggle. Obviously, there are a variety of layouts available on the net, but how will you find the authorized form you will need? Make use of the US Legal Forms internet site. The services gives thousands of layouts, such as the Montana Post Acquisition Opinion, which you can use for enterprise and personal needs. Every one of the varieties are checked out by pros and fulfill state and federal demands.

Should you be presently listed, log in in your accounts and then click the Down load switch to get the Montana Post Acquisition Opinion. Make use of accounts to check from the authorized varieties you possess purchased earlier. Proceed to the My Forms tab of your own accounts and acquire one more copy of the papers you will need.

Should you be a brand new customer of US Legal Forms, allow me to share basic guidelines that you should stick to:

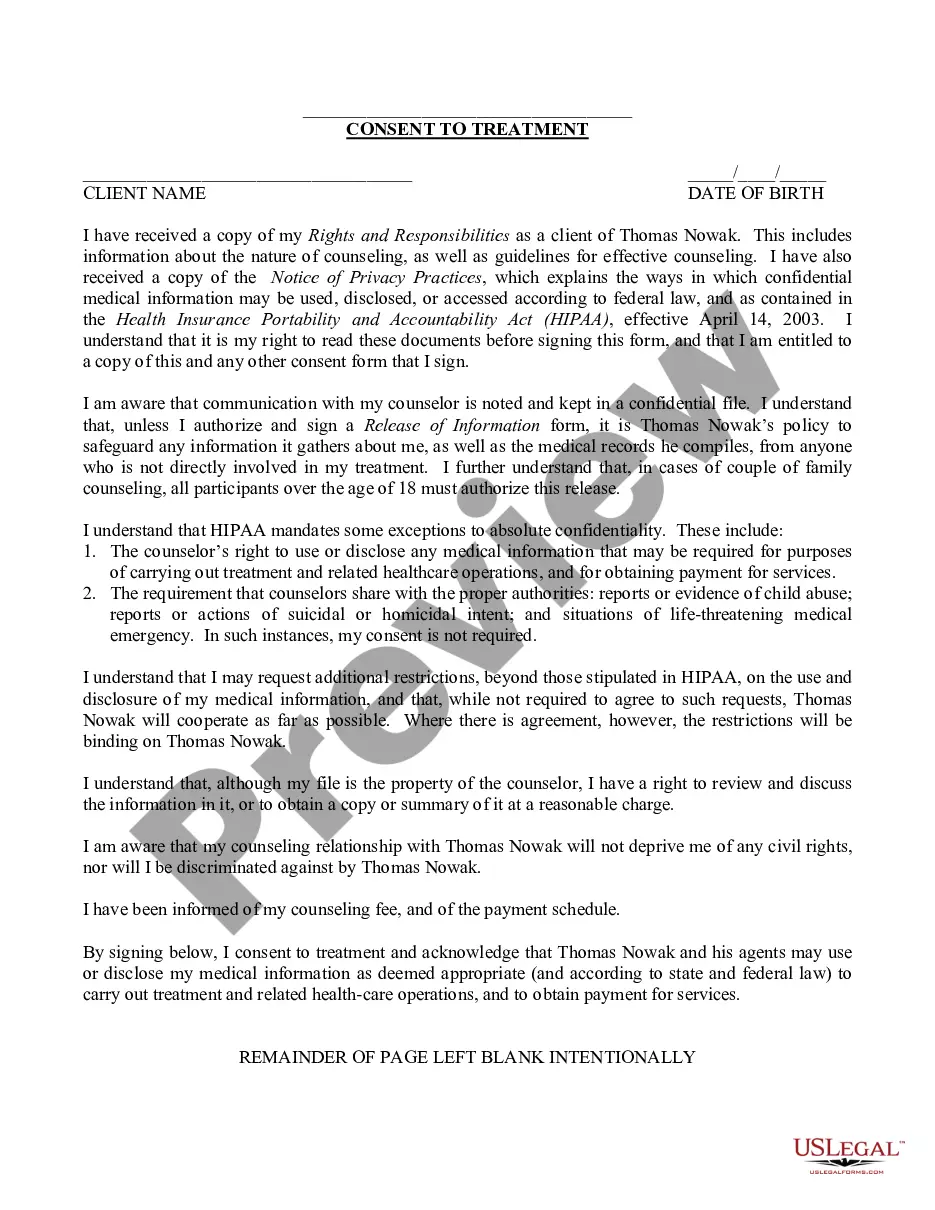

- First, make sure you have chosen the right form to your area/state. You are able to look through the shape making use of the Preview switch and study the shape description to guarantee it will be the best for you.

- In case the form will not fulfill your preferences, take advantage of the Seach area to obtain the right form.

- When you are certain that the shape is proper, click the Acquire now switch to get the form.

- Select the rates strategy you need and enter in the needed information. Make your accounts and purchase an order with your PayPal accounts or bank card.

- Opt for the document formatting and obtain the authorized papers template in your device.

- Full, revise and print and sign the acquired Montana Post Acquisition Opinion.

US Legal Forms may be the biggest library of authorized varieties that you can discover different papers layouts. Make use of the company to obtain appropriately-made files that stick to state demands.

Form popularity

FAQ

In conclusion, merger and acquisition (M&A) activity in India has been steadily increasing in recent years, driven by factors such as favorable government policies, growing investor interest, and the need for companies to expand their businesses and gain a competitive edge in the market.

Lacking a good motive for the acquisition. ... Targeting the wrong company. ... Overestimating synergies. ... Overpaying. ... Exogenous risks. ... Losing the trust of important stakeholders. ... Inadequate due diligence. ... Failing to pull out of a deal when all evidence says you should.

Answer and Explanation: The government will oppose the merger of two firms if they are large companies that influence its economy effectively. Therefore, the government is likely to prohibit merging two large firms because they are likely to create a monopolistic business environment.

Maintaining Momentum. The issue which underpins all integration challenges in mergers is maintaining momentum. ... Employee Engagement. ... Senior Management Issues. ... The Culture Shift. ... Technology Integration. ... Synergy Implementation. ... Customer Engagement. ... Communication Challenges.

Common Reasons Why Mergers and Acquisitions Fail Lack of Cultural Fit. ... Poor Due Diligence. ... Overvaluation and Overpaying. ... Ineffective Post-Merger Integration. ... Ineffective People Management and Change Management. ... Deciding To Persevere or Fail Fast. ... Investing in Cultural Due Diligence. ... Transparent Personnel Planning.

Value destruction, poor communication and integration, and cultural differences are some of the most common reasons. If these issues are not addressed, it can be very difficult to make a merger or acquisition a success. Lastly, another common reason for failure is that the two companies simply are not compatible.

An acquisition is a great way for a company to achieve rapid growth over a short period of time. Companies choose to grow through M&A to improve market share, achieve synergies in their various operations, and to gain control of assets.

In cases where there is little in common between the companies, it may be difficult to gain synergies. Also, a bigger company may be unable to motivate employees and achieve the same degree of control. Thus, the new company may not be able to achieve economies of scale.