Montana Self-Employed Tailor Services Contract

Description

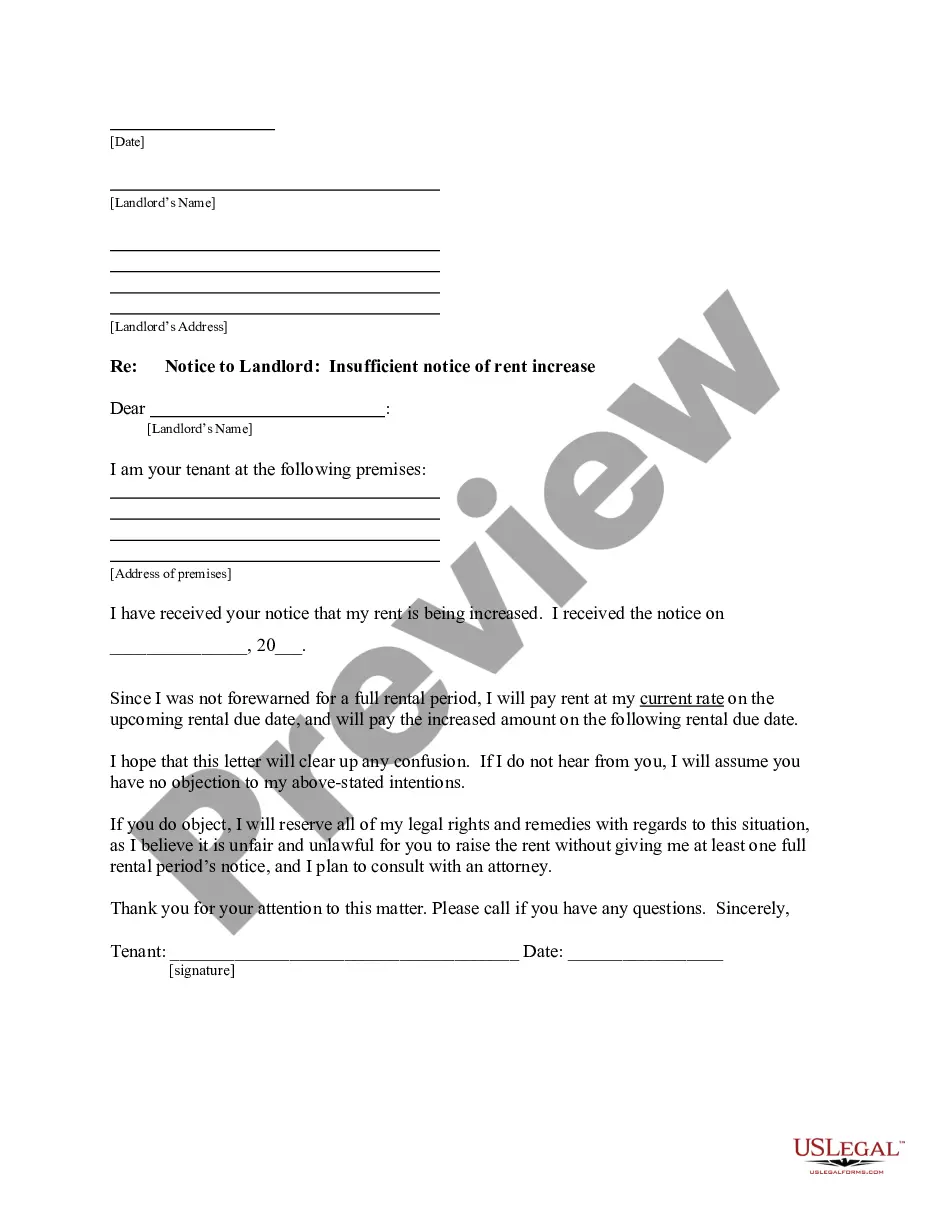

How to fill out Self-Employed Tailor Services Contract?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a broad selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Montana Self-Employed Tailor Services Contract in just a few minutes.

If you have an account, Log In and download the Montana Self-Employed Tailor Services Contract from your US Legal Forms library. The Download button will appear on every template you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Montana Self-Employed Tailor Services Contract. Each template you added to your account has no expiration date and is yours permanently. Therefore, if you want to download or print another copy, simply visit the My documents section and click on the form you desire. Access the Montana Self-Employed Tailor Services Contract with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Make sure you have selected the correct form for your area/region.

- Click the Preview button to review the form's contents.

- Read the form description to ensure that you have selected the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Writing a simple employment contract involves clearly stating the job title, responsibilities, and compensation details. Make sure to include the duration of employment and any benefits that may be offered. It’s essential to have both parties agree to the terms and sign the contract. For specific needs, consider a Montana Self-Employed Tailor Services Contract template from US Legal.

To write a self-employment contract, start by detailing the services you will provide and the terms of payment. Include clauses that outline the responsibilities of both parties, along with any confidentiality agreements. It’s wise to use a structured template like the Montana Self-Employed Tailor Services Contract from US Legal to ensure you cover all necessary points.

When writing a contract for a 1099 employee, be clear about the nature of the work and the method of compensation. Specify the deliverables, deadlines, and payment terms. It’s also important to clarify that the worker is an independent contractor, not an employee. A Montana Self-Employed Tailor Services Contract can provide the necessary framework for this type of agreement.

Yes, you can create your own legally binding contract, provided it meets certain legal requirements. Ensure that both parties agree to the terms and that the contract is signed by all involved. Including clear terms about services, payment, and obligations will help reinforce the contract’s validity. A template like the Montana Self-Employed Tailor Services Contract from US Legal can guide you in this process.

Writing a self-employed contract involves outlining the work to be performed and the compensation structure. Be specific about the duration of the contract and any terms regarding termination. Additionally, including clauses for confidentiality and dispute resolution can protect both parties. Utilizing a Montana Self-Employed Tailor Services Contract template can simplify this process.

Yes, you can write your own service agreement. It is crucial, however, to ensure that it includes all necessary components, such as descriptions of the services, payment terms, and cancellation policies. Using a reliable template can help streamline the process and ensure compliance with local laws. A Montana Self-Employed Tailor Services Contract template from US Legal can be a great starting point.

To write a contract agreement for services, start by clearly defining the services you will provide. Include details such as the scope of work, payment terms, and deadlines. It’s essential to specify the rights and responsibilities of both parties. Consider using the US Legal platform to access templates tailored for a Montana Self-Employed Tailor Services Contract.

Yes, it is legal to work without a signed contract, but it can lead to complications. Without formal documentation, you may struggle to prove the terms of your agreement or enforce your rights. A Montana Self-Employed Tailor Services Contract can clarify your role and responsibilities, making your work relationship more secure.

Self-employed individuals must comply with various legal requirements, including registering their business, paying taxes, and obtaining necessary licenses. It's essential to maintain accurate records of income and expenses for tax purposes. Additionally, using a Montana Self-Employed Tailor Services Contract can help you meet client expectations and legal obligations.

While it is not legally required to have a contract when you are self-employed, it is highly beneficial. A contract outlines the terms of your services, payment, and responsibilities, helping to prevent potential conflicts. Using a Montana Self-Employed Tailor Services Contract can help you establish a professional relationship with your clients and protect your interests.