Montana Self-Employed Independent Contractor Payment Schedule

Description

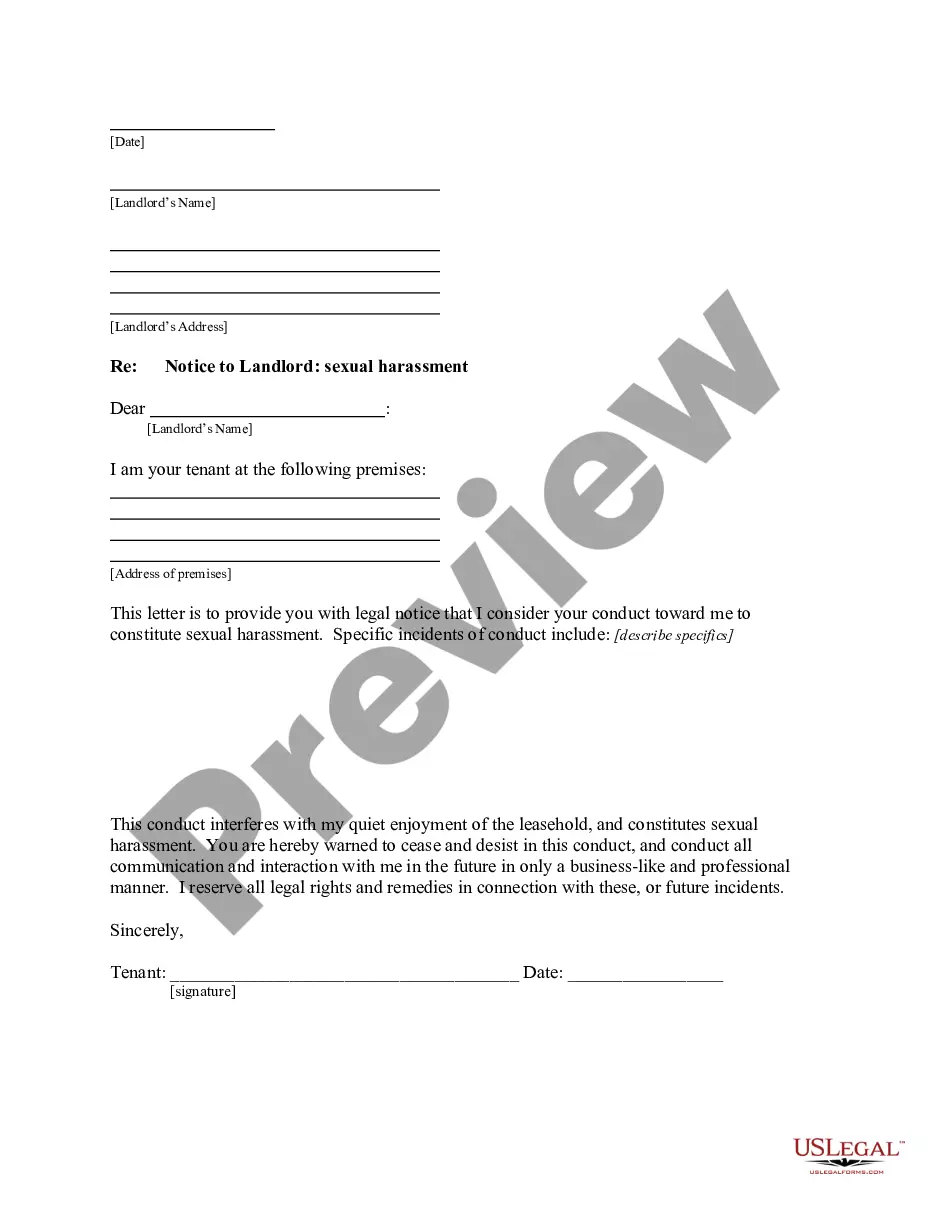

How to fill out Self-Employed Independent Contractor Payment Schedule?

You can dedicate several hours online searching for the official document template that meets the federal and state requirements you require. US Legal Forms offers a vast array of legal templates that have been reviewed by experts. You can obtain or print the Montana Self-Employed Independent Contractor Payment Schedule from our platform.

If you already have a US Legal Forms account, you can Log In and then click the Download button. After that, you can complete, modify, print, or sign the Montana Self-Employed Independent Contractor Payment Schedule. Every legal document template you purchase is yours to keep for a long time. To get another copy of a purchased form, visit the My documents section and click the appropriate option.

If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for your state/region of choice. Check the form description to confirm you have chosen the right template. If available, utilize the Preview feature to review the document template as well. If you wish to obtain another version of the form, use the Search field to find the template that fits your needs and requirements. Once you have located the template you need, click Acquire now to proceed. Select the pricing plan you prefer, enter your details, and create an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make adjustments to your document if necessary. You can complete, edit, sign, and print the Montana Self-Employed Independent Contractor Payment Schedule. Download and print a multitude of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to manage your business or personal requirements.

Form popularity

FAQ

The $600 rule from the IRS stipulates that any business that pays an independent contractor $600 or more in a calendar year must issue a Form 1099-NEC. This rule is significant because it helps ensure that income is reported accurately for tax purposes. By adhering to the Montana Self-Employed Independent Contractor Payment Schedule, you can effortlessly monitor your payments and stay compliant with this requirement. Resources such as US Legal Forms can provide you with the necessary templates and support to navigate this obligation.

To report self-employment income, you should use Schedule C (Form 1040) when filing your federal taxes. This form allows you to detail your earnings and expenses related to your independent contracting work. The Montana Self-Employed Independent Contractor Payment Schedule can assist you in organizing your income and expenses properly, ensuring that you report accurately. If you need guidance, platforms like US Legal Forms offer valuable tools for self-employed individuals.

As an independent contractor, you can receive payments through various methods, such as bank transfers, checks, or payment platforms like PayPal. It's crucial to communicate your preferred payment method clearly to clients upfront. Additionally, using the Montana Self-Employed Independent Contractor Payment Schedule can help you manage incoming payments effectively. Consider keeping detailed records of each transaction to ensure smooth financial management throughout the year.

The typical payment term for contractors often ranges from Net 30 to Net 60 days, but it can be customized to fit the needs of both parties. Establishing a clear Montana Self-Employed Independent Contractor Payment Schedule helps ensure timely payments and promotes professional relationships. Clients and contractors should discuss payment intervals upfront to avoid any disputes later on. For added assurance, consider using uslegalforms to document these terms in a legally recognized contract.

Yes, Montana requires self-employed individuals, including independent contractors, to make quarterly estimated tax payments. This requirement typically applies if you expect to owe tax of a certain amount when filing your annual return. Understanding this can help you manage your finances effectively, especially following a Montana Self-Employed Independent Contractor Payment Schedule. You can seek guidance from tax professionals or use reliable resources from platforms like uslegalforms to stay compliant.

For individuals receiving a 1099, payment terms depend on the contract terms set with clients. Generally, contractors may receive payment upon completion of a project, monthly, or as specified in their Montana Self-Employed Independent Contractor Payment Schedule. It’s essential to outline these terms in writing to ensure clarity and compliance. Utilizing platforms like uslegalforms can help you draft professional contracts that detail these terms precisely.

Payment terms for independent contractors can vary based on agreements between parties. Typically, contractors and clients agree on a payment schedule that outlines when payments should be made. It's crucial to establish a clear Montana Self-Employed Independent Contractor Payment Schedule to avoid any misunderstandings. You might also consider using services like uslegalforms to create a solid contract that protects both parties.

ICEC stands for Independent Contractor Exemption Certificate. It is a certification that allows eligible self-employed individuals to operate as independent contractors in Montana without being treated as employees. Understanding the implications of your ICEC is crucial for organizing your finances and establishing a reliable Montana Self-Employed Independent Contractor Payment Schedule, ultimately supporting your business's compliance and growth.

To obtain your Independent Contractor Exemption Certificate (ICEC) in Montana, you need to complete an application through the Montana Department of Labor and Industries. Ensure that you meet the eligibility criteria, as this will streamline the process. Having your ICEC can greatly aid you in following the Montana Self-Employed Independent Contractor Payment Schedule and navigating your independent contractor responsibilities.

To establish yourself as an independent contractor in Montana, you should first choose a business name and register it if necessary. Next, obtain any required licenses or permits depending on your specific industry. Lastly, you will need to set up a Montana Self-Employed Independent Contractor Payment Schedule for managing your finances, ensuring that you comply with tax regulations while you grow your business.