Montana Payroll Specialist Agreement - Self-Employed Independent Contractor

Description

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By utilizing the website, you can browse thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can retrieve the latest editions of documents such as the Montana Payroll Specialist Agreement - Self-Employed Independent Contractor in just a few minutes.

If you already have a membership, Log In and download the Montana Payroll Specialist Agreement - Self-Employed Independent Contractor from the US Legal Forms catalog. The Acquire button will appear on every document you view. You can access all previously downloaded files in the My documents section of your profile.

Proceed with the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Edit it. Complete, modify, print, and sign the downloaded Montana Payroll Specialist Agreement - Self-Employed Independent Contractor. Each document you add to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you require. Gain access to the Montana Payroll Specialist Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive collection of legal document templates. Utilize numerous professional and state-specific templates that fulfill your business or personal requirements.

- Ensure you have selected the correct document for your city/state.

- Click the Preview button to review the contents of the form.

- Read the form summary to confirm you have chosen the right document.

- If the document does not meet your needs, utilize the Search box at the top of the screen to locate one that does.

- Once satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose your preferred payment plan and provide your information to create an account.

Form popularity

FAQ

Setting up payroll for 1099 employees requires careful attention to detail. Start by developing a Montana Payroll Specialist Agreement - Self-Employed Independent Contractor to clarify compensation and expectations. Then, collect necessary tax information from the contractors and determine your payment schedule. Remember to keep thorough records, as you'll need them for tax filings. Using a reliable platform like uslegalforms can help streamline this process.

Payroll for independent contractors differs from traditional employees, as contractors receive a 1099 form instead of a W-2. Payments are made based on the agreed terms in the Montana Payroll Specialist Agreement - Self-Employed Independent Contractor, usually on a per-project or hourly basis. Companies do not withhold taxes from contractor payments, so it’s crucial for contractors to manage their own tax obligations. This approach gives contractors more flexibility while ensuring compliance.

Typically, the hiring company drafts the independent contractor agreement. However, both parties should review the agreement to ensure it meets their needs. Using a Montana Payroll Specialist Agreement - Self-Employed Independent Contractor can simplify this process, offering a comprehensive template that addresses essential terms. It is essential to clarify expectations and responsibilities to avoid conflicts down the line.

To manage payroll for independent contractors, first establish clear agreements using a Montana Payroll Specialist Agreement - Self-Employed Independent Contractor. Next, ensure that you gather necessary tax information, such as the contractor's Social Security number or Employer Identification Number. Calculate the payments owed and issue them based on the terms outlined in the agreement. Finally, keep records of payments for tax reporting and other purposes.

The basic independent contractor agreement is a document that outlines the terms of service between a contractor and a client. This typically includes roles, responsibilities, payment terms, and project timelines, ensuring all parties are in agreement. Using a Montana Payroll Specialist Agreement - Self-Employed Independent Contractor will help you create a straightforward but comprehensive contract tailored to your self-employment needs.

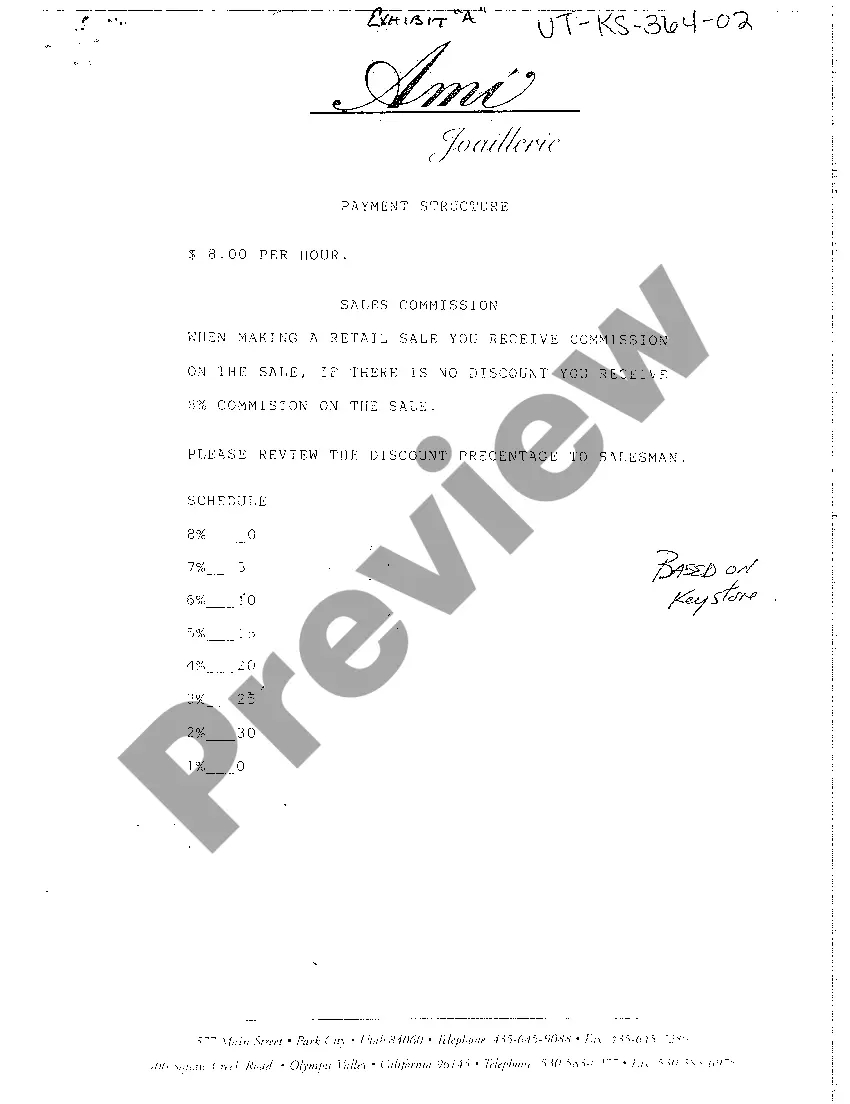

Writing an independent contractor agreement involves understanding the key components that define the relationship. You should detail the work scope, payment structure, timelines, and termination conditions. Utilizing a Montana Payroll Specialist Agreement - Self-Employed Independent Contractor can provide a strong foundation, helping you create a thorough and compliant agreement.

When writing a contract as an independent contractor, start with a clear title and introductory statement. Outline the scope of work, payment terms, and deadlines comprehensively. The Montana Payroll Specialist Agreement - Self-Employed Independent Contractor serves as a great template, providing a structured format to follow while ensuring you capture all essential details.

To fill out a contract agreement, begin by clearly stating the purpose of the agreement and the parties involved. Then, include all relevant terms and conditions, such as payment terms, deliverables, and deadlines. Using a Montana Payroll Specialist Agreement - Self-Employed Independent Contractor can simplify this process, ensuring you include all necessary elements for a legally binding contract.

The main difference between an independent contractor and an employee in Montana lies in the level of control over work performed. Independent contractors set their schedules and methods for completing tasks. In contrast, employees typically follow an employer's direction. Recognizing these differences is key when drafting your Montana Payroll Specialist Agreement - Self-Employed Independent Contractor.

In Montana, the independent contractor exemption allows specific individuals to work as self-employed independent contractors without being classified as employees. This exemption often applies to professionals who have more control over their work and business operations. It’s crucial to understand how the Montana Payroll Specialist Agreement - Self-Employed Independent Contractor fits into this exemption, as it clearly outlines your rights and responsibilities.