Montana Self-Employed Referee Or Umpire Employment Contract

Description

How to fill out Self-Employed Referee Or Umpire Employment Contract?

If you want to be thorough, obtain, or create authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you need.

Numerous templates for business and personal purposes are sorted by categories and states, or keywords. Use US Legal Forms to find the Montana Self-Employed Referee Or Umpire Employment Contract in just a few clicks.

Step 5. Process the purchase. You can use your Visa or Mastercard or PayPal account to complete the transaction.

Step 6. Select the format of the legal document and download it to your device. Step 7. Fill out, modify, and print or sign the Montana Self-Employed Referee Or Umpire Employment Contract. Every legal document template you purchase is yours indefinitely. You can access each form you downloaded within your account. Click on the My documents section and choose a form to print or download again. Compete and obtain, and print the Montana Self-Employed Referee Or Umpire Employment Contract with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Montana Self-Employed Referee Or Umpire Employment Contract.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

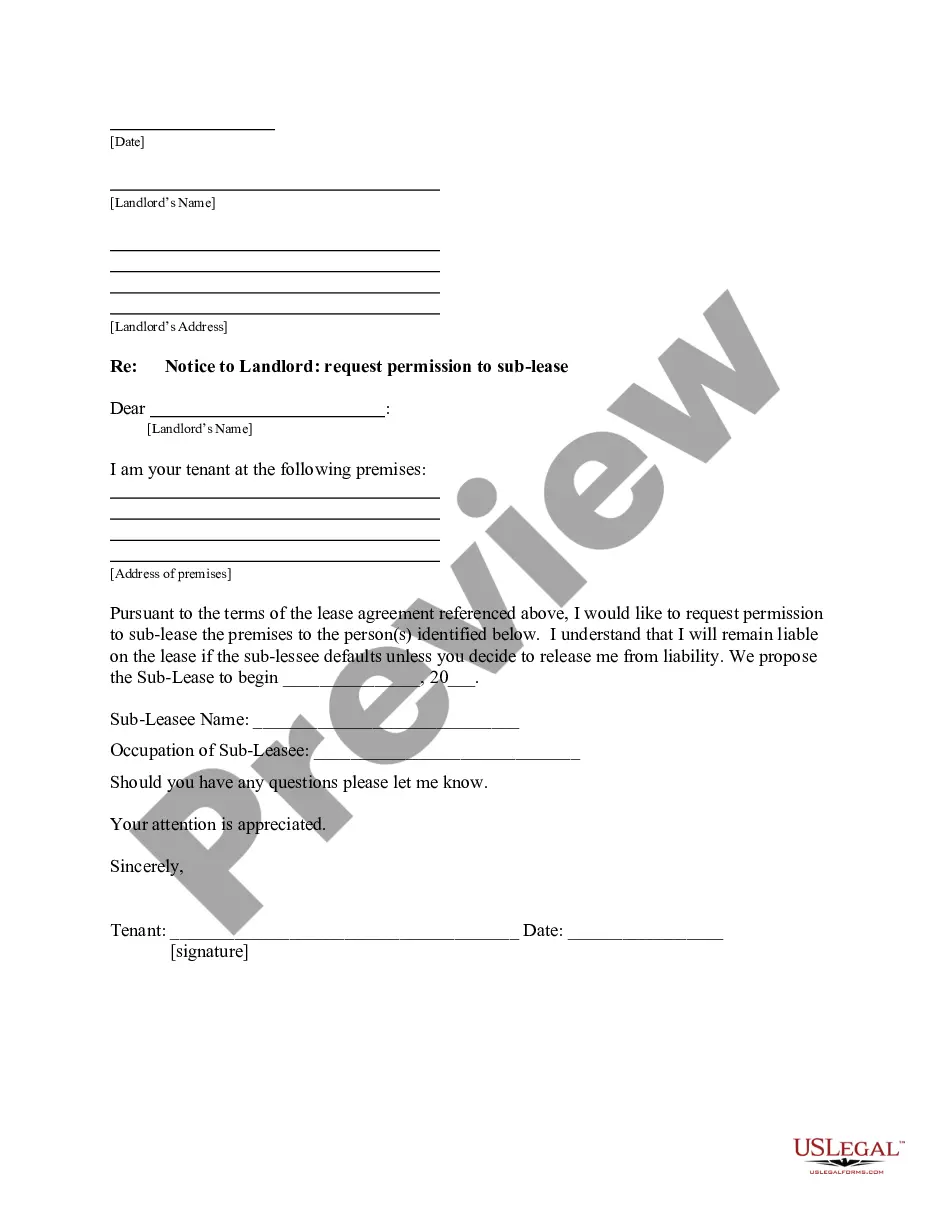

- Step 2. Use the Review option to view the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates in the legal form library.

- Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

To qualify as an independent contractor, you must demonstrate that you operate an independent business and fulfill the criteria set by local and federal regulations. This includes having a written Montana Self-Employed Referee Or Umpire Employment Contract that outlines your duties and payment terms. Additionally, maintaining proper records of your business activities and taxes is vital for establishing your status as an independent contractor.

Determining independent contractor status involves evaluating several factors, including the degree of control over work, the nature of the relationship with the hiring entity, and the type of work performed. Generally, if you manage your schedule, provide your equipment, and have a written Montana Self-Employed Referee Or Umpire Employment Contract, you are likely considered an independent contractor. The IRS and Montana state laws also provide guidelines for this classification.

A person qualifies as an independent contractor if they operate their business independently and provide services under a contract rather than as an employee. Factors like control over work, the ability to set schedules, and the provision of tools and equipment typically indicate independent contractor status. In the context of a Montana Self-Employed Referee Or Umpire Employment Contract, these elements are crucial in defining your role and responsibilities.

To become an independent contractor in Montana, you need to understand the legal requirements and regulations. First, you should register your business with the state. Additionally, it's essential to create a Montana Self-Employed Referee Or Umpire Employment Contract that outlines your services, payment terms, and responsibilities. This contract protects both you and the hiring party, ensuring clarity and compliance.

You can find a Montana Self-Employed Referee Or Umpire Employment Contract on our website. We offer a diverse selection of legally sound templates designed specifically for self-employed referees and umpires. By searching our database, you will discover contracts that suit various sports and events, ensuring that you are well-prepared for your upcoming engagements. Accessing these contracts is straightforward, allowing you to focus on your officiating.

You can easily download a Montana Self-Employed Referee Or Umpire Employment Contract from our website. Simply visit the legal forms section, and you'll find a variety of templates tailored to your needs. Each contract is designed to comply with state regulations and ensure your professional engagements are clear. With a few clicks, you can have your employment contract ready for use.

In Montana, being fired without warning is not typical due to the state's non-at-will employment laws. Employers are generally required to provide just cause for termination, which promotes transparency in the employment relationship. For self-employed referees or umpires, having a clear Montana Self-Employed Referee Or Umpire Employment Contract can further clarify expectations and grounds for termination, ensuring both parties are informed.

While it is generally more challenging to get fired in Montana compared to at-will employment states, it is not impossible. Montana's laws require employer accountability, which means that terminations must be justified under specific conditions. This protection can benefit self-employed referees or umpires, especially if they have a well-drafted Montana Self-Employed Referee Or Umpire Employment Contract, outlining their responsibilities and protections.

Montana's unique status as a non-at-will employment state is rooted in legislation aimed at promoting job security and fair treatment of workers. This law provides employees with a safeguard against wrongful termination, requiring employers to have valid reasons for dismissing staff. For individuals working as self-employed referees or umpires, this legal environment can influence how they negotiate their Montana Self-Employed Referee Or Umpire Employment Contract.

Montana stands out as the only non-at-will employment state due to specific laws designed to protect employees from arbitrary dismissal. This means that employers must demonstrate just cause for terminating an employee. For self-employed referees or umpires, understanding this legal framework is important when structuring their Montana Self-Employed Referee Or Umpire Employment Contract, to ensure they are aware of their rights and protections.