Montana Geologist Agreement - Self-Employed Independent Contractor

Description

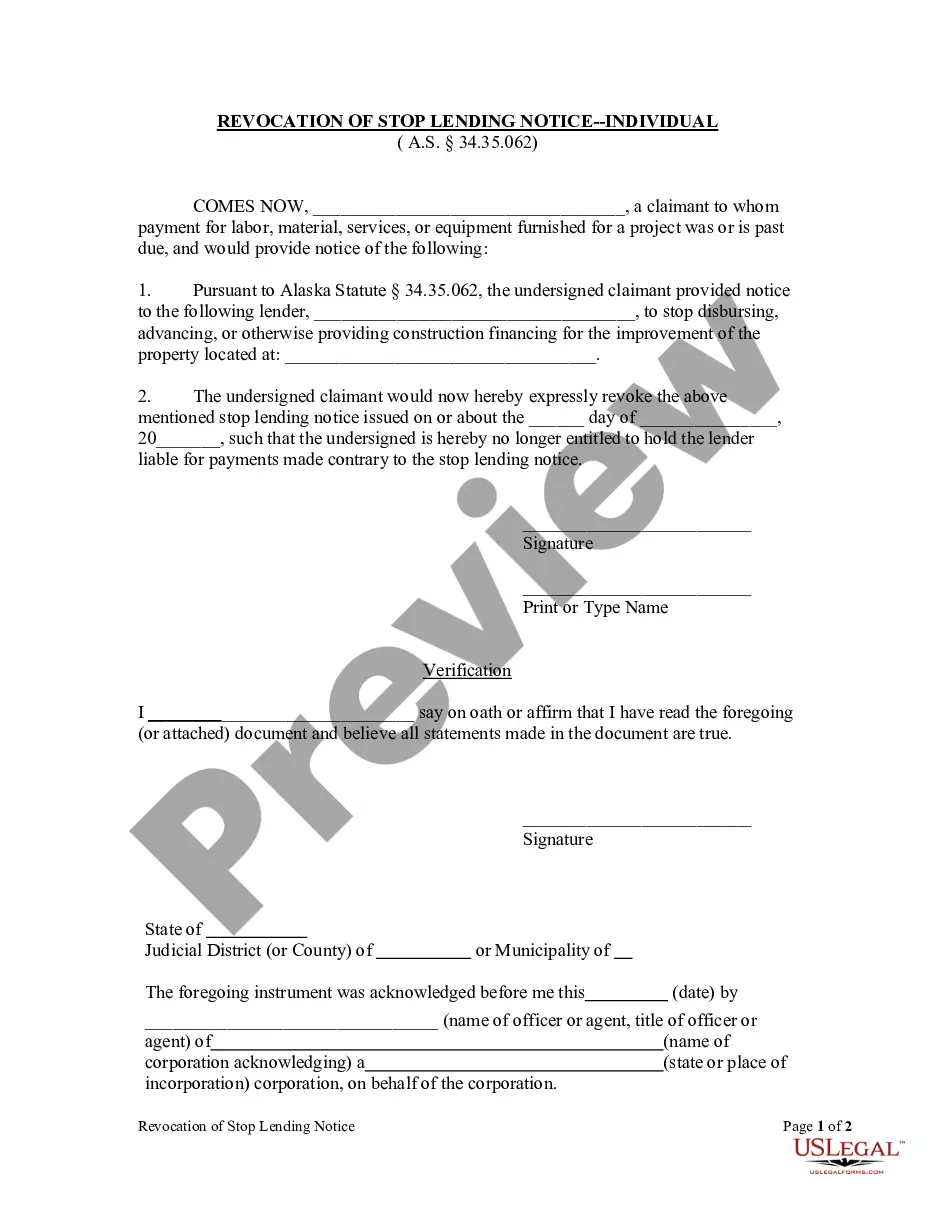

How to fill out Geologist Agreement - Self-Employed Independent Contractor?

You might spend several hours online trying to locate the legal document template that fulfills both state and federal requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can download or print the Montana Geologist Agreement - Self-Employed Independent Contractor from our platform.

If available, utilize the Preview option to view the document template as well. If you wish to find another version of the form, use the Search field to locate the template that suits your needs and requirements. Once you have found the template you want, click on Buy now to proceed. Choose the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal form. Select the format of the document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the Montana Geologist Agreement - Self-Employed Independent Contractor. Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and select the Download option.

- Then, you can complete, modify, print, or sign the Montana Geologist Agreement - Self-Employed Independent Contractor.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have chosen the correct document template for the area/city you select.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

Starting as an independent contractor involves a few essential steps. First, you should define your services clearly, particularly if you aim to become a Montana Geologist Agreement - Self-Employed Independent Contractor. Next, consider registering your business and developing a strong portfolio to showcase your expertise. Lastly, using platforms like USLegalForms can help you navigate the paperwork and legal requirements to establish your independent contractor status smoothly.

Professionals in various fields may need an Icec in Montana. If you work as a self-employed geologist, this agreement ensures you meet legal requirements while operating as a Montana Geologist Agreement - Self-Employed Independent Contractor. It protects your interests and clarifies your responsibilities. Additionally, having an Icec can enhance your credibility with clients and regulatory agencies.

Receiving a 1099 form is a strong indicator of self-employment. This form is used to report income earned outside of traditional employment, typically associated with independent contractors. Therefore, if your work falls under the Montana Geologist Agreement - Self-Employed Independent Contractor, you would indeed be considered self-employed, and this form plays a key role in documenting that status.

To be self-employed, you must run your own business and earn income from your services. This includes freelancers, independent contractors, and sole proprietors. In relation to the Montana Geologist Agreement - Self-Employed Independent Contractor, it’s vital to meet the legal criteria to ensure proper reporting of your earnings and tax obligations.

Absolutely, an independent contractor is classified as self-employed. This classification applies to individuals who take on projects for clients without being directly employed. When you enter into a Montana Geologist Agreement - Self-Employed Independent Contractor, you affirm your status and secure your rights as a self-employed professional.

The main difference lies in the level of control and responsibility. Independent contractors enjoy more freedom in how they complete their tasks, while employees typically follow specific directions from an employer. In the context of the Montana Geologist Agreement - Self-Employed Independent Contractor, recognizing these differences is essential for understanding your rights and obligations under Montana law.

The terms self-employed and independent contractor are often interchangeable, but they can imply different contexts. Self-employed refers broadly to anyone running their own business, while an independent contractor specifically refers to a person contracted for work. In the case of a Montana Geologist Agreement - Self-Employed Independent Contractor, using both terms appropriately can enhance your clarity when discussing your professional status.

Yes, an independent contractor is typically regarded as self-employed. When you engage in work without being under the direct control of an employer, you operate as an independent contractor, which aligns with the concept of being self-employed. In the context of the Montana Geologist Agreement - Self-Employed Independent Contractor, understanding this distinction is crucial for your legal and tax responsibilities.

The basic independent contractor contract outlines the relationship between the contractor and the client. Typically, it includes project details, payment terms, and timelines. Also, it may cover confidentiality and ownership of work produced. For a comprehensive template, the Montana Geologist Agreement - Self-Employed Independent Contractor from uslegalforms serves as an excellent foundation.

When writing a contract for an independent contractor, start with a detailed description of services to be rendered. Specify payment amounts and schedules to avoid any confusion. Also, include dispute resolution methods to address potential conflicts. You can access the Montana Geologist Agreement - Self-Employed Independent Contractor through uslegalforms for a reliable framework.