Montana Disability Services Contract - Self-Employed

Description

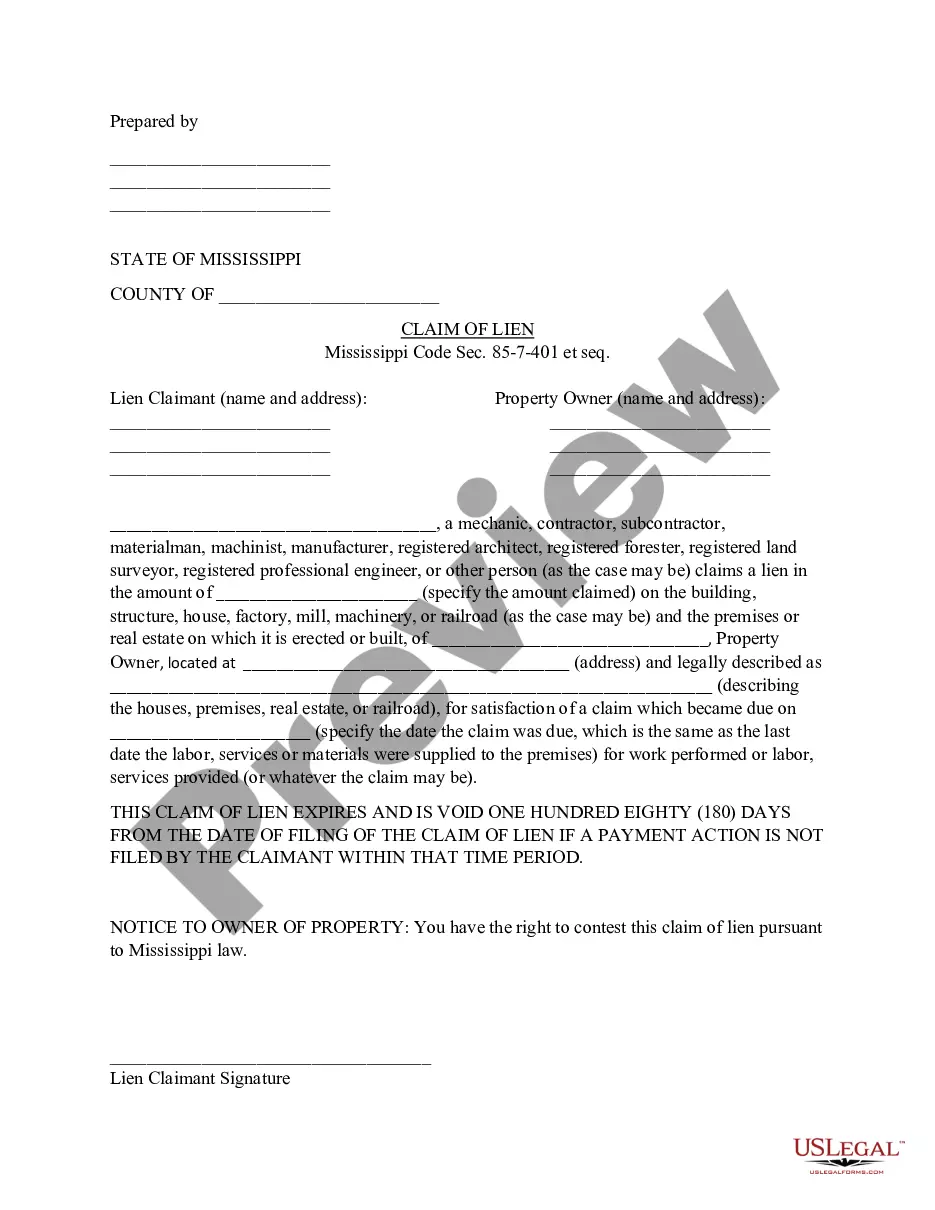

How to fill out Disability Services Contract - Self-Employed?

If you wish to finalize, acquire, or generate legal document templates, utilize US Legal Forms, the primary repository of legal forms, which is accessible online.

Take advantage of the site's straightforward and efficient search to locate the documents you need. Numerous templates for business and personal applications are categorized by types and states, or keywords.

Use US Legal Forms to locate the Montana Disability Services Contract - Self-Employed with just a few clicks.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify and print or sign the Montana Disability Services Contract - Self-Employed. Each legal document template you acquire is yours indefinitely. You will have access to every form you downloaded in your account. Choose the My documents section and select a form to print or download again. Stay competitive and obtain, and print the Montana Disability Services Contract - Self-Employed with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- When you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Montana Disability Services Contract - Self-Employed.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form's details. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have identified the form you need, select the Get now button. Choose the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

To qualify for disability in Montana, you must demonstrate a significant impairment that affects your ability to work. The Montana Disability Services Contract - Self-Employed can provide guidance on the necessary documentation and the evaluation process. Generally, you must show medical evidence of your condition and how it limits your daily activities. Understanding the requirements can help you navigate the application process effectively.

To qualify for disability benefits in Montana, you must have a medical condition that severely restricts your ability to perform daily tasks or work. This includes physical, mental, or emotional impairments lasting at least 12 months. A Montana Disability Services Contract - Self-Employed can provide guidance on the specific criteria required for your situation. Using uslegalforms can also help you understand the documentation needed to support your claim.

In Montana, self-employment tax consists of Social Security and Medicare taxes, which total 15.3% of your net earnings. This tax applies to your self-employed income, allowing you to contribute to your future benefits. Understanding these obligations is crucial, especially when managing a Montana Disability Services Contract - Self-Employed. You may find uslegalforms helpful for calculating your taxes accurately and staying compliant.

Yes, you can apply for disability benefits even if you are self-employed. The process involves demonstrating that your medical condition significantly limits your ability to work. With the right documentation and a Montana Disability Services Contract - Self-Employed, you can navigate the application process more easily. Consider using uslegalforms to find tailored resources that help you gather the necessary information.

To register yourself as an independent contractor, visit the Montana Secretary of State's website to access the registration forms. Complete these forms with accurate information about your business and submit them online. Remember to follow up on your application and ensure compliance with state regulations, especially concerning the Montana Disability Services Contract - Self-Employed.

To become an independent contractor in Montana, you must have a valid business license, and you may need to obtain specific permits depending on your industry. Additionally, you should maintain proper insurance coverage to protect yourself and your clients. Understanding the Montana Disability Services Contract - Self-Employed will help you meet specific requirements and provide services effectively.

In general, independent contractors who are sole proprietors are to be reported to the EDD.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed.

What is an independent contractor? (b) is engaged in an independently established trade, occupation, profession or business. Additionally, an independent contractor must obtain either an independent contractor exemption certificate or self-elected coverage under a Montana workers' compensation insurance policy.