Montana Terms for Private Placement of Series Seed Preferred Stock

Description

How to fill out Terms For Private Placement Of Series Seed Preferred Stock?

Choosing the right authorized record format could be a battle. Needless to say, there are plenty of templates available on the net, but how do you find the authorized type you will need? Take advantage of the US Legal Forms web site. The assistance delivers thousands of templates, including the Montana Terms for Private Placement of Series Seed Preferred Stock, which you can use for company and personal requirements. Every one of the varieties are checked out by professionals and fulfill state and federal specifications.

When you are already authorized, log in for your bank account and then click the Down load option to get the Montana Terms for Private Placement of Series Seed Preferred Stock. Make use of bank account to look with the authorized varieties you may have ordered formerly. Proceed to the My Forms tab of the bank account and obtain an additional duplicate of your record you will need.

When you are a new consumer of US Legal Forms, allow me to share easy directions for you to follow:

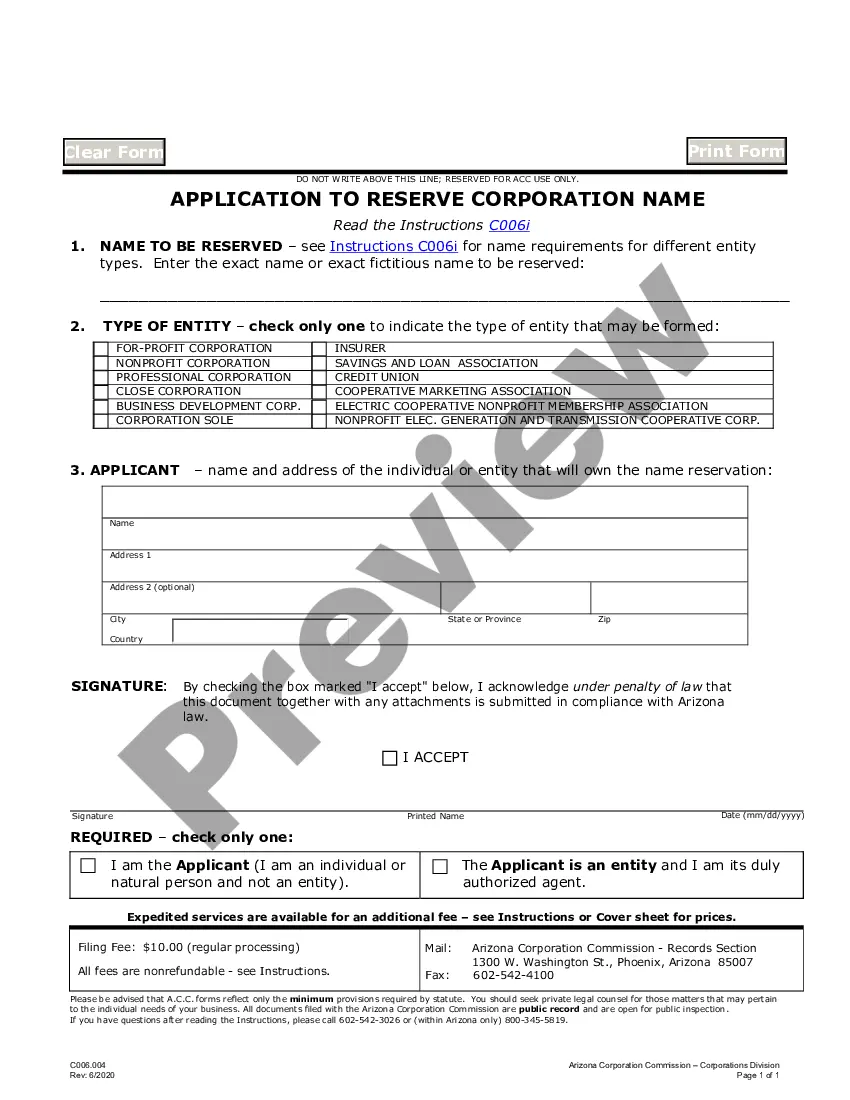

- Very first, be sure you have chosen the correct type for your town/county. You may look through the form while using Review option and look at the form information to ensure it will be the best for you.

- In the event the type fails to fulfill your expectations, make use of the Seach area to find the right type.

- Once you are certain that the form is suitable, go through the Get now option to get the type.

- Choose the rates program you need and enter the needed information. Build your bank account and pay money for an order making use of your PayPal bank account or charge card.

- Pick the submit file format and down load the authorized record format for your gadget.

- Comprehensive, revise and print and sign the obtained Montana Terms for Private Placement of Series Seed Preferred Stock.

US Legal Forms is the greatest collection of authorized varieties that you can see numerous record templates. Take advantage of the company to down load expertly-manufactured files that follow express specifications.

Form popularity

FAQ

Growth Stage (After Series A): The phase after the Series A is all about growth. You can call this Series B, C, D, etc. You can call it growth stage or expansion stage. Investors here can include traditional VC firms, ?growth? firms, private equity firms, or any other financial or strategic backer.

This leads to investors paying a higher price for equity in a series B financing round, when compared to series A. The risk is generally lower at series B, as the company has had the time (and previous investment) in order to generate revenue through sales.

Pre-Seed Funding A pre-seed round is a round of venture capital that is generally the first round of institutional capital that a startup raises. A pre-seed round generally allows a founding team to find product-market fit, hire early employees, and test go-to-market models.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).

The earliest stage of funding a new company comes so early in the process that it is not included in the traditional rounds of funding at all. Known as ?pre-seed? funding, this stage typically refers to the period in which a company's founders are first getting their operations or ideas off the ground.

Key provisions of a VC term sheet include: investment structure, key economic terms, shareholder agreements, due diligence, exclusivity and closing.

Series B financing is the second round of funding for a company that has met certain milestones and is past the initial startup stage. Series B investors usually pay a higher share price for investing in the company than Series A investors.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.