Montana Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services

Description

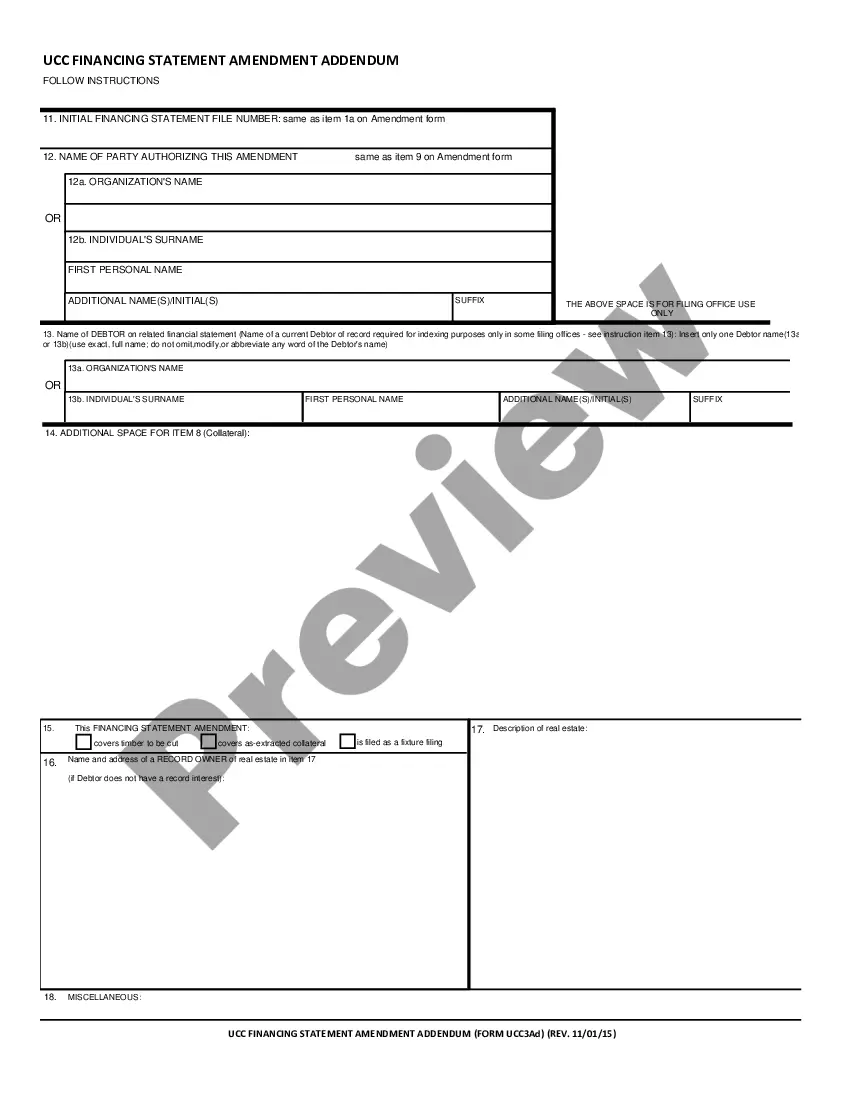

How to fill out Sub-Advisory Agreement Between Prudential Investments Fund Management, LLC And The Prudential Investment Corp. Regarding Provision Of Investment Advisory Services?

Finding the right legitimate file format can be a battle. Obviously, there are tons of templates available online, but how can you obtain the legitimate develop you require? Use the US Legal Forms internet site. The support offers 1000s of templates, like the Montana Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services, that you can use for organization and private requires. Each of the kinds are checked out by specialists and fulfill state and federal specifications.

When you are currently listed, log in to your profile and click on the Download button to obtain the Montana Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services. Use your profile to search through the legitimate kinds you might have ordered in the past. Proceed to the My Forms tab of your profile and get an additional version of your file you require.

When you are a brand new user of US Legal Forms, listed here are easy guidelines for you to adhere to:

- Very first, ensure you have selected the correct develop for your area/area. You may check out the form while using Preview button and read the form outline to make certain this is basically the best for you.

- In the event the develop is not going to fulfill your preferences, use the Seach discipline to get the appropriate develop.

- When you are sure that the form is suitable, go through the Acquire now button to obtain the develop.

- Pick the pricing prepare you desire and type in the required information and facts. Build your profile and purchase the transaction utilizing your PayPal profile or Visa or Mastercard.

- Opt for the submit structure and down load the legitimate file format to your device.

- Comprehensive, edit and print out and indication the attained Montana Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services.

US Legal Forms may be the greatest local library of legitimate kinds in which you can discover various file templates. Use the company to down load expertly-produced papers that adhere to state specifications.

Form popularity

FAQ

The company's solid financial position provides it with the flexibility to execute its transformation and invest in the long-term growth of businesses. Prudential Financial has been increasing its dividend for the past 15 years. Its dividend yield of 6.4% compares favorably with the industry's figure of 2.9%.

Attractive valuation As for the valuation here, it's attractive after the share price weakness this year. For 2024, analysts expect Prudential to generate earnings per share of 113 cents. That puts the forward-looking price-to-earnings (P/E) ratio at about 9.8 right now ? well below the FTSE 100 average.

To see this page as it is meant to appear/function please use a Javascript enabled browser. Effective April 1, 2022, Empower officially acquired the full-service retirement business of Prudential.

If you make a full withdrawal of your annuity, you will receive the greater of your account value (minus any surrender charges and adjusted by any applicable MVA) and your Minimum Guaranteed Surrender Value.

Independent view. The Prudential Assurance Company Limited With-Profits Fund, as at December 2022, has a 5/5 rating for financial strength from AKG Financial Analytics Ltd, who are specialists in providing independent With-Profits ratings. This is the highest rating that AKG. Source: AKG With-Profits Report (PDF).

Fitch has also affirmed PFI's Long-Term Issuer Default Rating (IDR) at 'A' and senior unsecured debt ratings at 'A-'. The Rating Outlook is Stable. Today's rating affirmation reflects a review of current operating results including previously announced reinsurance transactions.

The Prudential Investment Plan is an investment bond where you can invest your money in a range of different funds that aim to increase the value of your investment over the medium- to long-term, so 5 to 10 years or more.

Prudential is being tarred with the same brush as other companies operating predominately in Asia. Prudential's share price is down 20% since the beginning of 2023, not because of poor underlying performance but because investors have built in a discount because of where they operate.