Montana Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample

Description

How to fill out Sample Asset Purchase Agreement Between MPI Of Northern Florida And Venturi Technologies, Inc. Regarding The Sale And Purchase Of Assets - Sample?

US Legal Forms - one of many largest libraries of lawful kinds in the States - offers a wide array of lawful document web templates you are able to acquire or printing. While using internet site, you can get a huge number of kinds for organization and individual purposes, categorized by classes, states, or search phrases.You can get the most up-to-date versions of kinds such as the Montana Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample within minutes.

If you have a registration, log in and acquire Montana Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample through the US Legal Forms catalogue. The Down load button can look on every single type you perspective. You get access to all previously saved kinds in the My Forms tab of your account.

If you would like use US Legal Forms initially, listed below are straightforward recommendations to obtain started out:

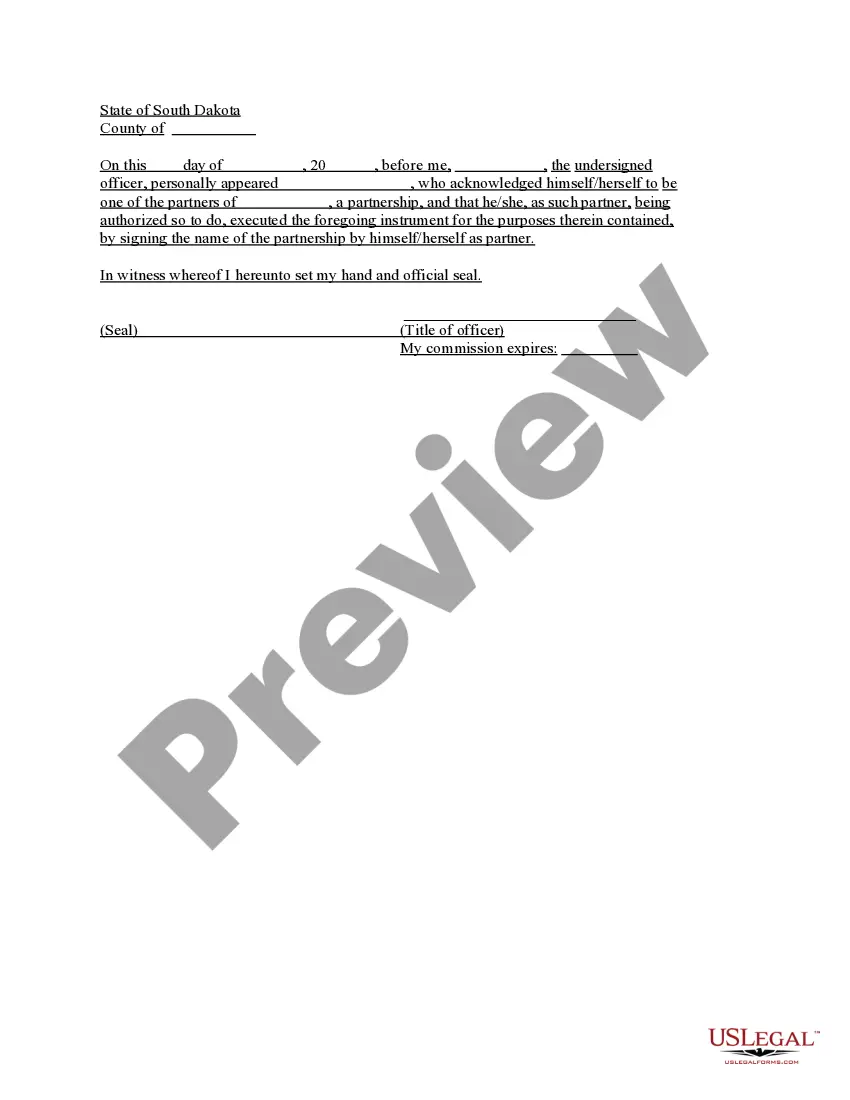

- Make sure you have picked out the best type for the area/area. Click the Preview button to examine the form`s content material. See the type information to actually have selected the appropriate type.

- In case the type does not match your demands, make use of the Research field near the top of the display to discover the one who does.

- Should you be pleased with the shape, affirm your decision by clicking the Get now button. Then, opt for the rates program you like and offer your qualifications to register on an account.

- Approach the deal. Use your credit card or PayPal account to accomplish the deal.

- Find the structure and acquire the shape in your product.

- Make adjustments. Load, edit and printing and indicator the saved Montana Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample.

Every design you put into your money does not have an expiry particular date and is the one you have permanently. So, in order to acquire or printing an additional version, just proceed to the My Forms section and click on about the type you will need.

Obtain access to the Montana Sample Asset Purchase Agreement between MPI of Northern Florida and Venturi Technologies, Inc. regarding the sale and purchase of assets - Sample with US Legal Forms, one of the most considerable catalogue of lawful document web templates. Use a huge number of specialist and state-particular web templates that meet up with your organization or individual requirements and demands.

Form popularity

FAQ

An asset sale occurs when a bank or other type of firm sells its receivables to another party. A type of non-recourse sale, these transactions are executed for a variety of reasons, including to mitigate asset-related risk, obtain free-cash flows, or meet liquidation requirements.

In an asset sale, the warranties will cover the assets (and liabilities, if any) being acquired and may cover: Plant and machinery. Stock and work in progress. Contracts.

Definitions of the words and terms to be used in the legal instrument. Terms and conditions of the sale and purchase of the assets, including purchase price and terms of the purchase (full payment at close, down payment, subsequent payments, etc.) Terms and conditions of the closing of the agreement, if any.

An asset purchase agreement (APA) is an agreement between a buyer and a seller that finalizes terms and conditions related to the purchase and sale of a company's assets. It is important to note in an APA transaction, it is not necessary for the buyer to purchase all of the assets of the company.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

An asset purchase agreement, or ?APA,? is a legal document that allows a business to sell its tangible or intangible property to another party (?buyer?). Common items sold include equipment, machinery, customer lists, trademarks, and patents.

An asset acquisition is the purchase of a company by buying its assets instead of its stock. In most jurisdictions, an asset acquisition typically also involves an assumption of certain liabilities.

The asset purchase agreement is typically drafted by the buyer and seller of the assets. However, in some cases, it may be handled by an attorney.