Montana Letter to Debt Collector - Only call me on the following days and times

Description

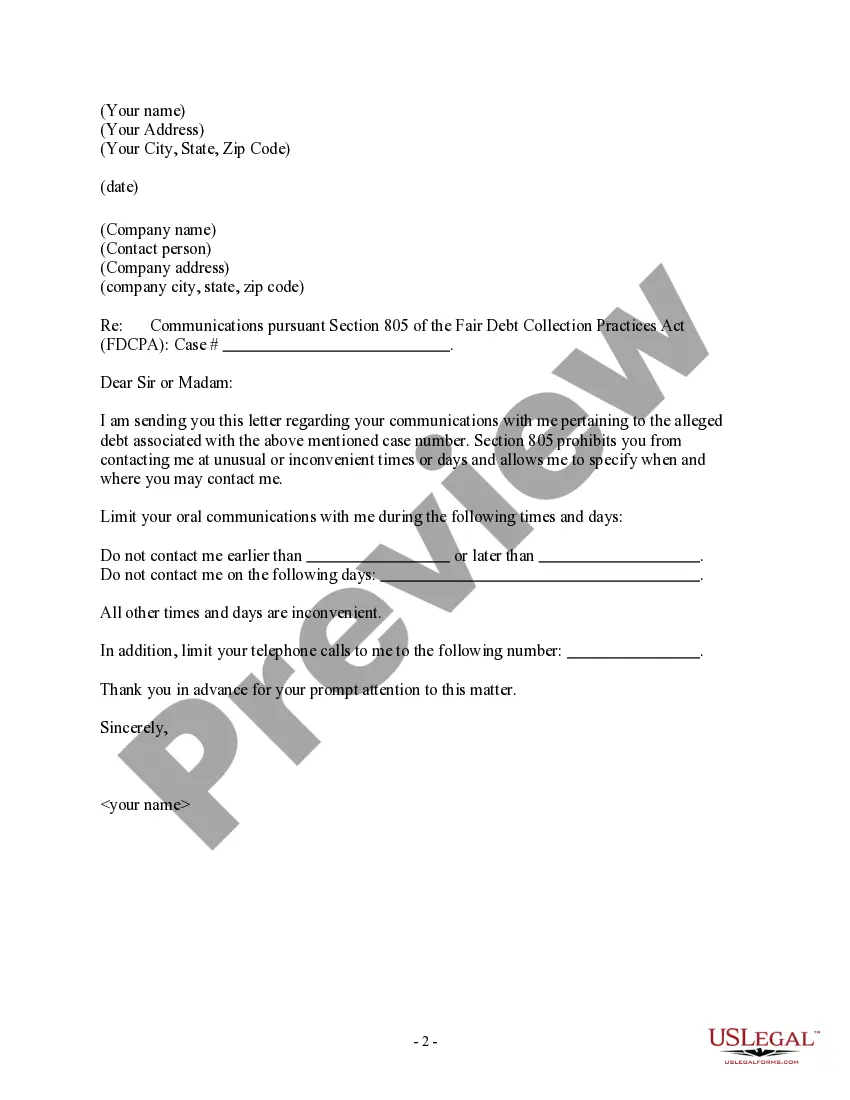

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

You can spend numerous hours online looking for the legal document format that meets the federal and state criteria you need.

US Legal Forms offers thousands of legal templates that have been reviewed by professionals.

You can easily download or print the Montana Letter to Debt Collector - Only call me on the following days and times through their services.

Initially, ensure that you have chosen the correct document format for your desired region/city. Review the document information to confirm that you selected the appropriate form. If available, use the Preview button to review the document format as well. If you wish to find another version of the form, use the Search field to locate the template that fits your needs and specifications. Once you have found the format you want, click Purchase now to continue. Choose the pricing plan you prefer, provide your details, and create an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make changes to your document if necessary. You can complete, edit, sign, and print the Montana Letter to Debt Collector - Only call me on the following days and times. Download and print thousands of document templates using the US Legal Forms website, which offers the widest selection of legal forms. Utilize expert and state-specific templates to meet your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Montana Letter to Debt Collector - Only call me on the following days and times.

- Every legal document template you obtain is yours permanently.

- To obtain another copy of any form you have acquired, visit the My documents section and click on the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

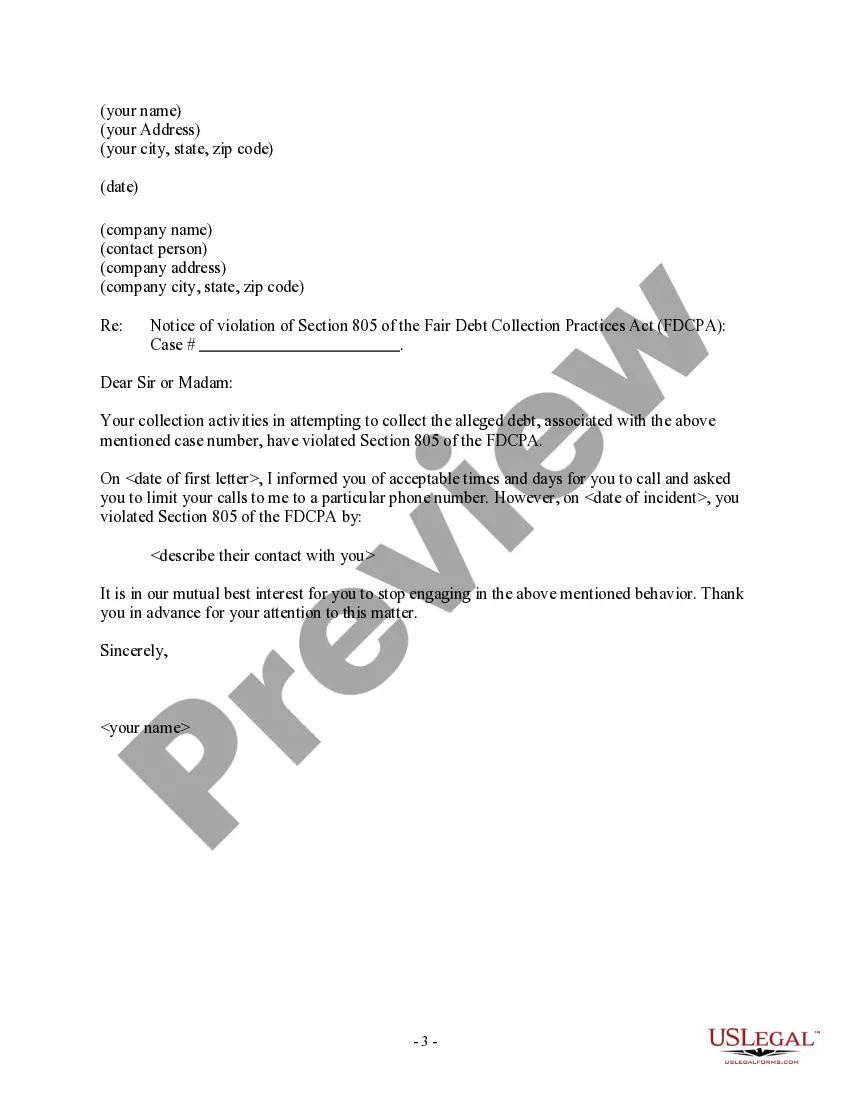

When writing to a debt collector, avoid making promises you cannot keep or acknowledging the debt outright. It’s important not to provide personal information that could compromise your security. Instead, focus on your right to communicate when it suits you, such as with a Montana Letter to Debt Collector - Only call me on the following days and times. This approach helps establish boundaries while keeping your communication effective.

The 11-word phrase to stop debt collectors is, 'I do not wish to be contacted by you.' By using this phrase in conjunction with a Montana Letter to Debt Collector - Only call me on the following days and times, you can firmly set boundaries and potentially halt unwanted communications. This empowers you to take control of your financial situation.

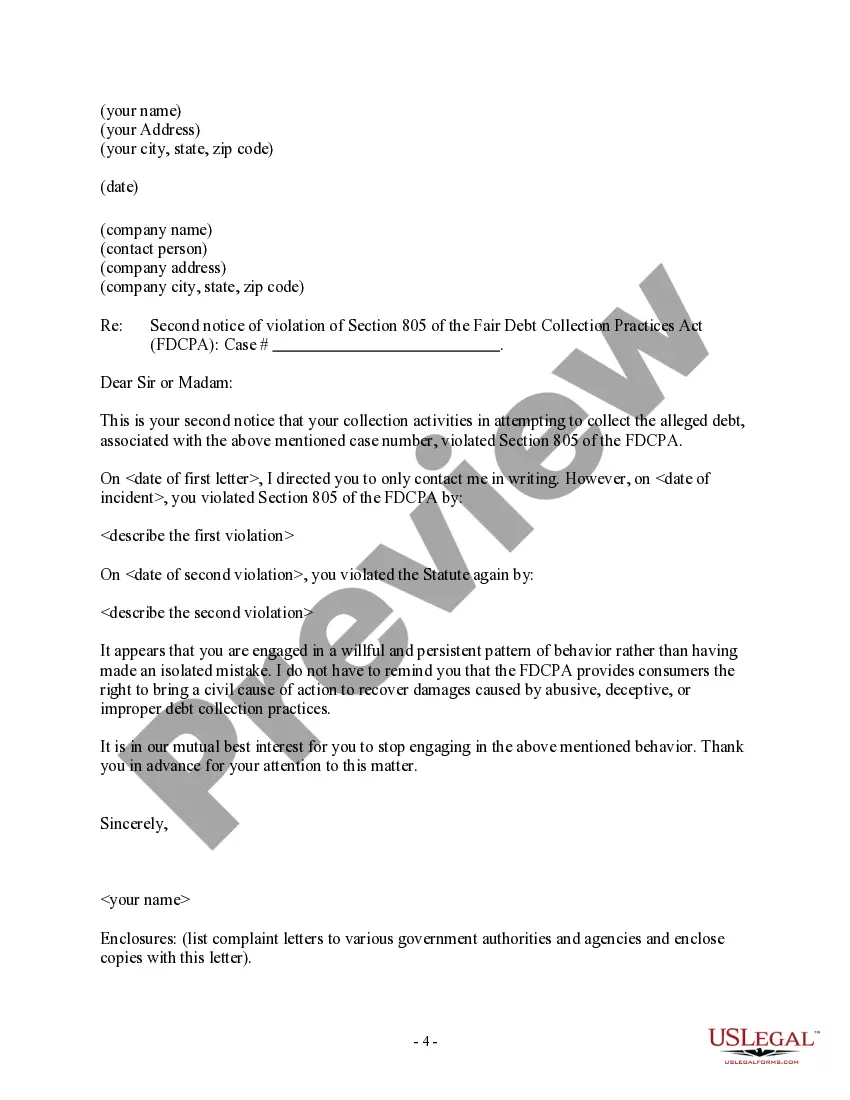

Failing to respond to a Debt Validation Letter while continuing to collect on the debt is a direct violation of the FDCPA. You can report a debt collector's failure to respond to your state's attorney general, the Consumer Financial Protection Bureau (CFPB), or the FTC.

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Make sure you respond in writing to dispute the debt. If you don't, the debt collector may keep trying to collect the debt from you and may even end up suing you for payment.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

Federal law says that after receiving written notice of a debt, consumers have a 30-day window to respond with a debt dispute letter.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.