Montana Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan

Description

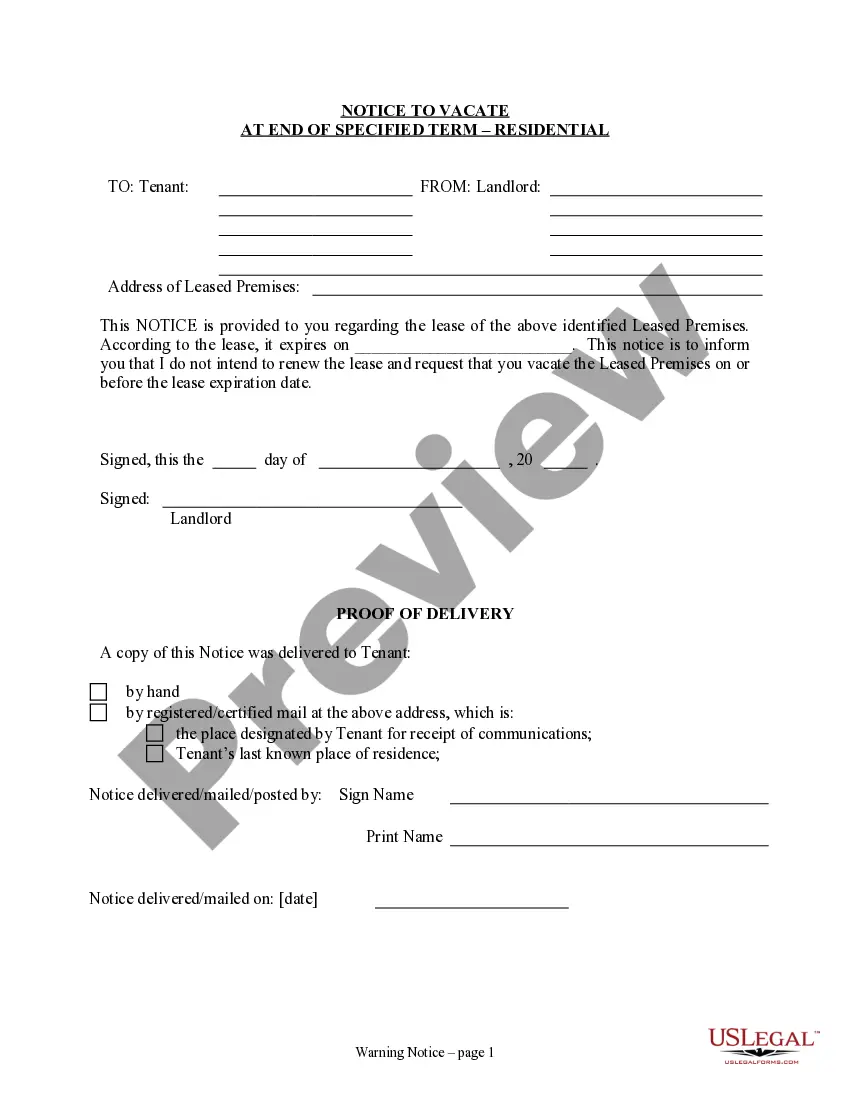

How to fill out Approval Of Grant Of Security Interest In All Of Assets To Secure Obligations Pursuant To Terms Of Informal Creditor Workout Plan?

US Legal Forms - one of many largest libraries of authorized kinds in America - provides an array of authorized document web templates you are able to download or printing. Utilizing the internet site, you can find a large number of kinds for enterprise and person purposes, categorized by categories, says, or keywords and phrases.You can get the newest variations of kinds just like the Montana Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan within minutes.

If you currently have a monthly subscription, log in and download Montana Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan in the US Legal Forms collection. The Down load button can look on each develop you perspective. You have access to all in the past delivered electronically kinds from the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, listed here are basic guidelines to help you get started out:

- Be sure to have picked the proper develop to your metropolis/region. Go through the Review button to analyze the form`s information. Browse the develop information to ensure that you have chosen the correct develop.

- In case the develop doesn`t suit your specifications, make use of the Research industry towards the top of the screen to find the one that does.

- Should you be happy with the shape, confirm your choice by simply clicking the Purchase now button. Then, select the costs plan you like and supply your accreditations to sign up on an bank account.

- Approach the deal. Utilize your Visa or Mastercard or PayPal bank account to perform the deal.

- Find the structure and download the shape on your gadget.

- Make adjustments. Fill up, edit and printing and signal the delivered electronically Montana Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan.

Each design you included in your account lacks an expiry date and is also your own eternally. So, in order to download or printing yet another backup, just visit the My Forms area and click on around the develop you want.

Obtain access to the Montana Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan with US Legal Forms, probably the most considerable collection of authorized document web templates. Use a large number of specialist and express-particular web templates that satisfy your business or person needs and specifications.

Form popularity

FAQ

A security interest is not enforceable unless it has attached. Attachment of a security interest generally requires a written security agreement, description of collateral, secured party's giving value, and the debtor having rights in collateral.

One of the most common examples of a security interest is a mortgage: a person borrows money from the bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan.

The term ?security interest? means an interest (including an interest established by a conditional sales contract, mortgage, equipment trust, or other lien or title retention contract, or lease) in a motor vehicle when the interest secures payment or performance of an obligation.

Below are common types of security interests that apply to land. Mortgage. This is a loan instrument where an individual acquires a loan to buy a house. ... Deed of Trust. In the US, a deed of trust is a legal instrument used to create security interests. ... A contract for the sale of land.

A security interest is retained in or taken by the seller of the collateral to secure part or all of its price. A security interest is taken by a person who, by making advances or incurring an obligation, gives something of value that enables the debtor to acquire the rights in the collateral or to use it.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

A security interest means that if you don't make the mortgage payments as agreed, or if you break your agreement with the lender, the lender can take your home and sell it to pay off the loan. You give the lender this right when you sign your closing forms.

In general: (1) the creditor must give value, (2) the debtor must have rights in the collateral, and (3) there must be a security agreement or other action indicating an intent to convey a security interest. Once the security interest has ?attached,? it is effective between the debtor and the creditor.