Montana Elimination of the Class A Preferred Stock

Description

How to fill out Elimination Of The Class A Preferred Stock?

Are you in the situation that you need papers for either organization or specific purposes virtually every working day? There are plenty of legitimate papers themes available on the net, but getting ones you can rely is not simple. US Legal Forms gives a huge number of type themes, much like the Montana Elimination of the Class A Preferred Stock, which can be published in order to meet state and federal demands.

If you are currently knowledgeable about US Legal Forms internet site and also have a free account, just log in. Next, it is possible to obtain the Montana Elimination of the Class A Preferred Stock template.

Unless you provide an bank account and need to start using US Legal Forms, adopt these measures:

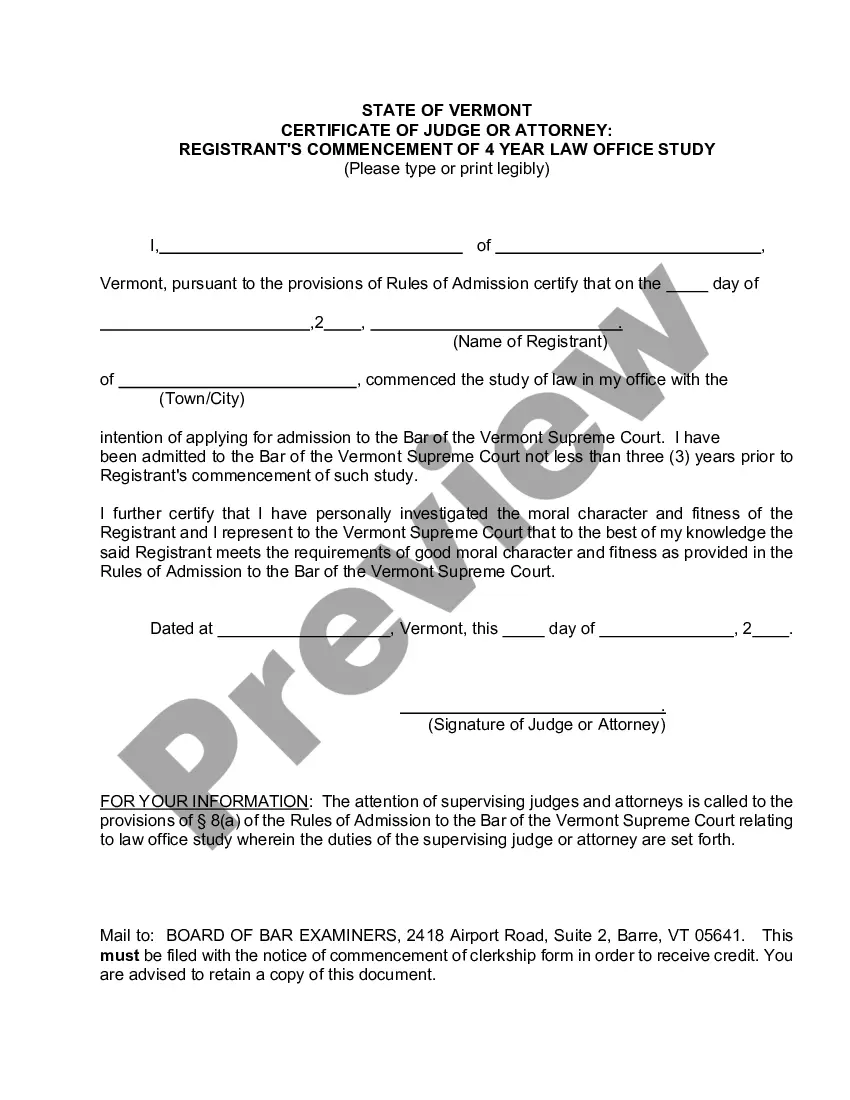

- Obtain the type you require and ensure it is for the appropriate metropolis/county.

- Take advantage of the Preview switch to analyze the shape.

- Browse the information to ensure that you have chosen the appropriate type.

- In case the type is not what you are trying to find, use the Research industry to obtain the type that meets your requirements and demands.

- If you find the appropriate type, simply click Get now.

- Pick the costs plan you want, complete the specified information to create your account, and pay for the transaction using your PayPal or bank card.

- Pick a practical file file format and obtain your copy.

Find each of the papers themes you may have bought in the My Forms food selection. You can obtain a extra copy of Montana Elimination of the Class A Preferred Stock anytime, if necessary. Just go through the necessary type to obtain or printing the papers template.

Use US Legal Forms, probably the most considerable collection of legitimate kinds, in order to save time as well as stay away from mistakes. The service gives skillfully produced legitimate papers themes that can be used for a range of purposes. Make a free account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

You can usually tell the difference between a company's common and preferred stock by glancing at the ticker symbol. The ticker symbol for preferred stock usually has a P at the end of it, but unlike common stock, ticker symbols can vary among systems; for example, Yahoo!

McDonald's Corporation Common Stock (MCD)

Real-Life Example & Figures To raise capital and avoid bankruptcy, Ford issued a series of preferred shares with a 6.5% dividend. This meant that every preferred share an investor bought was guaranteed a 6.5% return on the initial investment every year in the form of dividends.

IShares Preferred and Income Securities ETF (PFF) VanEck Preferred Securities ex Financials ETF (PFXF) First Trust Preferred Securities and Income ETF (FPE) Invesco Preferred ETF (PGX) SPDR ICE Preferred Securities ETF (PSK) Global X U.S. Preferred ETF (PFFD) Global X SuperIncome Preferred ETF (SPFF)

If the assessment results in an extinguishment, then the difference between the consideration paid (i.e., the fair value of the new or modified preferred stock) and the carrying value of the original preferred stock should be recognized as a reduction of, or increase to, retained earnings as a deemed dividend.

They calculate the cost of preferred stock by dividing the annual preferred dividend by the market price per share. Once they have determined that rate, they can compare it to other financing options. The cost of preferred stock is also used to calculate the Weighted Average Cost of Capital.

Calculating the cost of preferred stock To calculate the specific after-tax cost-of-preferred-stock all we need to do is to take the preferred stock dividend and divide it by the net proceeds from the sale of the preferred stock (funds received minus flotation cost).

Typically, preferred stock ticker symbols are the same as the company's common stock but with an additional letter to designate the series of preferred stock. For example, if you want to invest in Bank of America Series E preferred stock, the ticker symbol is BAC-E at many brokers.