Montana Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc.

Description

How to fill out Proposal To Approve Adoption Of Stock Option And Long-Term Incentive Plan Of The Golf Technology Holding, Inc.?

Are you in the position in which you need files for both organization or specific purposes virtually every working day? There are a lot of legitimate record themes available online, but finding types you can depend on isn`t effortless. US Legal Forms gives a large number of develop themes, just like the Montana Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc., which can be created to fulfill state and federal requirements.

If you are currently acquainted with US Legal Forms internet site and have a free account, simply log in. Following that, you may acquire the Montana Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc. web template.

Unless you have an bank account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the develop you want and make sure it is for the appropriate town/region.

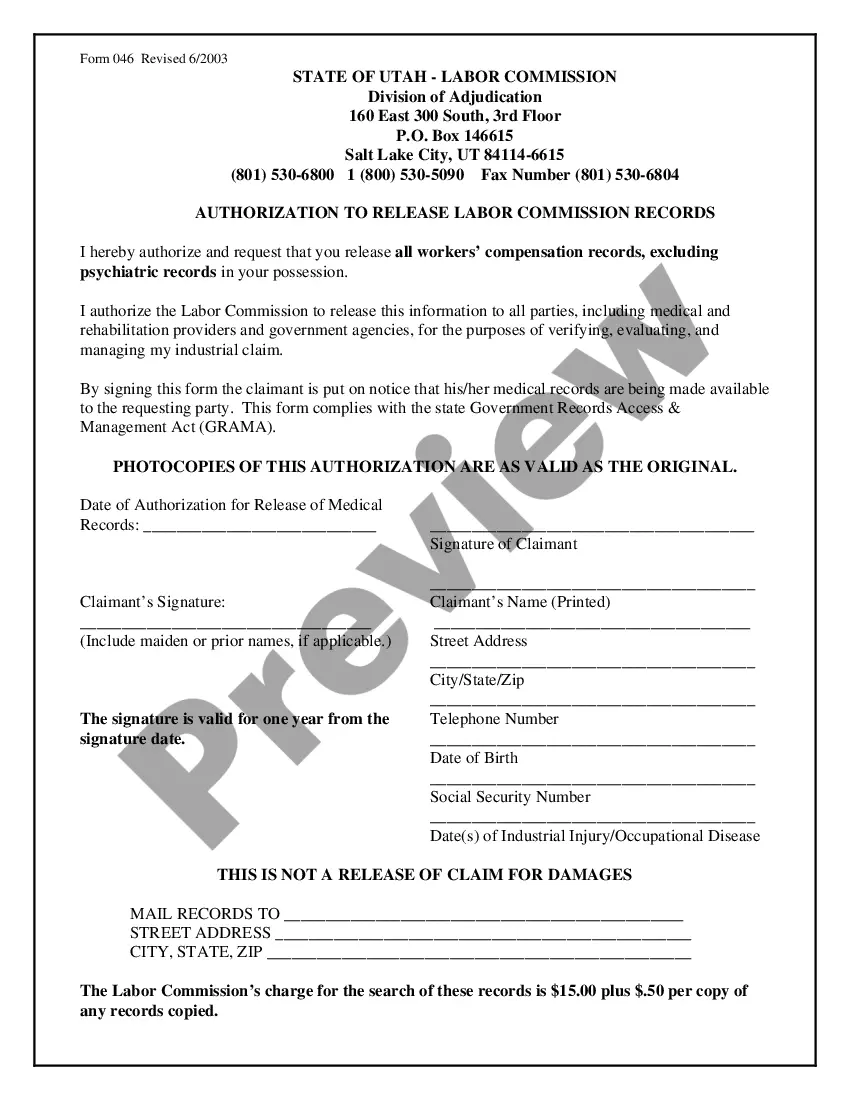

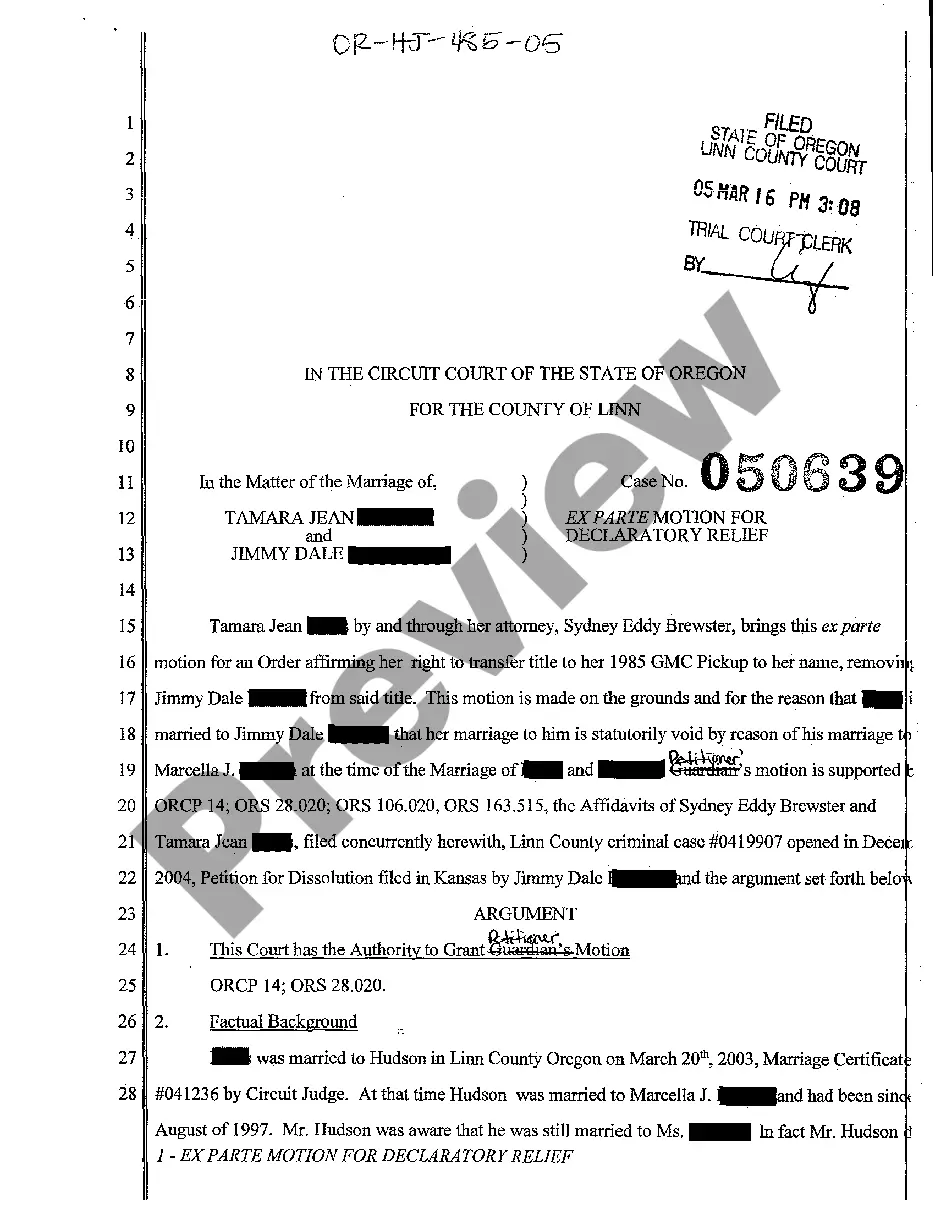

- Use the Preview key to analyze the form.

- See the explanation to actually have selected the appropriate develop.

- In case the develop isn`t what you`re looking for, utilize the Research industry to get the develop that fits your needs and requirements.

- Once you get the appropriate develop, click on Purchase now.

- Choose the pricing plan you need, submit the specified details to make your bank account, and buy the order using your PayPal or charge card.

- Pick a convenient data file structure and acquire your copy.

Locate every one of the record themes you have purchased in the My Forms menus. You can get a additional copy of Montana Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc. anytime, if needed. Just click the necessary develop to acquire or print out the record web template.

Use US Legal Forms, one of the most considerable variety of legitimate kinds, to save lots of efforts and steer clear of errors. The services gives skillfully manufactured legitimate record themes that you can use for a selection of purposes. Generate a free account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

When shares go up in value, executives can make a fortune from options. But when share prices fall, investors lose out while executives are no worse off. Indeed, some companies let executives swap old option shares for new, lower-priced shares when the company's shares fall in value.

With the offering company's stocks to the employees, the ?rm achieves two objectives? to offer incentives to the employees and to motivate them to worl-c hard to contribute towards the increment of the value of the stocks owned by them. This way a stock option plan provides an incentive for executives.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying asset?the company's stock?at a specified price for a finite period of time.