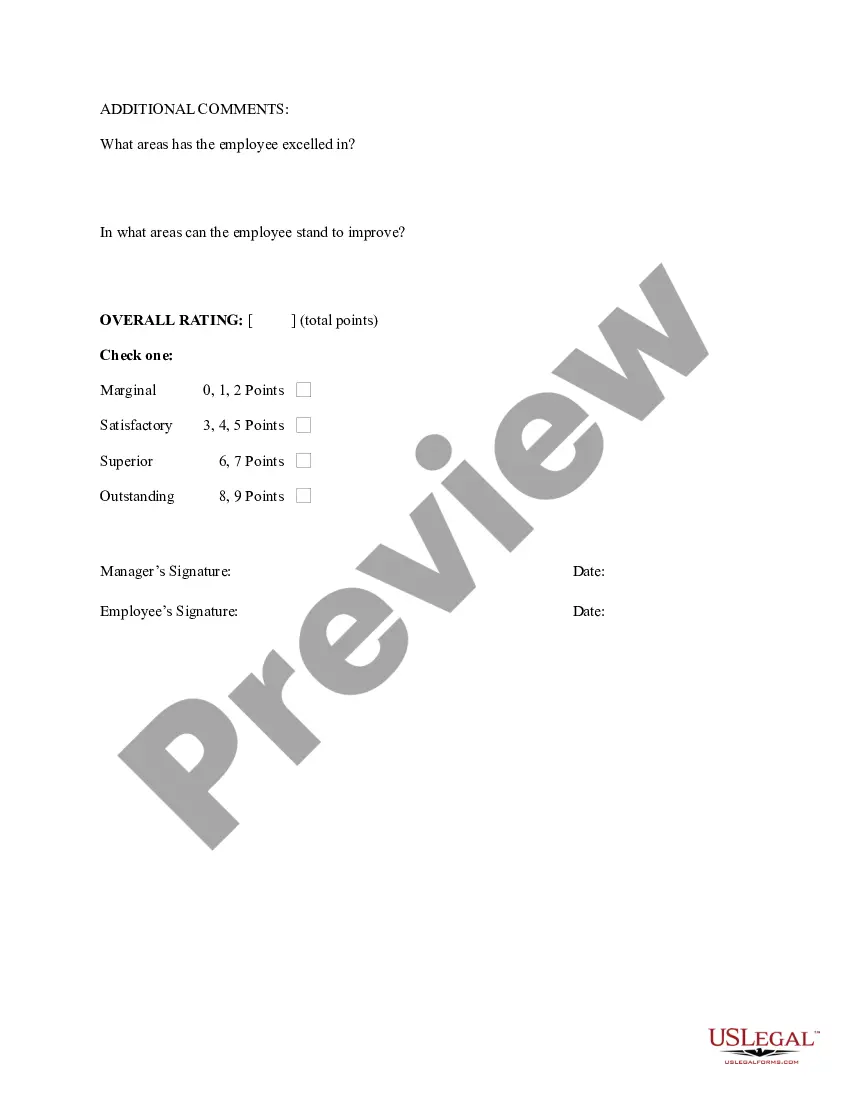

Montana Hourly Employee Evaluation

Description

How to fill out Hourly Employee Evaluation?

You can spend hours online searching for the legal document template that fulfills the federal and state requirements you need.

US Legal Forms offers a multitude of legal documents that are evaluated by experts.

It is easy to obtain or print the Montana Hourly Employee Evaluation from this service.

If you wish to find another version of the document, use the Search field to locate the template that satisfies your requirements.

- If you already possess a US Legal Forms account, you can Log In and press the Obtain button.

- Then, you can fill out, edit, print, or sign the Montana Hourly Employee Evaluation.

- Every legal document template you purchase is yours forever.

- To get another copy of the purchased form, visit the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, adhere to the straightforward instructions below.

- First, ensure that you have chosen the correct document template for the city/state of your choice. Review the form description to confirm you have selected the correct template.

- If available, use the Review button to browse through the document template as well.

Form popularity

FAQ

In fact, employees' right to discuss their salary is protected by law. While employers may restrict workers from discussing their salary in front of customers or during work, they cannot prohibit employees from talking about pay on their own time.

Montana is not an at will state. In some instances, the Wrongful Discharge From Employment Act does not apply, but generally, once an employee has completed the established probationary period, the employer needs to have good cause for termination.

A BILL FOR AN ACT ENTITLED: "AN ACT CREATING THE MONTANA PAYCHECK TRANSPARENCY ACT PROTECTIONS; ALLOWING EMPLOYEES TO DISCUSS WAGES OR BENEFITS WITHOUT PENALTY OR RETRIBUTION FROM AN EMPLOYER; LIMITING CONDITIONS OF EMPLOPYMENT; AND PROVIDING AN EFFECTIVE DATE."

In Montana it is unlawful for an employer to fire you in certain circumstances, such as: You were fired because you refused to violate public policy, or reported a violation of public policy, You had finished your probationary period and your employer did not have good cause to fire you.

Provides that an employer cannot prohibit workers from disclosing their wages, discussing the wages of others, or inquiring about others' wages; prohibits employers from relying on an employee's prior salary to justify the sex-, race-, or ethnicity- based pay difference.

Montana labor laws require employers to pay employees overtime at a rate of 1½ time their regular rate when they work more than 40 hours in a work week, unless otherwise exempt. MT Dept. of Labor: Overtime. See FLSA: Overtime for more information regarding overtime requirements.

An employer must thereafter evaluate the productivity of each worker with a disability who is paid an hourly commensurate wage rate at least every 6 months, or whenever there is a change in the methods or materials used or the worker changes jobs.

While exceptions exist, generally, punitive damages are unavailable in Montana for wrongful termination or constructive discharge. Damages for wrongful discharge, in Montana, are limited to four years of wages and fringe benefits.

Under the National Labor Relations Act (NLRA or the Act), employees have the right to communicate with other employees at their workplace about their wages. Wages are a vital term and condition of employment, and discussions of wages are often preliminary to organizing or other actions for mutual aid or protection.

Montana ranked especially high in its rate of new entrepreneurs. According to U.S. Census Bureau data, the number of new business applications in the state rose 50% between January of 2020 and January of 2021.