Montana Relocation Expense Agreement

Description

How to fill out Relocation Expense Agreement?

Finding the appropriate legal document templates can be challenging. Of course, there are numerous templates available online, but how do you locate the specific legal form you require? Utilize the US Legal Forms website. This service offers thousands of templates, including the Montana Relocation Expense Agreement, which is suitable for both business and personal purposes.

All the forms are reviewed by specialists and comply with federal and state regulations. If you are already registered, sign in to your account and then click the Download button to acquire the Montana Relocation Expense Agreement. Use your account to search for the legal forms you have previously purchased. Navigate to the My documents section of your account to obtain another copy of the documents you need.

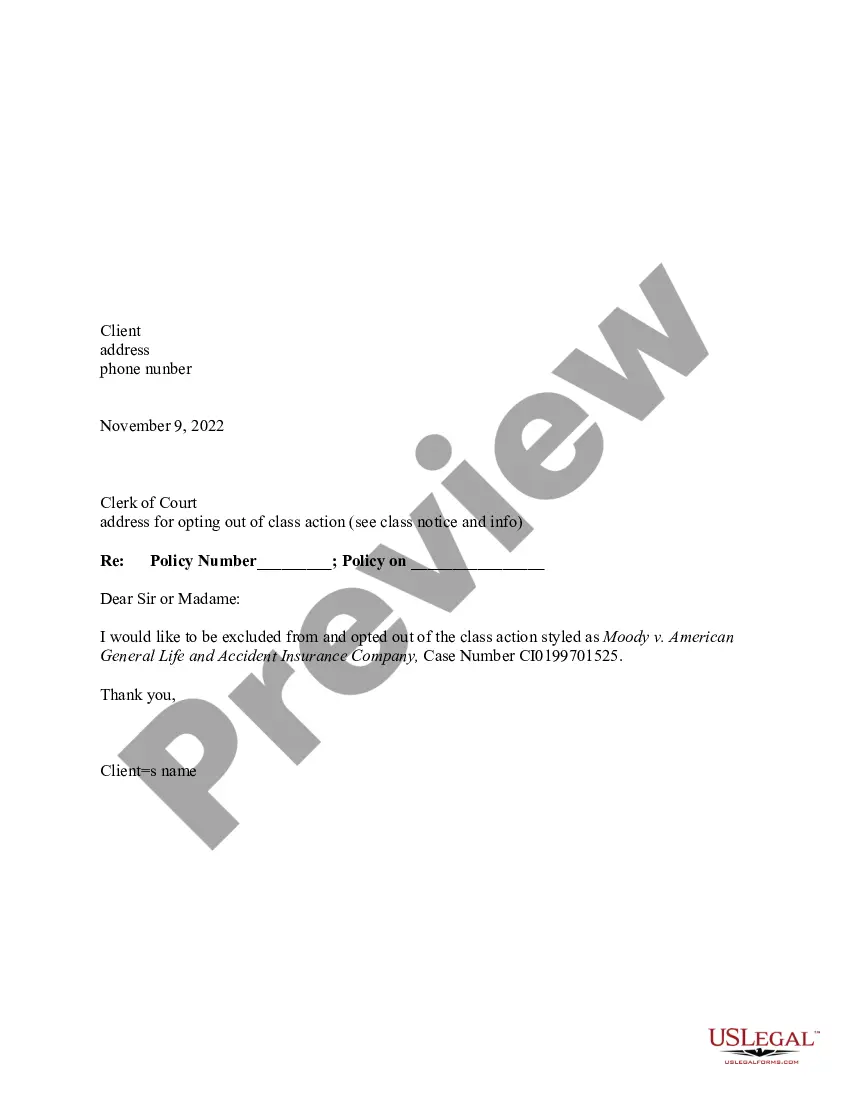

If you are a first-time user of US Legal Forms, here are some simple instructions to follow: First, ensure you have selected the correct form for your city/region. You can review the document using the Review button and glance at the form description to confirm it is the right one for your needs.

US Legal Forms is the largest collection of legal forms where you can explore various document templates. Take advantage of the service to download professionally created documents that meet state regulations.

- If the form does not fit your requirements, use the Search field to find the correct form.

- Once you are confident that the form is appropriate, click on the Acquire now button to obtain the form.

- Select the payment plan you want and enter the required information.

- Create your account and complete your purchase using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Fill out, edit, print, and sign the obtained Montana Relocation Expense Agreement.

Form popularity

FAQ

Growth Trends for Related Jobs A relocation occurs when you move to another city or state for a job and must leave behind your present life: your home, family, friends and your church.

Employee relocation occurs when a company chooses to move a new or existing employee from one location to another, and will often entice them with certain benefits to help make the move smoother and more affordable.

You cannot deduct house-hunting costs if you travel to the new location before you actually move. You can only deduct the cost of one trip as a moving expense. You can only deduct the cost of lodging at the old place for one day if you had to stay elsewhere because your furniture had been moved.

"Relocation offered" generally refers to an employer being willing to consider paying moving expenses and providing other considerations to enable a new hire to move there. It usually does not include things related to those not already eligible to work in the country in question.

How to write an employee relocation letterInform the employee.Determine the duration of the move.Discuss company coverage.Mention tax differences.Highlight potential bonuses.Reassure your employee.

Dear (Sir or Madam), I am writing this letter to request you a relocation from my position at (Your requirement) to a similar position at the (Job position) in (Branch/Department name). (Describe in your words). Due to some family issues, it is necessary for me to move in closer proximity to my family.

How to write a relocation cover letterExplain why you're relocating. Your relocation cover letter needs to highlight why you plan on moving.Prove you've done your research.Give the company a timeframe and interview details.State your ties and commitment to the new area.Appropriately present your contact details.30-Mar-2022

A relocation agreement, sometimes referred to as an employee relocation agreement, is a legal contract executed by an employer and an employee in which the employer agrees to compensate an employee for relocating for business purposes.

A typical relocation package usually covers the costs of moving and storing furnishings, household goods, assistance with selling an existing home, costs incurred with house-hunting, temporary housing, and all travel costs by the employee and family to the new location.

Ask directly or be upfront about your needs: If receiving relocation assistance is non-negotiable for you, it's best to be upfront about it. It doesn't hurt to ask what the policy is just hold off on asking for something specific until you have an offer.