Montana Petty Cash Form

Description

How to fill out Petty Cash Form?

If you need to total, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's simple and user-friendly search to find the documents you require.

A variety of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click on the Download now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Process the payment. You may use your Visa or MasterCard or PayPal account to complete the transaction.

- Use US Legal Forms to locate the Montana Petty Cash Form with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Montana Petty Cash Form.

- You can also access forms you have previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

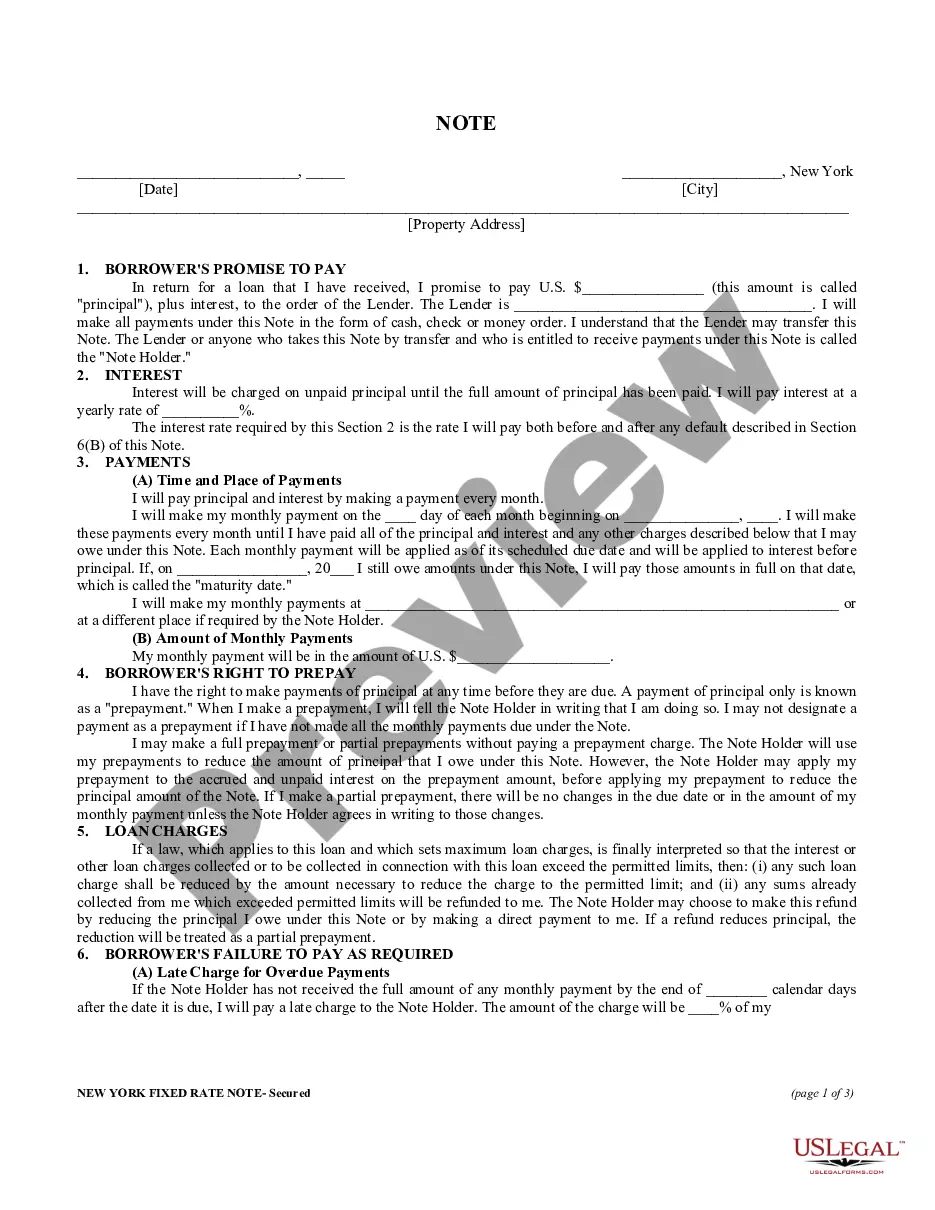

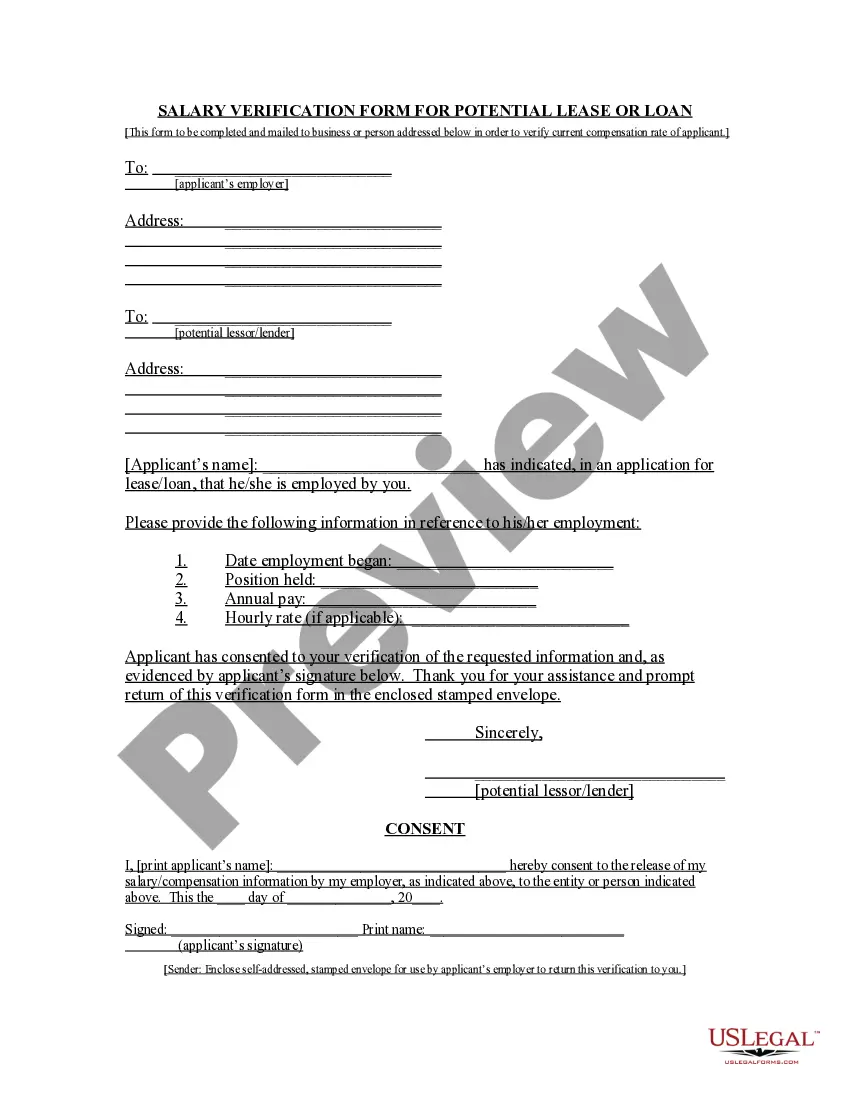

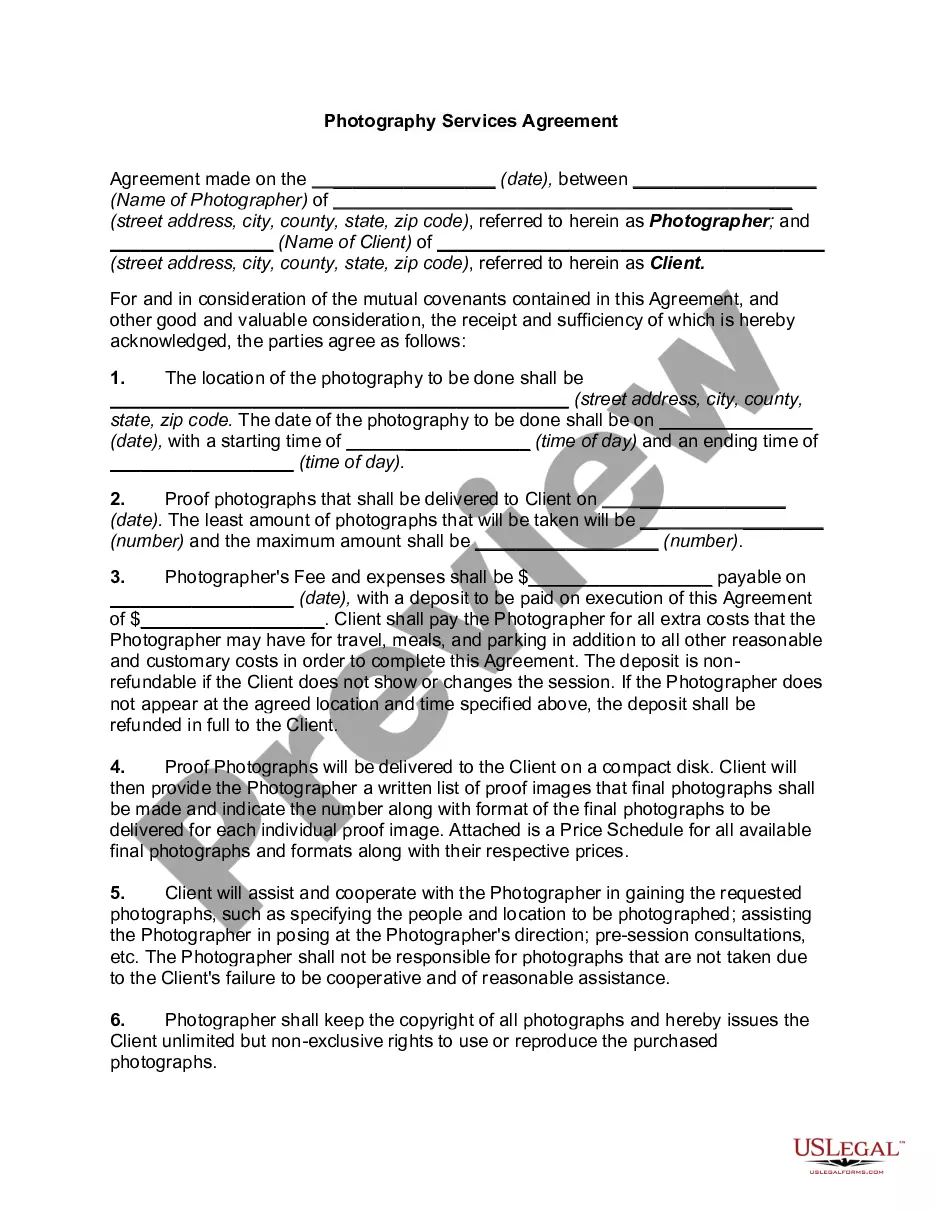

- Step 2. Use the Preview option to review the form’s contents. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

To make an entry in petty cash, complete a Montana Petty Cash Form for each transaction. Document the date, amount, and reason for the cash disbursement. Keep receipts associated with each expense for verification purposes. Utilizing the US Legal Forms platform can streamline this process, allowing you to create and track your entries efficiently.

Preparing a petty cash report involves summarizing all transactions made using the Montana Petty Cash Form during a specific period. Begin by listing each transaction, noting the date, amount, and purpose. After detailing all entries, calculate the total expenditures and compare it to the original petty cash balance. A well-organized report provides clarity about spending and helps maintain accurate financial records.

To fill out a Montana Petty Cash Form, start by entering the date at the top of the form. Then, list the purpose of the cash transaction clearly along with the amount requested or disbursed. Be sure to provide your name and any required approval signatures. Finally, keep the form organized to ensure easy reference for your records.

A petty cash voucher is typically prepared by the employee who is requesting reimbursement or the individual responsible for managing the petty cash account. They must complete the Montana Petty Cash Form to ensure proper documentation of each transaction. This form helps maintain transparency and accountability in how funds are spent. Using a clear form helps everyone involved understand the expenses and promotes better financial management within your organization.

Setting up a petty cash account involves a few simple steps. Start by determining the amount of cash you need for day-to-day expenses and gather the necessary funds. Next, create a petty cash policy that outlines how the funds will be used, who controls them, and the procedures for replenishing the cash. To streamline this process, consider using the Montana Petty Cash Form from US Legal Forms, which provides a clear structure for managing your petty cash efficiently.

Recording petty cash involves documenting each transaction in a ledger or tracking system. Use the Montana Petty Cash Form to note the date, amount, purpose, and initials of the person handling the funds. Consistent entries help maintain an accurate balance, minimizing the risk of discrepancies. Regularly review and reconcile your petty cash records to ensure proper management.

To fill out a Montana Petty Cash Form, start by entering the date and the purpose of the cash disbursement. Next, provide the amount being withdrawn and detail the transaction. Make sure to attach any relevant receipts that support your expenses. This process ensures transparency and accountability, key aspects of managing petty cash effectively.