Montana Grantor Retained Annuity Trust

Description

How to fill out Grantor Retained Annuity Trust?

Are you currently in a situation where you require documents for business or specific purposes almost all the time.

There are many legal document templates available online, but locating trustworthy ones can be challenging.

US Legal Forms offers a wide variety of form templates, including the Montana Grantor Retained Annuity Trust, which can be customized to comply with state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and minimize errors.

The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you may download the Montana Grantor Retained Annuity Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it pertains to your specific area/state.

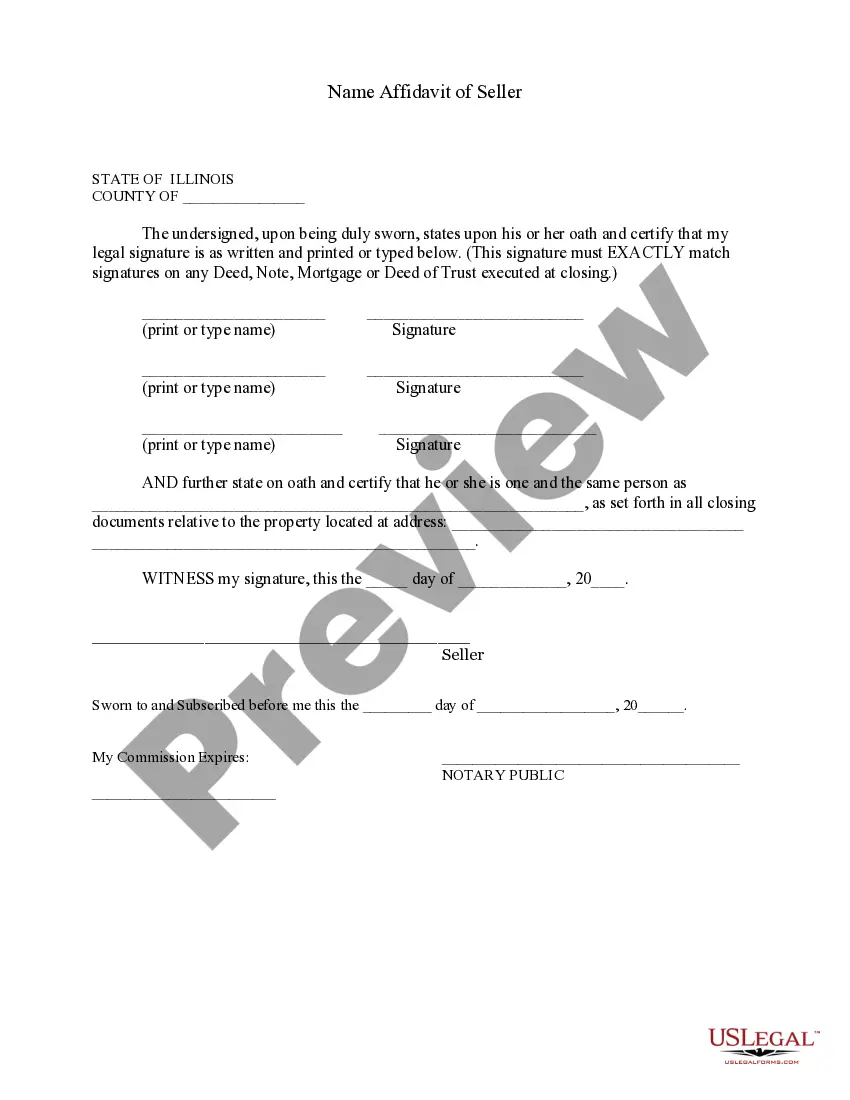

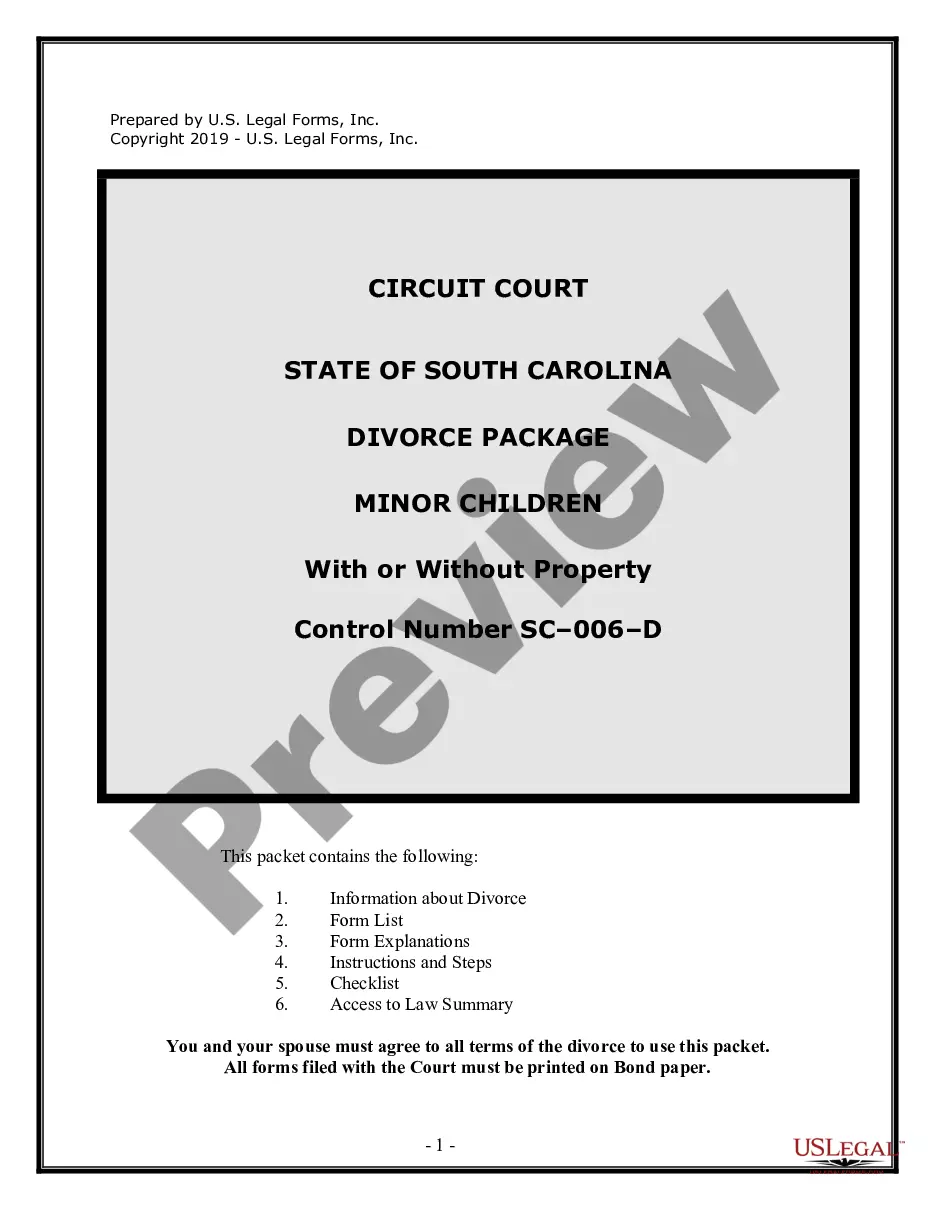

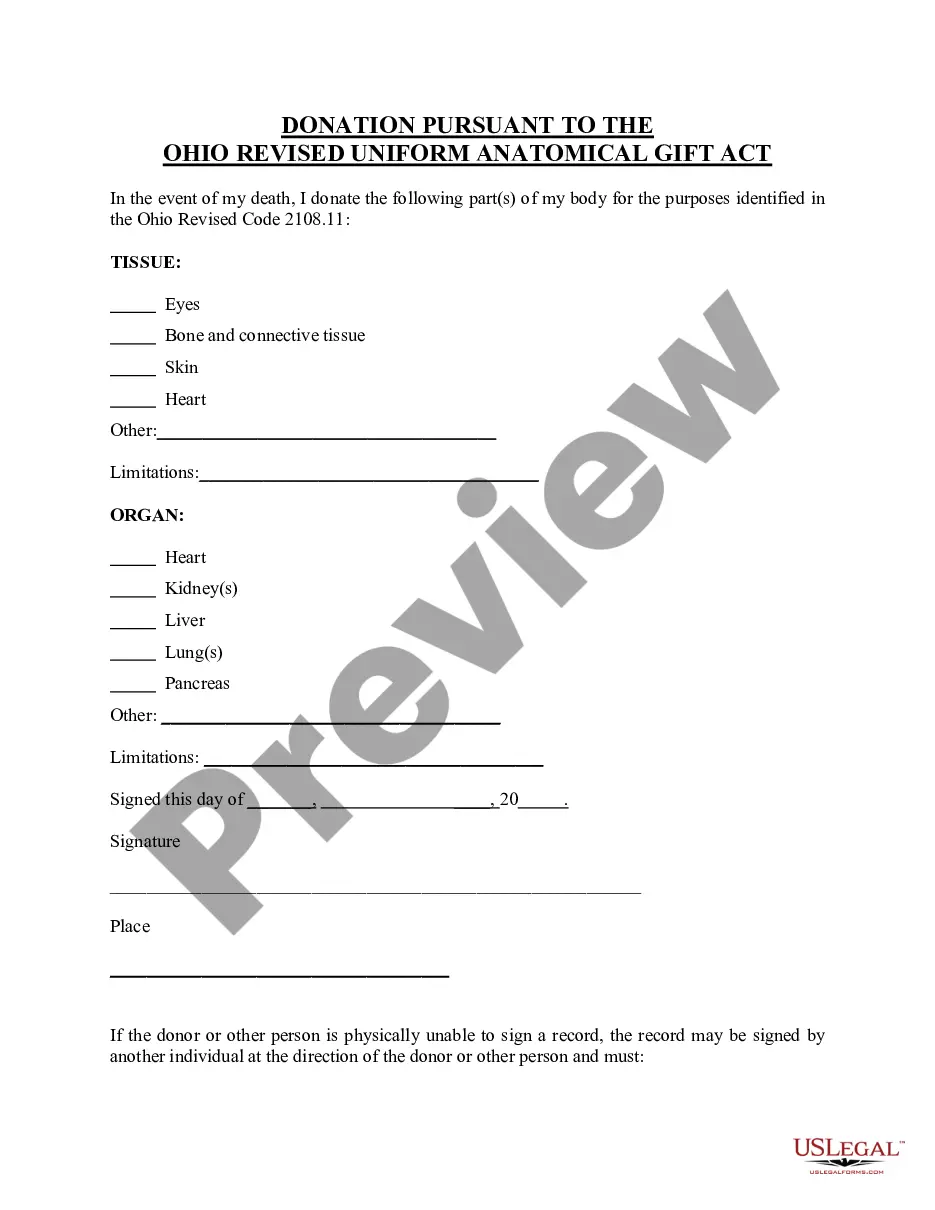

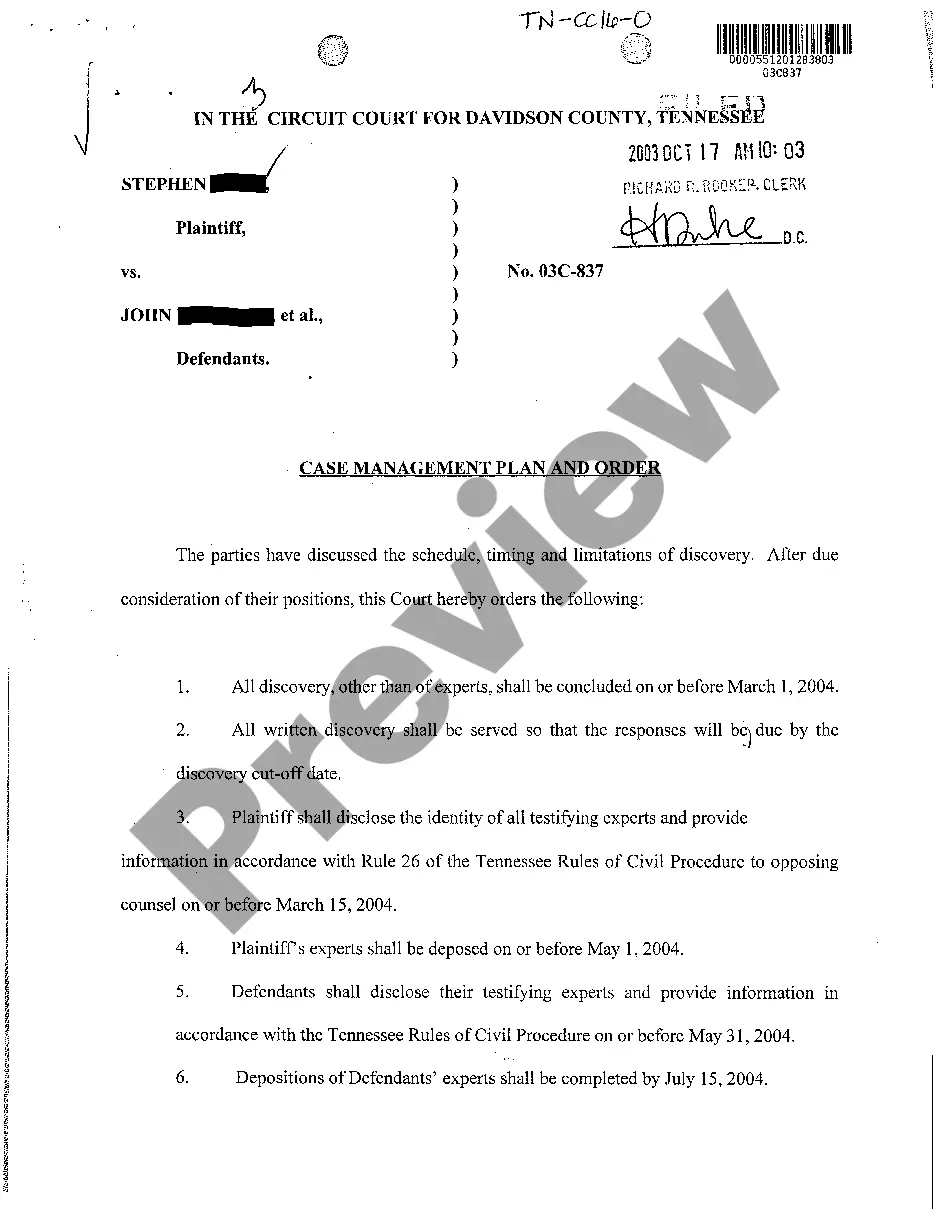

- Utilize the Preview button to view the form.

- Review the description to confirm that you have chosen the correct form.

- If the form is not what you're looking for, use the Search area to find the form that meets your needs and requirements.

- Once you locate the appropriate form, click Get now.

- Select the pricing plan you prefer, enter the required information to create your account, and complete the payment with your PayPal or credit card.

- Choose a suitable file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can download another copy of the Montana Grantor Retained Annuity Trust whenever necessary. Just select the desired form to download or print the document template.

Form popularity

FAQ

Typically, a trust must file a separate income tax return for each calendar year. However, for most grantor trusts, filing a separate tax return is optional.

The trustee must give the trust's name, TIN, and address to all payors for the taxable year, and the trustee must file Forms 1099 with the IRS and appropriately attribute the income of the trust among the grantors in proportion to their deemed ownership.

Entering the Grantor Trust data directly into the 1040 returnOpen Screen K1T in the K1 E/T folder.Enter the Trust's identifying information, and mark the Grant Trust checkbox near the top of the screen.Enter data in the Grantor Trust Income, Expenses, and Other Information section at the bottom of the screen.

Grantor retained annuity trusts (GRAT) are estate planning instruments in which a grantor locks assets in a trust from which they earn annual income. Upon expiry, the beneficiary receives the assets with minimal or no gift tax liability. GRATS are used by wealthy individuals to minimize tax liabilities.

Fiduciaries are able to e-file FTB Form 541, California Fiduciary Income Tax Return, for this year and the past two tax years.

Grantor Retained Income Trust, Definition A grantor retained income trust allows the person who creates the trust to transfer assets to it while still being able to receive net income from trust assets. The grantor maintains this right for a fixed number of years.

GRATs are taxed in two ways: Any income you earn from the appreciation of your assets in the trust is subject to regular income tax, and any remaining funds/assets that transfer to a beneficiary are subject to gift taxes.

The general rule is that all grantor trusts must file a Form 1041, which contains only the trust's name, address, and tax identification number (TIN) (see Regs....Second AlternativeThe grantor's name;The grantor's taxpayer identification number (i.e., Social Security number (SSN)); and.The trustee's address.

If a trust is a grantor trust, then the grantor is treated as the owner of the assets, the trust is disregarded as a separate tax entity, and all income is taxed to the grantor.