Montana Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty

Description

How to fill out Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice Or Course Of Dealing Stockbroker Churning - Violation Of Blue Sky Law And Breach Of Fiduciary Duty?

You may devote hours on-line trying to find the authorized file template that suits the state and federal needs you want. US Legal Forms offers thousands of authorized kinds which can be analyzed by professionals. You can actually obtain or printing the Montana Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty from my support.

If you currently have a US Legal Forms account, you may log in and click on the Obtain key. Following that, you may comprehensive, modify, printing, or indication the Montana Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty. Each authorized file template you acquire is the one you have for a long time. To get yet another duplicate for any obtained form, visit the My Forms tab and click on the corresponding key.

If you work with the US Legal Forms web site initially, keep to the simple guidelines under:

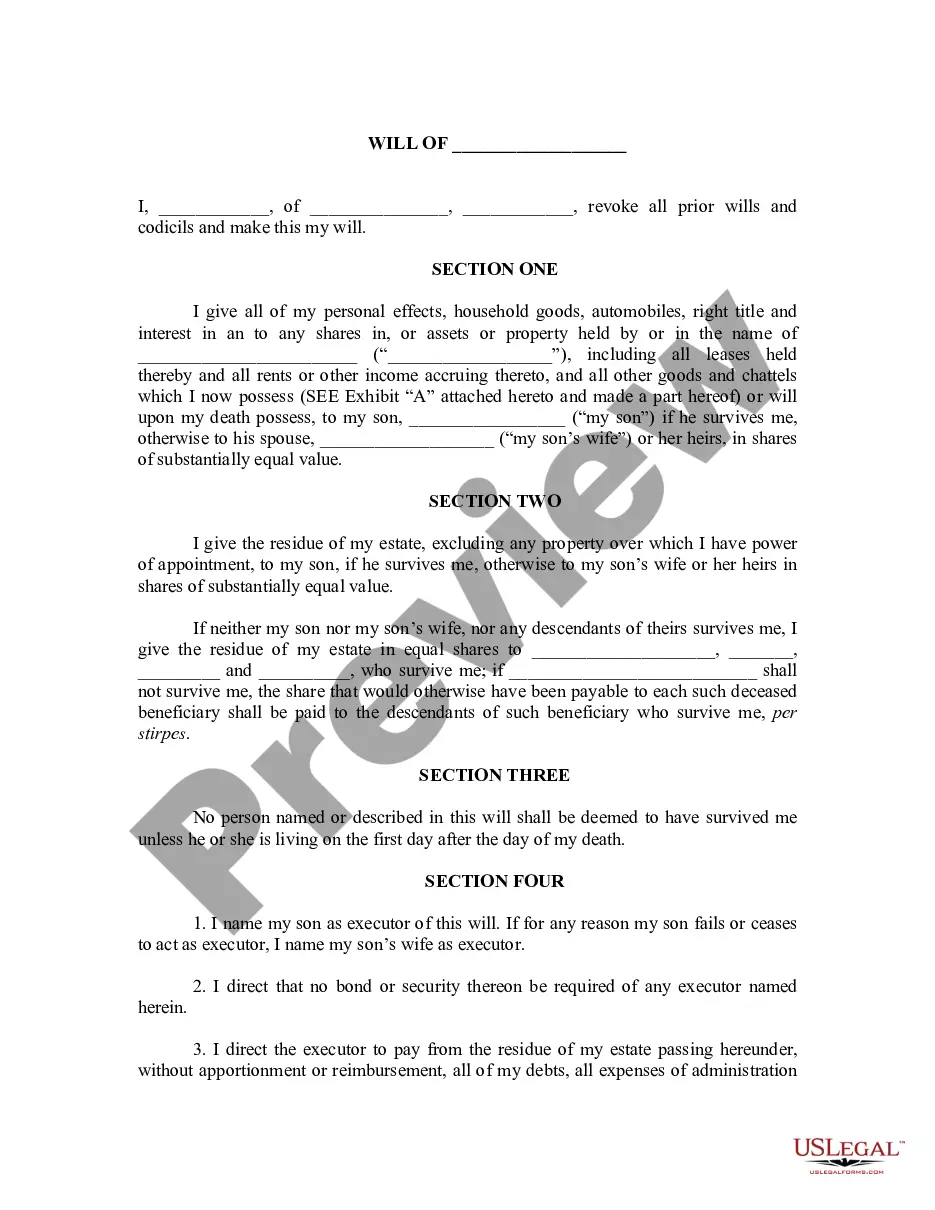

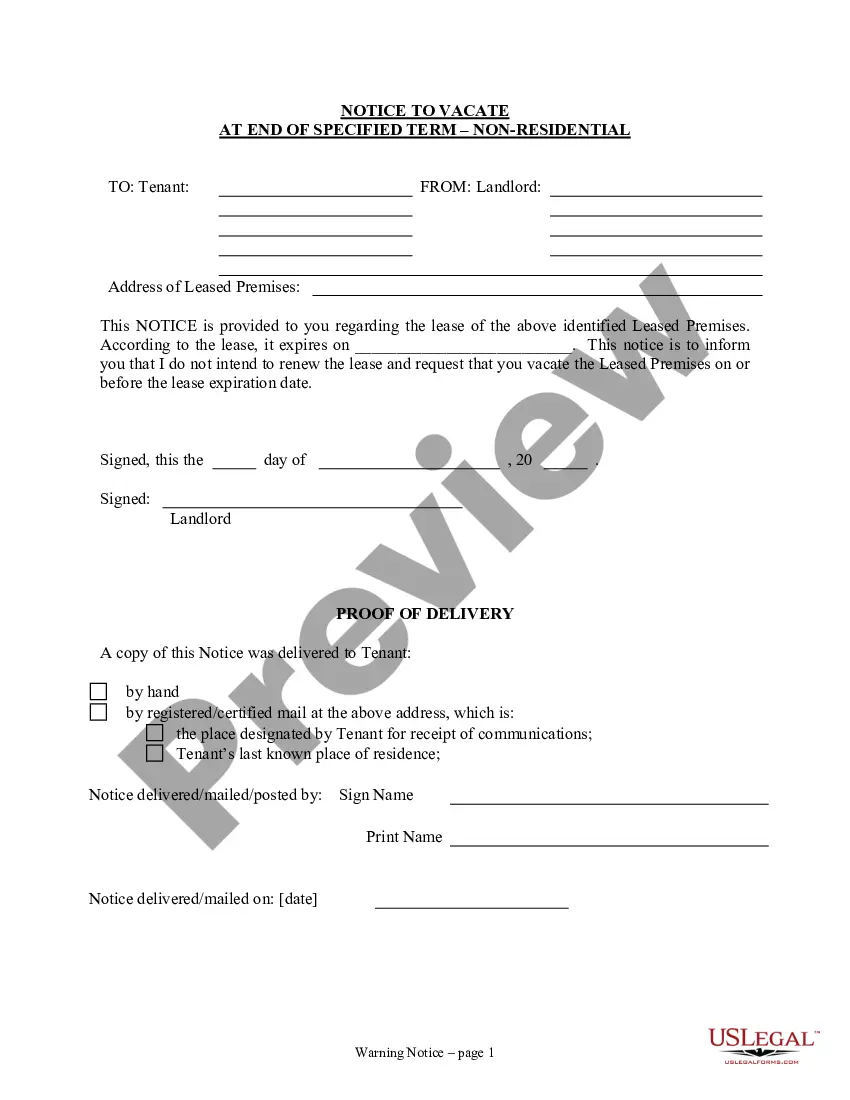

- First, ensure that you have selected the correct file template for the area/metropolis of your liking. Browse the form information to make sure you have chosen the correct form. If readily available, take advantage of the Preview key to appear throughout the file template as well.

- If you want to locate yet another model of your form, take advantage of the Look for industry to find the template that meets your requirements and needs.

- When you have identified the template you want, click on Purchase now to move forward.

- Choose the pricing prepare you want, type in your references, and sign up for a free account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal account to pay for the authorized form.

- Choose the format of your file and obtain it to the product.

- Make changes to the file if necessary. You may comprehensive, modify and indication and printing Montana Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty.

Obtain and printing thousands of file web templates while using US Legal Forms web site, which offers the greatest collection of authorized kinds. Use professional and state-particular web templates to deal with your company or person needs.