Montana Partnership Agreement for LLC: A Comprehensive Guide to Understanding and Utilizing this Legal Document Introduction: A Montana Partnership Agreement for LLC is a crucial legal document that outlines the terms and conditions agreed upon by partners forming a limited liability company (LLC) in the state of Montana. This agreement serves as the foundation for the company's operations, responsibilities, and profit distribution, providing a clear roadmap for effective collaboration and minimizing potential conflicts. This article will delve into the key aspects of a Montana Partnership Agreement for LLC, highlighting its importance and various types available. Key Elements of a Montana Partnership Agreement for LLC: 1. Organizational Structure: The agreement outlines the organizational structure of the LLC, including the names and roles of partners, their responsibilities, and decision-making authority. It defines the management style, laying out whether the LLC will be managed by all partners (member-managed) or by designated individuals (manager-managed). 2. Contributions and Ownership Interests: The partnership agreement specifies the capital contributions, assets, or services each partner brings into the LLC. It also documents the percentage of ownership interests of each partner, influencing profit distribution and voting rights. 3. Allocations and Distributions: This section clarifies how profits and losses will be allocated among partners, either based on their ownership percentage or by an alternative arrangement agreed upon by the partners. Distributions of profits, typically in proportion to ownership interests, are detailed to ensure fairness and transparency. 4. Decision Making and Voting: The agreement sets forth the decision-making process, whether it requires unanimous consent or a percentage of majority votes. It outlines the voting rights of each partner, ensuring equal representation and collective decision-making power. 5. Admission and Withdrawal of Partners: In case a new partner wants to join the LLC, the agreement establishes the procedures for admission, including the process to determine capital contribution, ownership interest, and voting rights. Similarly, it outlines the circumstances and processes under which a partner can withdraw from the LLC. 6. Dissolution and Termination: The agreement addresses the conditions that would warrant dissolution of the LLC, such as bankruptcy, unanimous consent, or a specified triggering event. It also outlines the procedures and responsibilities for winding up the company's affairs and distributing remaining assets in case of termination. Types of Montana Partnership Agreements for LLC: 1. General Partnership Agreement: This agreement governs partnerships where all partners have collective management authority and share personal liability for the LLC's debts and liabilities. 2. Limited Partnership Agreement: In this arrangement, there are general partners responsible for managing the LLC and limited partners who invest capital but have limited liability, shielding them from personal obligations beyond their investment. 3. Limited Liability Partnership Agreement: This agreement is suitable for professionals conducting a licensed practice, such as law firms or architectural partnerships. It provides certain liability protections while allowing partners to have collective management authority. Conclusion: A Montana Partnership Agreement for LLC is a crucial legal document that outlines the rights, responsibilities, and obligations of LLC partners in the state of Montana. By clarifying the organizational structure, ownership interests, profit distributions, decision-making procedures, and more, this agreement helps establish a strong foundation for a successful and harmonious LLC. Understanding the importance of this agreement and the various types available is essential for entrepreneurs and business professionals looking to form an LLC in Montana.

Montana Partnership Agreement for LLC

Description

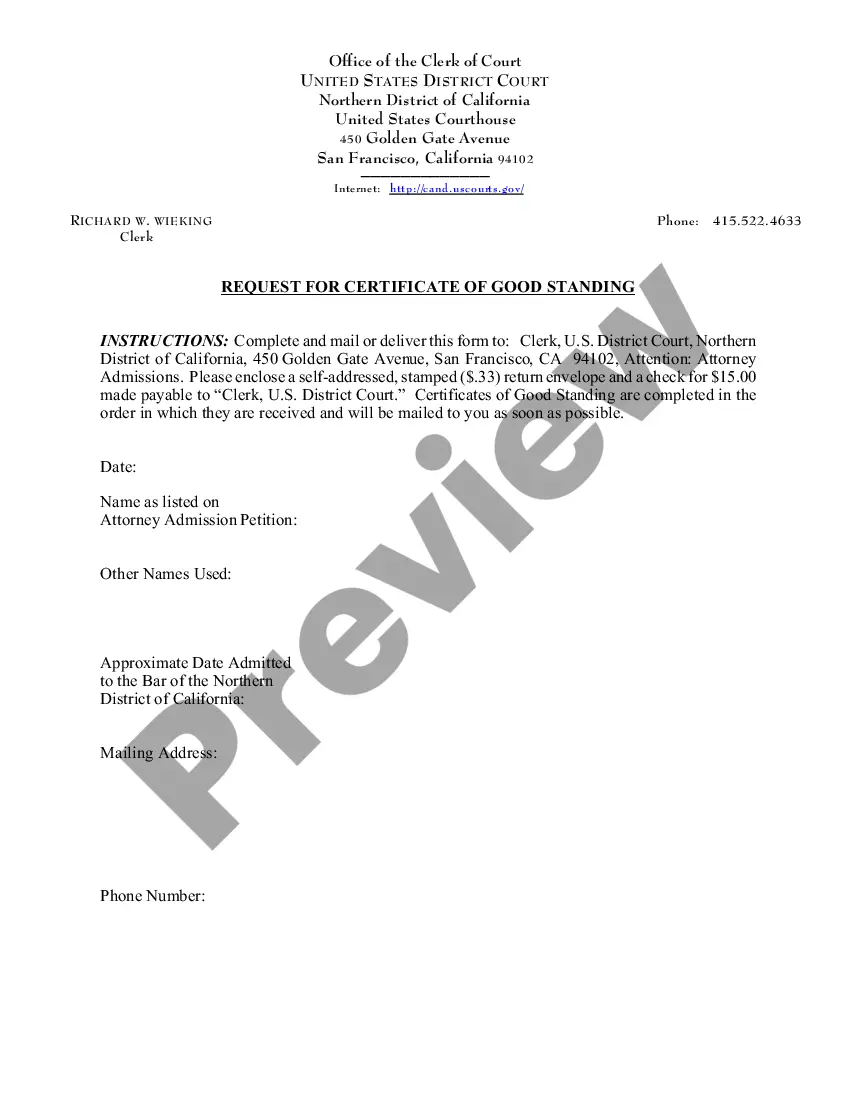

How to fill out Montana Partnership Agreement For LLC?

Have you been within a situation in which you will need documents for either business or individual purposes almost every day? There are tons of authorized papers themes available on the net, but getting ones you can rely isn`t straightforward. US Legal Forms gives 1000s of kind themes, like the Montana Partnership Agreement for LLC, which are written to meet federal and state demands.

Should you be previously familiar with US Legal Forms site and get your account, merely log in. Next, you are able to acquire the Montana Partnership Agreement for LLC format.

Should you not come with an bank account and want to start using US Legal Forms, abide by these steps:

- Find the kind you want and make sure it is for your right metropolis/state.

- Take advantage of the Review button to check the shape.

- See the description to actually have selected the appropriate kind.

- In case the kind isn`t what you`re trying to find, use the Research field to find the kind that fits your needs and demands.

- If you find the right kind, click on Buy now.

- Choose the pricing plan you desire, fill in the necessary information to generate your money, and buy an order with your PayPal or charge card.

- Select a practical file format and acquire your backup.

Discover every one of the papers themes you possess bought in the My Forms menus. You can obtain a further backup of Montana Partnership Agreement for LLC anytime, if needed. Just click on the necessary kind to acquire or print the papers format.

Use US Legal Forms, probably the most considerable collection of authorized types, in order to save some time and steer clear of faults. The support gives professionally manufactured authorized papers themes that can be used for a selection of purposes. Produce your account on US Legal Forms and initiate making your life easier.

Form popularity

FAQ

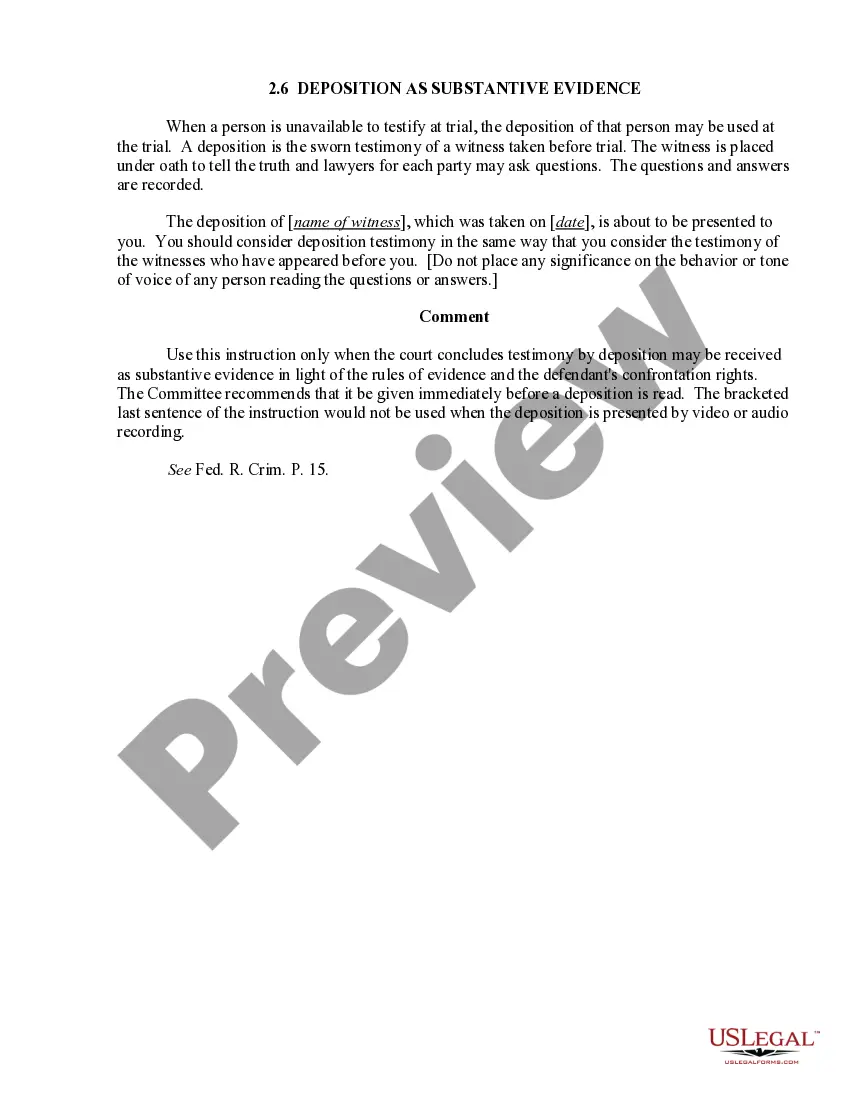

An LLC operating agreement contains clear provisions about each owner's contributions to the business, their share of profits and their responsibilities to the company and other members. That means the agreement is a good dispute resolution tool.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Montana does not require you to have an operating agreement when you form an LLC; however, even as the sole owner of the company, it's in your best interest to file an operating agreement when you create your LLC.

An LLC can be a partnership for tax purposes, because the IRS automatically classifies both LLCs and partnerships as disregarded entities." This means that owners report their share of company profits and losses on their personal tax returns.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Thus, an LLC with multiple owners can either accept its default classification as a partnership, or file Form 8832 to elect to be classified as an association taxable as a corporation.

When you add a new member to a single-member LLC, the LLC becomes a partnership for federal tax rules. This event occurs automatically under federal tax rules. Many people mistakenly file a Form 8832 to elect a partnership classification, which is an incorrect filing and unnecessary.

An LLC is a formal partnership arrangement that requires articles of organization to be filed with the state. An LLC is easier to set up than a corporation and provides more flexibility and protection for its investors. LLCs may elect not to pay federal taxes directly.

An LLC partnership agreement (also called an LLC Operating Agreement) lays the ground rules for operating a Limited Liability Company and protects the legal rights of its owners (called members). It's written by the LLC's members and describes the plans and provisions for the company.