Montana Sample Letter for Intentions regarding Defense of Priority of Insured Mortgage

Description

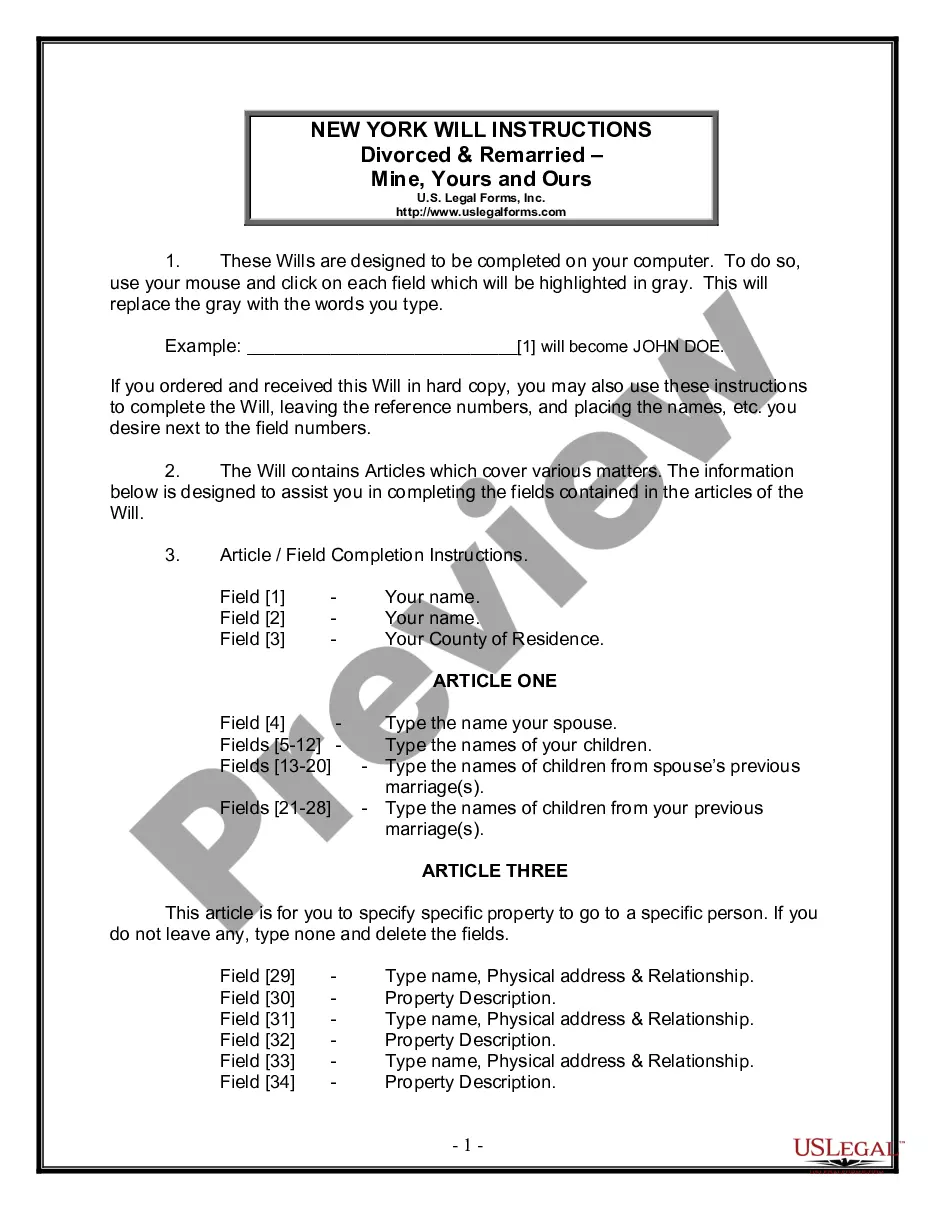

How to fill out Sample Letter For Intentions Regarding Defense Of Priority Of Insured Mortgage?

Are you presently in the place that you require papers for either organization or specific purposes just about every time? There are tons of lawful record web templates available on the Internet, but discovering types you can trust isn`t easy. US Legal Forms provides thousands of develop web templates, much like the Montana Sample Letter for Intentions regarding Defense of Priority of Insured Mortgage, which are composed in order to meet state and federal specifications.

If you are already informed about US Legal Forms site and get your account, basically log in. Following that, you can down load the Montana Sample Letter for Intentions regarding Defense of Priority of Insured Mortgage template.

Unless you have an profile and need to begin using US Legal Forms, adopt these measures:

- Find the develop you need and ensure it is for your correct town/area.

- Take advantage of the Preview option to examine the shape.

- See the description to actually have chosen the appropriate develop.

- When the develop isn`t what you`re trying to find, utilize the Look for industry to get the develop that fits your needs and specifications.

- If you discover the correct develop, just click Get now.

- Pick the costs prepare you need, fill out the required information to generate your bank account, and pay money for an order utilizing your PayPal or bank card.

- Select a practical data file structure and down load your duplicate.

Get each of the record web templates you possess bought in the My Forms menus. You can get a further duplicate of Montana Sample Letter for Intentions regarding Defense of Priority of Insured Mortgage whenever, if needed. Just go through the essential develop to down load or printing the record template.

Use US Legal Forms, by far the most comprehensive collection of lawful kinds, to conserve time and prevent mistakes. The assistance provides appropriately produced lawful record web templates that can be used for a selection of purposes. Make your account on US Legal Forms and initiate generating your way of life a little easier.

Form popularity

FAQ

An Intent to Purchase Real Estate letter provides the opportunity to commit previously negotiated terms to writing and to create an outline of the prospective sale. Use an Intent to Purchase Real Estate letter when you want to hammer out the terms of the deal before committing to the purchase.

A letter of intent (LOI) is a document written in business letter format that declares your intent to do a specific thing. It's usually, but not always, nonbinding, and it states a preliminary commitment by one party to do business with another party.

Remember that the form's purpose is to communicate your intent to proceed so everyone is on the same page. You can still cancel the loan at any time until you sign the loan agreement at closing when you buy the home. It's up to you to decide which lender you'll use for your mortgage.

Here are some of the things mortgage experts recommend you include: The date you're writing the letter. The lender's name, mailing address, and phone number. Your full legal name and loan application number. Your explanation, with references to any supporting documents you're including. Your mailing address and phone number.

Once the LOI has been signed, the transaction enters the due diligence process, where the seller is typically unable to negotiate with other buyers.

For CMHC-insured mortgage loans, the maximum purchase price or as-improved property value must be below $1,000,000. You will typically have a minimum down payment starting at 5%. For a purchase price of $500,000 or less, the minimum down payment is 5%.

* CMHC-insured financing is available for one property per borrower/co-borrower at any given time.

The letter of intent gives the mortgage lender more certainty about your income and the options for paying the mortgage. With an 'employer statement of intent', or employer's statement, there is a chance that you can also take out a mortgage without a permanent contract.