Montana Complex Deed of Trust and Security Agreement

Description

How to fill out Complex Deed Of Trust And Security Agreement?

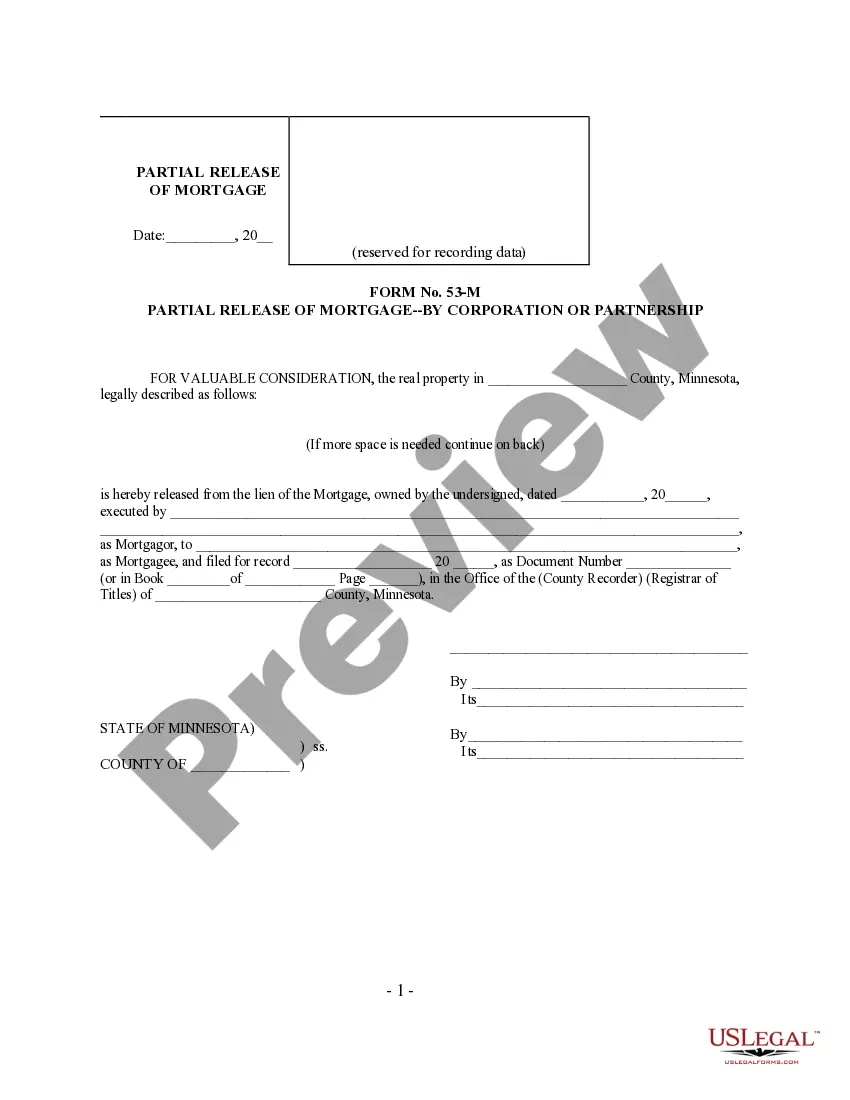

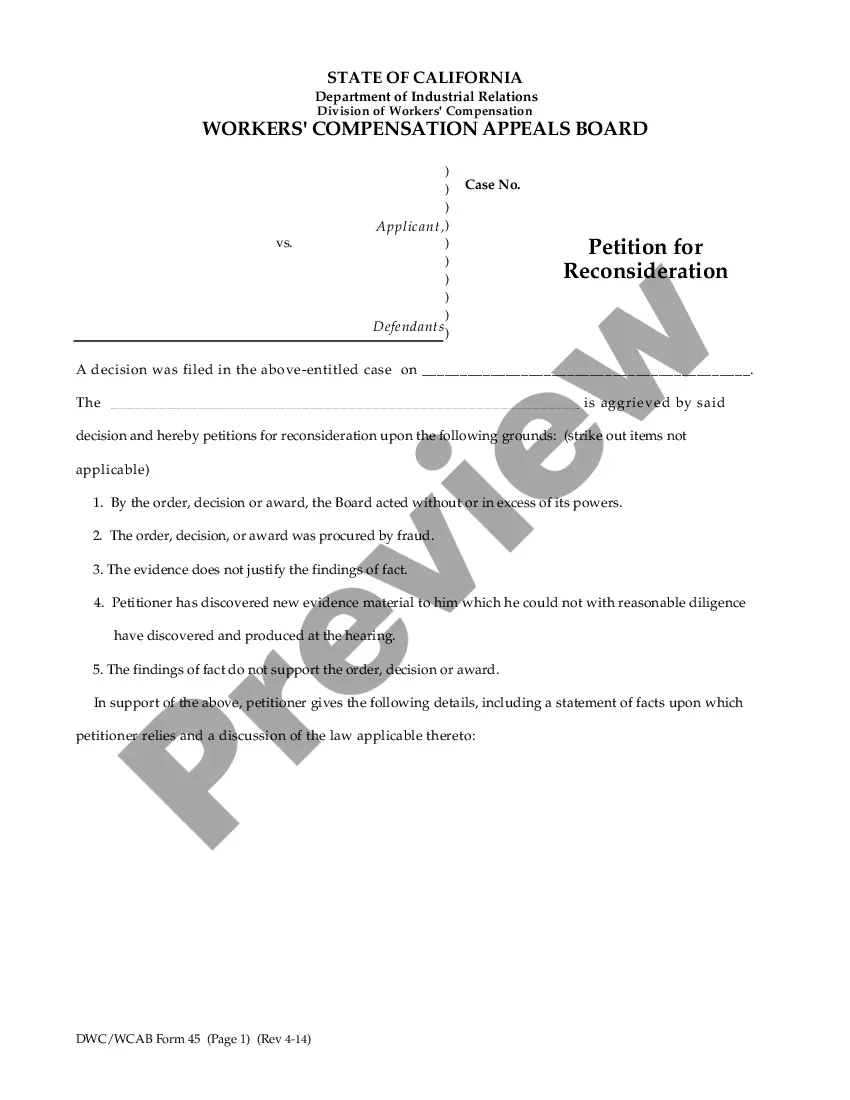

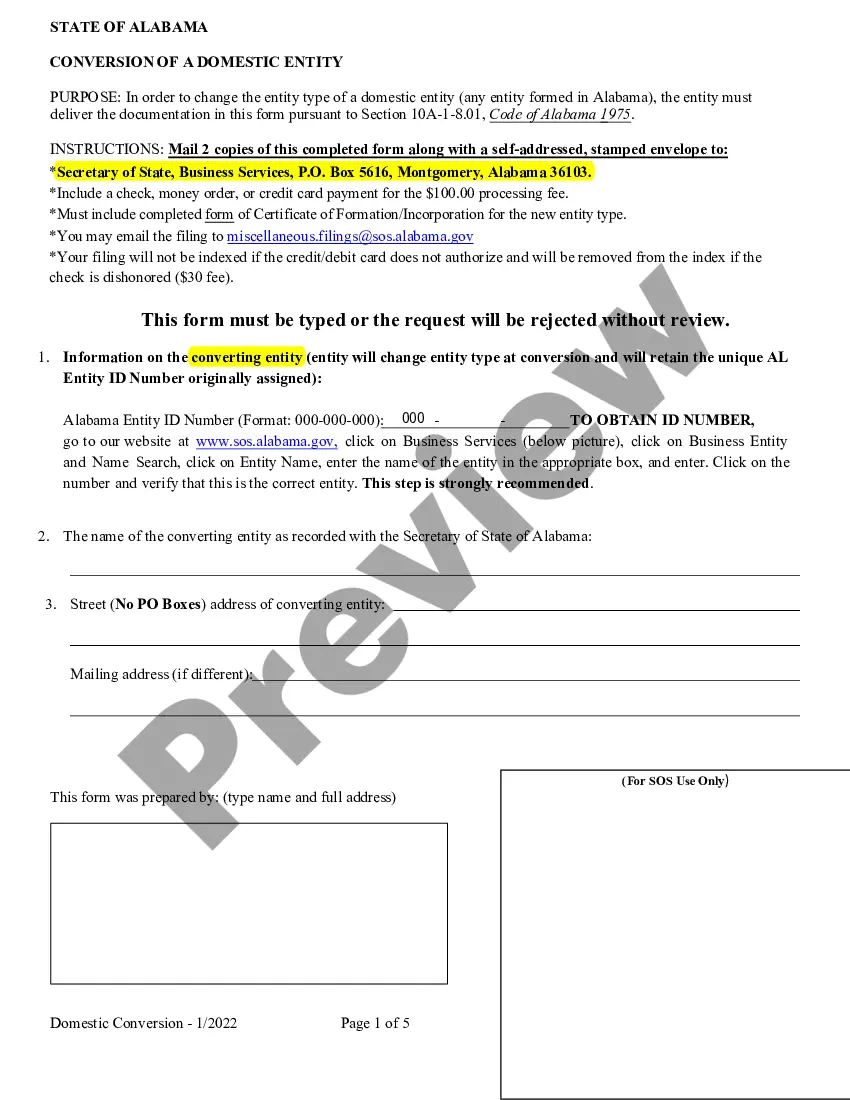

Choosing the right legal record template can be a battle. Naturally, there are plenty of templates available online, but how would you discover the legal kind you need? Utilize the US Legal Forms site. The service delivers 1000s of templates, for example the Montana Complex Deed of Trust and Security Agreement, that can be used for company and personal demands. Each of the forms are checked by pros and fulfill federal and state needs.

If you are presently authorized, log in in your accounts and click on the Obtain button to have the Montana Complex Deed of Trust and Security Agreement. Utilize your accounts to appear from the legal forms you have acquired in the past. Visit the My Forms tab of your own accounts and acquire an additional backup of the record you need.

If you are a new consumer of US Legal Forms, allow me to share easy guidelines so that you can follow:

- Initial, make sure you have chosen the appropriate kind for the city/county. You may examine the form using the Preview button and look at the form outline to make certain this is basically the right one for you.

- In the event the kind is not going to fulfill your needs, use the Seach field to find the appropriate kind.

- Once you are positive that the form is acceptable, click on the Get now button to have the kind.

- Select the costs strategy you would like and type in the essential info. Design your accounts and pay for an order using your PayPal accounts or Visa or Mastercard.

- Choose the file structure and acquire the legal record template in your gadget.

- Total, edit and print and indication the attained Montana Complex Deed of Trust and Security Agreement.

US Legal Forms will be the most significant library of legal forms where you will find different record templates. Utilize the company to acquire appropriately-manufactured files that follow status needs.

Form popularity

FAQ

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

In ance with Montana's Small Tract Financing Act, only real estate with an area of forty (40) acres or less is eligible to be conveyed with a deed of trust, and such instruments are subject to the same laws as mortgages on real estate.

Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan. If the loan is not repaid on time, the lender can foreclose on and sell the property and use the proceeds to pay off the loan.

A security agreement is not used to transfer any interest in real property (land/real estate), only personal property. The document used by lenders to obtain a lien on real property is a mortgage or deed of trust.

The security deed is an interest in real estate which gives legal title of property to the lender of the mortgage for the term of the mortgage note. Trust deed is a written instrument legally conveying property to a trustee often used to secure an obligation such as a mortgage or promissory note.

Trust deeds are an alternative to mortgages in certain states. Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee.

For a Deed of Trust, the parties involved are the lender, the borrower, and a neutral third party who will serve as a trustee. The title of the property is held as security for the loan and held by the trustee for the benefit of the lender. The title is released from the trust once the loan is paid.