Montana Release and Indemnification of Personal Representative by Heirs and Devisees

Description

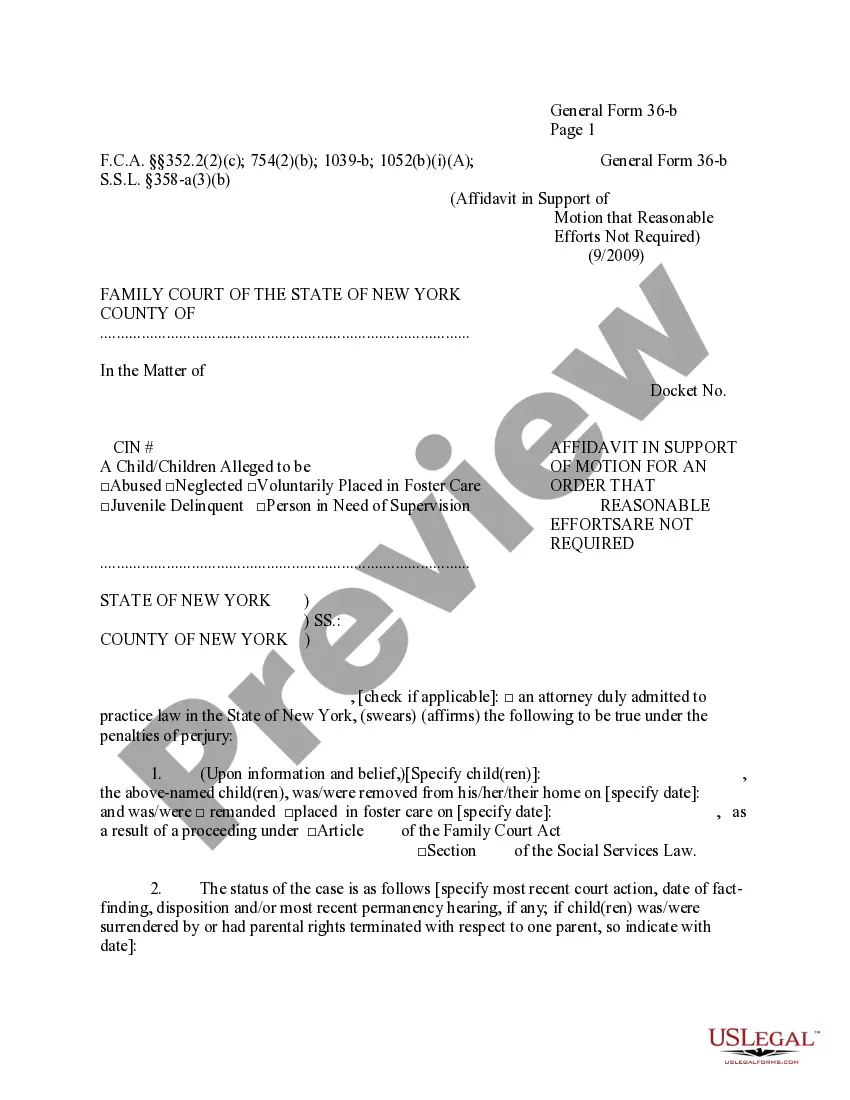

How to fill out Release And Indemnification Of Personal Representative By Heirs And Devisees?

Selecting the ideal approved document template can be challenging.

It's obvious that there are numerous designs accessible online, but how can you locate the approved form you require.

Utilize the US Legal Forms site. The service offers thousands of designs, including the Montana Release and Indemnification of Personal Representative by Heirs and Devisees, which you can employ for business and personal needs.

First, confirm that you have selected the appropriate form for your city/state.

- All of the forms are reviewed by specialists and comply with state and federal regulations.

- If you are already registered, Log In to your account and then click the Acquire button to download the Montana Release and Indemnification of Personal Representative by Heirs and Devisees.

- Use your account to review the legal forms you have previously purchased.

- Visit the My documents tab in your account to obtain another copy of the document you need.

- If you are a new US Legal Forms user, here are straightforward steps you can follow.

Form popularity

FAQ

The personal representative fee is $4,400. In proceedings conducted for the termination of joint tenancies, the compensation of the personal representative may not exceed two percent of the value that passes to the surviving joint tenants.

Probate timelines vary in Montana, depending on the size of the estate and if there are any disputes or other delays. In a small estate with no complications, it can be completed in as little as six months. Other probate cases will take up to a year.

There is normally a six-month period from the deceased's death for creditors to advise the executor of any sums due to them from the estate.

How Long Do You Have to File Probate After a Death in Montana? According to the Montana Uniform Probate Code, probate must be filed and closed within two years of the person's death. The exception to this rule is if the executor can show just cause why it hasn't been closed.

In informal, formal and supervised probate procedures, creditors must be given four months to submit claims for debts after the first publication of the notice in a local newspaper.

Attorney fees. Personal Representative compensation - Montana state law limits Executor fees at five percent (but it's common for compensation to be treated the same as reasonable compensations states do)

A personal representative is a person responsible for dealing with the estate (possessions, property, shares, bank accounts, etc) of a deceased person. A personal representative can also be known as an 'executor' or an 'administrator.

(1) A personal representative is entitled to reasonable compensation for services. The compensation may not exceed 3% of the first $40,000 of the value of the estate as reported for federal estate tax purposes and 2% of the value of the estate in excess of $40,000 as reported for federal estate tax purposes.