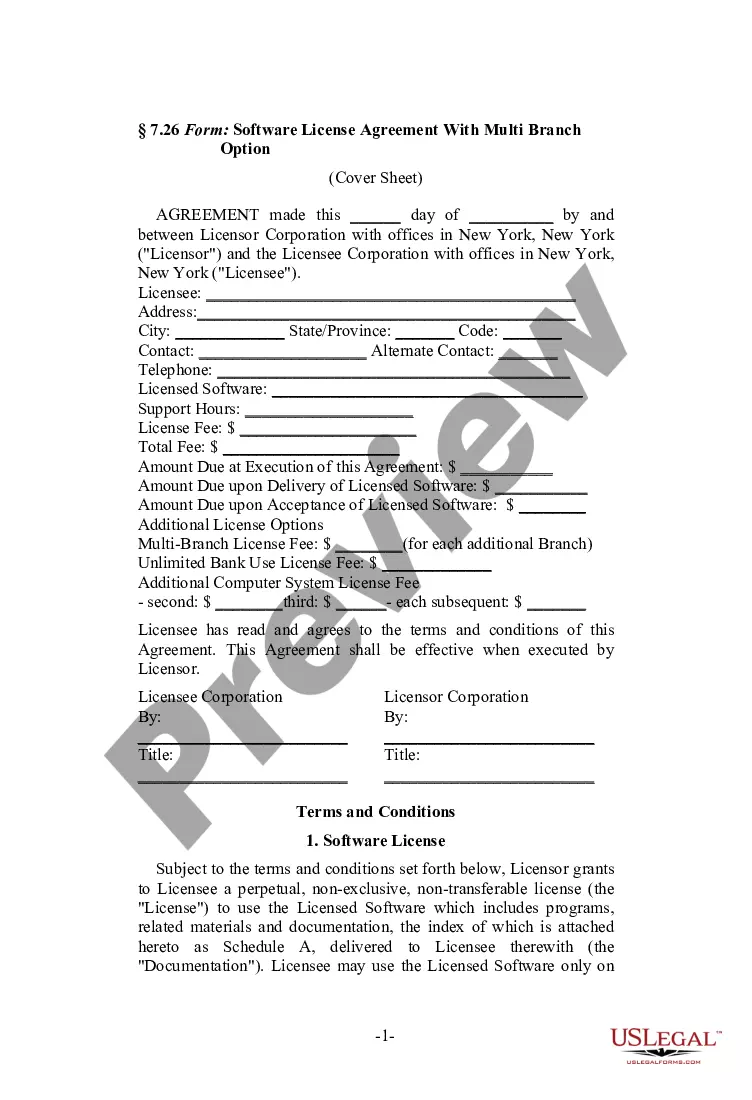

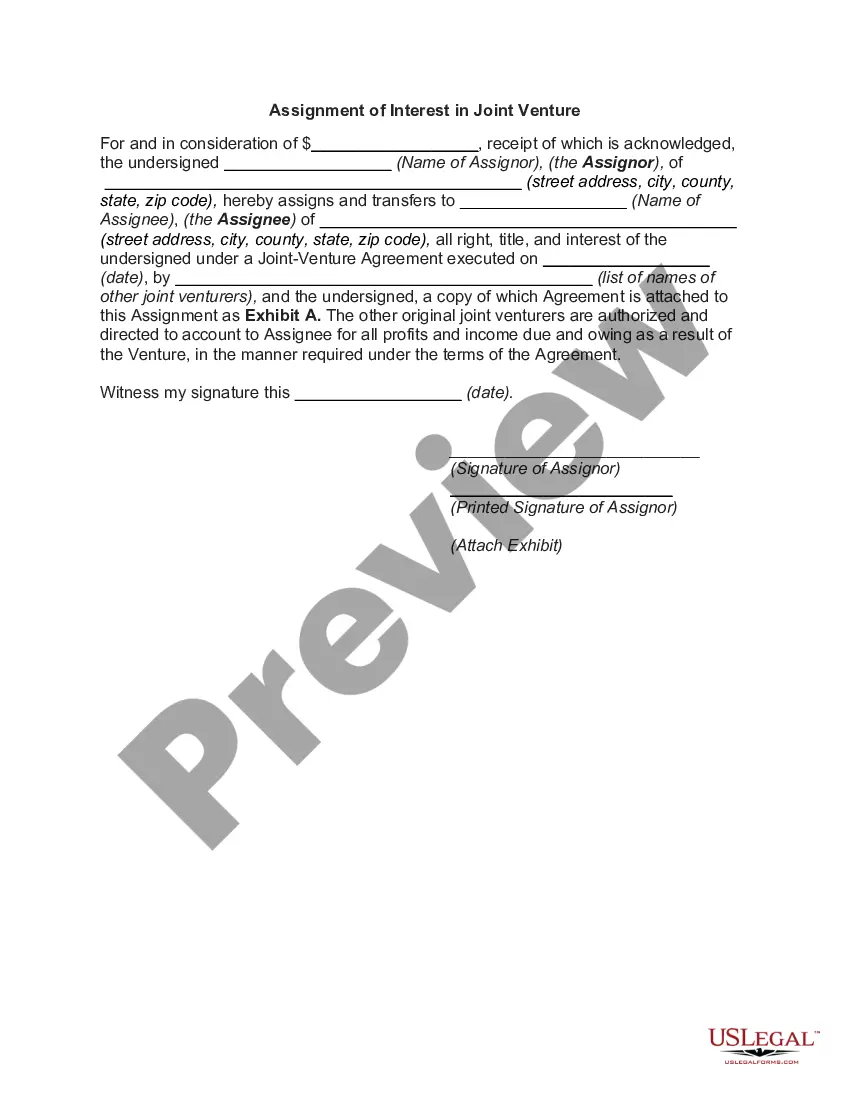

Montana Assignment of Interest in Joint Venture

Description

How to fill out Assignment Of Interest In Joint Venture?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

Through the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest templates of forms such as the Montana Assignment of Interest in Joint Venture in no time.

Read the form description to confirm that you have selected the appropriate document.

If the form does not meet your requirements, use the Search box at the top of the page to locate one that does.

- If you already have a subscription, Log In and download the Montana Assignment of Interest in Joint Venture from the US Legal Forms collection.

- The Download button will appear on every form you view.

- You can find all previously downloaded forms in the My documents section of your account.

- If you are a first-time user of US Legal Forms, here are simple steps to help you get started.

- Ensure that you have selected the correct form for your area/region.

- Click the Preview button to review the form's details.

Form popularity

FAQ

Proportional Consolidation Method of Joint Venture Accounting.

The investor's share of the joint venture's profits and losses are recorded within the income statement of the investor. Also, if the joint venture records changes in its other comprehensive income, the investor should record its share of these items within other comprehensive income, as well.

How to Account for Joint Ventures. The accounting for a joint venture depends upon the level of control exercised over the venture. If a significant amount of control is exercised, the equity method of accounting must be used.

Joint Venture Interest means an acquisition of or Investment in Equity Interests in another Person, held directly or indirectly by the MLP, that will not be a Subsidiary after giving effect to such acquisition or Investment.

The Equity MethodThe investor's share of the joint venture's profits and losses are recorded within the income statement of the investor. Also, if the joint venture records changes in its other comprehensive income, the investor should record its share of these items within other comprehensive income, as well.

In all other cases, instruments containing potential voting rights in an associate or a joint venture are accounted for in accordance with IPSAS 29. be classified as a non-current asset.

If consolidated accounts are prepared, joint ventures should be accounted for using the equity method. The FRS 102 SORP requires the net equity method, showing the net income or net expenditure under either 'income', if a net gain or 'expenditure', if a net loss (paragraph 29.13).

The equity method is a method of accounting whereby the investment is initially recognized at cost and adjusted thereafter for the post-acquisition change in the investor's share of the investee's net assets/equity of the associate or joint venture.

Accounting Rules Under the U.S. generally accepted accounting principles (GAAP), a firm's interest in a joint venture is accounted for using the equity method.