Montana Sample Letter to Client regarding Dissolution Finalized

Description

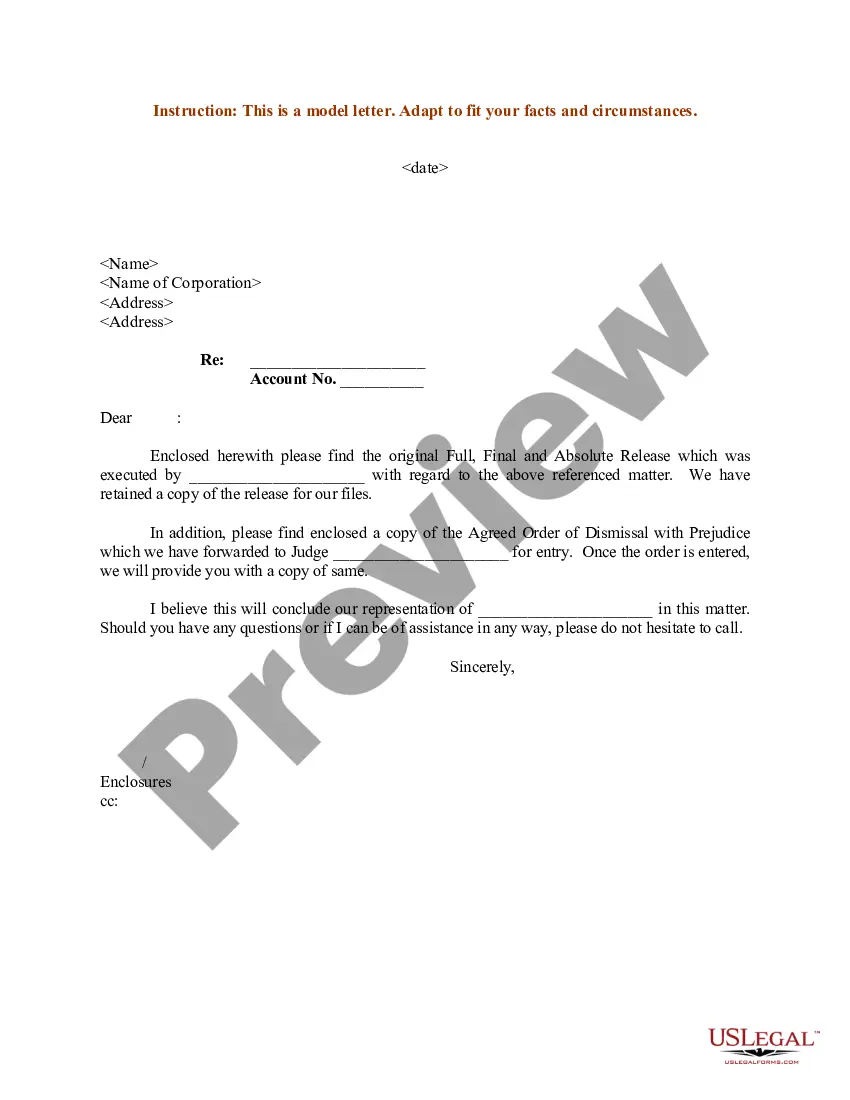

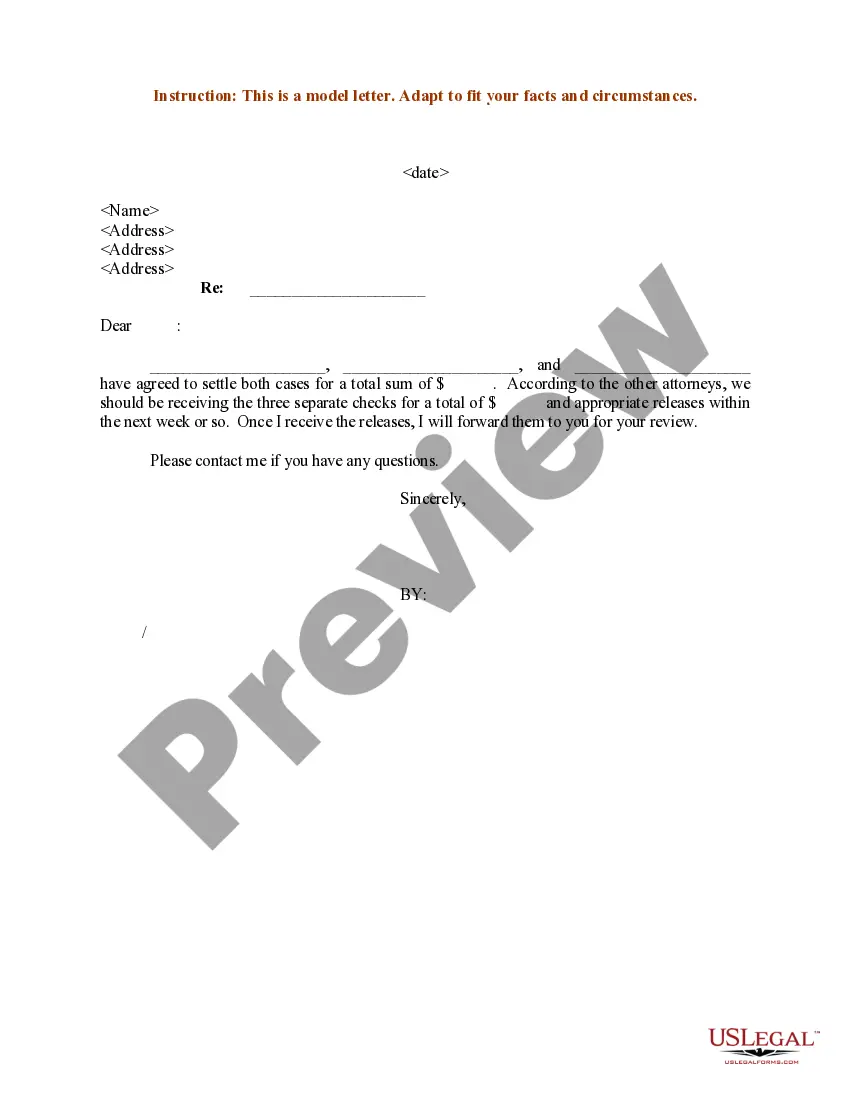

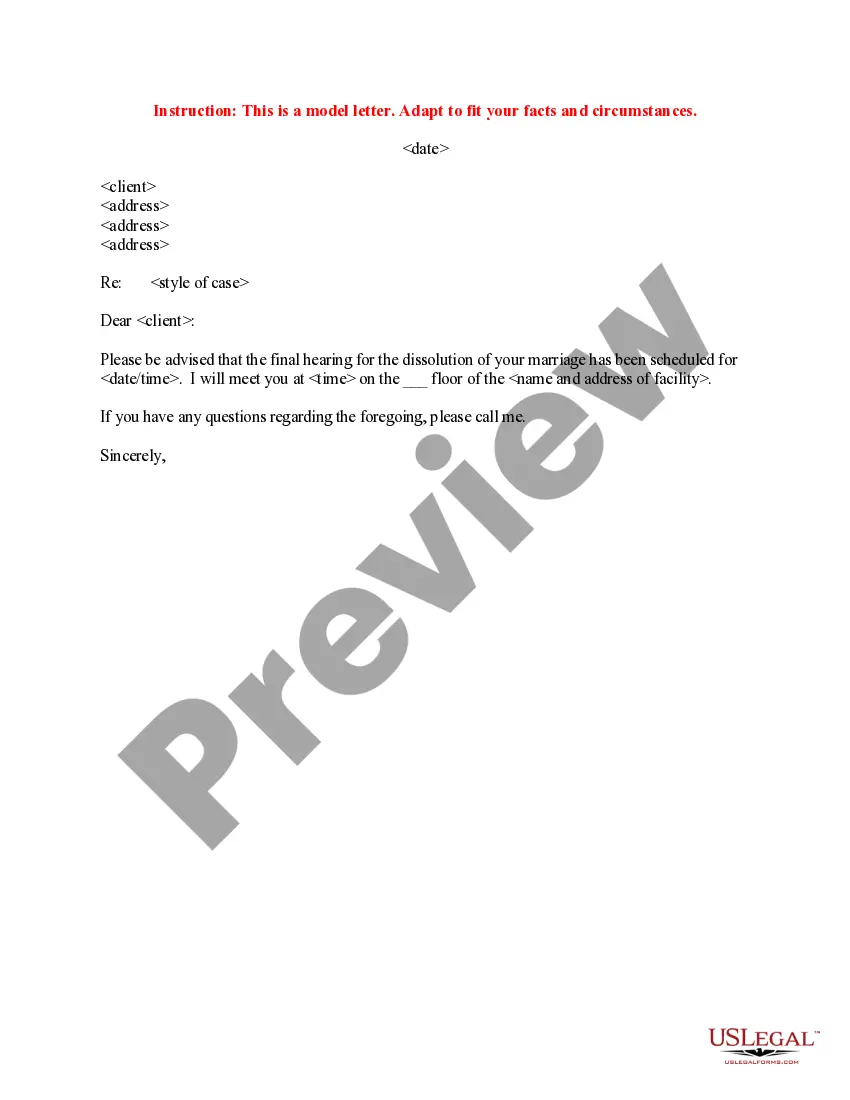

How to fill out Sample Letter To Client Regarding Dissolution Finalized?

US Legal Forms - one of many biggest libraries of authorized types in the United States - delivers a variety of authorized document themes you are able to down load or printing. Utilizing the web site, you may get thousands of types for company and person uses, sorted by types, claims, or search phrases.You will discover the newest variations of types such as the Montana Sample Letter to Client regarding Dissolution Finalized within minutes.

If you already have a registration, log in and down load Montana Sample Letter to Client regarding Dissolution Finalized through the US Legal Forms local library. The Download key will show up on every single develop you perspective. You gain access to all in the past downloaded types inside the My Forms tab of your own bank account.

If you want to use US Legal Forms for the first time, allow me to share easy guidelines to help you began:

- Make sure you have picked out the proper develop to your town/state. Select the Review key to examine the form`s articles. Read the develop explanation to ensure that you have selected the right develop.

- In the event the develop does not satisfy your specifications, make use of the Lookup field on top of the monitor to obtain the the one that does.

- If you are content with the form, confirm your choice by clicking the Acquire now key. Then, choose the costs plan you want and offer your accreditations to register to have an bank account.

- Method the purchase. Utilize your credit card or PayPal bank account to accomplish the purchase.

- Pick the structure and down load the form on the system.

- Make adjustments. Fill up, edit and printing and sign the downloaded Montana Sample Letter to Client regarding Dissolution Finalized.

Each and every web template you added to your bank account lacks an expiry particular date which is yours forever. So, if you wish to down load or printing an additional version, just proceed to the My Forms segment and click in the develop you require.

Obtain access to the Montana Sample Letter to Client regarding Dissolution Finalized with US Legal Forms, the most extensive local library of authorized document themes. Use thousands of skilled and condition-certain themes that fulfill your company or person demands and specifications.

Form popularity

FAQ

Dear [Client], We regret to inform you that we will no longer be needing your services effective by [Date]. We've decided to terminate our partnership with [Name of client/company] due to [reasons]. Our time together has been valuable, but now it's best we grow independently.

First, you need to be sure to include the legal name of your company. Second, your articles of dissolution should state the date when your company will be dissolved. Finally, there should be a statement that your corporation's board of directors or your LLC's members approved the dissolution.

This intent to dissolve should include the following information: A detailed description of the claim. Information regarding the claim, the amount of the claim, and whether it is admitted to or not. A mailing address where any claims can be sent. A deadline: This must be at least 120 days after the written notice date.

Although the content will vary, certain elements should be included in every letter of dissolution. These include: The name of the recipient and the name of the person sending the letter. The purpose of the letter, including the relationship to be terminated and the date of termination, stated in the first paragraph.

Firstly, start by addressing the recipient in a professional manner using their full name or company name. Be clear and concise about your intentions for writing the letter, stating that you intend to dissolve the partnership. Next, provide context for why you've made this decision.

Please be advised that the [corporation] [the partnership between (insert partner names)] [limited liability company between (insert member names)] known as (insert name of business), doing business at (insert address) will be dissolved by [shareholder and director resolution] [mutual consent of the partners] [[mutual ...