A nonprofit corporation is one that is organized for charitable or benevolent purposes. These corporations include certain hospitals, universities, churches, and other religious organizations. A nonprofit entity does not have to be a nonprofit corporation, however. Nonprofit corporations do not have shareholders, but have members or a perpetual board of directors or board of trustees.

Montana Articles of Incorporation for Church Corporation

Description

How to fill out Articles Of Incorporation For Church Corporation?

Are you currently situated in a location where you require documents for possibly business or personal reasons almost every day.

There are numerous legal document templates available online, but finding templates you can rely on isn't easy.

US Legal Forms offers thousands of form templates, such as the Montana Articles of Incorporation for Church Corporation, that are crafted to meet federal and state requirements.

If you find the right form, simply click Buy now.

Select the pricing plan you want, provide the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Montana Articles of Incorporation for Church Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

- Use the Review button to review the form.

- Check the summary to ensure that you have selected the correct form.

- If the form is not what you are seeking, use the Search field to locate the form that suits your needs and criteria.

Form popularity

FAQ

To amend your Montana Articles of Incorporation for Church Corporation, start by drafting the amendment document. This document should specify the changes you wish to make and include any required information according to state guidelines. Once completed, file the amendment with the Montana Secretary of State, along with the required fees. You can easily use the US Legal Forms platform to access templates and ensure compliance with state regulations for a smooth amendment process.

Individuals often choose to create LLCs in Montana for several reasons, including favorable tax treatment, privacy protection, and simplified maintenance requirements. The state offers a business-friendly environment, which is appealing to many entrepreneurs. Specifically, for Church Corporations, utilizing Montana Articles of Incorporation for Church Corporation can provide the legal framework needed to operate effectively while enjoying those benefits.

An LLC, or Limited Liability Company, is a business structure that provides personal liability protection to its owners, while Articles of Incorporation refer specifically to the legal document that creates a corporation. In essence, an LLC is a type of business entity, whereas Articles of Incorporation are crucial for establishing a corporation. If you are establishing a Church Corporation, you'll need to focus on the Montana Articles of Incorporation for Church Corporation to ensure legal compliance.

Montana does not require an operating agreement for LLCs, but having one is highly recommended. An operating agreement outlines the management structure and operating procedures of your LLC, which can prevent conflicts down the road. When forming a Church Corporation, considering the Montana Articles of Incorporation for Church Corporation along with an operating agreement can provide a clear blueprint for your organization.

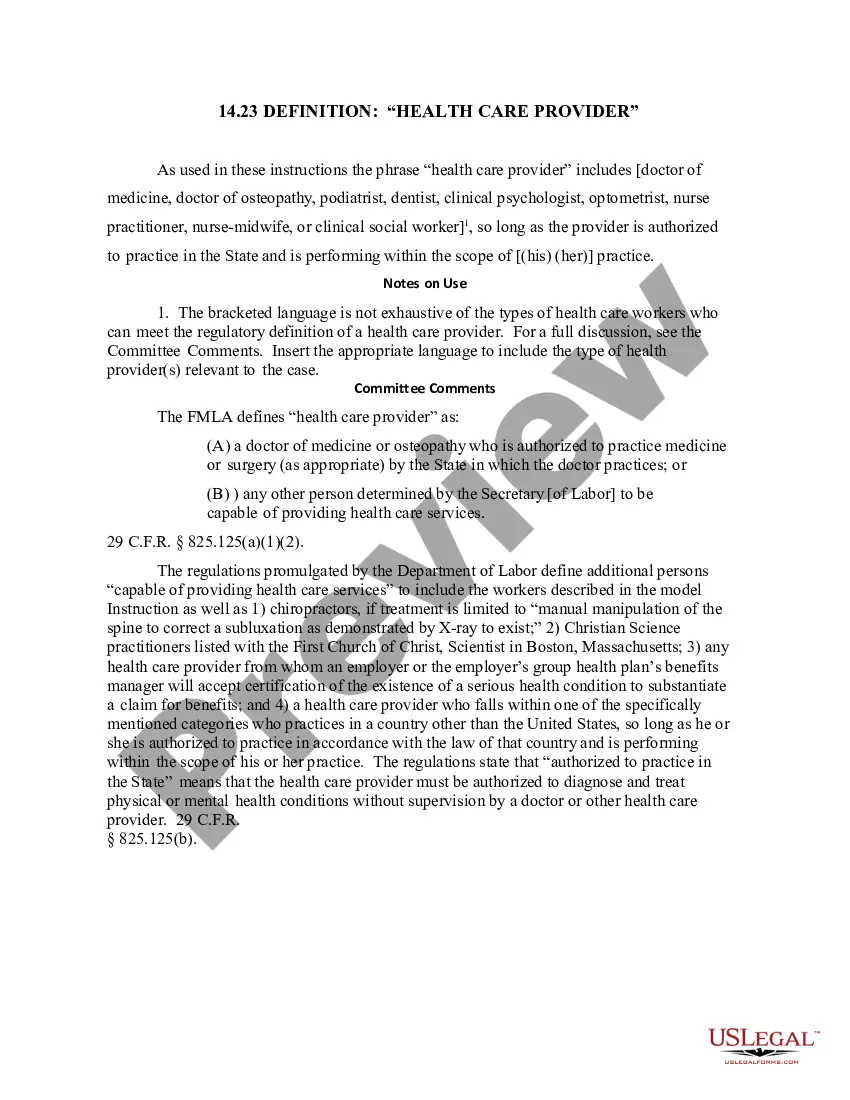

The articles of incorporation are legal documents that establish a corporation's existence in the eyes of the state. They typically include the organization’s name, purpose, registered agent, and duration. For a Church Corporation, the Montana Articles of Incorporation for Church Corporation serve as a foundational document that outlines your organization’s mission and operational framework.

In Montana, a business license is generally not required at the state level, but local governments may have their own requirements. It is crucial to check with your city or county to ensure compliance. For those forming a Church Corporation, understanding the local regulations surrounding Montana Articles of Incorporation for Church Corporation is essential to avoid any potential issues.

Writing articles of incorporation for a non-profit requires clarity and adherence to legal requirements. Start with the name of the organization, followed by stating its purpose, registered agent information, and the structure of the board. Consider using uslegalforms for templates and guidance to ensure your Montana Articles of Incorporation for Church Corporation are properly drafted and filed.

An effective purpose statement in the articles of incorporation should clearly define the mission of your church corporation. For instance, it might state, 'This church corporation exists to promote community worship, provide religious education, and support outreach programs.' Such clarity ensures compliance with Montana laws and helps in applying for 501(c)(3) status.

A certificate of incorporation serves as official proof of your non-profit organization’s legal existence. This document outlines your non-profit’s name, purpose, and other key details as required under Montana law. Essentially, it is the formal recognition of your Montana Articles of Incorporation for Church Corporation, granting you certain legal rights and responsibilities.

Writing articles of incorporation for a non-profit involves several key components. Begin with the name of your church corporation, followed by its purpose, which must relate to charitable, educational, or religious activities. Additionally, include details about the office address, registered agent, and the management structure, ensuring your document complies with Montana laws for church corporations.