Montana Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

Selecting the appropriate legal document format can be challenging.

Of course, there are numerous templates accessible online, but how do you locate the legal document you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Montana Promissory Note with Payments Amortized for a Specific Number of Years, which you can employ for both business and personal purposes. All the forms are verified by experts and comply with state and federal regulations.

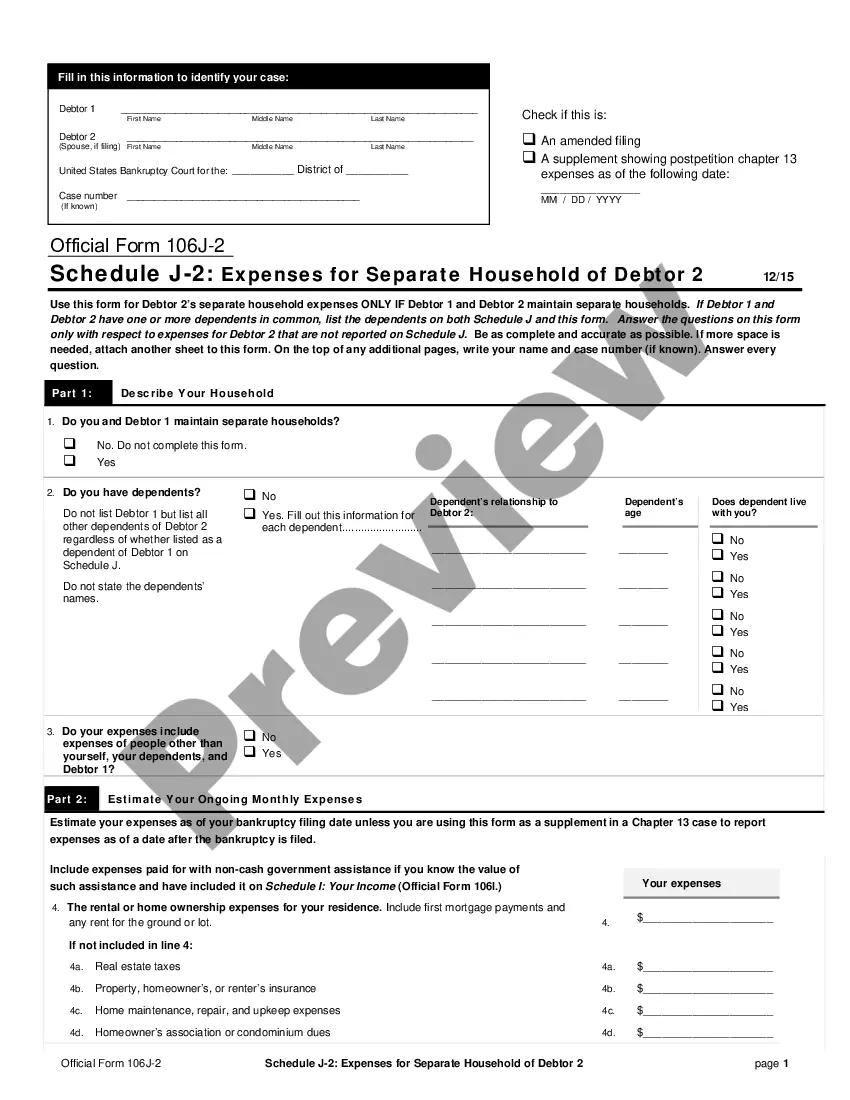

Once you are confident that the form is suitable, click on the Buy now button to purchase the form. Choose your pricing plan and provide the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the document format and download the legal document design to your device. Finally, review, print, and sign the received Montana Promissory Note with Payments Amortized for a Specific Number of Years. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Use the service to obtain professionally crafted documents that adhere to state requirements.

- If you are already registered, Log In to your account and click the Acquire button to locate the Montana Promissory Note with Payments Amortized for a Specific Number of Years.

- Use your account to review the legal forms you may have previously purchased.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, make sure you have selected the appropriate form for your locality. You can preview the form using the Preview option and review the form details to ensure it suits your needs.

- If the form does not meet your expectations, use the Search area to find the correct form.

Form popularity

FAQ

To calculate the monthly payment for a Montana Promissory Note with Payments Amortized for a Certain Number of Years, you can use the formula for amortization. This involves taking the principal amount, the annual interest rate, and the number of payment periods into account. Once you have these figures, you can determine the fixed monthly payment over the entire term of the note. If you prefer a straightforward approach, consider using the resources available on the uslegalforms platform to help simplify this process.

Examples of promissory notes include personal loans, student loans, and business loans. Each type may have different terms, but a Montana Promissory Note with Payments Amortized for a Certain Number of Years is a common example for structured repayment. Reviewing examples can help you understand how to draft your own note effectively.

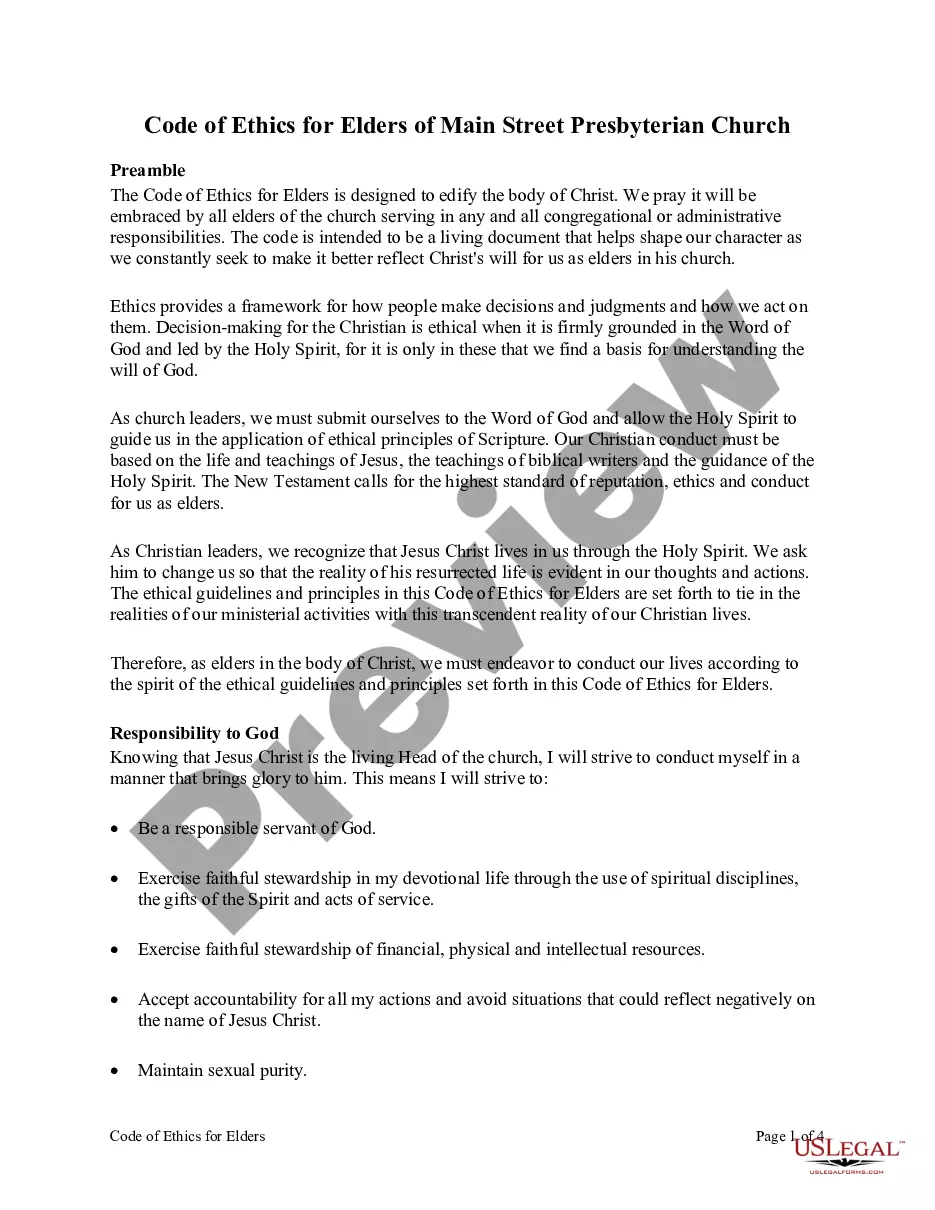

A promissory note typically includes the title, date, amount, interest rate, repayment schedule, and signature lines. For a Montana Promissory Note with Payments Amortized for a Certain Number of Years, it’s essential to be clear and concise in each section. Following a structured format ensures that all critical information is captured, and uslegalforms can provide valuable templates to guide you.

The duration of a promissory note can vary significantly, depending on the agreement between the parties. Typically, a Montana Promissory Note with Payments Amortized for a Certain Number of Years can last anywhere from a few months to several years. It's important to clarify the term within the note to avoid any confusion later on.

To write a simple promissory note, clearly state the names of the borrower and lender, the amount loaned, and the repayment terms. For a Montana Promissory Note with Payments Amortized for a Certain Number of Years, specify the duration of payments and the interest rate. Utilizing templates from uslegalforms can streamline this process and ensure you include all necessary elements.

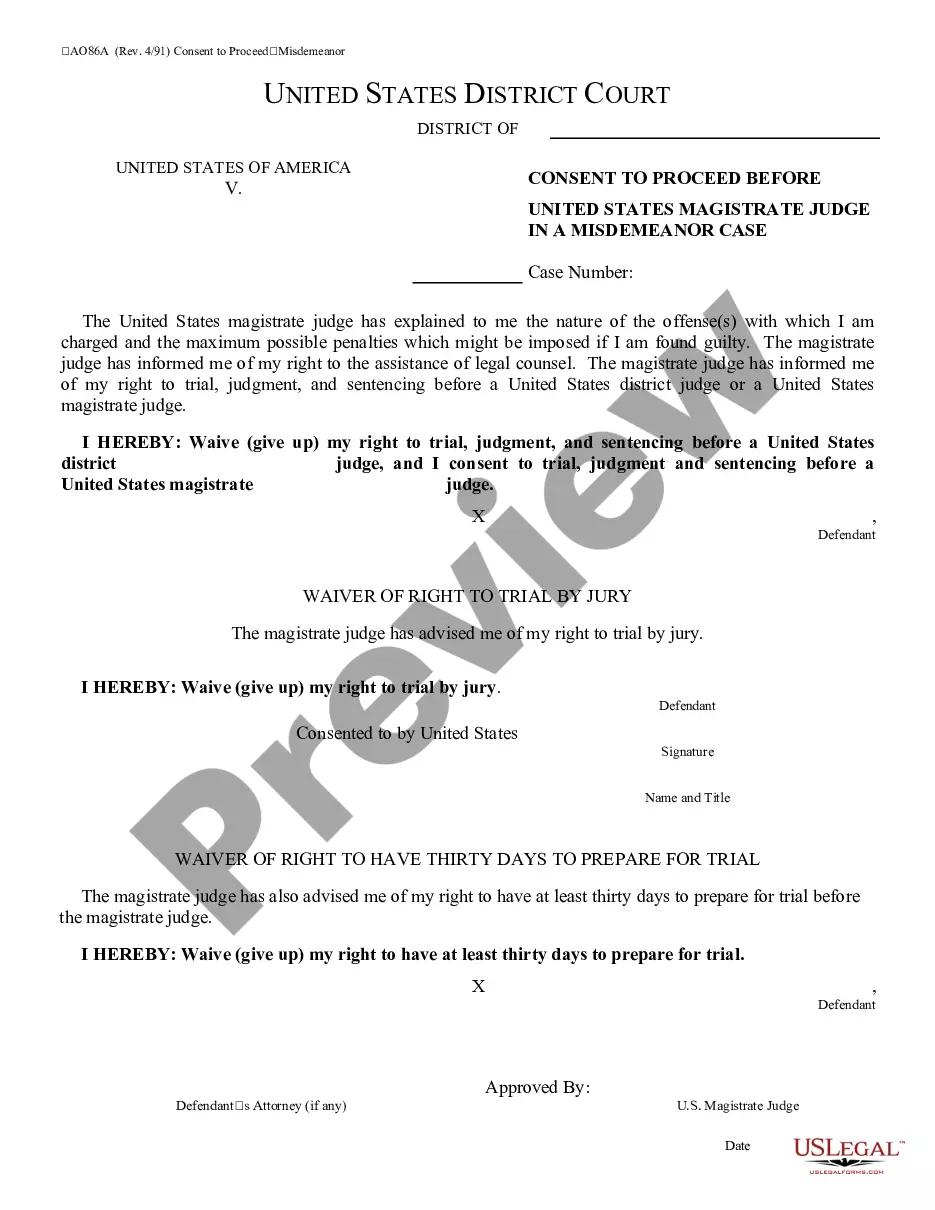

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

In general, promissory notes are used for more informal relationships than loan agreements. A promissory note can be used for friend and family loans, or short-term, small loans. Loan agreements, on the other hand, are used for everything from vehicles to mortgages to new business ventures.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.