Montana Sample Letter for Assets and Liabilities of Decedent's Estate

Description

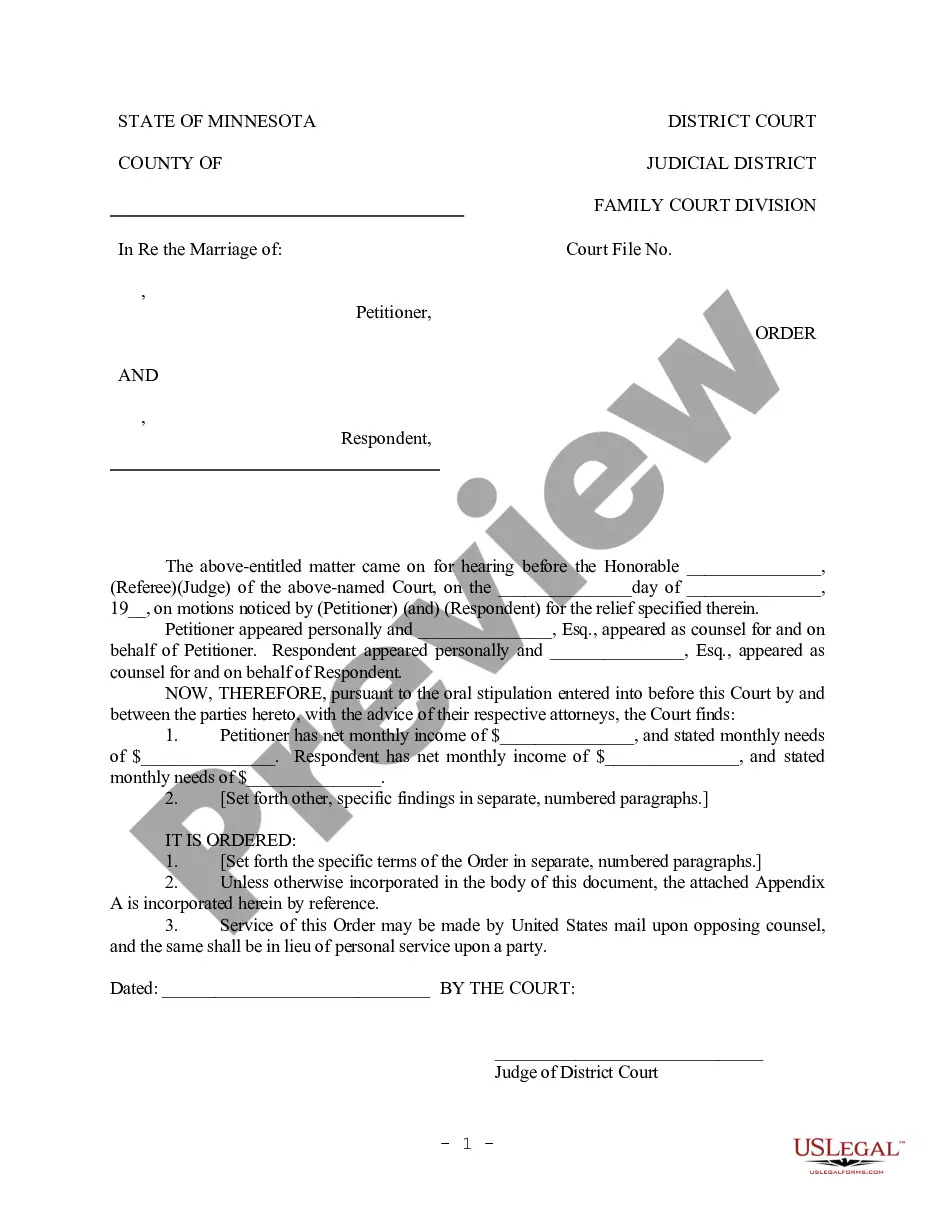

How to fill out Sample Letter For Assets And Liabilities Of Decedent's Estate?

US Legal Forms - one of many largest libraries of lawful kinds in the USA - provides an array of lawful document templates you are able to down load or printing. Making use of the internet site, you can get a huge number of kinds for enterprise and specific reasons, categorized by types, states, or keywords.You will discover the most up-to-date models of kinds such as the Montana Sample Letter for Assets and Liabilities of Decedent's Estate in seconds.

If you already have a subscription, log in and down load Montana Sample Letter for Assets and Liabilities of Decedent's Estate from your US Legal Forms local library. The Download key will show up on each form you see. You have access to all previously acquired kinds inside the My Forms tab of your own accounts.

If you want to use US Legal Forms initially, here are simple recommendations to help you started off:

- Be sure to have chosen the correct form for your personal city/county. Click on the Review key to review the form`s content material. Look at the form outline to ensure that you have chosen the right form.

- In the event the form does not suit your specifications, take advantage of the Search industry on top of the screen to get the one who does.

- In case you are content with the form, validate your decision by clicking the Buy now key. Then, pick the pricing strategy you prefer and give your references to register for an accounts.

- Method the transaction. Make use of bank card or PayPal accounts to accomplish the transaction.

- Choose the formatting and down load the form on the gadget.

- Make adjustments. Fill out, modify and printing and indicator the acquired Montana Sample Letter for Assets and Liabilities of Decedent's Estate.

Every single format you put into your bank account lacks an expiration particular date which is your own eternally. So, if you want to down load or printing yet another version, just go to the My Forms segment and then click around the form you need.

Get access to the Montana Sample Letter for Assets and Liabilities of Decedent's Estate with US Legal Forms, by far the most considerable local library of lawful document templates. Use a huge number of professional and status-specific templates that fulfill your company or specific demands and specifications.

Form popularity

FAQ

10 tips to avoid probate Give away property. Establish joint ownership for real estate. Joint ownership for other property. Pay-on-death financial accounts. Transfer-on-death securities. Transfer on death for motor vehicles. Transfer on death for real estate. Living trusts.

One of the most common ways to avoid probate is to create a living trust. Through a living trust, the person writing the trust (grantor) must "fund the trust" by putting the assets they choose into it. The grantor retains control over the trust's property until their death or incapacitation.

Here are some things to consider when drafting a letter to your executor or trustee. Your thoughts about wealth. Share your story about how you came to the assets that you are leaving in your will. How was your wealth created, what do you value and what are your long-term goals for your wealth?

Under Montana's probate laws, you can distribute certain types of property and assets without a probate court's approval. They include: Accounts with a named beneficiary, such as life insurance policies and retirement funds. Assets and property that is held in a living trust.

Formal Proceeding ? Formal probate may be necessary when no will exists, when the validity of a will may be questioned, or when parties disagree about the appointment of a personal representative or distribution of the assets.

Under Montana statute, where as estate is valued at less than $50,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to to demand payment on any debts owed to the decedent. Montana Requirements: Montana requirements are set forth in the statutes below.

An estate skips probate in Montana if it's less than $50,000. Avoiding the probate process could be beneficial for an estate's heirs, as the probate process in Montana can be long and expensive.