This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Notice of Non-Responsibility of Wife for Debts or Liabilities

Description

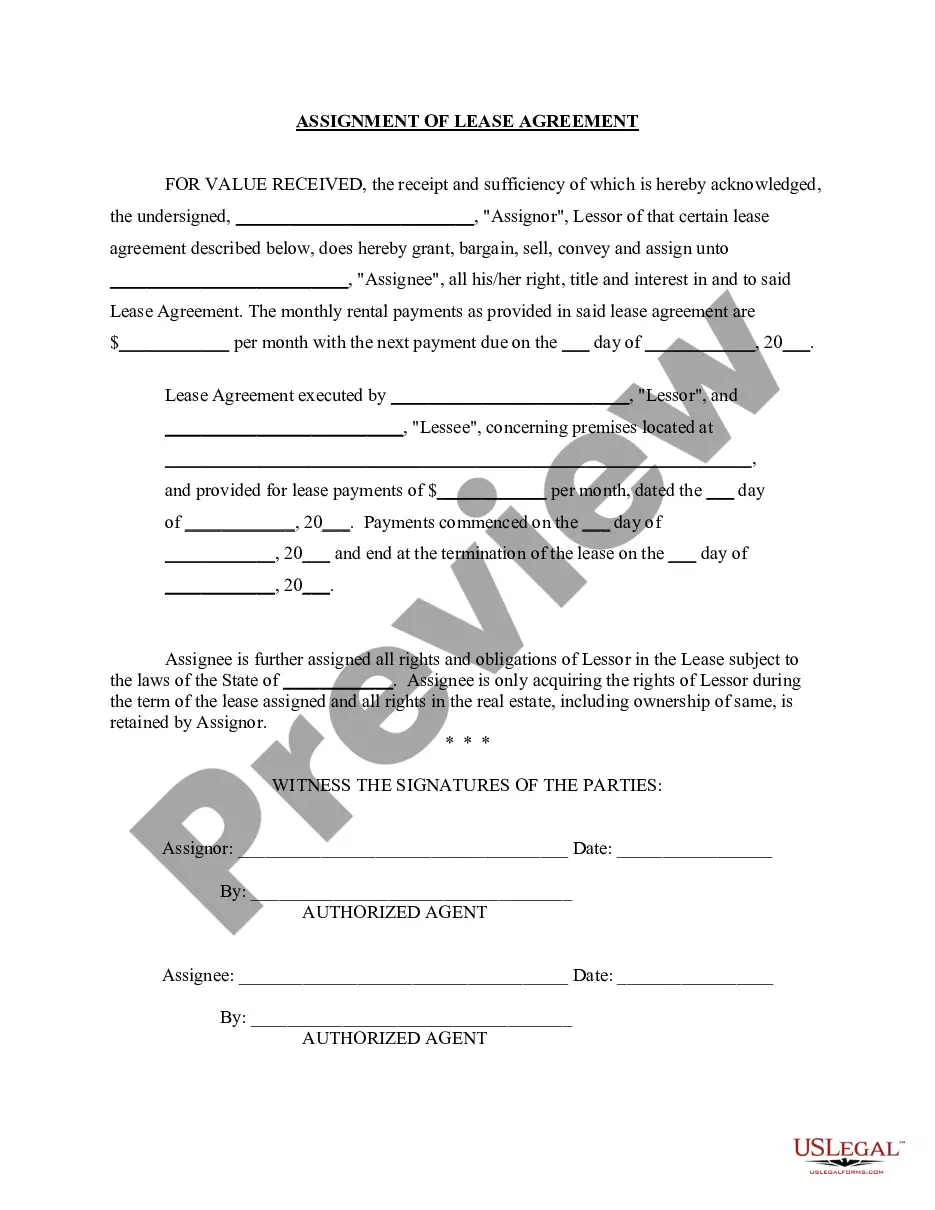

How to fill out Notice Of Non-Responsibility Of Wife For Debts Or Liabilities?

US Legal Forms - one of the most extensive compilations of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of templates for commercial and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of documents such as the Montana Notice of Non-Responsibility of Wife for Debts or Liabilities in just seconds.

If you are already a member, Log In to download the Montana Notice of Non-Responsibility of Wife for Debts or Liabilities from the US Legal Forms library. The Download button will appear for every document you view. You have access to all previously downloaded documents in the My documents section of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the purchase.

Select the format and download the document to your device. Edit it as needed. Fill out, modify, print, and sign the downloaded Montana Notice of Non-Responsibility of Wife for Debts or Liabilities. Each document added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Montana Notice of Non-Responsibility of Wife for Debts or Liabilities through US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct document for your area/region.

- Click on the Preview button to review the document’s content.

- Read the document description to confirm you have selected the right one.

- If the document doesn’t meet your needs, use the Search box at the top of the screen to find one that does.

- Once satisfied with the document, confirm your choice by clicking the Get now button.

- Then, select the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

Your liability for your spouse's IRS debt depends on the filing status you chose during the tax year. If you filed jointly, you might share responsibility for the liabilities incurred. Knowing the implications of the Montana Notice of Non-Responsibility of Wife for Debts or Liabilities empowers you with information on your rights. Consulting a tax professional can provide clarity on your individual situation.

Yes, a wife can be held responsible for her husband's tax debt if they filed jointly. However, if a wife can demonstrate she qualifies for innocent spouse relief, she may escape liability. Leveraging the Montana Notice of Non-Responsibility of Wife for Debts or Liabilities is essential in this assessment. Professional guidance can be critical in navigating this complex area.

The IRS typically cannot pursue your wife for your tax debt if she did not sign the tax return. In cases of joint filing, however, both spouses may be held accountable. Understanding the Montana Notice of Non-Responsibility of Wife for Debts or Liabilities can help clarify these responsibilities. Legal resources can provide further information on what steps to take.

Yes, the IRS can garnish your wages if your husband owes taxes, especially if you filed jointly. However, your rights may protect you if you can prove you are a non-liable spouse. The Montana Notice of Non-Responsibility of Wife for Debts or Liabilities is significant here as it illustrates your protections. Seeking legal advice can empower you to take the right actions if faced with wage garnishment.

The four types of innocent spouse relief include Innocent Spouse Relief, Separation of Liability Relief, Equitable Relief, and Allocation of Tax Liability. Each type addresses different scenarios regarding tax liabilities arising from a joint return. It's beneficial to understand how the Montana Notice of Non-Responsibility of Wife for Debts or Liabilities applies to these options. Utilizing platforms like USLegalForms can simplify this understanding.

liable spouse is a partner who is not financially responsible for the tax debts acquired during the marriage. This designation often applies when a spouse can prove that they should not be held accountable for the other spouse's actions. Familiarity with the Montana Notice of NonResponsibility of Wife for Debts or Liabilities assists in understanding one's rights. Legal assistance can guide you in establishing this status.

Generally, a wife is not responsible for her husband’s tax debt after his death if she did not jointly file the tax return. When the couple filed jointly, the responsibility may shift to the surviving spouse. Therefore, knowing the implications of the Montana Notice of Non-Responsibility of Wife for Debts or Liabilities can be vital. Consulting legal resources can help clarify individual situations effectively.

To seek innocent spouse relief, the taxpayer must submit Form 8857, Request for Innocent Spouse Relief. This form initiates the request to the IRS for relief from tax liabilities incurred by a spouse during the marriage. It is crucial to file this form within two years after the IRS begins collection actions. You can reference resources on the Montana Notice of Non-Responsibility of Wife for Debts or Liabilities for guidance during this process.

liable spouse is an individual who is not responsible for debts taken on by their partner. This term often comes into play when discussing a Montana Notice of NonResponsibility of Wife for Debts or Liabilities. By identifying yourself as a nonliable spouse, you can effectively protect your assets from your partner's debts. Understanding this distinction is vital for maintaining financial security in any marital situation.

In Montana, a wife is entitled to equitable distribution of marital property during a divorce. This process considers various factors, including contributions to the marriage and the interests of both parties. If a Montana Notice of Non-Responsibility of Wife for Debts or Liabilities is established, it can also influence the division concerning liabilities. Being informed about your entitlements can help you navigate the divorce process with confidence.