Montana Invoice of Handyman

Description

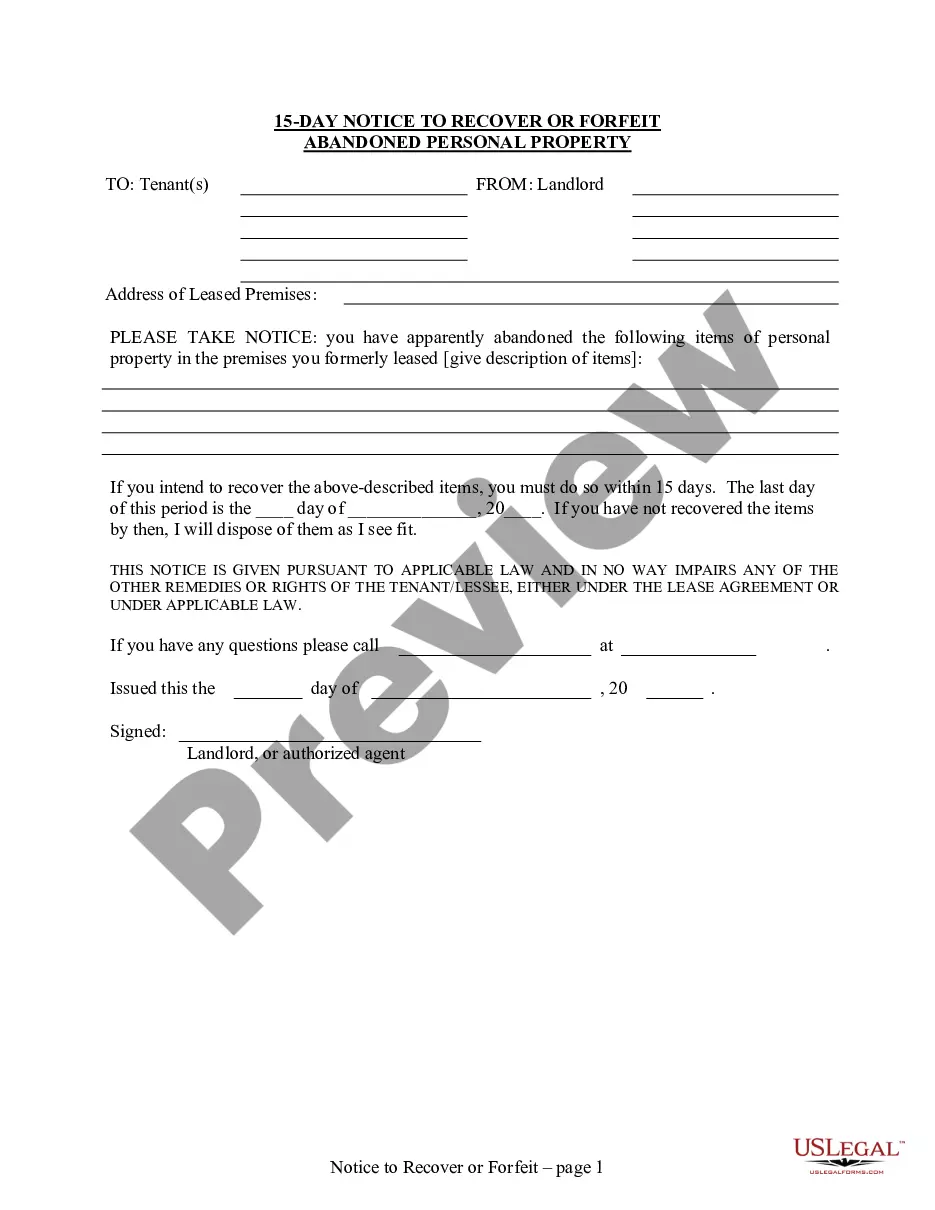

How to fill out Invoice Of Handyman?

You may allocate time online trying to locate the legal document template that fulfills the state and federal requirements you desire.

US Legal Forms offers thousands of legal documents that are evaluated by experts.

You can obtain or print the Montana Invoice of Handyman from their service.

If available, utilize the Preview button to review the document template as well. To find another version of your form, employ the Search field to locate the template that meets your needs and requirements.

- If you possess a US Legal Forms account, you can Log In and hit the Download button.

- Then, you can complete, modify, print, or sign the Montana Invoice of Handyman.

- Every legal document template you acquire is yours permanently.

- To access another version of the purchased form, go to the My documents tab and click on the relevant button.

- If this is your first time using the US Legal Forms site, follow the straightforward instructions below.

- First, ensure you have picked the correct document template for the state/city of your choice.

- Review the form details to guarantee that you have selected the proper template.

Form popularity

FAQ

Self-employed contractors in Montana are responsible for paying both income tax and self-employment tax, which covers Social Security and Medicare contributions. It is crucial to set aside a portion of your income for tax purposes since you do not have an employer withholding these amounts. By using a Montana Invoice of Handyman, you can better manage your earnings and plan for your tax obligations effectively.

In Montana, the threshold for issuing a 1099 form is generally set at $600 for services provided by independent contractors. If your handyman services earn this amount or more from a client, they are required to report that income to the IRS using a 1099 form. Keeping track of your income effortlessly can be managed through a Montana Invoice of Handyman, ensuring you meet reporting deadlines without hassle.

The taxable amount of gross receipts is the income that you must report to the state and local governments when filing taxes. In Montana, certain deductions may apply, but generally, your gross receipts minus any eligible deductions equal your taxable amount. Tracking this accurately is essential for compliance and minimizing tax liability. A Montana Invoice of Handyman can help you segregate taxable income effectively.

Writing an invoice for handyman services involves detailing the services you offered and setting clear payment expectations. Start with your business information and include the client’s name and address. Break down the costs for each service, and do not forget to specify the total amount due and any payment terms. A well-structured Montana Invoice of Handyman can make this task easier for you, ensuring professionalism and clarity.

Filling out a contractor's invoice requires clarity and precision. Begin with your name and contact details, followed by the client’s information. Clearly outline the services you provided, accompanied by itemized costs and any applicable taxes. Utilizing a Montana Invoice of Handyman from platforms like uslegalforms can help you create an organized and professional invoice.

To fill out a service invoice, start by including your business name and contact information at the top. Next, specify the client's details and provide a clear description of the services rendered along with the associated costs. It is important to list payment terms and due dates to ensure both parties are aligned. For your handyman services in Montana, consider using a Montana Invoice of Handyman to streamline this process.

Not all contractors in Montana need a specific license, but it's essential to check the requirements for your type of work. Handyman services often fall under exceptions, but larger contractors must obtain licenses, especially for specialty trades. Whether licensed or not, utilizing a Montana Invoice of Handyman is an excellent way to maintain financial records and present a professional image to your clients.

In Montana, a handyman can perform a variety of tasks without needing a license, including basic repair work and maintenance services. However, certain jobs, like electrical or plumbing work, typically require a licensed professional. If you're operating as a handyman without a license, using a Montana Invoice of Handyman can help you professionally manage your payments and keep everything organized.

Montana imposes a gross receipts tax on contractors, which applies to the total income from services provided. Currently, this tax rate is 3% for contractors without a physical presence in the state. When billing your clients, you can utilize a Montana Invoice of Handyman, which allows you to calculate and itemize these taxes efficiently.

To become an independent contractor in Montana, you should register your business, obtain the necessary licenses, and make sure to follow tax regulations. Some handyman services may not require specific licensing, but knowing local laws is crucial. Using a Montana Invoice of Handyman will also help you keep track of transactions and provide professional documentation for your clients.