Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

Montana Revocable Trust Agreement with Husband and Wife as Trustors and Income to

Description

How to fill out Revocable Trust Agreement With Husband And Wife As Trustors And Income To?

You can devote multiple hours online trying to discover the valid document format that complies with the federal and state requirements you require.

US Legal Forms provides a vast array of authorized forms that have been reviewed by professionals.

You can download or print the Montana Revocable Trust Agreement with Husband and Wife as Trustors and Income from the services.

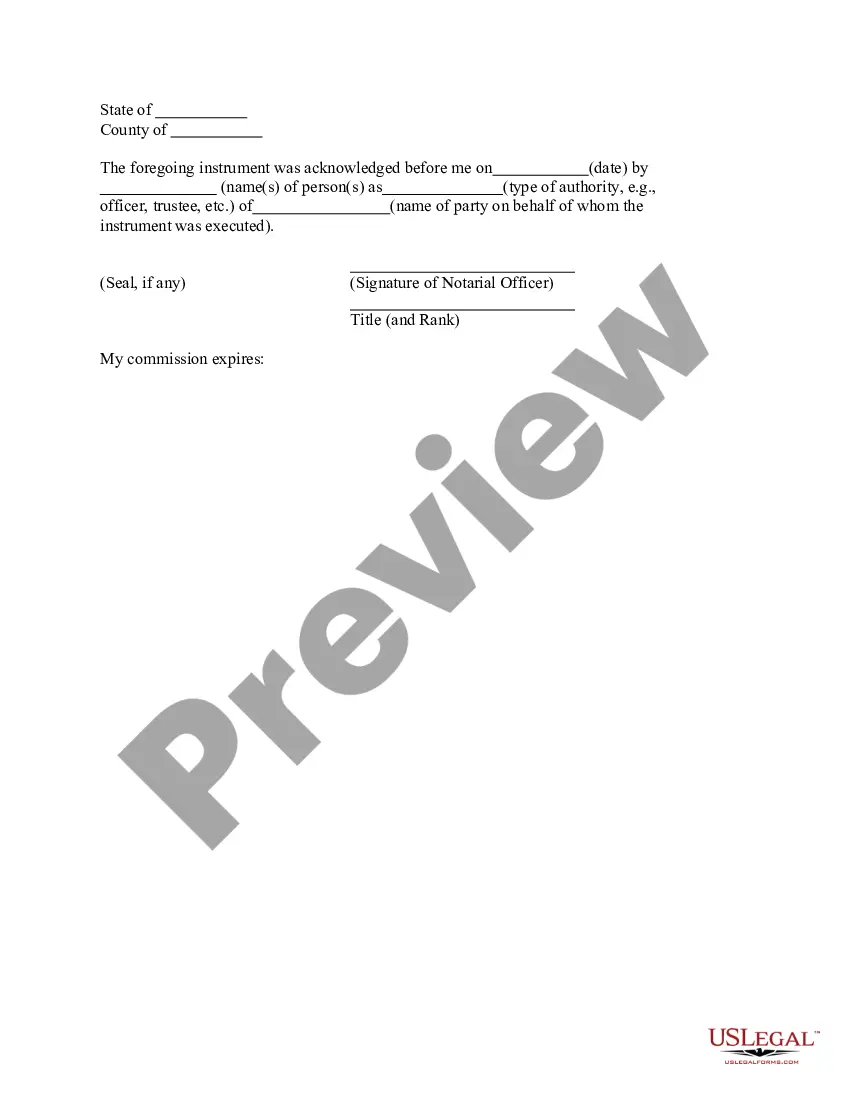

If available, utilize the Preview option to view the document format as well. To find another version of the form, use the Search field to locate the format that meets your needs and specifications.

- If you already possess a US Legal Forms account, you may Log In and then click the Acquire option.

- Then, you can complete, amend, print, or sign the Montana Revocable Trust Agreement with Husband and Wife as Trustors and Income.

- Every legal document format you acquire is yours permanently.

- To obtain another copy of the purchased form, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the easy instructions below.

- First, ensure that you have selected the correct document format for the state/city you choose.

- Review the form description to ensure you have selected the appropriate form.

Form popularity

FAQ

While joint revocable trusts offer many benefits, they can also present certain challenges. For instance, a Montana Revocable Trust Agreement with Husband and Wife as Trustors and Income to might lead to complications if one spouse passes away or if there are disagreements about asset management. Additionally, both spouses may need consent for actions related to the trust, potentially slowing down decision-making. It’s essential to weigh these factors and discuss them with legal and financial advisors.

Yes, a married couple can certainly establish a revocable trust together. A Montana Revocable Trust Agreement with Husband and Wife as Trustors and Income to is a popular choice for couples looking to manage their joint assets. This type of trust allows both partners to retain control and make decisions together while facilitating the transfer of assets upon one partner’s passing. Creating such a trust can enhance estate planning and simplify asset distribution.

The income from a revocable trust is reported by the trustors, who are the individuals who created the trust. In a Montana Revocable Trust Agreement with Husband and Wife as Trustors and Income to, both spouses should include their share of trust income on their individual returns. This means that each spouse takes responsibility for reporting the income effectively and accurately to the IRS. Regular communication with a tax expert can help clarify the reporting process.

A joint revocable trust is generally taxed in the same manner as individual revocable trusts. In the case of a Montana Revocable Trust Agreement with Husband and Wife as Trustors and Income to, both spouses report the income on their individual tax returns. Because the trust is revocable, it is treated as transparent for tax purposes, simplifying reporting and compliance. However, seek guidance from a tax advisor for specific situations.

Income from a revocable trust is reported on the personal tax returns of the trustors. For a Montana Revocable Trust Agreement with Husband and Wife as Trustors and Income to, each spouse must include their appropriate share of the income in their total taxable income for the year. This approach simplifies tax reporting as the trust does not stand alone for tax purposes. Consult a tax professional to ensure accuracy in reporting.

No, revocable trusts typically do not file separate tax returns. Income generated from a Montana Revocable Trust Agreement with Husband and Wife as Trustors and Income to is reported directly on the individual tax returns of the trustors. Since the trust is revocable, the IRS treats it as a pass-through entity for tax purposes. Therefore, each spouse reports their share of the income individually.

Yes, two people can own a revocable trust, and the Montana Revocable Trust Agreement with Husband and Wife as Trustors and Income to perfectly illustrates this. In this case, both partners typically act as co-trustors and co-trustees, giving them equal control over the trust’s assets and decision-making. This shared ownership promotes collaboration in managing their estate and aligning their goals. For those looking to create such a trust, platforms like uslegalforms can guide you through the necessary steps.

For a married couple, a trust, such as the Montana Revocable Trust Agreement with Husband and Wife as Trustors and Income to, functions as a shared management tool for assets. The couple, as trustors, designate themselves as administrators, empowering them to control the trust's assets during their lifetime. Upon the passing of one partner, the assets seamlessly transfer to the surviving spouse, often without court intervention. This arrangement enhances the couple's estate management and strengthens their financial legacy.

The joint revocable trust offers several advantages, especially for the Montana Revocable Trust Agreement with Husband and Wife as Trustors and Income to. It allows both spouses to manage assets together while providing a unified strategy for estate planning. This arrangement can streamline the distribution of assets upon death, potentially avoiding probate. Additionally, it fosters transparency and collaboration between partners regarding their financial planning.

While it may seem beneficial, married couples typically do not need separate revocable trusts. A Montana Revocable Trust Agreement with Husband and Wife as Trustors and Income to works effectively for joint asset management. This arrangement simplifies administration and provides clarity on asset distribution. However, if there are unique circumstances, consulting a legal professional can provide tailored guidance.