An A-B trust is a revocable living trust which divides into two trusts upon the death of the first spouse. This type of trust makes use of both the estate tax exemption ($3.5 million per person in 2009) and the marital deduction to make it so that no estate taxes are due upon the death of the first spouse. The B Trust is also known as the Bypass trust and it contains the amount of that years applicable exclusion amount. The A trust is the marital deduction trust which will typically contain both the surviving spouse's separate property and one half community property interests but also the residue of the deceased spouse's estate after the estate tax exemption has been utilized by the B trust. The use of an A-B trust ensures that both spouse's applicable exclusion amounts are effectively used, thereby doubling the amount of property which can pass to heirs free of Federal Estate Taxes.

Montana Marital Deduction Trust - Trust A and Bypass Trust B

Description

How to fill out Marital Deduction Trust - Trust A And Bypass Trust B?

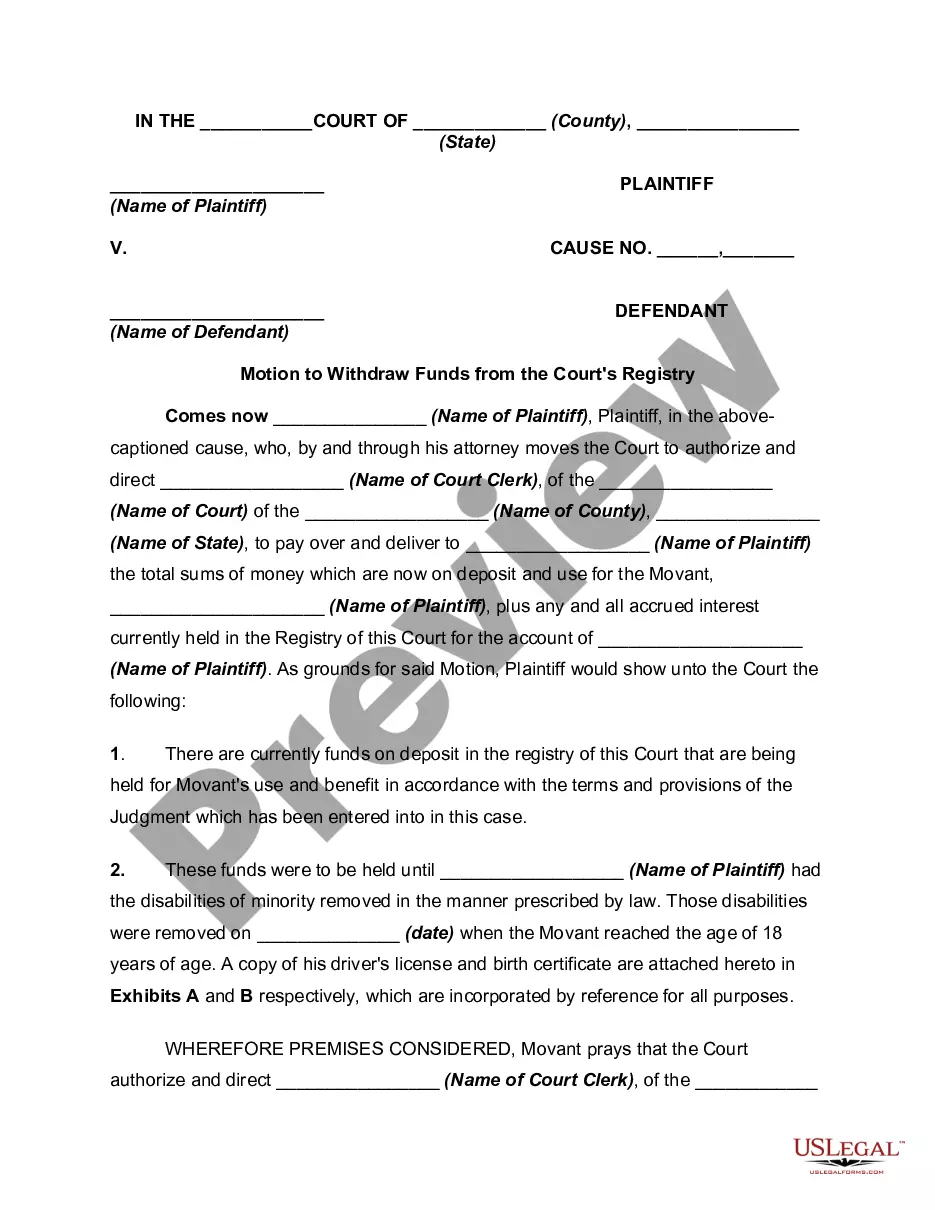

You can dedicate hours online searching for the legal document format that aligns with federal and state requirements you will encounter.

US Legal Forms offers thousands of legal documents that have been reviewed by professionals.

You can obtain or print the Montana Marital Deduction Trust - Trust A and Bypass Trust B from their services.

If available, use the Preview button to view the document format as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Next, you can complete, modify, print, or sign the Montana Marital Deduction Trust - Trust A and Bypass Trust B.

- Every legal document format you acquire is yours permanently.

- To access another version of any purchased form, navigate to the My documents section and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document format for the state/city of your choice.

- Review the document details to confirm you have chosen the appropriate form.

Form popularity

FAQ

A trust for a married couple, such as the Montana Marital Deduction Trust - Trust A and Bypass Trust B, functions by holding and managing assets for the benefit of both spouses. This structure allows for the seamless transfer of assets between spouses without tax implications during their lifetimes. Additionally, it can protect family wealth and provide provisions for heirs. Understanding how these mechanisms work can empower couples to secure their financial futures.

Certain types of assets do not qualify for the marital deduction, including those outside the surviving spouse’s control or those held in irrevocable trusts. Moreover, assets like life insurance policies may also face unique limitations under the Montana Marital Deduction Trust guidelines. It’s crucial to evaluate your assets closely. A comprehensive review with a legal expert will ensure you're aware of any potential issues.

Yes, a bypass trust, often connected with the Montana Marital Deduction Trust - Trust B, typically files its own tax return. Because this trust holds assets beyond the surviving spouse's control, it may be subject to specific tax regulations. However, the income from the trust usually isn’t taxed at the individual level. Engaging with a tax professional can help navigate these complexities.

Yes, a trust can qualify for the marital deduction if it follows the guidelines established for the Montana Marital Deduction Trust - Trust A. The trust must provide for the surviving spouse's interest and meet certain requirements regarding distribution. Structuring your trust correctly ensures that your assets are protected while benefiting your spouse. Consulting with an expert can help clarify the requirements.

Trusts that qualify for the marital deduction include those that meet specific IRS requirements under the Montana Marital Deduction Trust - Trust A structure. These trusts allow the surviving spouse to receive benefits without incurring immediate tax liabilities. It's important to designate the trust properly to ensure eligibility. Consider speaking with a professional to maximize your trust benefits.

A trust is a financial arrangement that can hold and manage assets for beneficiaries, serving various purposes including estate planning. In contrast, a B trust specifically refers to the Bypass Trust B, which is created to hold assets outside of the surviving spouse's estate, thereby avoiding estate taxes upon their death. Understanding the nuances between a general trust and a Montana Marital Deduction Trust - Trust A and Bypass Trust B can help individuals make informed choices for their financial future.

One downside of an AB trust is the potential for reduced flexibility when it comes to managing assets. Once a spouse passes away, the assets in Trust B may not be easily altered or accessed by the surviving spouse, which could limit their financial options. It's essential to weigh these factors against the benefits of a Montana Marital Deduction Trust - Trust A and Bypass Trust B strategy before finalizing estate planning decisions.

The primary disadvantage of a Bypass Trust B is that it may result in increased administrative costs and complexity in managing the trust. Moreover, the assets placed in a B trust are not eligible for a step-up in basis at the surviving spouse's death, which could lead to higher capital gains taxes when the heirs eventually sell those assets. Understanding this aspect of the Montana Marital Deduction Trust - Trust A and Bypass Trust B is crucial for effective estate planning.

The purpose of an A/B trust structure is to maximize estate tax benefits while providing for a surviving spouse. When one spouse passes away, Trust A (the marital trust) provides support to the surviving spouse, while Trust B (the Bypass Trust) preserves wealth for future heirs. This combination ensures both immediate financial security and long-term tax advantages for beneficiaries in the context of a Montana Marital Deduction Trust - Trust A and Bypass Trust B arrangement.

A marital deduction trust allows the assets to pass to a surviving spouse without incurring estate taxes, effectively deferring tax liabilities. In contrast, a Bypass Trust B, also known as a credit shelter trust, keeps assets out of the surviving spouse's estate, thereby preserving the estate tax exemption for future generations. This primary difference between the Montana Marital Deduction Trust - Trust A and Bypass Trust B allows families to create a tailored estate plan that meets their specific financial goals.