A number of states have enacted measures to facilitate greater communication between borrowers and lenders by requiring mortgage servicers to provide certain notices to defaulted borrowers prior to commencing a foreclosure action. The measures serve a dual purpose, providing more meaningful notice to borrowers of the status of their loans and slowing down the rate of foreclosures within these states. For instance, one state now requires a mortgagee to mail a homeowner a notice of intent to foreclose at least 45 days before initiating a foreclosure action on a loan. The notice must be in writing, and must detail all amounts that are past due and any itemized charges that must be paid to bring the loan current, inform the homeowner that he or she may have options as an alternative to foreclosure, and provide contact information of the servicer, HUD-approved foreclosure counseling agencies, and the state Office of Commissioner of Banks.

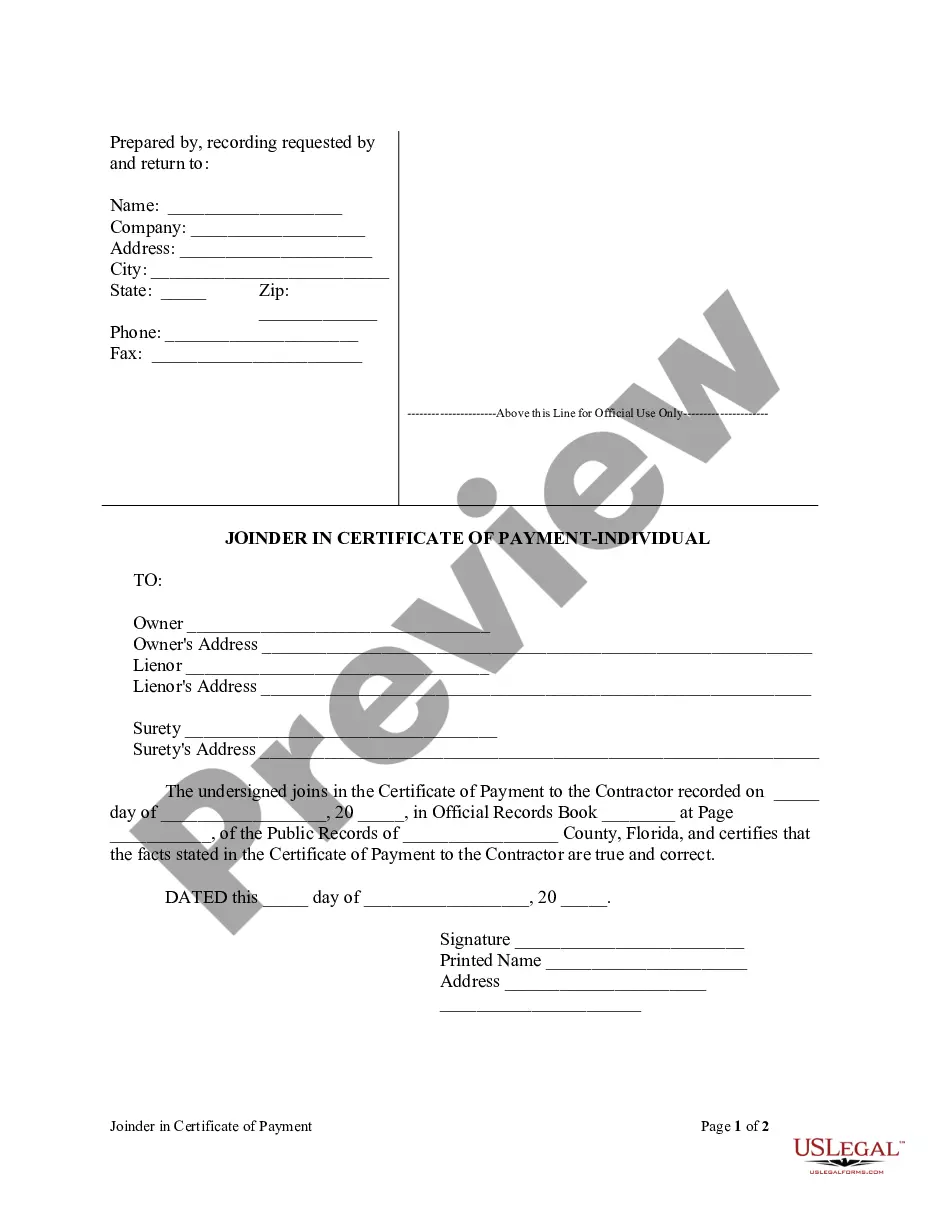

Montana Notice of Default and Election to Sell - Intent To Foreclose

Description

How to fill out Notice Of Default And Election To Sell - Intent To Foreclose?

Are you presently in a situation where you need to have documentation for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but locating versions you can rely on is not simple.

US Legal Forms provides thousands of form templates, such as the Montana Notice of Default and Election to Sell - Intent To Foreclose, which can be customized to meet federal and state regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can download another copy of the Montana Notice of Default and Election to Sell - Intent To Foreclose at any time, if needed. Simply click the desired form to download or print the document template.

- If you are already aware of the US Legal Forms website and have an account, simply Log In.

- Then, you may download the Montana Notice of Default and Election to Sell - Intent To Foreclose template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Acquire the form you require and ensure it is for your specific city/county.

- Utilize the Review button to evaluate the form.

- Examine the description to guarantee you have selected the correct form.

- If the form does not meet your expectations, use the Search field to locate the form that satisfies your needs.

- If you find the appropriate form, click Buy now.

- Select the payment plan you prefer, complete the necessary information to create your account, and pay for the order with your PayPal or credit card.

Form popularity

FAQ

Redemption Period After a Foreclosure Sale in Montana In Montana, if the foreclosure is nonjudicial under the STFA, you don't get a right of redemption. (Mont. Code Ann. § 71-1-318).

Key Takeaways. Generally, banks lose more money on a short sale than on a foreclosure, but there are still times when a short sale is a better option.

The state of Montana allows 150 days before your home can be fully foreclosed on, but that means that you will be notified by the bank after one missed payment. You must make recompense with the bank or they will take your home, claim it and eventually sell it.

2. Notice of Sale Filed, Posted and Mailed Next, the law requires at least 21 days' written notice of the date on which the foreclosure sale (auction) is to take place. The 21 days begin from the date the notice is mailed, not the date you receive it.

year waiting period is required, and is measured from the completion date of the foreclosure action as reported on the credit report or other foreclosure documents provided by the borrower.

Learn how foreclosures in Montana work. The method will most likely be nonjudicial, although judicial foreclosures are also allowed. Montana law specifies how nonjudicial procedures work, and both federal and state laws give you rights and protections throughout the foreclosure.

It takes approximately five months for a simple foreclosure to occur in Montana. However, if the borrower requests delays, contests the foreclosure or files or bankruptcy then it may take longer than five months.