Montana Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship

Description

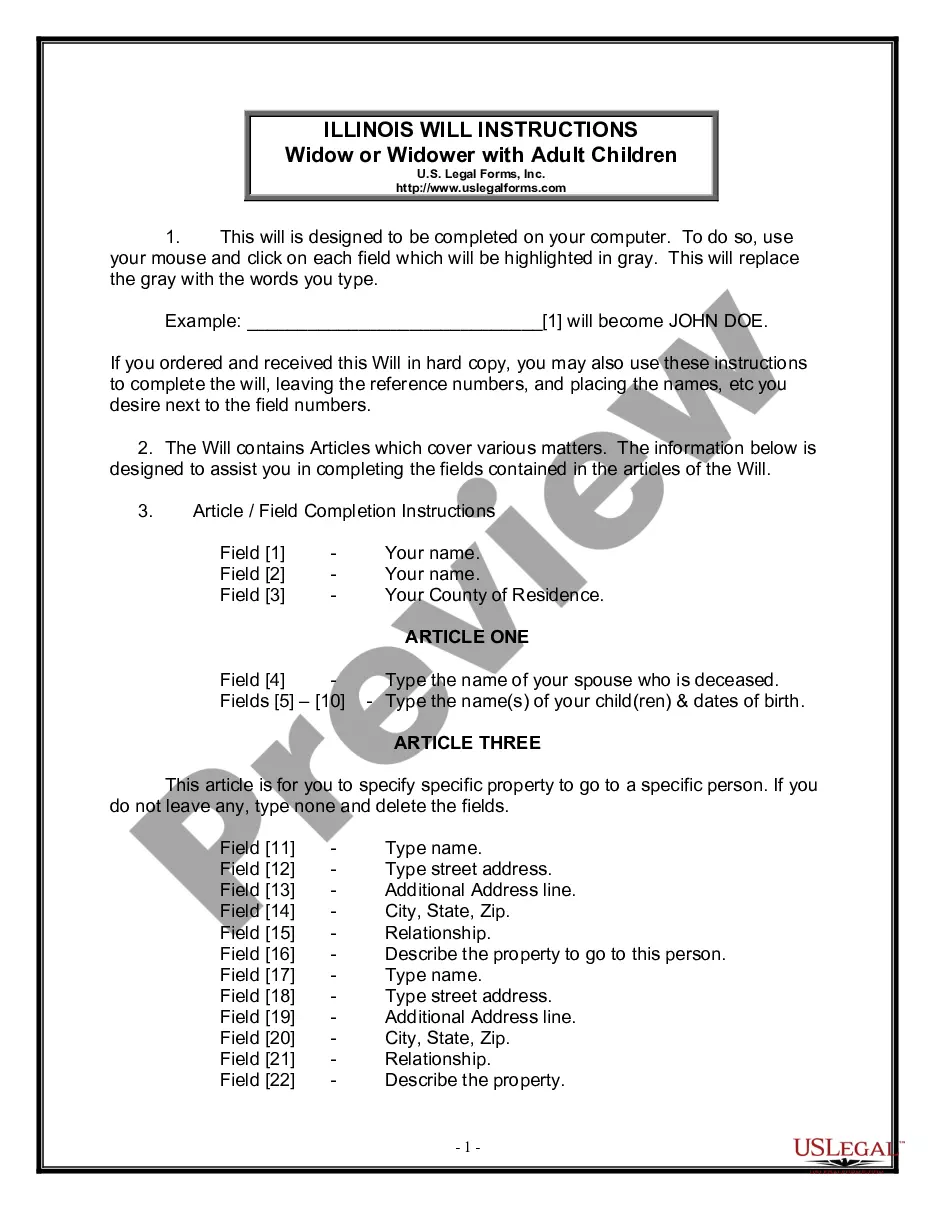

How to fill out Agreement Between Unmarried Individuals To Purchase And Hold Residence As Joint Tenants With Right Of Survivorship?

If you need to download, retrieve, or print legitimate document templates, utilize US Legal Forms, the largest assortment of legal forms that can be accessed online.

Utilize the site's straightforward and convenient search feature to locate the documents you require.

Various templates for business and personal applications are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types in the legal form collection.

Step 4. Once you have located the form you desire, click the Get now button. Choose your preferred payment plan and enter your details to register for an account.

- Use US Legal Forms to find the Montana Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Montana Agreement between Unmarried Individuals to Purchase and Hold Residence as Joint Tenants with Right of Survivorship.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to examine the form's content. Remember to read the description.

Form popularity

FAQ

In Montana, there are several straightforward rules for getting married. Both individuals must be at least 18 years old, or have parental consent if younger. It's essential to obtain a marriage license from a county office, which remains valid for 180 days. Understanding these guidelines can help couples move forward confidently.

You don't have to be married to someone to buy a house together; however, some important factors should be considered before signing the papers. Both parties must have qualifying credit scores and income to be approved for the mortgage loan.

To truly protect yourself legally, you can put together a cohabitation agreement, which is sort of like a prenup. "Cohabitation agreements usually include how property will be divided in the event of a separation," said attorney David Reischer, CEO of LegalAdvice.com.

The term "joint tenancy" refers to a legal arrangement in which two or more people own a property together, each with equal rights and obligations. Joint tenancies can be created by married and non-married couples, friends, relatives, and business associates.

Because mortgage lenders treat married couples as a single entity, these couples can qualify for sizeable loans with good terms and rates as long as one partner has a good credit history. However, lenders treat unmarried couples as individual home buyers.

Each state has its own laws, but generally, property is distributed to the deceased person's spouse and children. If the person is not married, the property will be divided among parents, siblings, aunts and uncles, nieces and nephews, and then to more distant relatives.

Yes. You can find a lender that will allow you to apply for a home loan with your partner. However, you'll run into different challenges than married couples based on the current legal framework. Take the time to determine whether you and your partner should apply for a loan together.