The Fair Credit Reporting Act (FCRA) is designed to help ensure that credit bureaus furnish correct and complete information to businesses to use when evaluating your application. Your rights include:

The right to receive a copy of your credit report. The copy of your report must contain all of the information in your file at the time of your request.

The right to know the name of anyone who received your credit report in the last year for most purposes or in the last two years for employment purposes.

Any company that denies your application must supply the name and address of the credit bureau they contacted, provided the denial was based on information given by the credit bureau.

The right to a free copy of your credit report when your application is denied because of information supplied by the credit bureau. Your request must be made within 60 days of receiving your denial notice.

If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the furnisher of information are legally obligated to investigate your dispute.

A right to add a summary explanation to your credit report if your dispute is not resolved to your satisfaction.

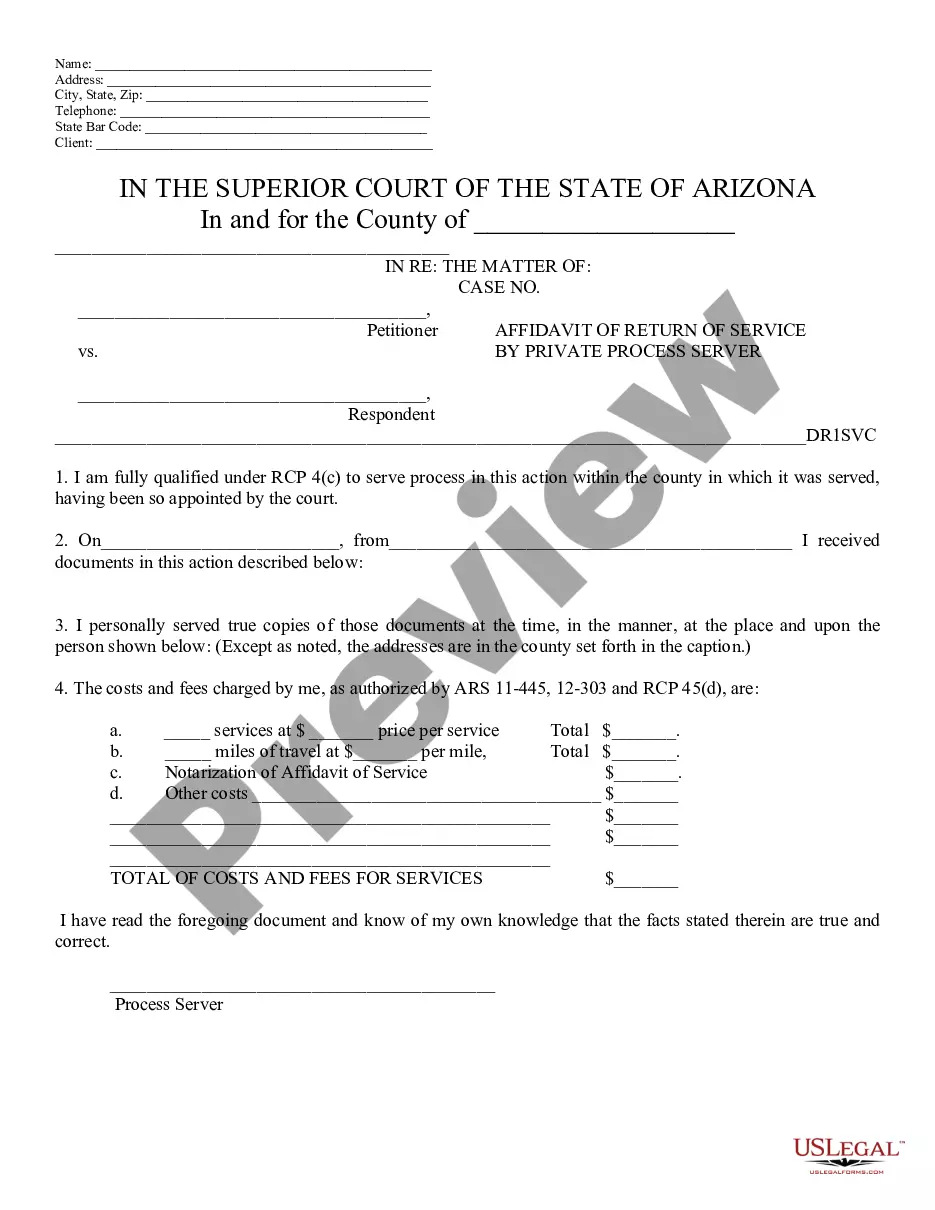

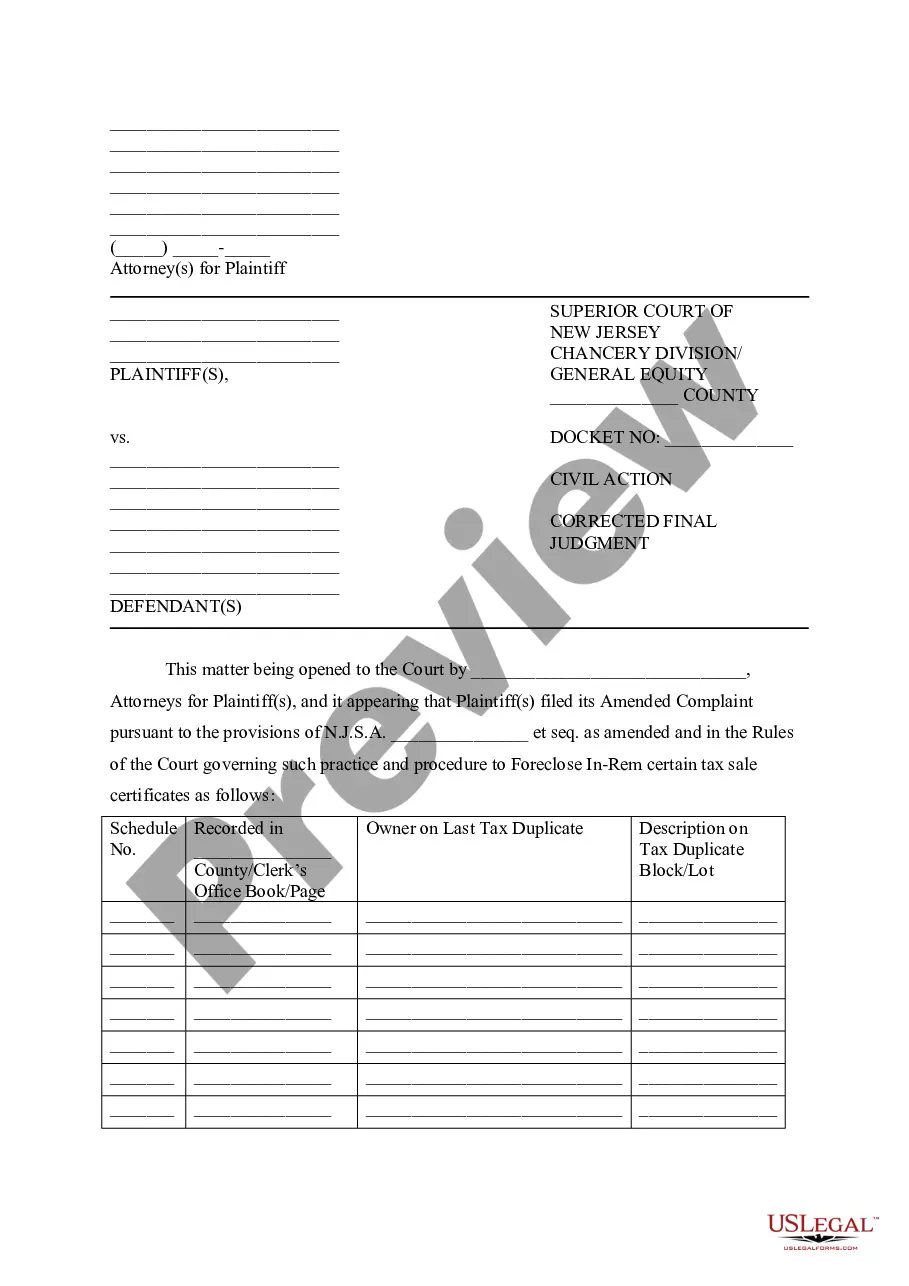

Montana Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency

Description

How to fill out Request For Disclosure Of Reasons For Denial Of Credit Application Where Action Was Based On Information Not Obtained By Reporting Agency?

US Legal Forms - one of many largest libraries of legitimate types in the States - offers a wide range of legitimate papers web templates it is possible to download or print. Using the web site, you can find thousands of types for company and person uses, categorized by types, suggests, or key phrases.You will discover the most recent models of types just like the Montana Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency within minutes.

If you already possess a monthly subscription, log in and download Montana Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency from your US Legal Forms library. The Acquire switch will appear on each and every kind you see. You gain access to all earlier saved types inside the My Forms tab of the account.

If you want to use US Legal Forms for the first time, allow me to share simple directions to help you get began:

- Make sure you have picked the proper kind for the area/region. Click the Review switch to examine the form`s content material. Read the kind outline to ensure that you have chosen the appropriate kind.

- In case the kind does not suit your requirements, use the Look for field near the top of the display screen to get the the one that does.

- If you are happy with the form, affirm your selection by visiting the Get now switch. Then, select the pricing prepare you favor and supply your accreditations to register for the account.

- Approach the purchase. Make use of your charge card or PayPal account to complete the purchase.

- Choose the file format and download the form on your own gadget.

- Make changes. Load, edit and print and indication the saved Montana Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency.

Each web template you put into your account lacks an expiry particular date and it is your own property eternally. So, if you wish to download or print an additional copy, just go to the My Forms portion and then click on the kind you want.

Obtain access to the Montana Request for Disclosure of Reasons for Denial of Credit Application Where Action Was Based on Information Not Obtained by Reporting Agency with US Legal Forms, the most substantial library of legitimate papers web templates. Use thousands of specialist and condition-certain web templates that meet your organization or person needs and requirements.

Form popularity

FAQ

The best way to find out why you've been refused credit is to ask the lender for a reason. However, it also helps to get a copy of your Experian Credit Report ? check it for accuracy and anything listed above.

You must be informed in writing why you were denied a credit card or loan. If the letter you receive doesn't say why you were denied, it must tell you of your right to be given the specific reasons for denial if you request it. You should always request this information.

The Equal Credit Opportunity Act (ECOA) mandates that lenders that deny credit to their applicants must state their reason for the rejection. 1 Borrowers who are rejected because of adverse reports from other creditors have the right to review a copy of their credit report.

A mortgage denial letter is a disclosure that the federal government requires lenders to send to a borrower who is unable to meet the financing criteria for a home loan request.

Once a creditor has obtained all the information it normally considers in making a credit decision, the application is complete and the creditor has 30 days in which to notify the applicant of the credit decision.

Regulation B A written statement of actual and specific reasons for the adverse action or, if not providing the specific reason within the written notice, a statement that the applicant has a right to receive the specific reason for adverse action if requested within 60 days of the notification.

What are the only three reasons a creditor may deny credit? Credit report showing past records of an individual where there is a poor performance of making payments. Credit report showing that an individual has a low source of income. Credit report showing that the individual's accumulated debts in the present.

If a lender rejects your application, it's required under the Equal Credit Opportunity Act (ECOA) to tell you the specific reasons your application was rejected or tell you that you have the right to learn the reasons if you ask within 60 days.