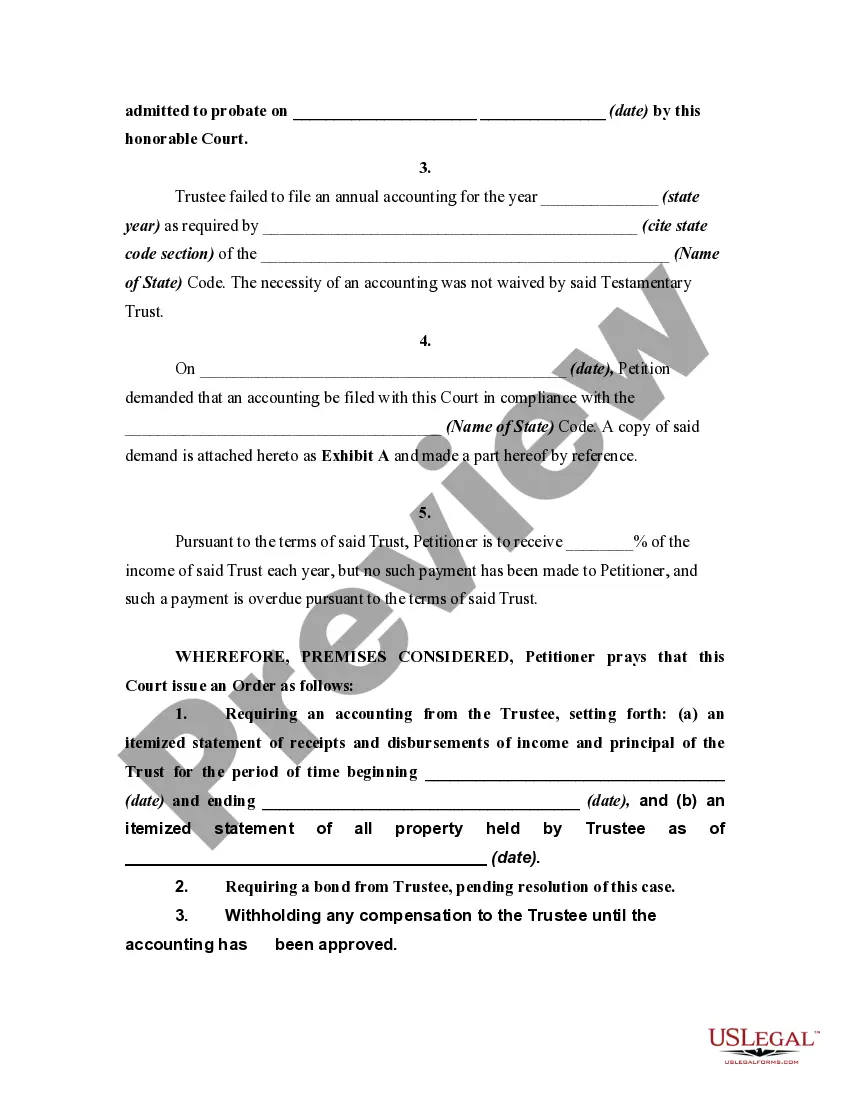

An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Montana Petition to Require Accounting from Testamentary Trustee

Description

How to fill out Petition To Require Accounting From Testamentary Trustee?

If you have to full, download, or print out lawful papers layouts, use US Legal Forms, the largest selection of lawful types, which can be found on-line. Take advantage of the site`s simple and convenient search to obtain the files you need. Various layouts for company and personal functions are sorted by groups and says, or key phrases. Use US Legal Forms to obtain the Montana Petition to Require Accounting from Testamentary Trustee in a number of click throughs.

Should you be presently a US Legal Forms buyer, log in for your account and then click the Download button to have the Montana Petition to Require Accounting from Testamentary Trustee. You can also access types you earlier acquired in the My Forms tab of your account.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have selected the form for your proper area/land.

- Step 2. Make use of the Preview method to examine the form`s content material. Never forget to read through the outline.

- Step 3. Should you be unhappy together with the form, use the Lookup industry on top of the screen to find other versions of the lawful form template.

- Step 4. After you have found the form you need, click the Buy now button. Select the prices prepare you like and put your qualifications to sign up on an account.

- Step 5. Approach the purchase. You can use your Мisa or Ьastercard or PayPal account to complete the purchase.

- Step 6. Choose the formatting of the lawful form and download it in your system.

- Step 7. Complete, change and print out or indication the Montana Petition to Require Accounting from Testamentary Trustee.

Each lawful papers template you acquire is the one you have for a long time. You have acces to each and every form you acquired inside your acccount. Click on the My Forms portion and choose a form to print out or download once more.

Compete and download, and print out the Montana Petition to Require Accounting from Testamentary Trustee with US Legal Forms. There are thousands of expert and express-specific types you can use to your company or personal requirements.

Form popularity

FAQ

The executor must prepare a full accounting with the court, and beneficiaries should be provided with a copy. ing to the California Probate Code, an accounting should include the following information: The property and value of the estate at the beginning of the accounting period.

California statutory law requires a trustee to account annually to current trust beneficiaries, i.e., those who are currently entitled to receive distributions of income and principal during the accounting period. Any trustee, other than the settlor(s) who established the trust, has a duty to account.

As a beneficiary, you are entitled to review the trust's records including bank statements, the checking account ledger, receipts, invoices, etc. Before the trust administration is complete, it is recommended you request and review the trust's records which support the accounting.

Generally speaking, California law states that beneficiaries have a right to information and accounting regarding the trust. More specifically, beneficiaries have a right to information regarding all changes made to the trust promptly, and they have a right to know the plan to administer and distribute the estate.

A trust accounting protects beneficiaries against negligent or underhanded trustees, but it also provides essential protection for trustees against liability. In simple terms, a California trust accounting is a window into how a trustee is administering the trust.

The trustee has 60 days to provide an accounting when a trust beneficiary requests one in writing. California Probate Code grants beneficiaries the right to petition the probate court for an accounting of trust if the trustee fails to produce an accounting within a reasonable time period.

Montana law requires that a testator have ?testamentary capacity.? This means that the testator must have been at least 18 years old and must have been ?of sound mind? at the time that they made the will. In other words, the testator must not have been suffering from a mental incapacity.