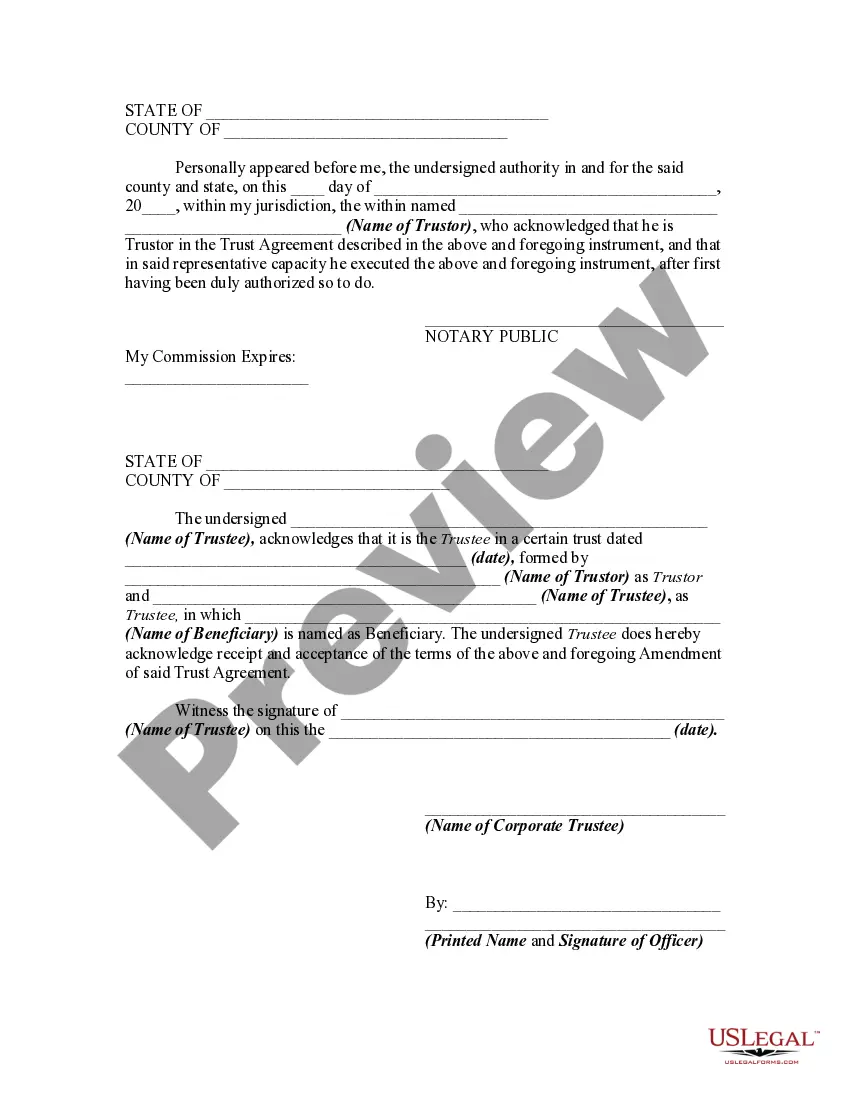

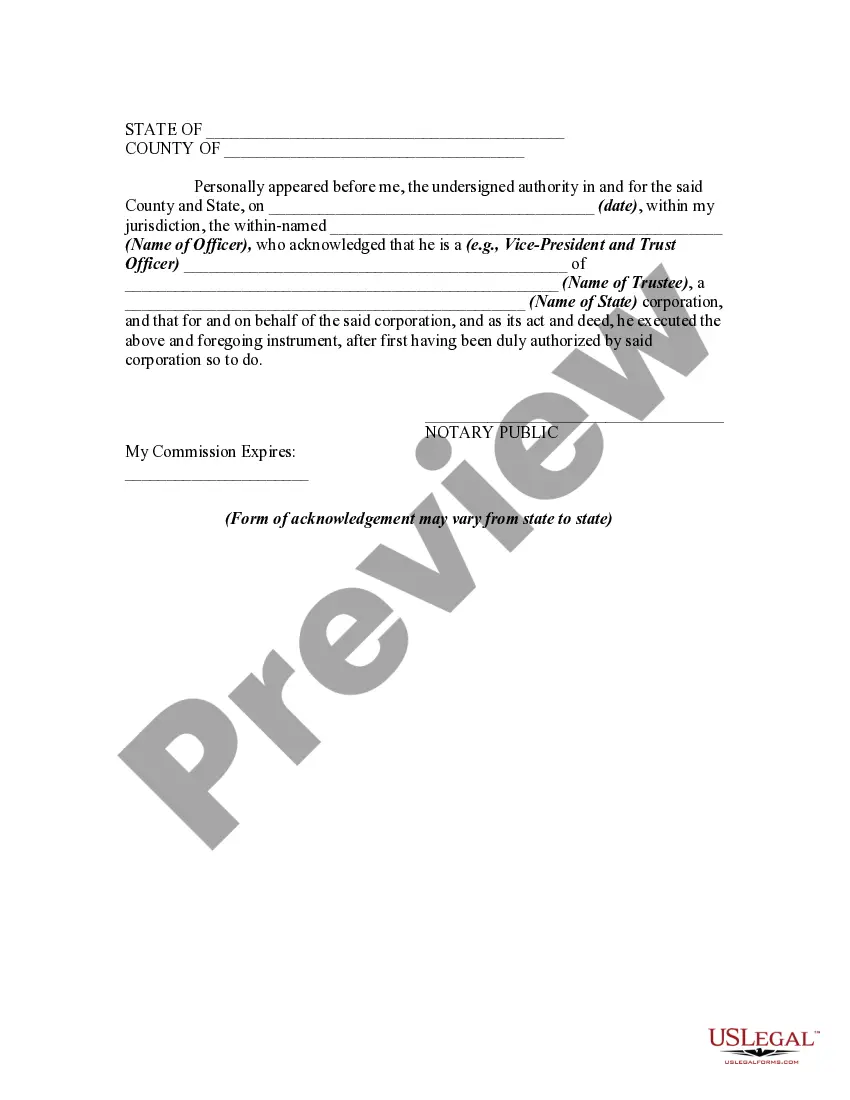

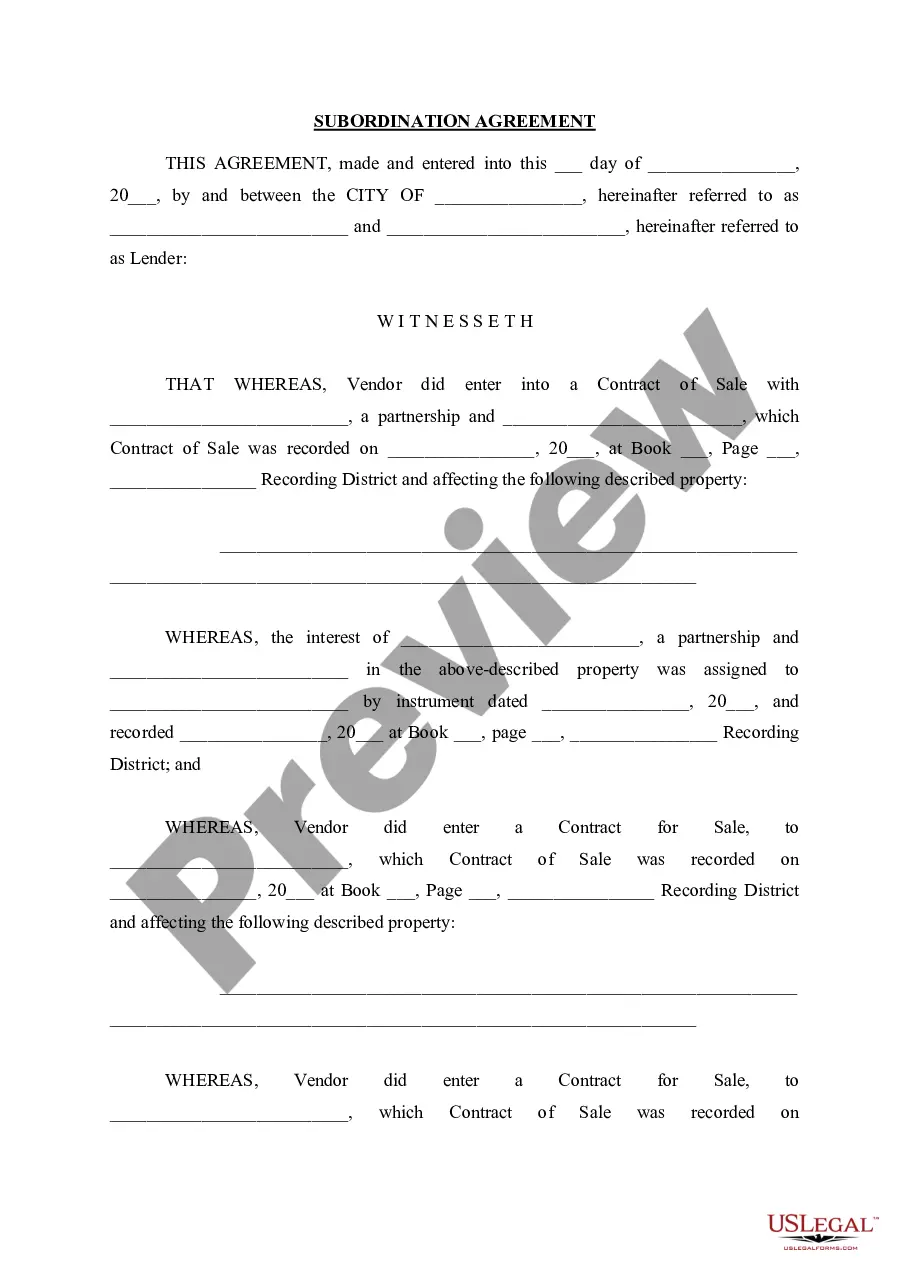

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to withdraw property from the trust. This form is a sample of a trustor amending the trust agreement in order to withdraw property from the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.