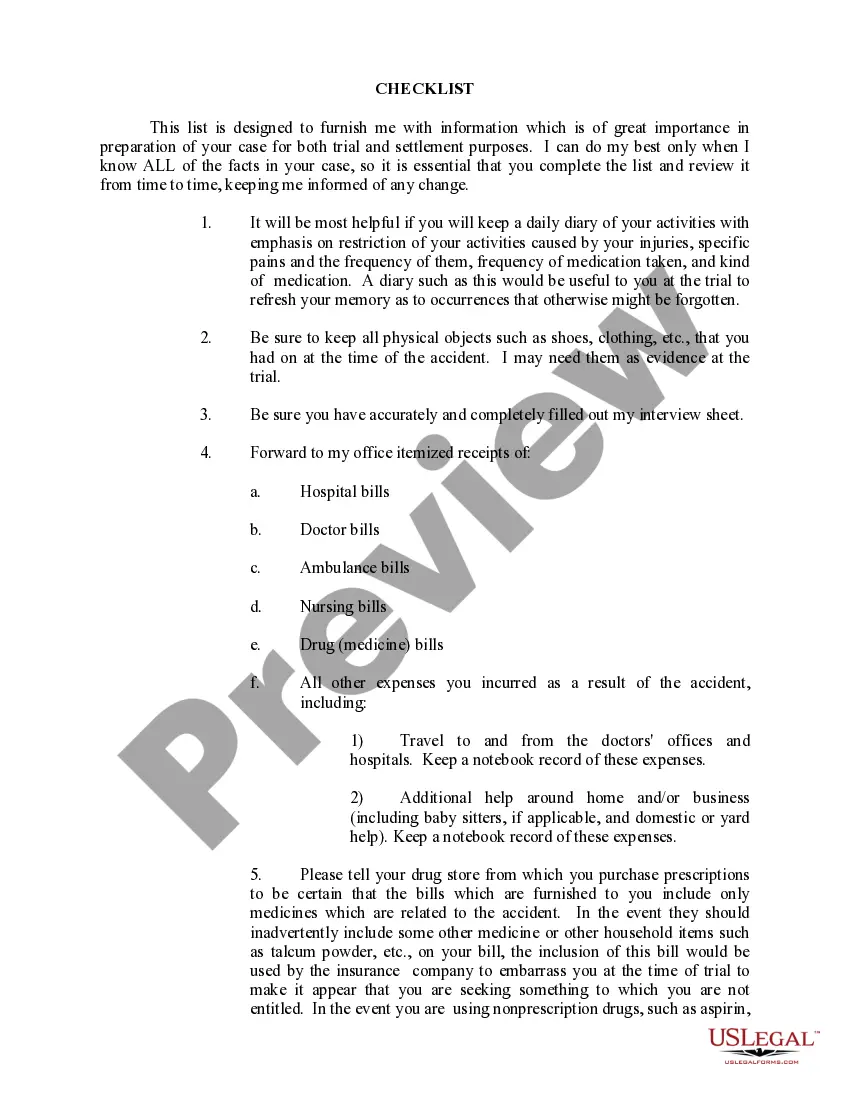

Montana Instructions to Clients with Checklist - Long

Description

How to fill out Instructions To Clients With Checklist - Long?

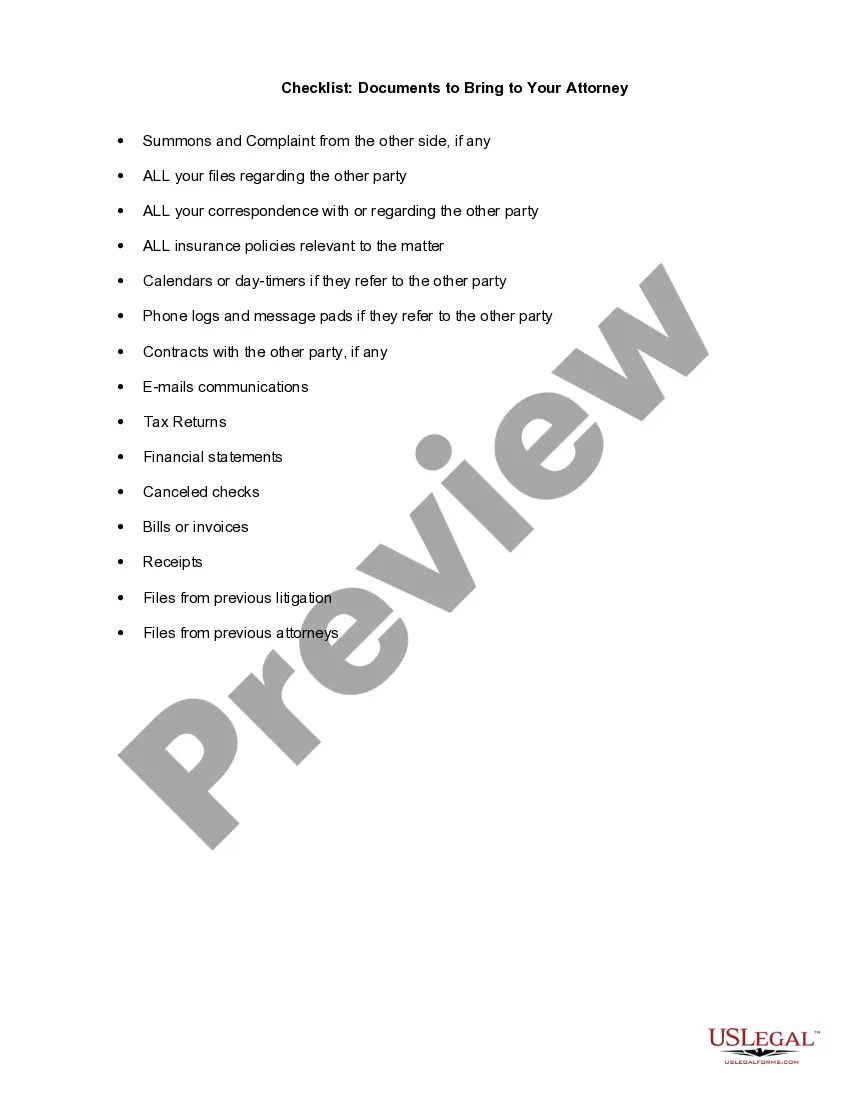

Have you ever found yourself in a situation where you frequently require documents for certain organizations or specific purposes? There are numerous legitimate document templates available online, but finding versions you can trust is not easy. US Legal Forms offers thousands of template options, including the Montana Instructions to Clients with Checklist - Long, which can be tailored to meet state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Montana Instructions to Clients with Checklist - Long template.

If you do not have an account and wish to start using US Legal Forms, take the following steps: Find the document you need and ensure it is for the correct city/county. Utilize the Preview feature to review the document. Check the summary to confirm you have selected the right document. If the document does not meet your requirements, use the Search field to locate the document that fits your needs.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- Once you find the correct document, click Get now.

- Select the pricing plan you want, fill out the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can download another copy of the Montana Instructions to Clients with Checklist - Long whenever needed. Just click on the desired document to download or print the template.

- Use US Legal Forms, the most extensive collection of legitimate forms, to save time and reduce errors.

- The service provides properly designed legal document templates that you can utilize for various purposes.

- Create your account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Fiduciary - Montana allows an automatic six-month extension without written request.

Montana's itemized deductions are the same as federal itemized deductions with a few differences: Montana law allows a federal income tax deduction of up to $5,000 (or $10,000 for MFJ). Taxpayers itemizing on the federal return receive the deduction for state income taxes paid.

Montana becomes the 35th jurisdiction to enact an elective pass-through entity tax. On , Montana Governor Greg Gianforte signed Senate Bill 554 (SB 554), making Montana the latest state to adopt an elective pass-through entity (PTE) tax intended to comply with IRS Notice 2020-75.

If you're looking at your old tax filings, the department says the income tax number used for its rebate calculations is the number on line 20 of its 2021 Montana Individual Income Tax Return form.

What is the Montana resident rebate for 2023? If you were a Montana resident over the past full year and you paid your state taxes both on 2021 and 2022 on time. You will be getting a rebate that will go up to $675 but you need to meet the criteria.

The Montana Property Tax Rebate provides qualifying Montanans up to $675 of property tax relief on a primary residence in both 2023 and 2024. The qualifications to claim the rebate are at GetMyRebate.mt.gov.

The Individual Income Tax Rebate amount depends on a taxpayer's 2021 filing status and the amount of tax paid for 2021, which can be found on line 20 of the 2021 Montana Form 2.

Individual Income Tax Rebate (House Bill 192) The amount of your Montana income tax liability on line 20 of your 2021 Montana tax return, OR. $1,250 for single, married filing separately, or head of household filing statuses; and $2,500 for married filing jointly.