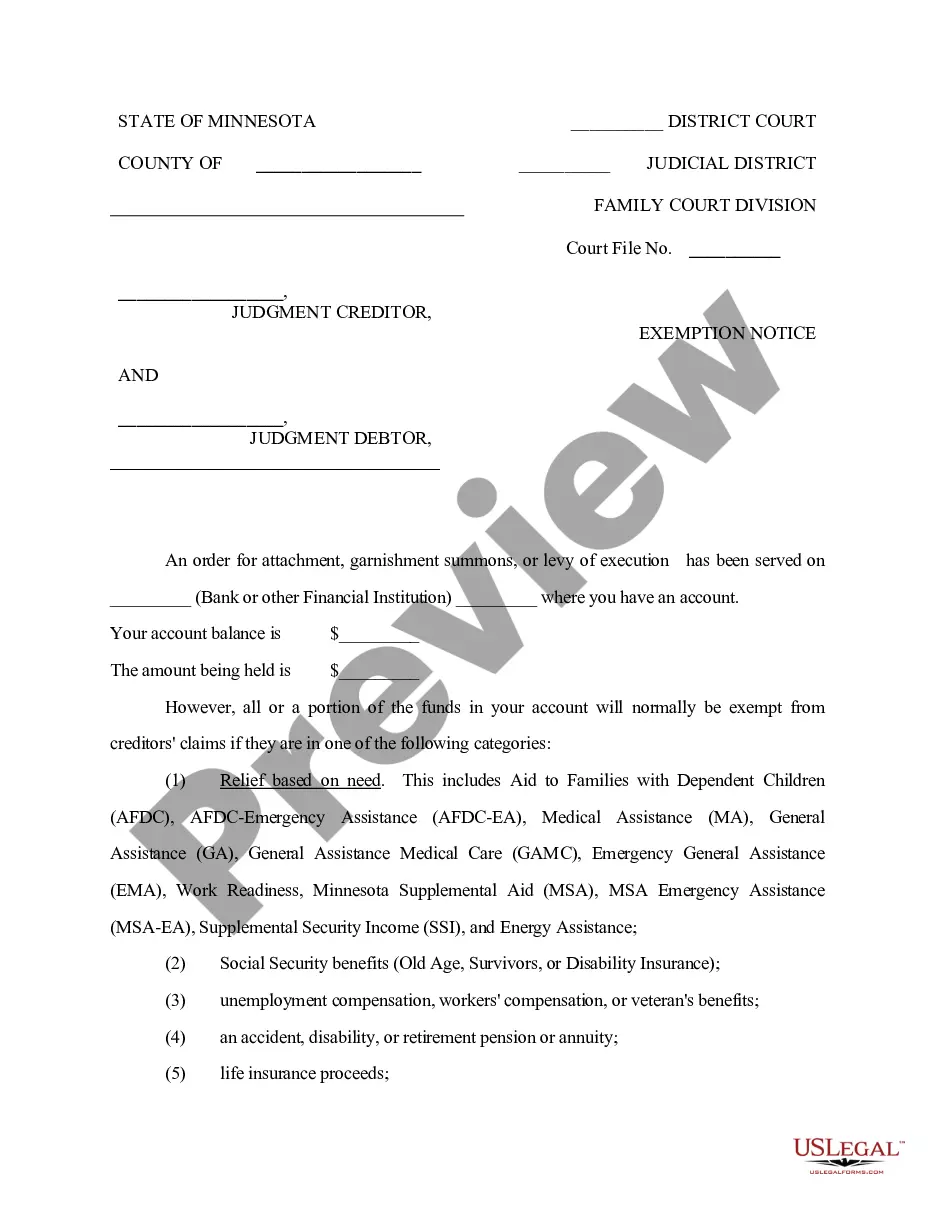

In this guaranty, the guarantor is guaranteeing both payment and performance of all leases now or later entered into with lessee and all the obligations and liabilities due and to become due to lessor from lessee under any lease, note, or other obligation of lessee to lessor. Such a blanket guaranty would suggest a close business relationship between the lessee and guarantor like that of a parent and subsidiary corporation.

Montana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease

Description

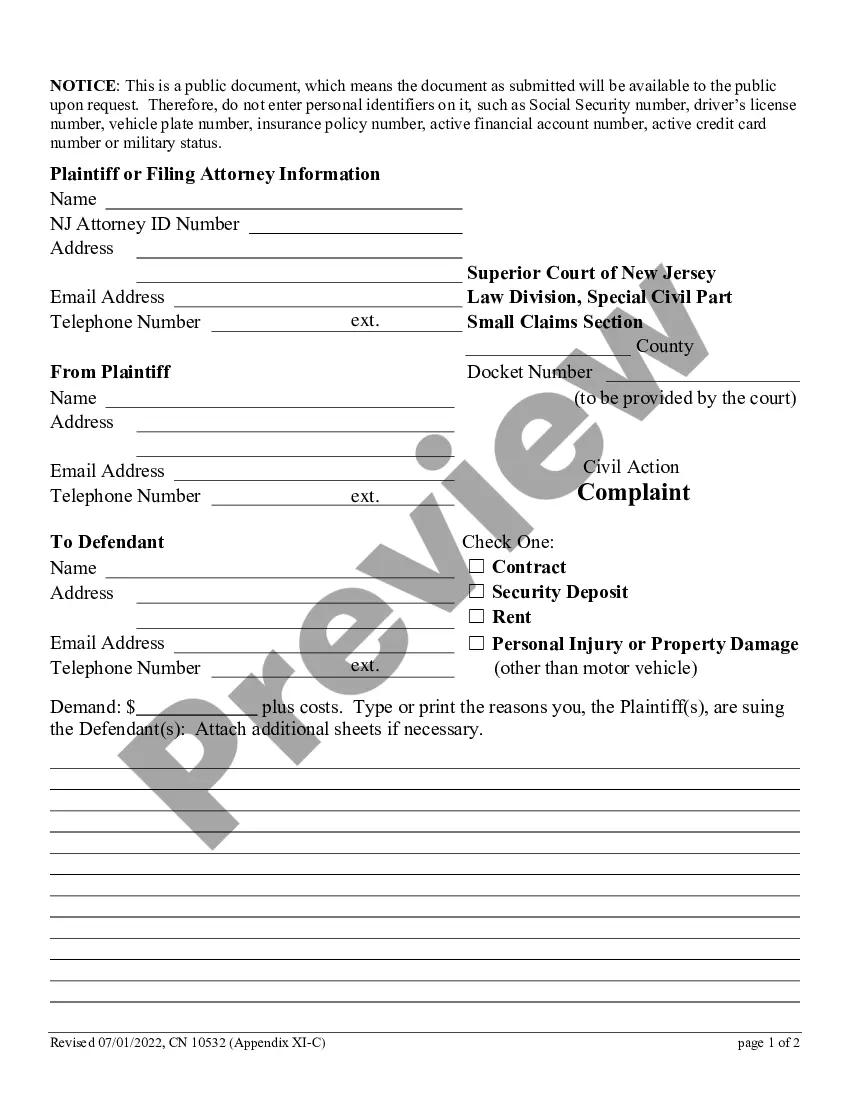

How to fill out Continuing Guaranty Of Payment And Performance Of All Obligations And Liabilities Due To Lessor From Lessee Under Lease?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal form templates that you can download or print.

By using the site, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can quickly acquire the latest versions of forms such as the Montana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease.

If you already have a subscription, Log In and download the Montana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease from the US Legal Forms library. The Download button appears on every form you view. You can access all previously downloaded forms from the My documents tab of your account.

Make modifications. Complete, edit, print, and sign the downloaded Montana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease.

Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply return to the My documents section and click on the form you require. Access the Montana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, follow these simple instructions to get started.

- Ensure you have selected the right form for your city/county. Click on the Review button to examine the form's content. Check the form description to make sure you have chosen the correct form.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Order now button. Then, choose your preferred pricing plan and provide your details to sign up for an account.

- Complete the payment. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

A lease guaranty is a legal document in which a guarantor agrees to be responsible for a tenant's obligations under a lease if the tenant fails to meet them. Landlords often require such a guaranty when renting to tenants with limited credit history or financial instability. The Montana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease provides landlords with peace of mind that their financial interests are secured.

A continuing guaranty is a specific type of guarantee that remains in effect over time, covering successive transactions or obligations. This ensures that the lessor is protected against defaults by the lessee for the duration of the lease agreement. The Montana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease is a prime example of how a continuing guaranty operates to protect all parties involved.

Reaffirmation of guaranty occurs when a guarantor formally confirms their obligation to continue supporting a financial obligation, often after a significant change, such as bankruptcy. This process ensures that the guarantor remains liable for the obligations despite shifts in circumstances. It's essential in maintaining the validity of agreements, such as the Montana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease.

A continuing guarantee refers to a legal commitment that remains valid over a specified period or until a specified condition is met. This type of guarantee covers multiple transactions or obligations, providing ongoing assurance to the beneficiary. In the context of leasing, the Montana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease exemplifies how such guarantees work in practice.

There are three main types of guarantees: conditional guarantees, unconditional guarantees, and continuing guarantees. Conditional guarantees require specific conditions to be met for the guarantor's obligation to activate. Unconditional guarantees impose immediate liability on the guarantor, while continuing guarantees, such as those found in the Montana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, remain valid over time until revoked.

The primary distinction between guarantee and guaranty lies in their usage in legal contexts. Generally, a guarantee refers to the act of assuring something, like the fulfillment of a duty or obligation. In contrast, a guaranty specifically represents a formal, legal commitment where one party agrees to uphold another's obligations, such as in the Montana Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease.

A guarantee is a legal promise made by a third party (guarantor) to cover a borrower's debt or other types of liability in case of the borrower's default. The time a default happens varies, depending on the terms agreed upon by the creditor and the borrower.

A guarantee agreement definition is common in real estate and financial transactions. It concerns the agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain.

Rolling guaranty: this can be a 12 month, 24 month or some other number of months, rolling guaranty. It means that the total exposure is the number of months regardless of how many months are remaining in the lease (unless the remaining months are less than the rolling months.

The Burn-Off Guaranty. This represents an incentive approach to a limited guaranty, in which the guarantor liability is reduced or eliminated upon the satisfaction of one or more conditions. Under the terms of most burn-down/burn-off guaranties, on day 1 of the loan term, the guaranty is at its maximum coverage.