Puerto Rico Self-Employed Environmental Testing Service Contract

Description

How to fill out Self-Employed Environmental Testing Service Contract?

Are you currently in the position where you require documents for either business or personal purposes almost every workday.

There are numerous legal document templates available online, but locating forms you can trust is not simple.

US Legal Forms offers thousands of form templates, including the Puerto Rico Self-Employed Environmental Testing Service Contract, which are designed to meet state and federal requirements.

If you find the right form, click on Get now.

Select the pricing plan you want, fill in the necessary information to process your payment, and complete your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Puerto Rico Self-Employed Environmental Testing Service Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/state.

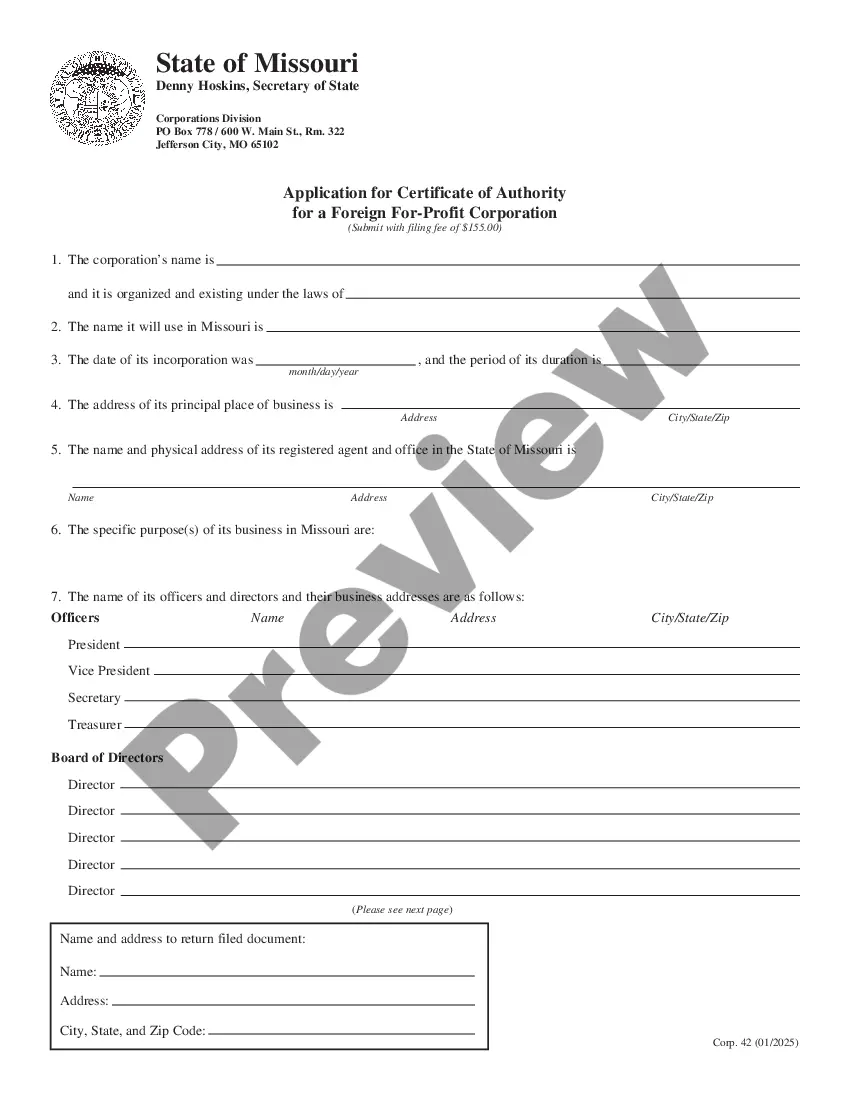

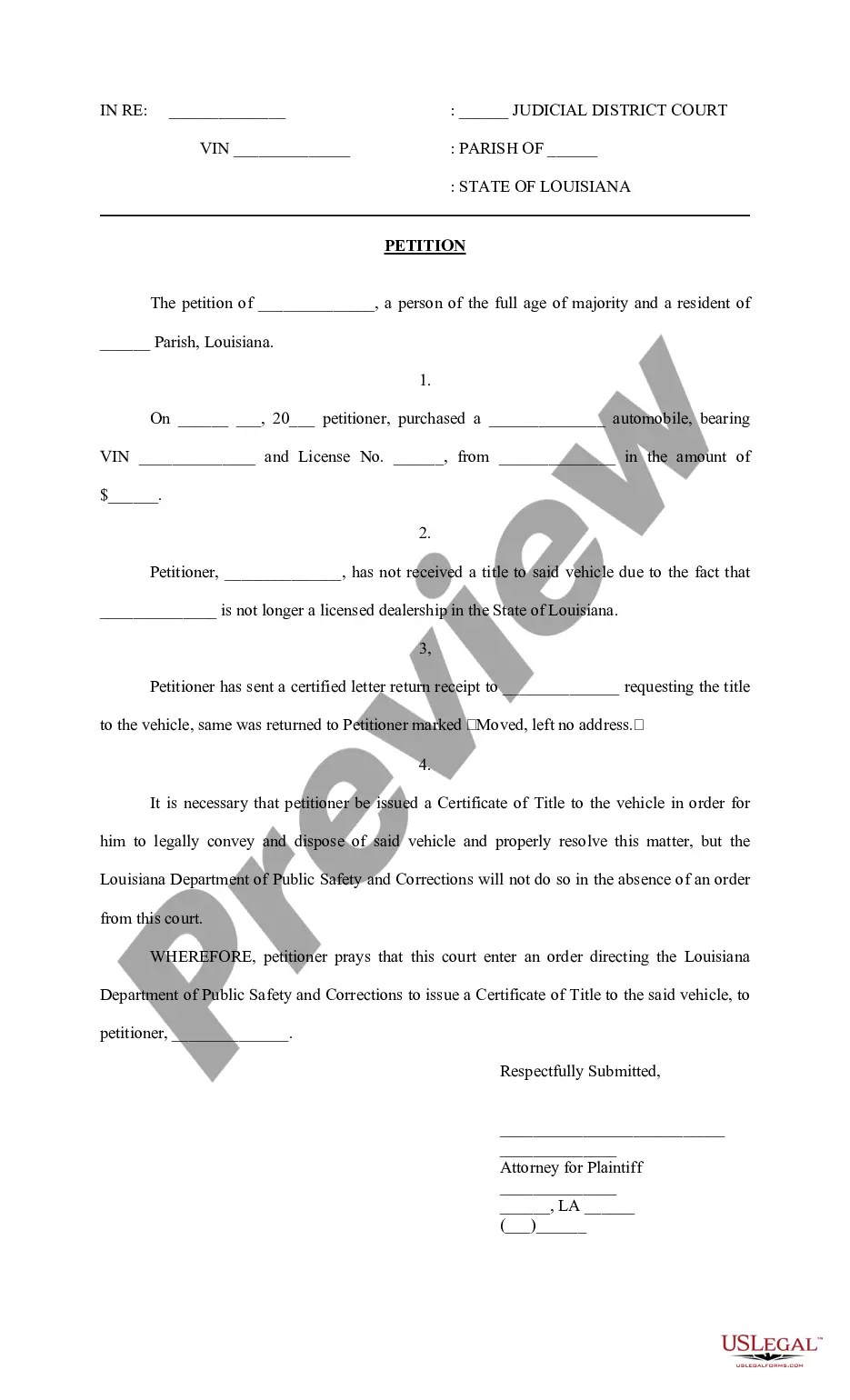

- Use the Preview button to examine the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

Puerto Rico sourced income includes income that originates from activities conducted within Puerto Rico. This can encompass earnings from services performed, property located, or businesses operated in Puerto Rico. As a self-employed individual under a Puerto Rico Self-Employed Environmental Testing Service Contract, accurately identifying your sourced income is vital for tax purposes and compliance with local regulations. Understanding these details can greatly impact your financial planning.

In Puerto Rico, the self-employment tax is similar to the federal rate, which is approximately 15.3%. However, you may also have to consider local tax laws that can affect your overall tax rate. It's crucial to consult with a tax professional to ensure compliance with both federal and Puerto Rican tax requirements. This becomes especially important when managing finances under a Puerto Rico Self-Employed Environmental Testing Service Contract.

Yes, professional services rendered in Puerto Rico are generally subject to taxation. This includes services provided under a Puerto Rico Self-Employed Environmental Testing Service Contract. To navigate these tax requirements effectively, consider using tools available on platforms like uslegalforms, which can help you understand and fulfill your obligations.

The 183-day rule in Puerto Rico determines tax residency based on the number of days an individual spends in the territory. If you are present in Puerto Rico for at least 183 days during the tax year, you may be considered a resident for tax purposes. This rule is particularly relevant for those working under a Puerto Rico Self-Employed Environmental Testing Service Contract, as residency status can impact your tax obligations.

Puerto Rico residents are exempt from certain federal taxes, such as federal income tax, but they are still subject to local tax laws. Specifically, income earned through a Puerto Rico Self-Employed Environmental Testing Service Contract may be taxed differently than in other U.S. jurisdictions. It's essential to consult with a tax professional to understand your specific tax obligations.

Yes, Puerto Rico does have a self-employment tax, which applies to individuals earning income through self-employment. If you're contracted for services like environmental testing, this tax will affect your earnings under a Puerto Rico Self-Employed Environmental Testing Service Contract. Staying informed about this tax will help you avoid potential penalties and manage your finances effectively.

In Puerto Rico, the equivalent of a 1099 form is Form 480.6A. This form is used to report payments made to self-employed individuals, including those under a Puerto Rico Self-Employed Environmental Testing Service Contract. Be sure to keep detailed records of your income and expenses to make reporting straightforward and accurate.

In Puerto Rico, the self-employment tax rate is generally around 15.3%, which includes both Social Security and Medicare contributions. It's important to calculate this tax accurately if you are working under a Puerto Rico Self-Employed Environmental Testing Service Contract. By understanding your tax obligations, you can effectively manage your finances and ensure compliance with local regulations.