US Legal Forms - one of many biggest libraries of legitimate varieties in America - offers a wide range of legitimate papers web templates you may acquire or produce. Making use of the web site, you can get a huge number of varieties for business and personal uses, sorted by categories, suggests, or key phrases.You can find the newest variations of varieties such as the Montana Agreement Between Widow and Heirs as to Division of Estate within minutes.

If you currently have a subscription, log in and acquire Montana Agreement Between Widow and Heirs as to Division of Estate in the US Legal Forms local library. The Acquire option can look on every form you view. You have accessibility to all earlier delivered electronically varieties in the My Forms tab of your own accounts.

If you would like use US Legal Forms the first time, listed here are easy instructions to obtain started out:

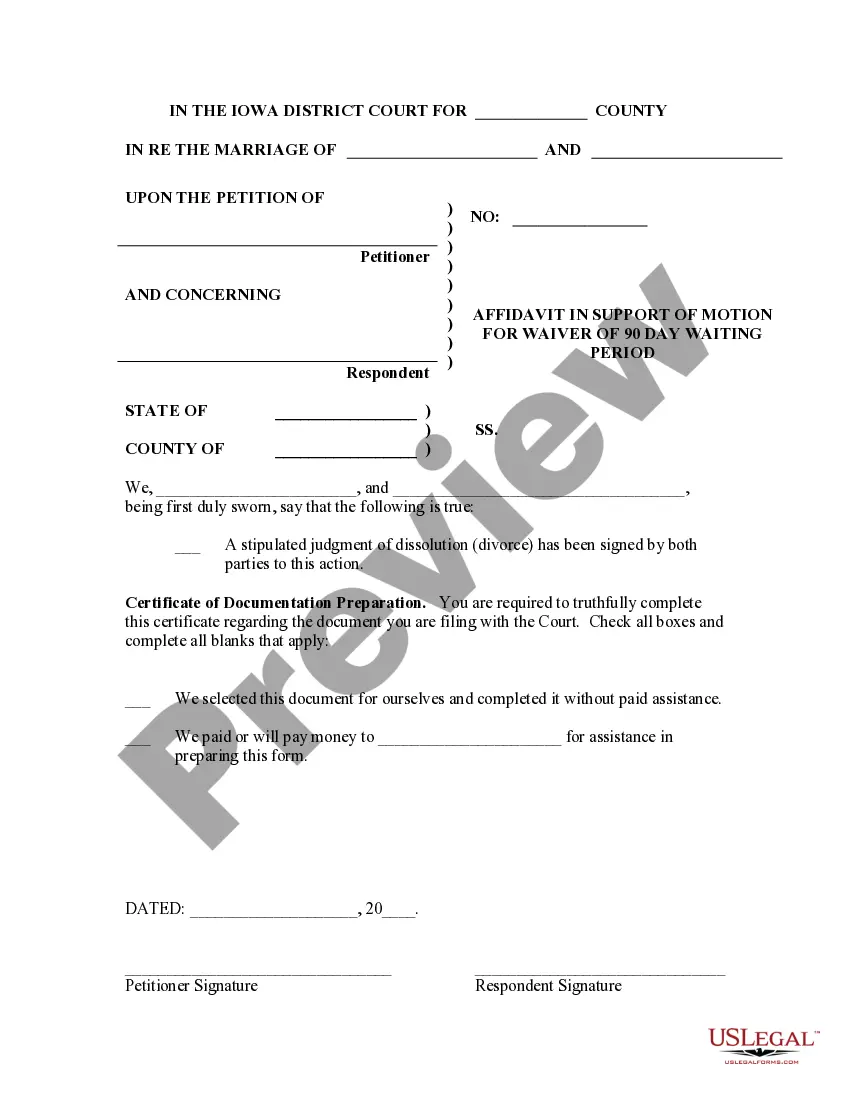

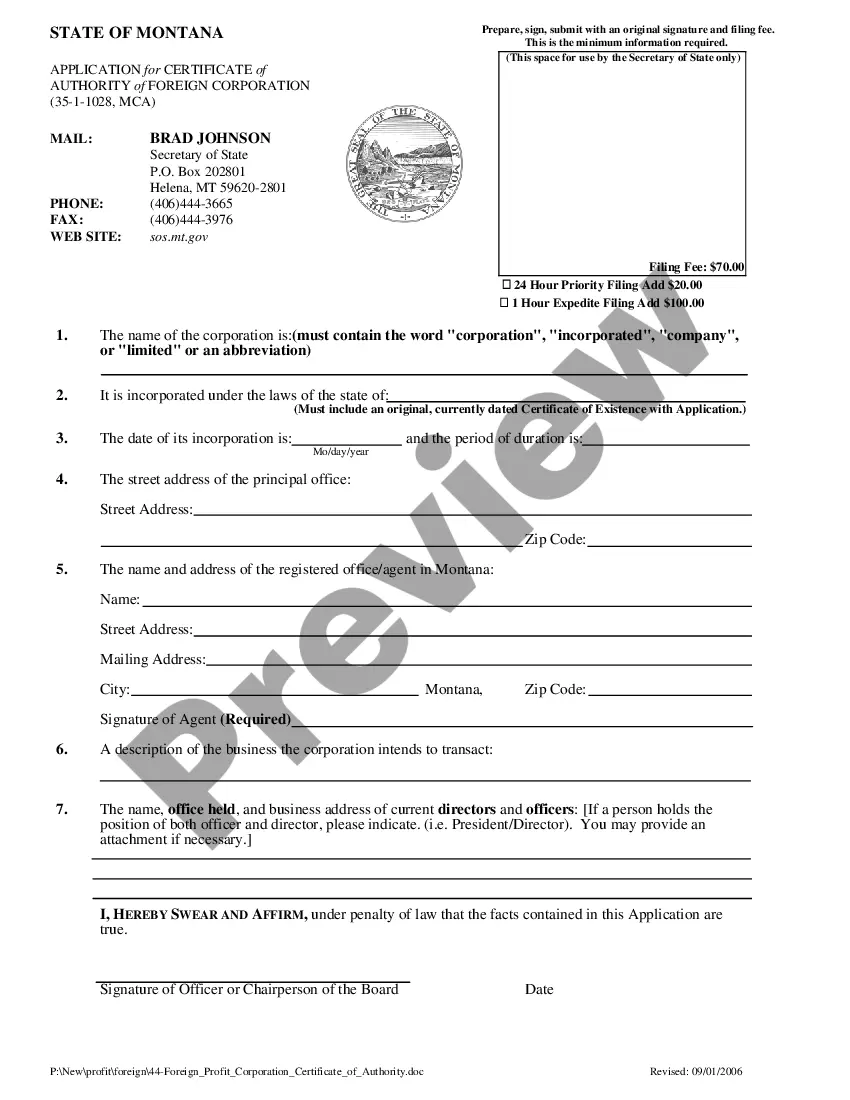

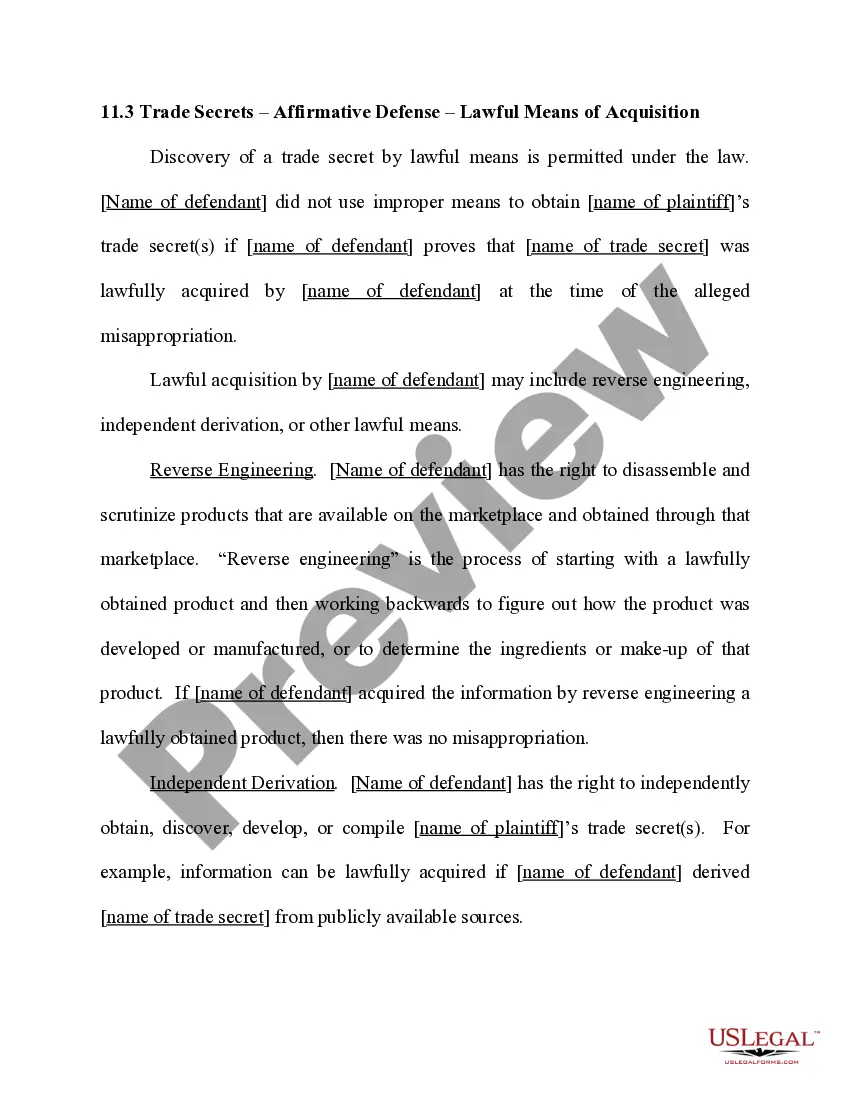

- Make sure you have picked out the best form for your personal metropolis/county. Click the Review option to analyze the form`s articles. Read the form outline to actually have selected the appropriate form.

- In the event the form does not match your specifications, make use of the Lookup area near the top of the monitor to find the one who does.

- If you are content with the shape, affirm your decision by clicking on the Purchase now option. Then, select the prices strategy you prefer and supply your qualifications to sign up to have an accounts.

- Approach the purchase. Use your Visa or Mastercard or PayPal accounts to accomplish the purchase.

- Select the formatting and acquire the shape on your own product.

- Make alterations. Load, change and produce and signal the delivered electronically Montana Agreement Between Widow and Heirs as to Division of Estate.

Each and every template you added to your bank account lacks an expiry day and is also your own property forever. So, if you want to acquire or produce an additional duplicate, just go to the My Forms section and click around the form you want.

Gain access to the Montana Agreement Between Widow and Heirs as to Division of Estate with US Legal Forms, one of the most extensive local library of legitimate papers web templates. Use a huge number of professional and state-distinct web templates that fulfill your business or personal needs and specifications.