Montana Resolution Form for Corporation

Description

How to fill out Resolution Form For Corporation?

It is feasible to spend hours online searching for the authentic document template that complies with the state and federal requirements you desire.

US Legal Forms provides countless authentic forms that can be reviewed by specialists.

It is easy to obtain or print the Montana Resolution Form for Corporation from my service.

To find another version of the form, use the Lookup field to search for the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you may Log In and then click the Download button.

- Afterward, you can complete, modify, print, or sign the Montana Resolution Form for Corporation.

- Every authentic document template you acquire is yours permanently.

- To get another copy of any purchased form, go to the My documents tab and click the respective option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document template for the county/region of your choice.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

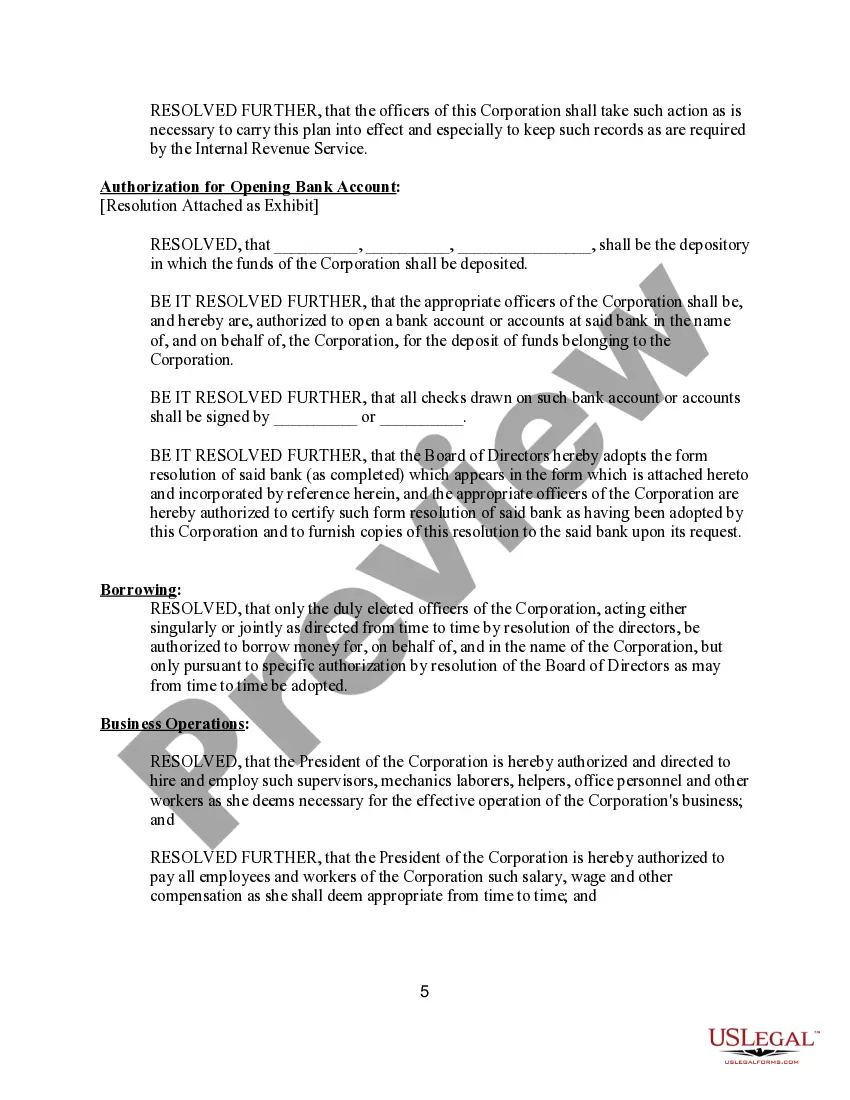

A corporate resolution for authorized signers is a document that designates individuals who can act on behalf of the corporation regarding financial and contractual matters. This resolution helps prevent unauthorized transactions and clarifies responsibilities. Completing the Montana Resolution Form for Corporation ensures your corporate governance is structured and protects your business's interests.

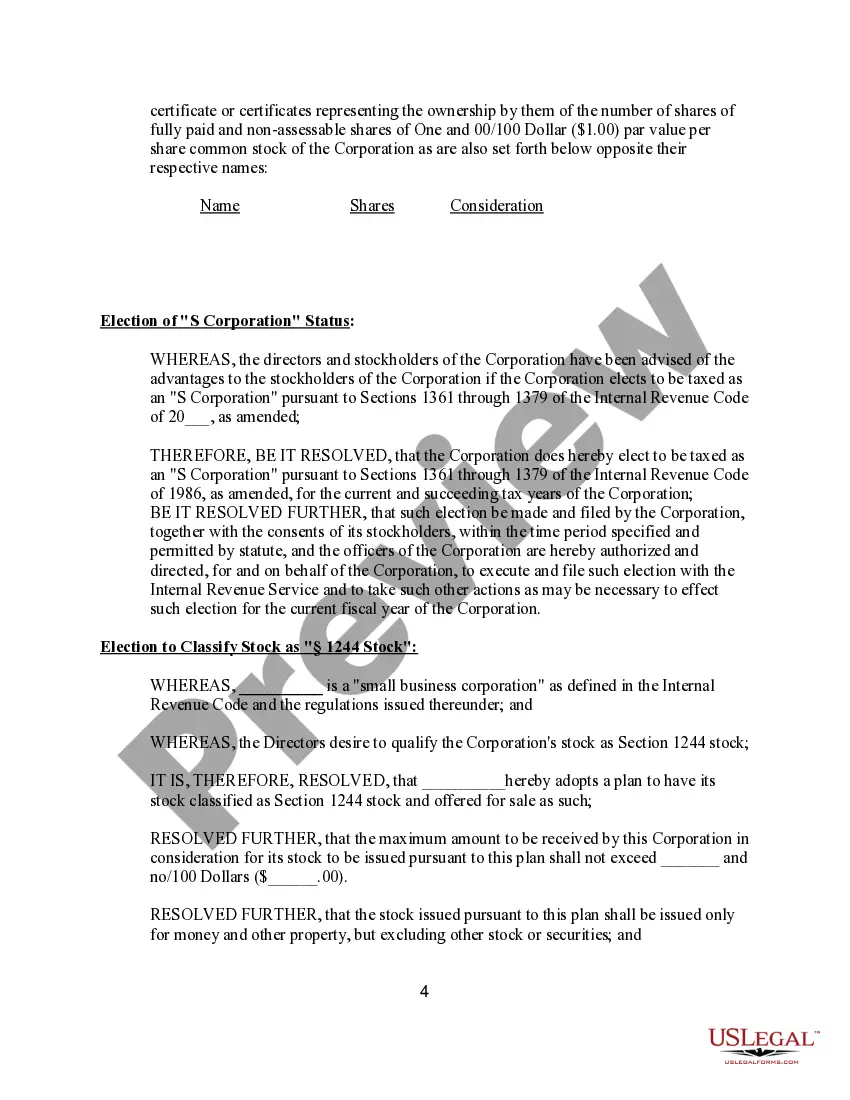

Montana does not have a pass-through entity tax (PTET) as seen in some other states. However, it’s essential to stay informed about any tax obligations your S Corporation may have. Using the Montana Resolution Form for Corporation can help you document any resolutions regarding tax strategies to ensure compliance.

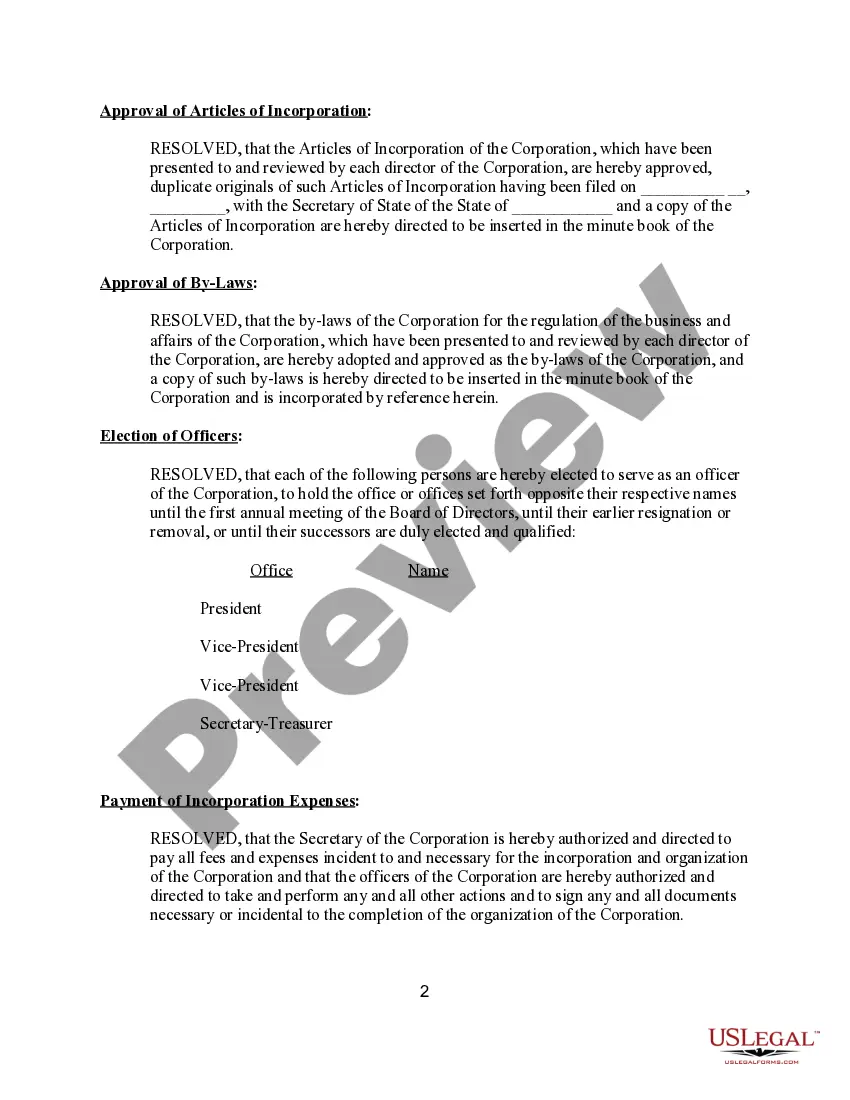

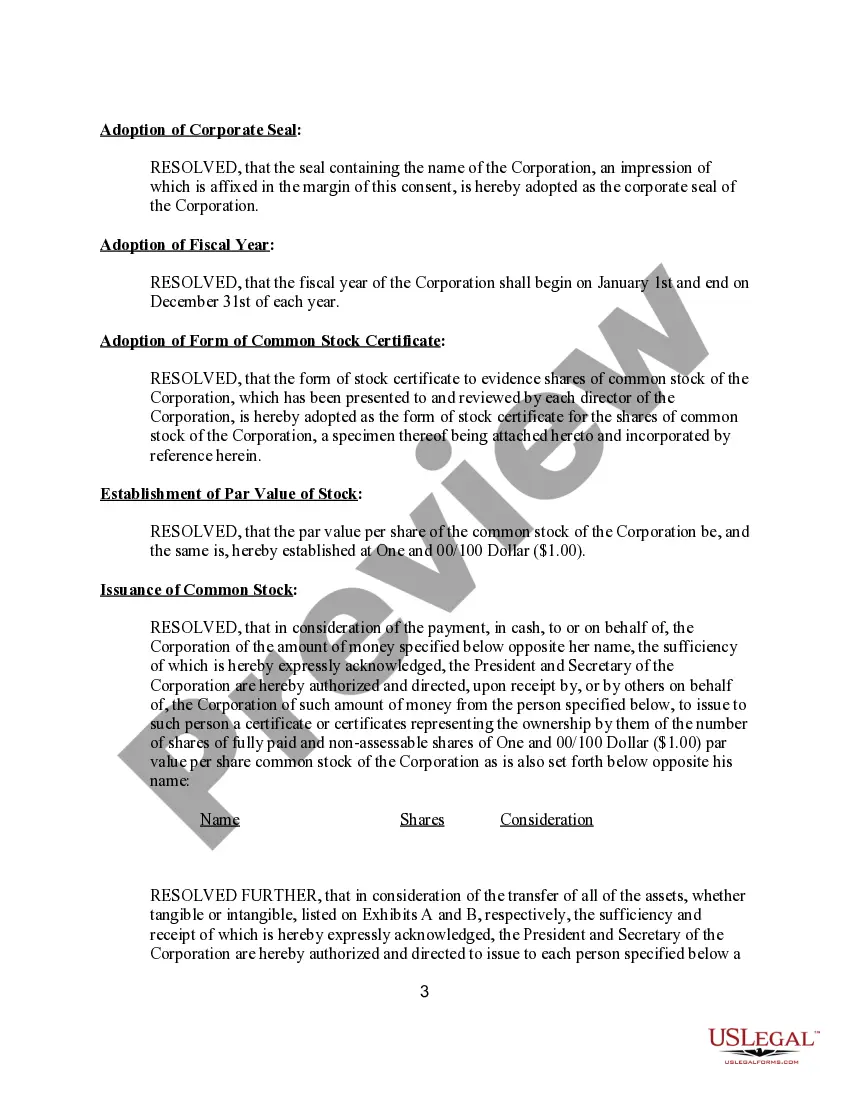

When writing a corporate resolution, start with the corporation's name, the date, and the specific action being resolved. Clearly articulate the decision and any relevant details that support the resolution. The Montana Resolution Form for Corporation includes examples and templates that can guide you in crafting effective resolutions that meet legal requirements.

Filling out a board of directors resolution involves defining the decision at hand, stating the date, and providing a section for signatures of the board members. You should also include the corporation's name and the context for the resolution. Utilizing the Montana Resolution Form for Corporation streamlines this process, ensuring that all essential elements are included for legal clarity.

There isn't a specific minimum income requirement for an S Corporation in Montana; however, having sufficient income is crucial for covering expenses and obtaining tax benefits. It’s advisable to consult a tax professional to understand how income levels may affect your corporation’s tax situation. Additionally, using the Montana Resolution Form for Corporation can aid in outlining financial expectations and operational plans.

A company resolution is a formal decision made by a company's shareholders or board members regarding important matters. This document is critical for ensuring compliance with corporate governance. The Montana Resolution Form for Corporation helps record these vital decisions effectively, serving as a reliable reference for future actions.

To write a company resolution, begin by clearly defining the subject matter and decision to be documented. Incorporate the necessary elements such as the date, names of the directors or shareholders, and the precise wording of the resolution. Utilizing the Montana Resolution Form for Corporation from US Legal Forms simplifies this process and ensures completeness.

A company resolution form is a formal document that records decisions made by a company's board or shareholders. The Montana Resolution Form for Corporation provides a standardized format that is legally recognized. By using this form, you ensure that important corporate decisions are recorded clearly and can be referenced in the future.

An example of a resolution for a company may include a decision to authorize a bank account setup or to approve a major business transaction. Using a Montana Resolution Form for Corporation can provide a clear format for these types of decisions, ensuring everything is documented properly. This serves to protect the interests of the corporation and its shareholders.

Typically, corporate resolutions are prepared by corporate secretaries, legal counsel, or authorized corporate officers. If you're unsure about the preparation process, using the Montana Resolution Form for Corporation from US Legal Forms can guide you through the required details. This helps ensure that the resolution adheres to legal standards.