Montana Minutes for Corporation

Description

How to fill out Minutes For Corporation?

Locating the appropriate legal document template may be a challenge.

Clearly, there are many designs accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website. This service provides a vast array of templates, including the Montana Minutes for Corporation, suitable for both business and personal purposes.

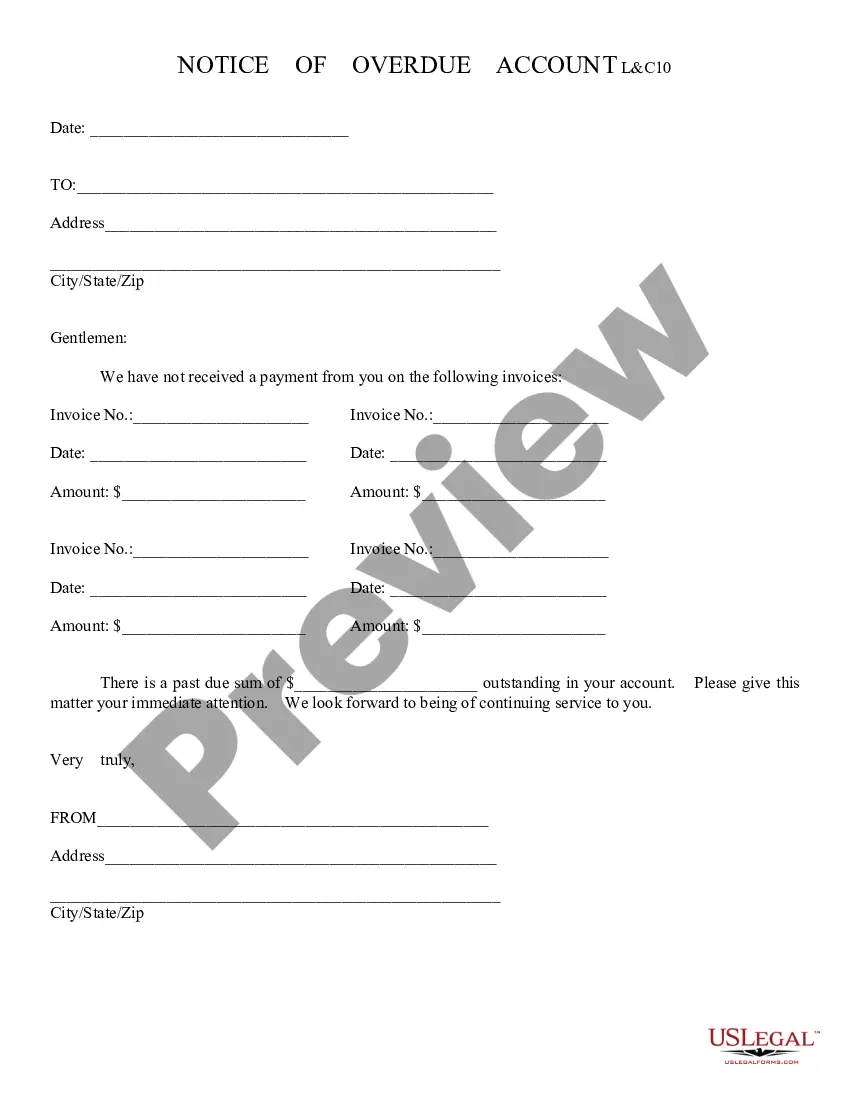

You can preview the form using the Preview button and review the form details to confirm it is correct for you.

US Legal Forms boasts the largest collection of legal forms, allowing you to access numerous document templates.

Use the service to download professionally crafted documents that comply with state regulations.

- All forms are verified by professionals and meet federal and state requirements.

- If you are already registered, sign in to your account and click the Download button to access the Montana Minutes for Corporation.

- Use your account to search for the legal documents you have previously purchased.

- Navigate to the My documents section of your account and obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/county.

- If the form does not meet your requirements, use the Search box to find the right form.

- Once you are confident the form is suitable, click the Get now button to retrieve the form.

- Choose the pricing plan you want and provide the required information.

- Create your account and purchase the order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, edit, print, and sign the obtained Montana Minutes for Corporation.

Form popularity

FAQ

Corporate minutes should include essential elements such as the date, time, and location of the meeting, as well as a list of attendees. You must also document the decisions made, motions proposed, and votes taken. These records are vital for maintaining corporate compliance and providing a clear history of actions. Montana Minutes for Corporation offers templates that ensure you meet all necessary requirements while saving time.

Meeting minutes typically do not need to be notarized in Montana. Instead, you should focus on keeping them accurate and well-organized. These minutes serve as an official record of the corporate decisions and can be requested during audits or legal reviews. Using Montana Minutes for Corporation helps you generate minutes that meet all legal requirements without the need for notarization.

Writing minutes for a corporation involves recording key details of the meetings, such as the date, time, location, and attendees. You should summarize the discussions and decisions made during the meeting, noting any motions and votes. Maintaining accurate minutes is crucial for compliance and transparency. Montana Minutes for Corporation provides a structured template that can streamline this process, enhancing your record-keeping.

Corporate resolutions in Montana do not usually require notarization to be legally binding. That said, it is essential to properly document these resolutions in your corporate records. This practice can help prevent any disputes regarding the actions taken by the board. By utilizing Montana Minutes for Corporation, you can ensure that all resolutions are recorded accurately and consistently.

In Montana, corporate bylaws generally do not need to be notarized. However, it is important for your corporation to have these bylaws properly documented and adopted by the board of directors. This ensures clear guidelines for your corporation's operations. Using Montana Minutes for Corporation simplifies this process and helps you maintain compliance.

To create effective corporation minutes, start by recording the date, time, and location of your meeting. List present members and summarize discussions and decisions made during the meeting. These notes should be clear, concise, and reflect the actions taken. Utilizing Montana Minutes for Corporation can streamline this process, helping you maintain accurate and accessible records.

In general, corporate minutes do not need to be notarized. However, some situations or state rules may require notarization for legal verification. It's best to consult local regulations or your legal advisor to determine if notarization is needed for your Montana Minutes for Corporation. Being informed helps you stay compliant and avoid legal issues.

You should keep corporate meeting minutes for a minimum of seven years. Storing them for this period ensures you have a reliable history of decision-making and compliance. In some cases, local regulations may require you to retain records longer. Properly organized Montana Minutes for Corporation can simplify future audits and inquiries.

Writing company minutes involves documenting key details from your corporate meetings. Start by noting the meeting date, location, attendees, and the agenda. Then, summarize discussions and decisions made during the meeting. Clear and accurate Montana Minutes for Corporation ensure you maintain a reliable record of your business activities.

The corporate license tax in Montana applies to businesses operating in the state. This tax is calculated based on the corporation's entire income, including income earned outside of Montana. Understanding the tax implications is crucial for maintaining compliance and managing expenses effectively. Proper documentation, including Montana Minutes for Corporation, can help you stay organized throughout the process.