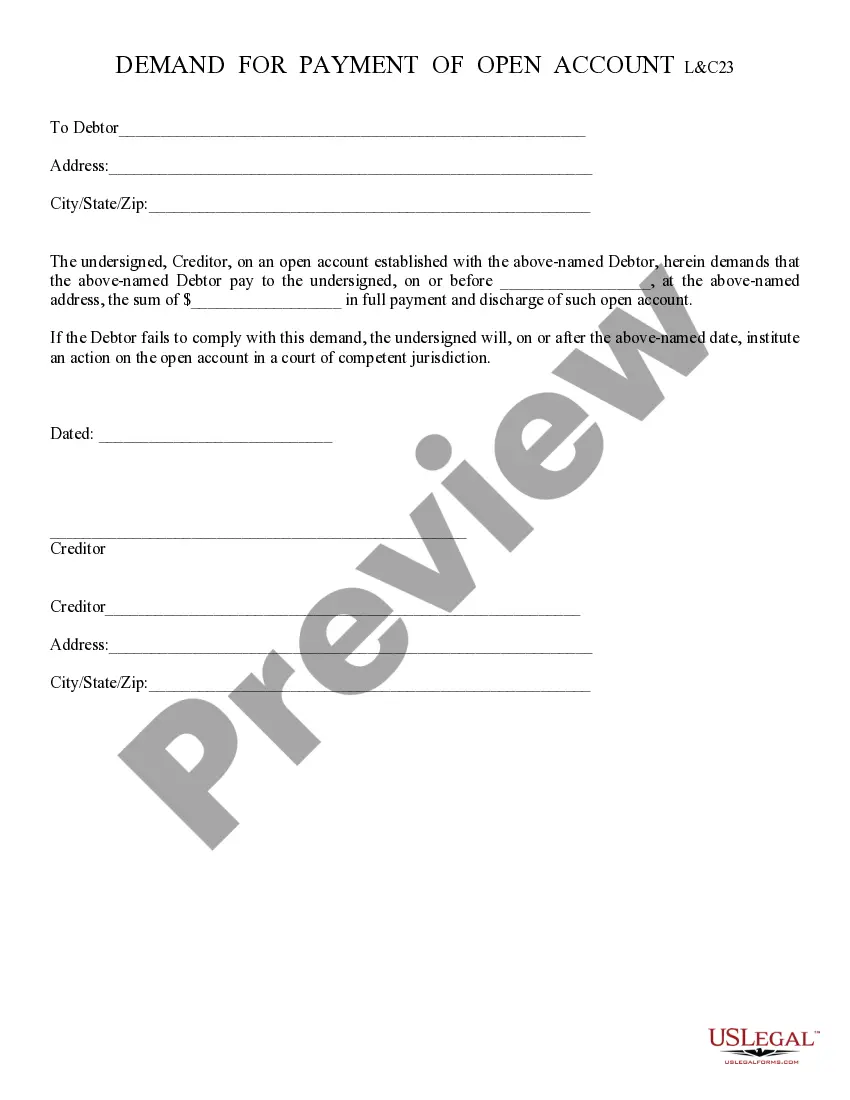

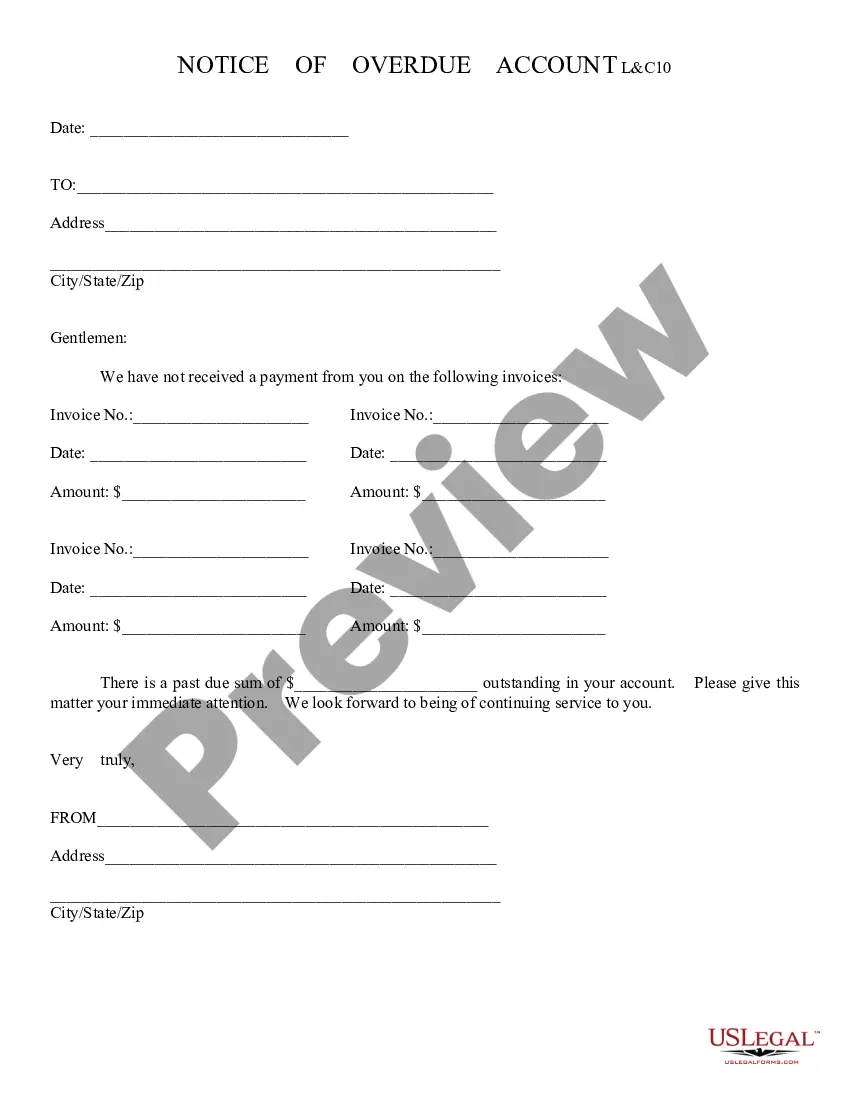

Overdue Account: This is a general notice to a consumer that his/her account is past due and immediate payment is needed. This particular notice can be used in most consumer situations. This form is available for download in both Word and Rich Text formats.

Arizona Overdue Account

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Overdue Account?

If you're searching for accurate Arizona Overdue Account formats, US Legal Forms is precisely what you require; obtain documents created and reviewed by state-licensed attorneys.

Using US Legal Forms not only helps you evade issues related to legal paperwork; moreover, you conserve time, effort, and money! Downloading, printing, and completing a professional form is considerably less expensive than hiring an attorney to do it on your behalf.

And that's all. With just a few simple clicks, you have an editable Arizona Overdue Account. Once you create your account, all future requests will be even simpler. After obtaining a US Legal Forms subscription, just Log In to your account and click the Download button located on the form's page. Then, whenever you need to access this template again, you can always find it in the My documents section. Don't waste your time scouring countless forms across various websites. Obtain accurate copies from a single secure platform!

- To start, complete your registration procedure by providing your email and creating a password.

- Follow the instructions below to set up your account and locate the Arizona Overdue Account template to address your concerns.

- Utilize the Preview feature or review the document details (if available) to ensure that the template is what you need.

- Verify its legality in your state.

- Click Buy Now to proceed with your purchase.

- Select a preferred payment plan.

- Create an account and pay using a credit card or PayPal.

- Choose a suitable format and download the document.

Form popularity

FAQ

To obtain an Arizona tax ID number, you can apply online through the Arizona Department of Revenue website, or utilize platforms like US Legal Forms for a streamlined process. You'll need to provide essential information about your business and its owners. Receiving your Arizona tax ID number is crucial for tax reporting and compliance, particularly if you face issues with an overdue account.

Filing your taxes late in Arizona can result in significant penalties, impacting your Arizona overdue account. The penalty may be as high as 5% of the amount owed for each month you delay filing, up to a maximum of 25%. Additionally, interest accrues on the amount due starting from the original due date. To avoid these penalties, it’s wise to file your returns as soon as possible.

Yes, Arizona does recognize federal extensions for filing taxes. If you obtain a federal extension, it also extends your Arizona filing deadline. However, it's essential to ensure that any payments are submitted on time to keep your Arizona overdue account in good standing.

The late filing penalty in Arizona generally stands at 4.5% of unpaid tax for each month the return is overdue, capped at a total of 22.5%. If you find yourself facing this situation, it may be beneficial to consult services like USLegalForms to guide you in resolving any Arizona overdue account issues effectively.

The maximum penalty for filing a late return in Arizona can reach up to 22.5% of the total taxes owed. This penalty accrues at a rate of 4.5% for each month the return is late. To mitigate financial strain on your Arizona overdue account, it’s crucial to file as soon as you can.

To write a waiver letter for a penalty in Arizona, start by clearly stating your request at the top of the letter. Explain the details of your Arizona overdue account and the reasons for your late payment or filing. Include any relevant documentation that might support your case, and conclude by expressing your hope for a favorable review from the department.

To request a penalty waiver in Arizona, you should submit a written request to the Arizona Department of Revenue detailing the reasons for your late filing. Include any supporting documents that highlight the circumstances of your Arizona overdue account. The department will review your request and communicate the outcome.

Penalties for late filing of returns in Arizona can vary. Late filers typically face a 4.5% penalty of the tax owed for each month the return is delayed, with a maximum of 22.5%. Consistently addressing your Arizona overdue account can help you avoid these growing costs.

The penalty on a late filing of your tax return in Arizona is primarily based on the amount you owe. If you file late, you will incur a 4.5% penalty for each month the return is overdue. To avoid increasing your Arizona overdue account and incurring additional penalties, it is wise to file on time or seek extensions.

In Arizona, the penalty for filing taxes late can be significant. Generally, if you fail to file your return by the deadline, you may face a penalty of 4.5% of the taxes owed for each month your return is late, capped at 22.5%. This can add up quickly, so it's important to address any Arizona overdue account as soon as possible.